Devaluation & Pakistan’s Competitiveness

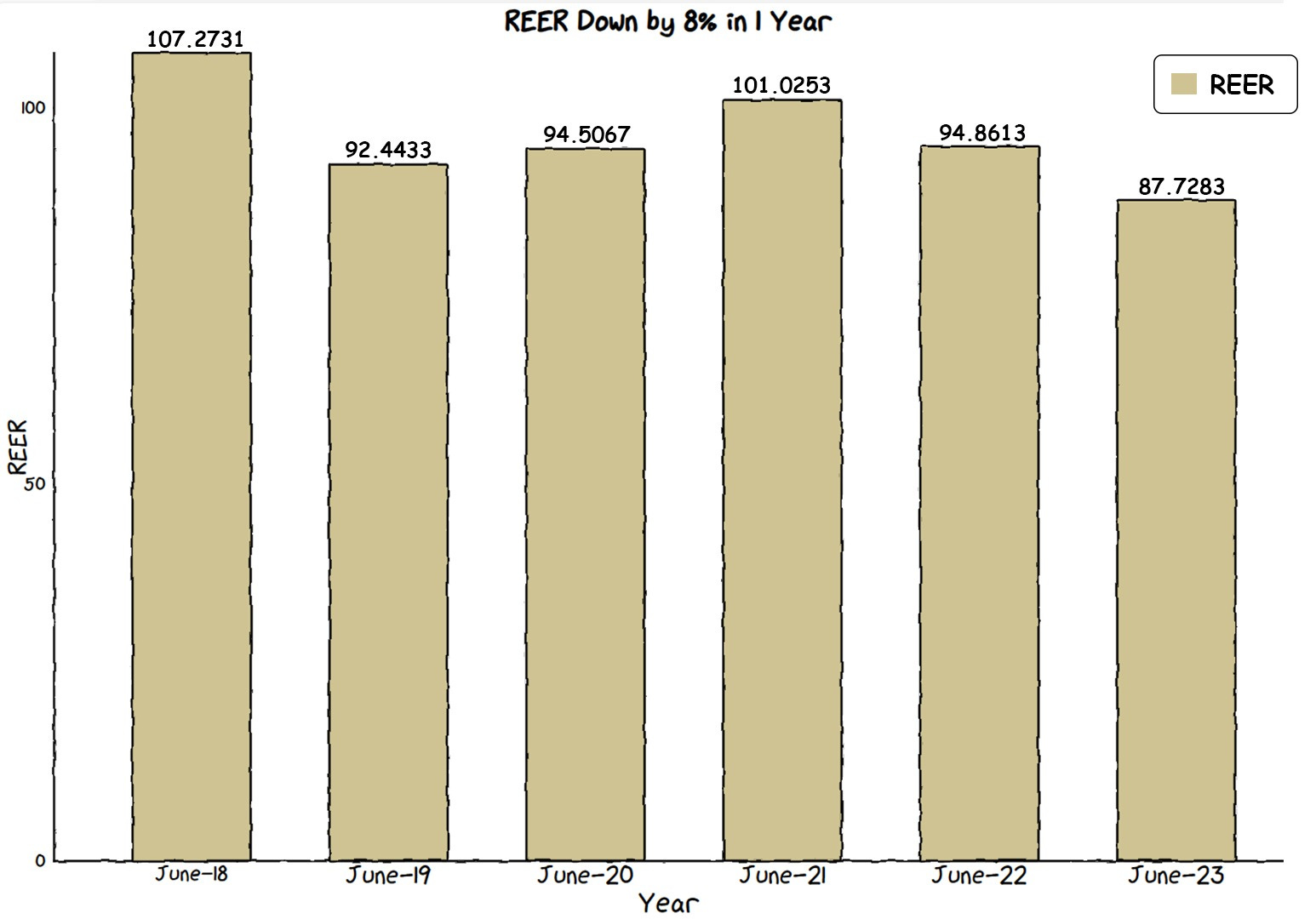

Pakistan’s REER depreciates as an undervalued PKR fights inflation.

A slight change in the exchange rate results in multitudinous changes in inflation, interest rates, and most importantly public debt in a country like Pakistan. A suitable indicator for the exchange rate is the Real Effective Exchange Rate (REER) which is determined by factoring in inflation adjustments to the value of the country's currency. Many have proposed that the reduction in Pakistan’s REER will finally result in an export boost. Does this idea hold true in reality, or is it just a way to find a positive angle in the situation?

At this point, we should mention that Pakistan's industrial nature leans towards import substitution rather than being export-driven. The majority of the country's industries are fueled by domestic demand, and this is reinforced by protectionist measures. As a result, only a limited number of industries prioritize producing goods for export, and among these, most are small-scale enterprises.

Shifting the focus to the government, during the period spanning from FY09 to FY13, Pakistan was largely operating under the IMF Program, leading to an average annual increase of 19% in public debt. However, between FY14 and FY18, the growth rate of public debt moderated to an average of 12.3% per year. This deceleration was attributed to the implementation of a relatively stable exchange rate policy by the government in power at that time. This era also saw improved growth in industry, agriculture, etc.

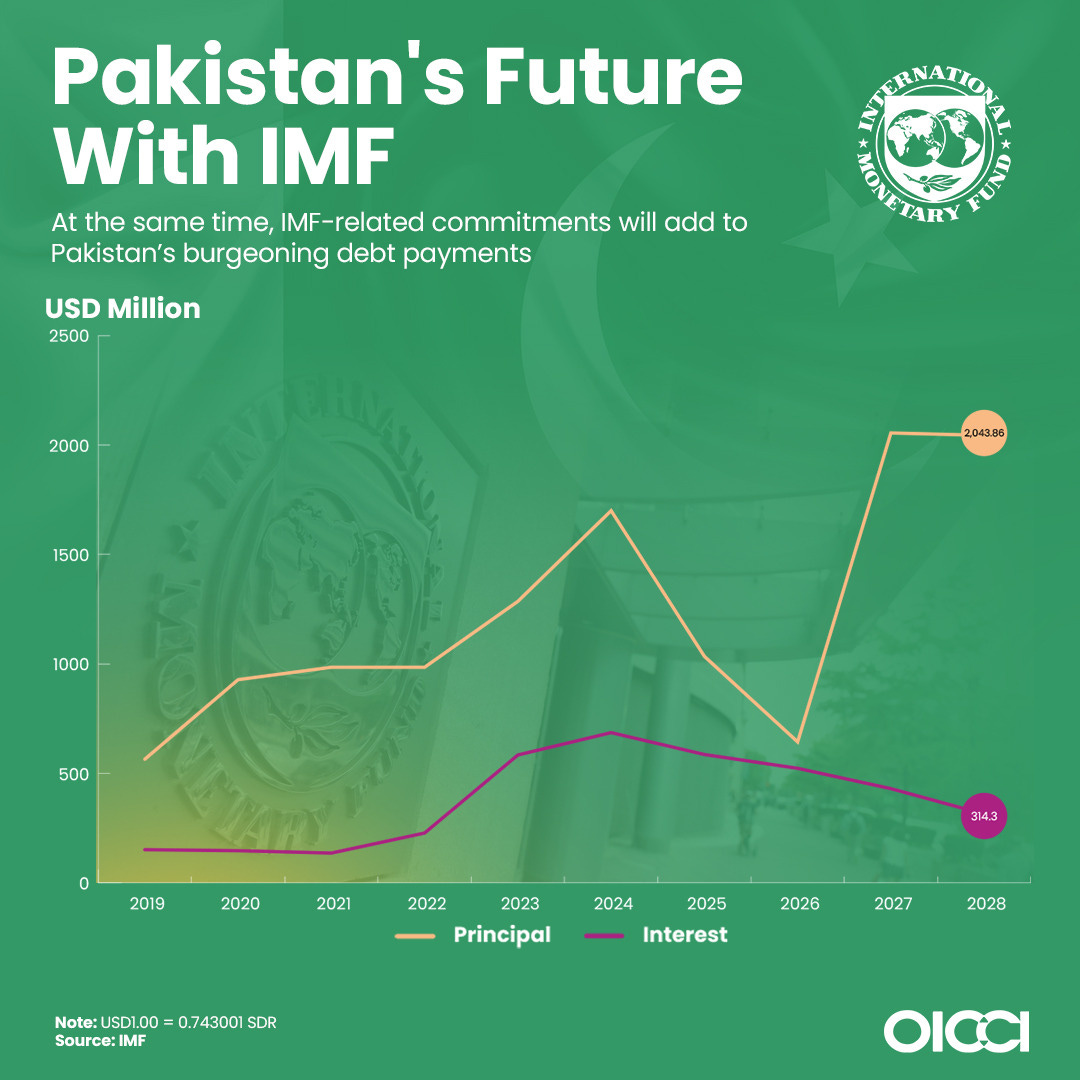

Considering that Pakistan is under another IMF program, the threat of devaluation poses a serious obstacle to export improvement. The challenges of devaluation and an immature export sector raise doubts on the potential positive impact of a stable "real effective exchange rate."

GRAPHIC

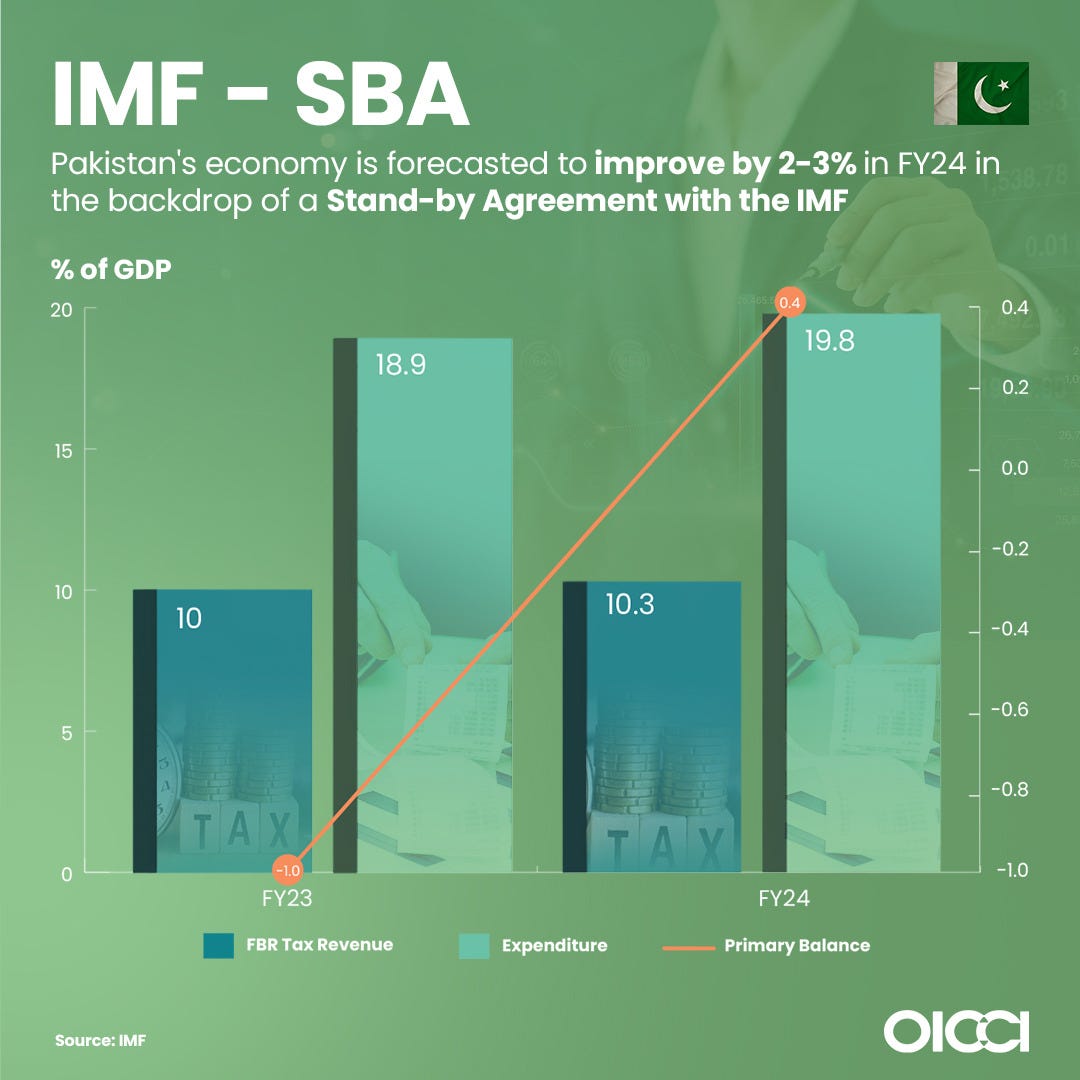

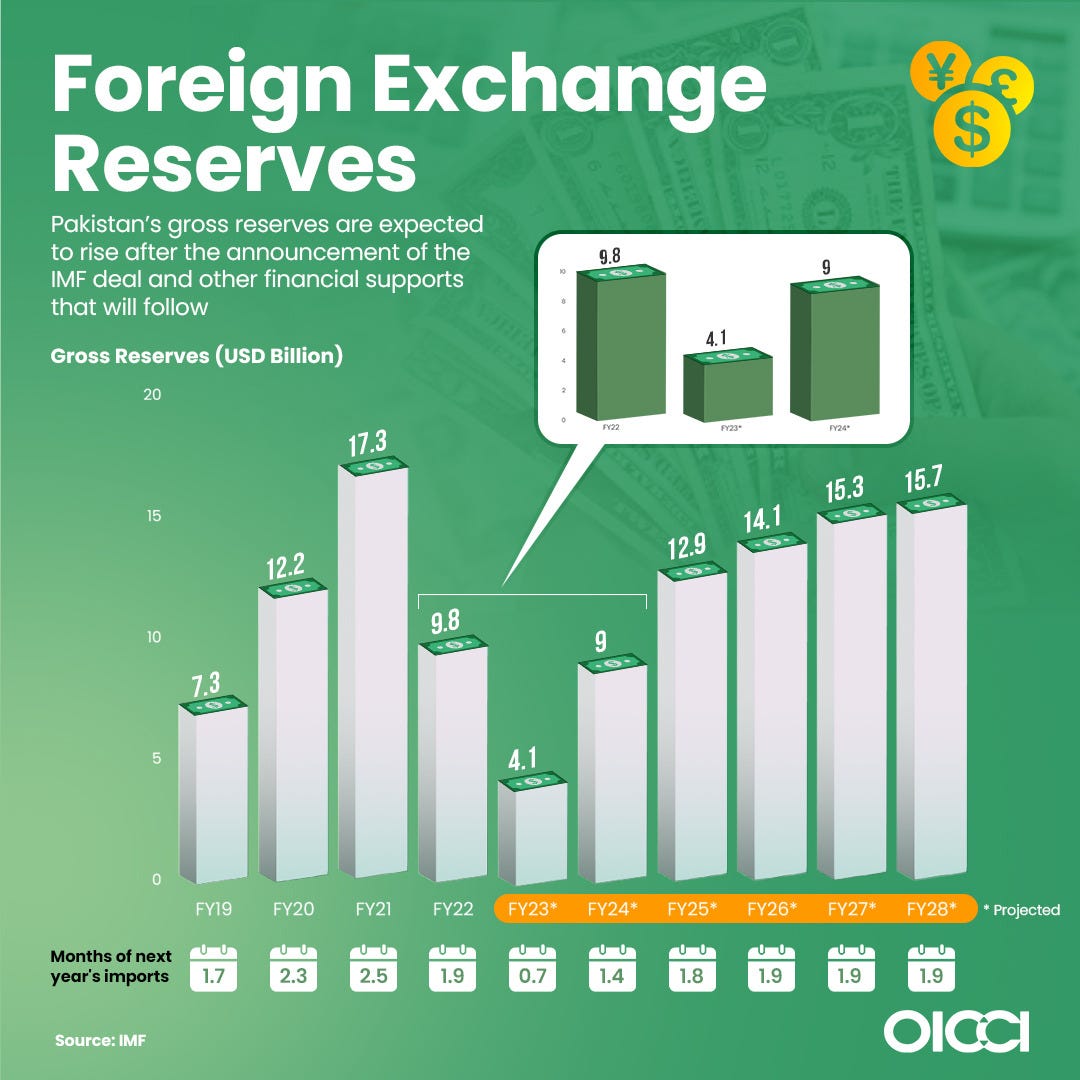

The recent deal between Pakistan and the IMF is a significant step for our country's financial strength. This agreement arrives during a testing economic phase for Pakistan. A complex current account problem, destructive floods, and policy miscalculations have resulted in substantial twin deficits, escalating inflation, and diminished economic safeguards in FY 2023.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.