An Ineffective 'Monetary Policy'?

The monetary policy committee maintained the policy rate at 22% despite expectations for a 3% increase in line with the IMF modus operandi due to ‘declining inflation’.

According to the MPC statement, it has ‘stressed maintaining a prudent fiscal stance to keep aggregate demand in check’. The dynamics of monetary policy are different from the world’s. The field has lacked consequential research for Pakistan-specific dilemmas. Since its inception, the IMF and most of Western economics have asserted the relationship between money and inflation and left it at that. However, Pakistan’s problems are more complex and require a specialized solution instead of the one-size-fits-all approach of varying policy rates.

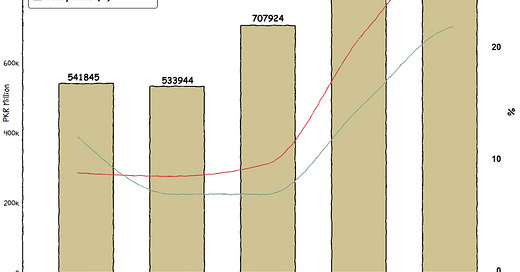

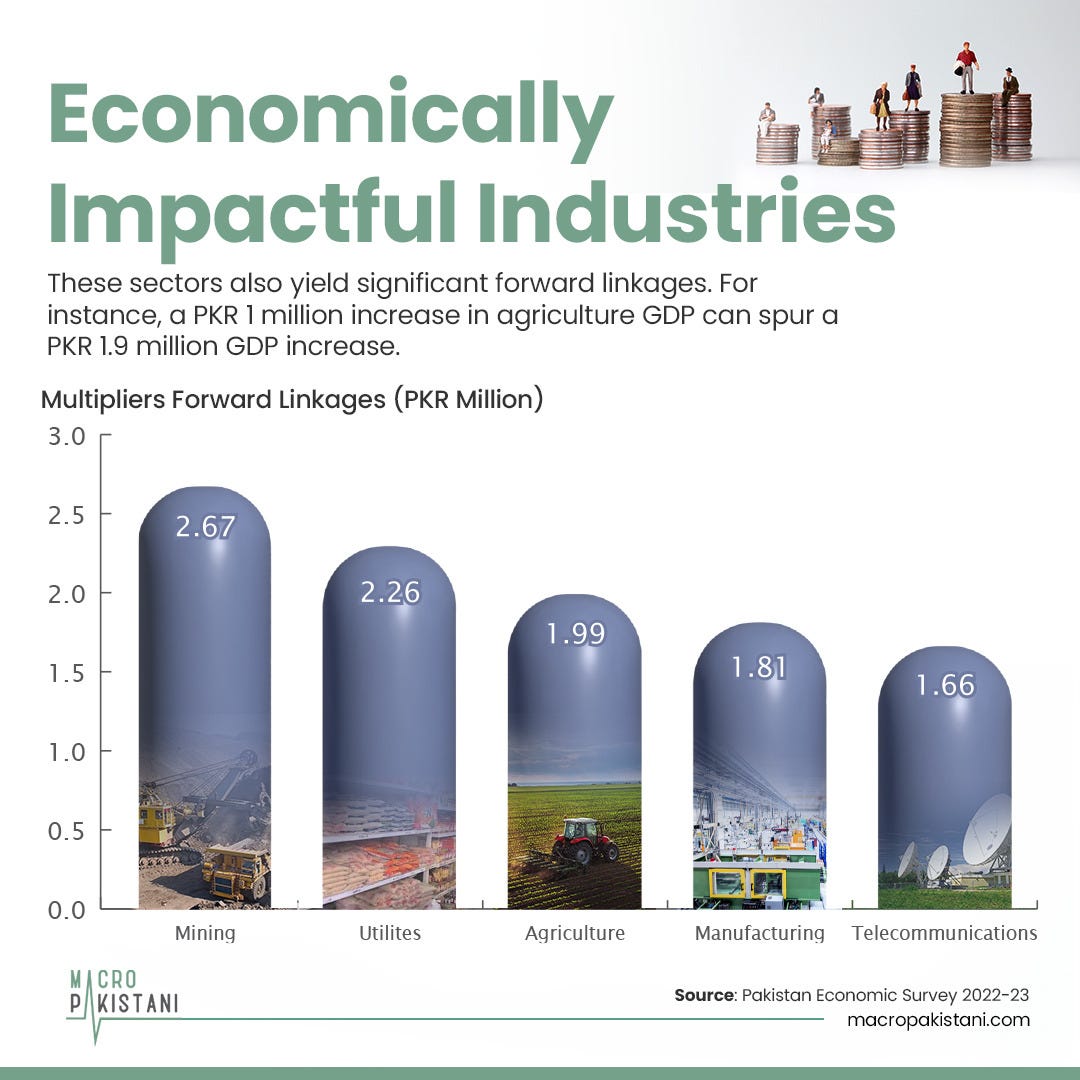

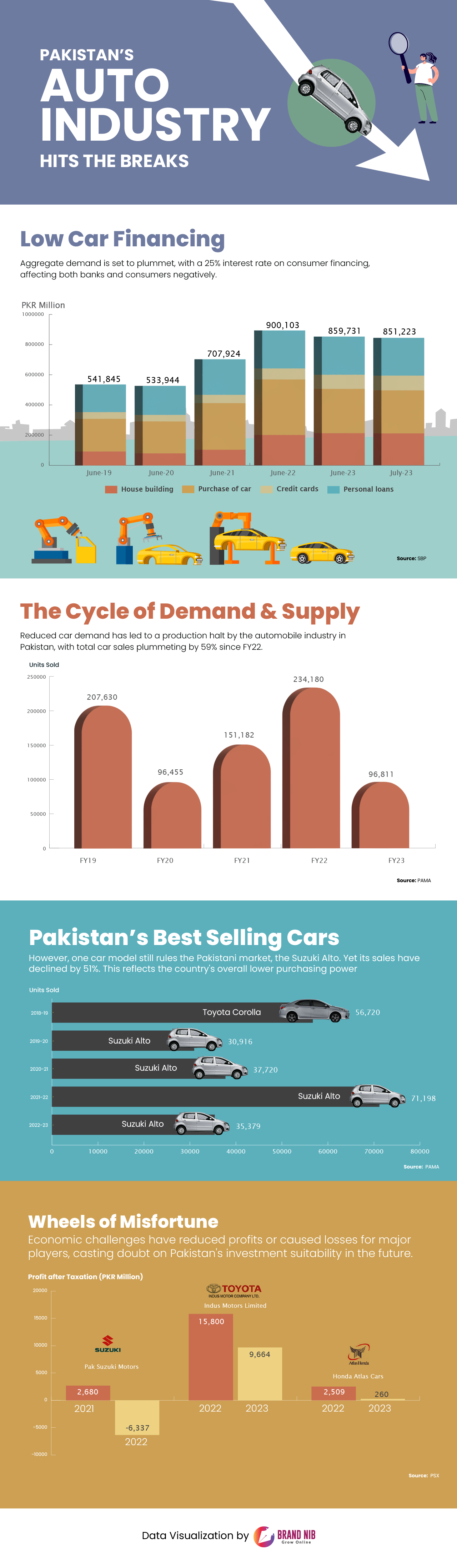

In the developed world, private credit, including household credit, contributes significantly to the aggregate demand observed in those economies. However, Pakistan’s total consumer financing was recorded at a mere PKR 8.5 billion in July 2023. Currently, it appears that this relationship is not responding strongly to proposed changes in monetary policy, especially concerning inflation and policy rates. However, the monetary policy is proposing that the inflationary trend is on its way to approaching 5-7% as targeted for the medium term.

Repeatedly, analysts and the public have highlighted Pakistan's policy rate's impact on inflation. Especially, how detrimental it is for future business investments in the country. Regrettably, Pakistan persists in adopting the IMF's approach, or in simpler terms, the neoliberal strategy for tackling inflation in a country where more potent and direct factors are available for targeting.

GRAPHIC

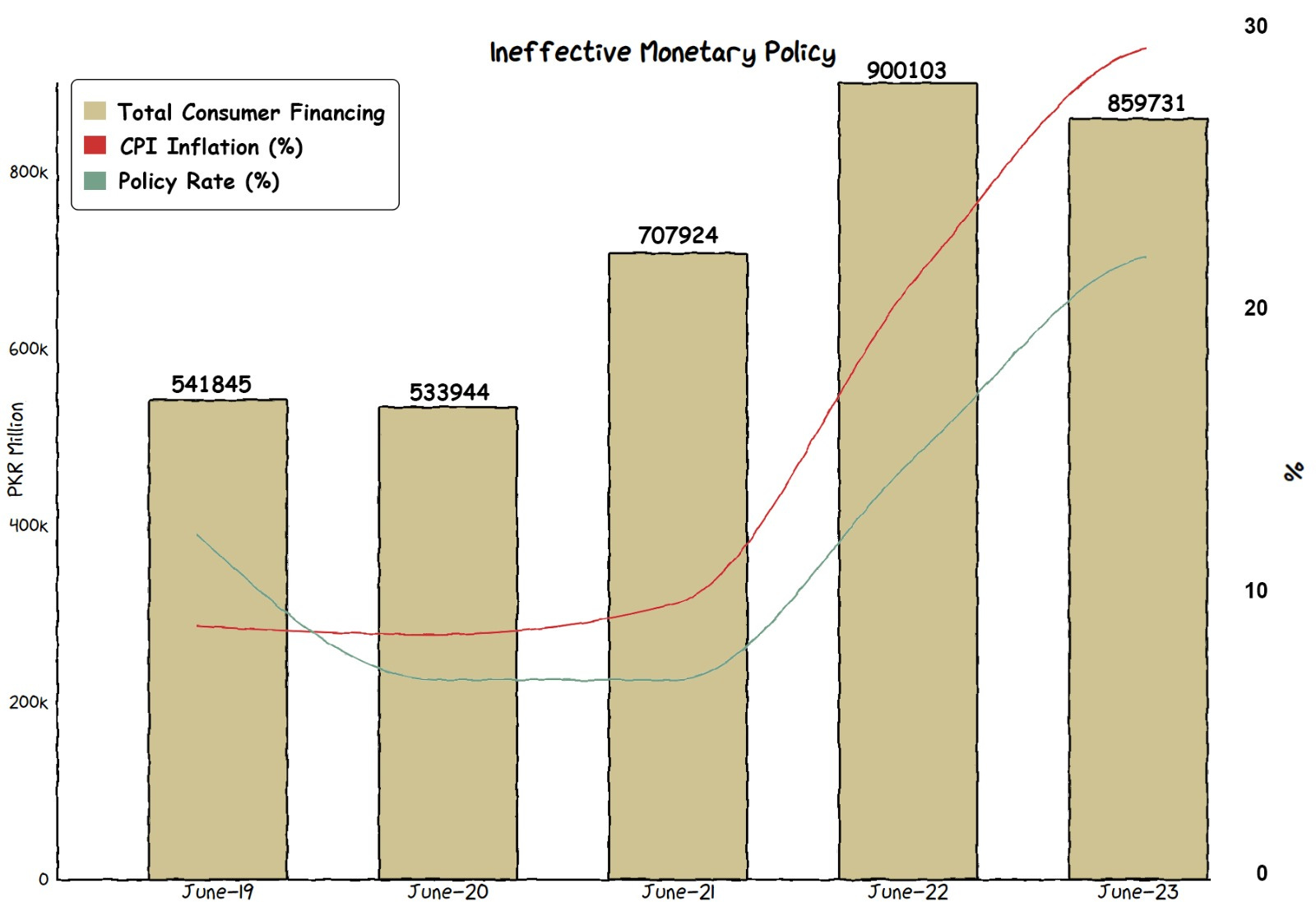

The Special Investment Facilitation Council is a collaboration between significant stakeholders in Pakistan to sustainably improve the investment climate in Pakistan🇵🇰 especially to attract foreign investment.

SIFC intends to bring in USD 100 billion worth of investment in significant sectors including:

🚜 Agriculture: 37% of Pakistan's workforce is engaged in agricultural activities.

ℹ Information Technology: Pakistan ranks as the world's 3rd largest contributor to online labor.

⛏ Mines & Minerals: Notably, projects like Reko Diq have the potential to generate up to USD 40 billion in revenue over the next three decades.

⚡ Energy: Pakistan boasts an untapped solar energy potential of 2,900 GW.

These sectors are also known to have significant forward linkages which signifies their capacity to stimulate and positively impact various related industries and economic activities. Hopefully, these investments can improve labor conditions and spur economic growth in the region.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.