Caretakers’ Eleventh Hour Strategies

Approaching the end of its tenure, the caretaker government checks off PIA and circular debt from its to-do list.

The Privatization Commission in collaboration with the Special Investment Facilitation Council (SIFC) is close to finishing off the PIA and circular debt fiascos. After a long back and forth, the government will finally restructure Pakistan International Airlines’ debt. As a result, taxpayers will be burdened with a total of PKR 572 billion over the course of the next 10 years. According to the plan principal payments will be funded through privatization proceeds and the sale of other fixed assets. In the absence of available proceeds, the finance ministry will cover the payments from the budget, thus essentially incorporating PIA’s debt into the public debt. Despite opposition from various stakeholders, the PIA plan was swiftly concluded in a slapdash manner.

The caretaker government finalized the plan regardless of the Election Commission's orders, but will the IMF oblige as well?

Another persistent point of concern, the circular debt, is being handled by the SIFC as well. The ingenious plan includes ‘rationalizing tariffs, eliminating cross-subsidies, and injecting cash into the system’. Since it targets the gas sector, which contributes upwards of PKR 3 trillion as of January 2024, the plan will inject around PKR 556 million into the Oil and Gas Development Company (OGDC) which will decrease its receivables. With a substantial influx of funds, the company will distribute dividends amounting to PKR 467 billion out of which, 85% will be allocated to the government, while shareholders other than the government will receive the rest.

The SIFC has set out to resolve two pertinent pain points in the IMF-Pakistan relationship, i.e., state-owned enterprises and circular debt. So far it looks like the solution encompasses basic accounting tactics as the government is trying to balance inflows and outflows. Yet no one seems to target the major variables including ‘Unaccounted for Gas’, ‘differential margins’, and ‘subsidized tariffs’. The focal points revolve around administrative and structural issues in the circular debt as well as the PIA problem, however, these aspects are notably absent from the discourse on solutions.

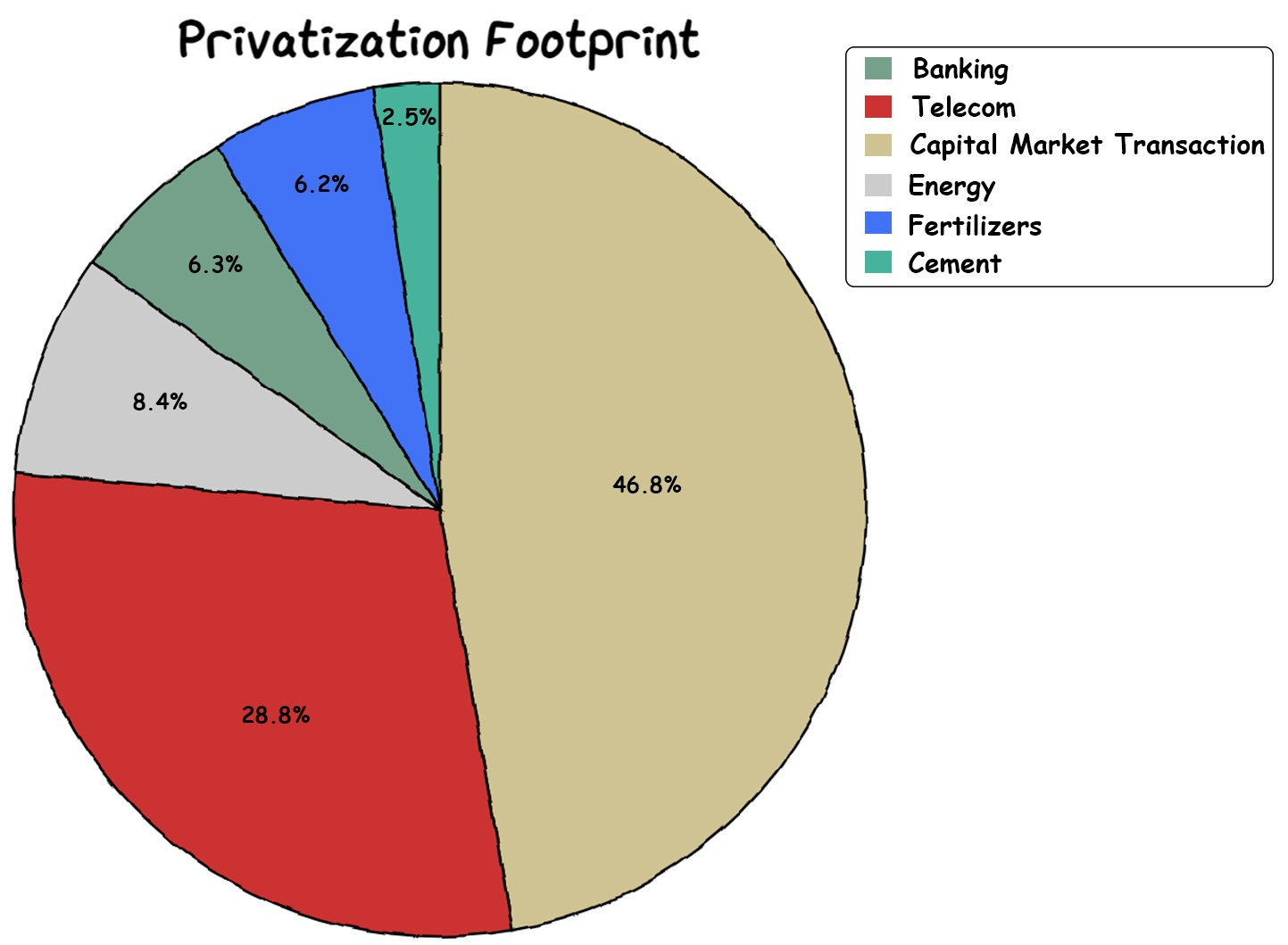

GRAPHIC

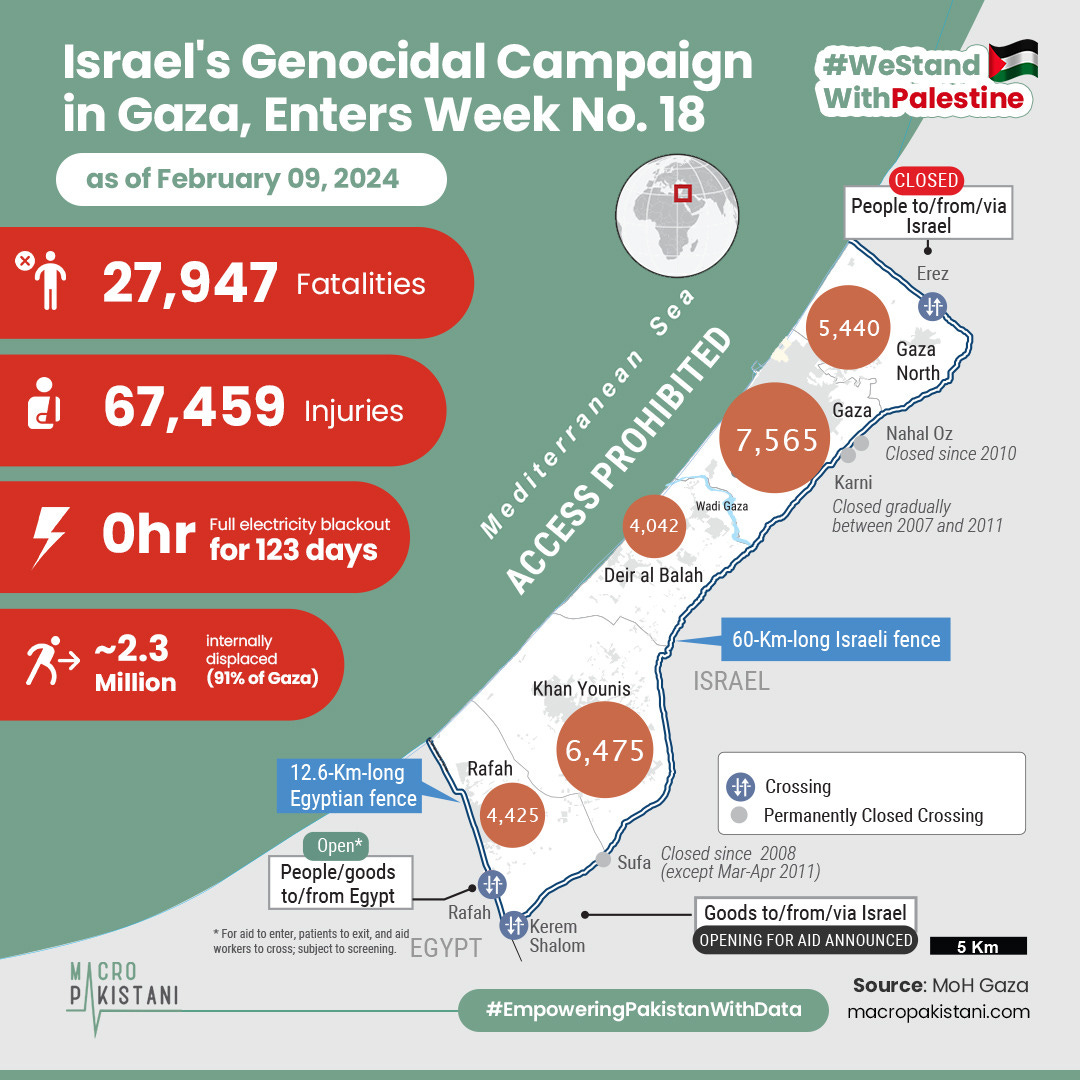

The people of the Gaza Strip are facing a worsening, devastating humanitarian situation of destruction, massacres, displacement, infectious diseases, and shortages of food, clean water, fuel, communications, and medical supplies.

Pakistan heavily relies on tariffs, constituting about 50% of tax revenues. Lowering these taxes could potentially generate Rs. 101 million in revenue and stimulate trade. Unfortunately, Pakistan's protectionist strategies, evident in its 2021 high tariff rates, haven't made industries competitive.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.