Banking on Economic Turmoil?

Thanks to ever-increasing investments in sovereign bonds, HBL boosted its profits by 82% in 9MCY23 compared to the same period last year.

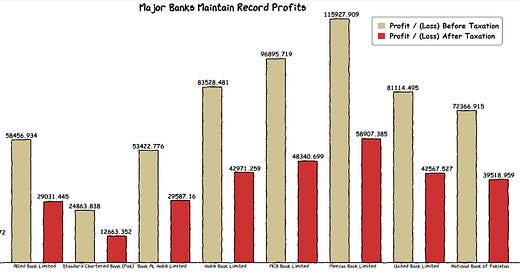

A rising interest rate and consequently rising government expenditures have created a conducive environment for banks to make comfortable profits. In 2022, the industry's overall profits increased by 54%, which couldn’t have been based on higher credit needs by Pakistan’s economic sectors. Instead, the profits have been made on the backs of the bank’s interest income made through sovereign bonds. Does the rising share of government borrowing, in comparison to the industry's borrowing, genuinely lead to “crowding out” of available funding for investment?

Certainly, increasing the interest rate also has an impact on both interest expenses and interest income. Yet, Habib Bank Limited’s net interest income grew by 58% in 9MCY23. As of September 2023, HBL observed a remarkable growth in their investment portfolio, which grew by an impressive PKR 550 billion since December 2022, reaching a substantial PKR 2.5 trillion. The real showstopper here? Short-term securities, particularly treasury bills, stole the spotlight, while PIBs played a supporting role.

The banking sector serves a pivotal function in directing funds towards profitable investments. However, a bank opts for the path of least resistance, earning profits by lending to the government to settle its existing debt, it diminishes opportunities for productive investments.

Here, the government needs to take on responsibility and refrain from domestic borrowing and manage its expenditures through other avenues.

GRAPHIC

In 1945, the U.S. dropped the atomic bomb "Little Boy" on Hiroshima, causing widespread destruction. Nearly 80 years later, Israeli airstrikes on Gaza are claimed to have a similar explosive force, resulting in a significant death toll.

Courtesy: TRT World

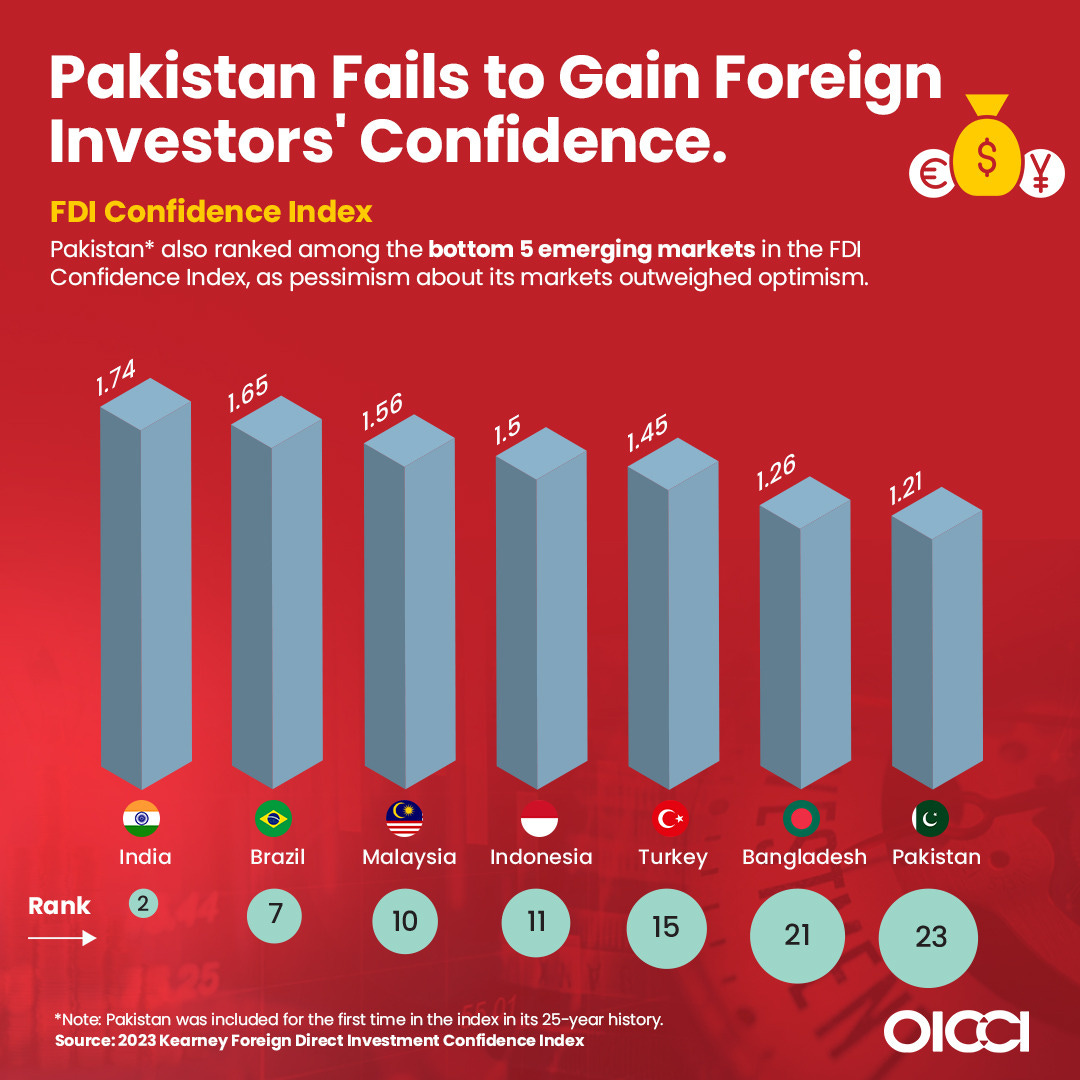

Pakistan's transport sector is the largest consumer of petroleum products in the country. Due to rising petroleum prices and the deteriorating exchange rate it is facing financial strain. Furthermore, this has resulted in a falling current account balance.

When will Pakistan join the ranks of EV adoption?

Follow @oiccipk to learn more about Pakistan’s climate efforts at the

2nd Pakistan Climate Conference 2023 (PCC’23) happening on November 1, 2023 in Karachi.

We are excited to join OICCI in this endeavour to unite national and international experts to combat climate challenges being faced by Pakistan.

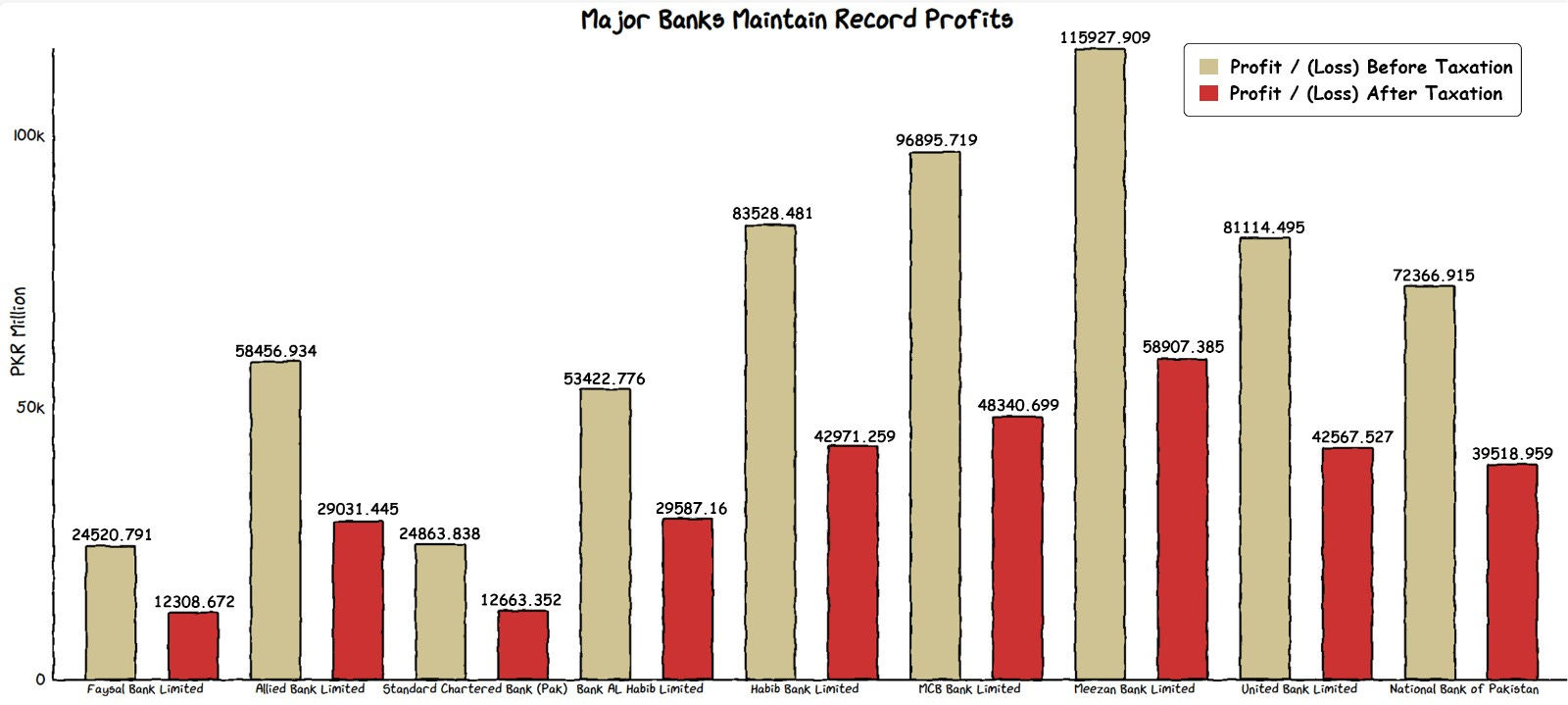

As part of its FDI Confidence Index, which ranks economies to facilitate businesses in making their international investments, Kearney included Pakistan among emerging markets in the FDI Confidence Index for 2023 (for the first time in 25 years) . However, Pakistan ranked last among Southeast Asian countries.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.