$60 Billion Remittance Target by 2034

Remittances are a crucial source of external financing for Pakistan, totaling approximately $26.6 billion, which constitutes 7.9% of the country's gross domestic product (GDP) in FY 2023.

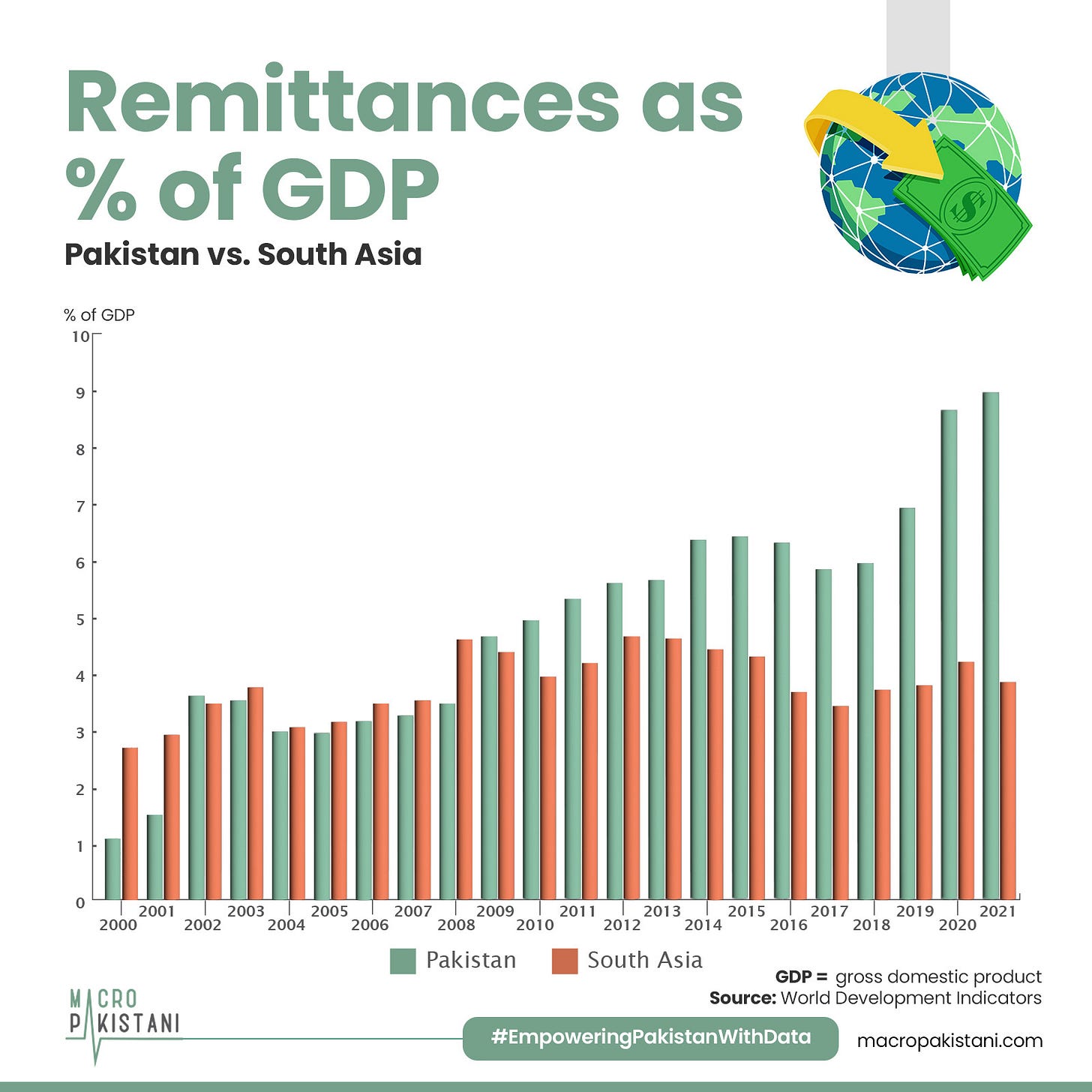

Remittances have become crucial for macroeconomic dynamics in the country for three reasons. The first is their relative size. Following continued growth in the 2000s, remittances accounted for about 9% of Pakistan’s GDP in 2021, considerably higher than that for South Asia as a whole. The second is their relative stability. Remittances to Pakistan proved resilient to the impact of the Global Financial Crisis (GFC) of 2007–2008 and soared during the coronavirus disease (COVID-19) pandemic. In 2021, Pakistan received $31.1 billion in remittances from overseas, a 19.8% increase from the previous year. The third is that remittances have grown so large, which roughly equals the value of net imports of goods and services. As such, they have non-trivial effects on the balance of payments and macroeconomic stability.

What strategic measures will the government implement to reach its ambitious remittance target by 2034?

For the current financial year, Pakistan aims to achieve a remittance target of $30.27 billion, with a plan to boost annual remittances by over $3 billion. Key strategies include appointing 26 community welfare attachés in Saudi Arabia, Dubai, Qatar, and other European and American countries. Technical programs and training, in collaboration with the EU, will be launched to enhance skilled labor. Over 50 new skill centers will be established nationwide to support this goal.

Additionally, overseas Pakistanis will receive incentives and protections for investing in technology zones, including blue passports, while efforts will focus on increasing remittances from Europe and the Gulf countries.

According to the Global Knowledge Partnership on Migration and Development and the World Bank, South Asia houses 3 of the top 10 global remittance recipients: India, Pakistan, and Bangladesh. Increased remittances can boost per capita income primarily through heightened consumption by low-income recipients, which stimulates local demand and supports investment activity. This boost in purchasing power often leads to expanded business activity, job creation, and economic growth. Additionally, remittance inflows can be invested in savings or development projects, contributing to both immediate consumption and long-term economic potential.

GRAPHIC

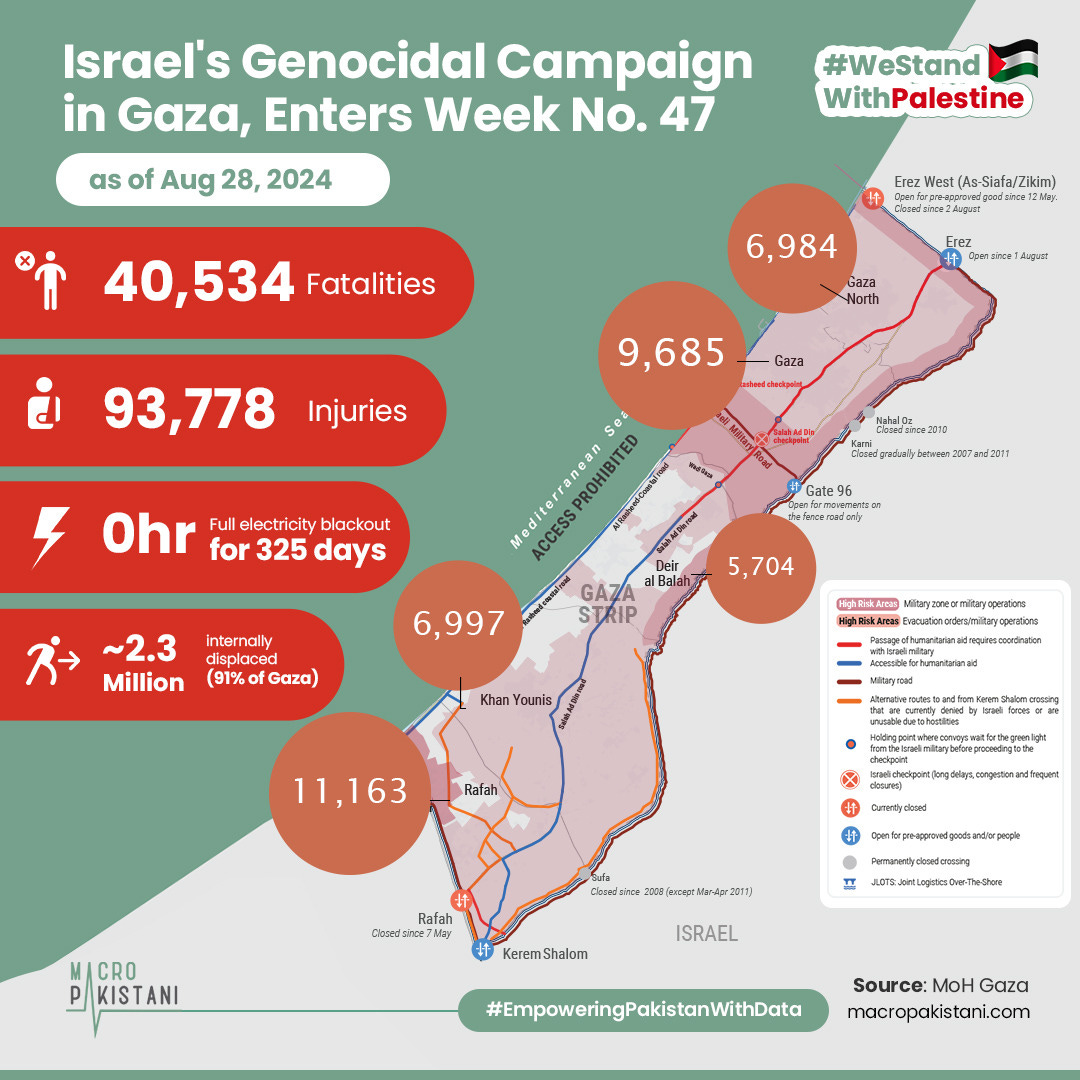

The announcement of a "Chief Gaza (Genocidal) Officer" by the Israeli Occupation Forces (IOF) has indeed raised significant concerns about Israel's long-term plans for occupying Gaza. The role's focus on overseeing essential services like food, fuel, and infrastructure suggests a commitment to a prolonged presence in the region through tyranny and suppression.

This move can clearly be interpreted as a potential step towards reoccupation and could be seen as aligning with historical patterns of displacement and control. The comparison to the Nakba of 1948 highlights the depth of the concerns about the continuity of displacement and genocidal destruction in the region.

In case anyone wants to contribute (to the Palestine solidarity campaign on Macro Pakistani) and send data-backed content, please feel free to send an email to fakiha.rizvi@brandnib.com

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.