Feeding Pakistan’s Energy Dragon

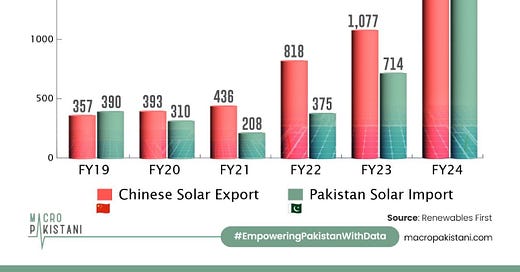

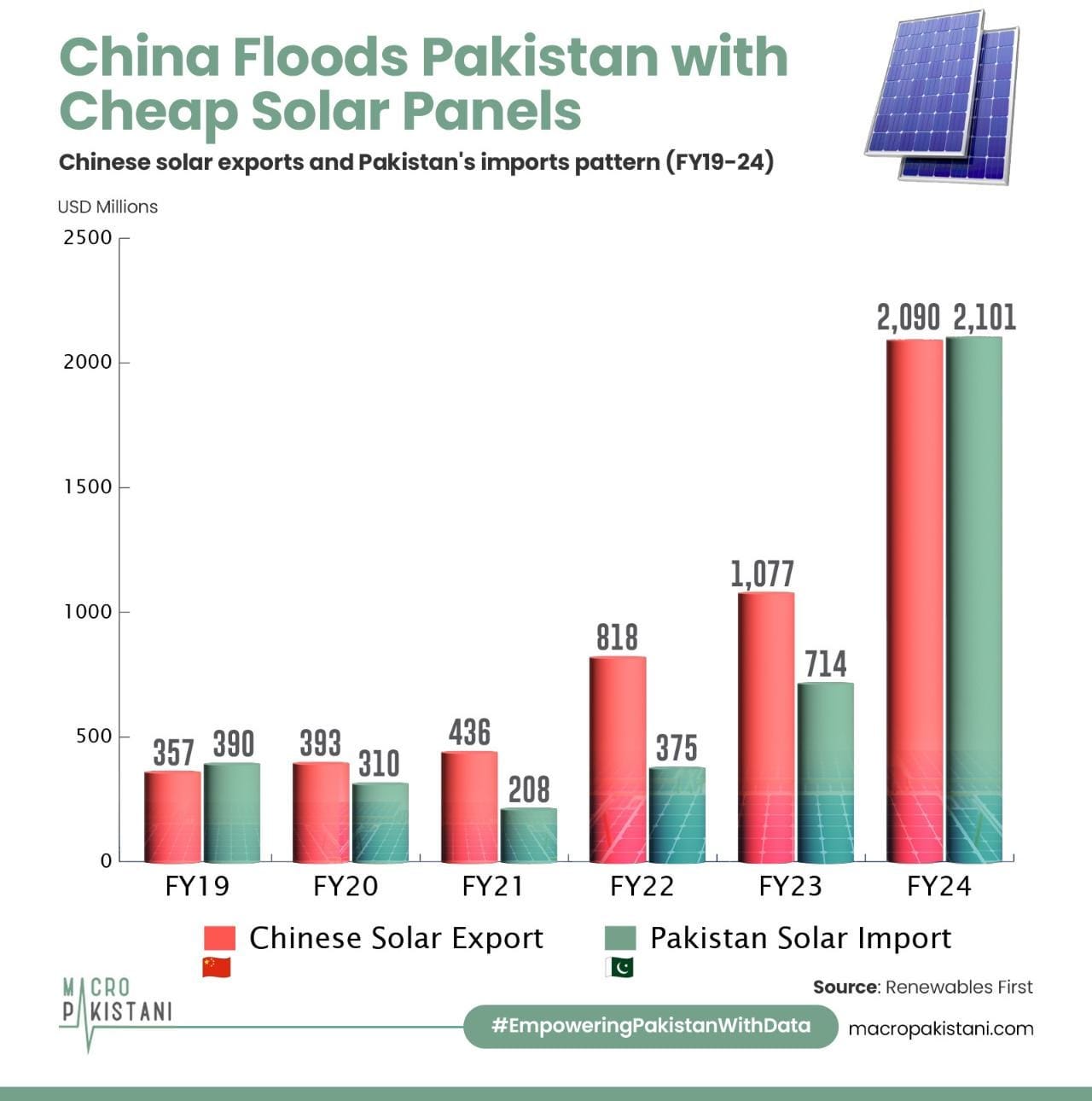

Soaring electricity bills and cheaper solar panels are pushing more Pakistanis to ditch the grid, creating a $2.1 billion solar import and forcing a rethink of the country’s energy future.

In the 1990s, Pakistan faced crippling power shortages that stifled industrial growth and economic progress. Today, a different crisis is unfolding—not of scarcity, but rather of declining electricity demand. For the first time in a decade, power consumption is shrinking as industries struggle with high costs and sluggish GDP growth. Many are abandoning the national grid, either shutting down or shifting to captive power, both of which jeopardize Pakistan’s economic growth and the IMF plan. In these circumstances, solar energy is emerging as a powerful alternative. As demand projections drop, Pakistan must rethink its energy strategy, and embrace decentralized solutions instead of stubbornly halting progress.

Pakistan stands at a crossroads, will it embrace sustainable energy or continue feeding the energy sector’s insatiable dragon?

Amid this chaos, a quiet revolution is underway. Households, businesses, and industries are turning away from the national grid, fueling an unprecedented solar boom. With $2 billion worth of solar panel imports in FY24 alone, most of them from China, Pakistan has become the world's sixth-largest solar market. This shift is not driven by government policy or climate commitments but by necessity, as electricity prices in the country have skyrocketed by 155% in just three years. But this leads to an unprecedented problem, one that we might be unprepared for. As high-income consumers defect to self-generation, utilities lose their best-paying customers, forcing them to raise tariffs on the remaining, largely lower-income, grid-dependent population—triggering a vicious cycle known as the utility death spiral. With each tariff hike, more consumers will seek alternatives, further weakening the financial viability of the grid, increasing the circular debt, and disproportionately burdening those who cannot afford to leave it.

If left unchecked, this unplanned transition could deepen social inequities and destabilize the entire power sector. What remains to be seen is whether state authorities adopt a strategy of adaptation or persist with one of control through tariffs and taxes. So far, it seems that the authorities might be taking the road most traveled as the Federal Tax Ombudsman has directed DISCOs to charge 18% sales tax on the gross value of electricity, rejecting net metering deductions. The latest Uraan Pakistan plan specifically mentions green energy solutions and infrastructure, but practical steps remain to be outlined.

GRAPHIC

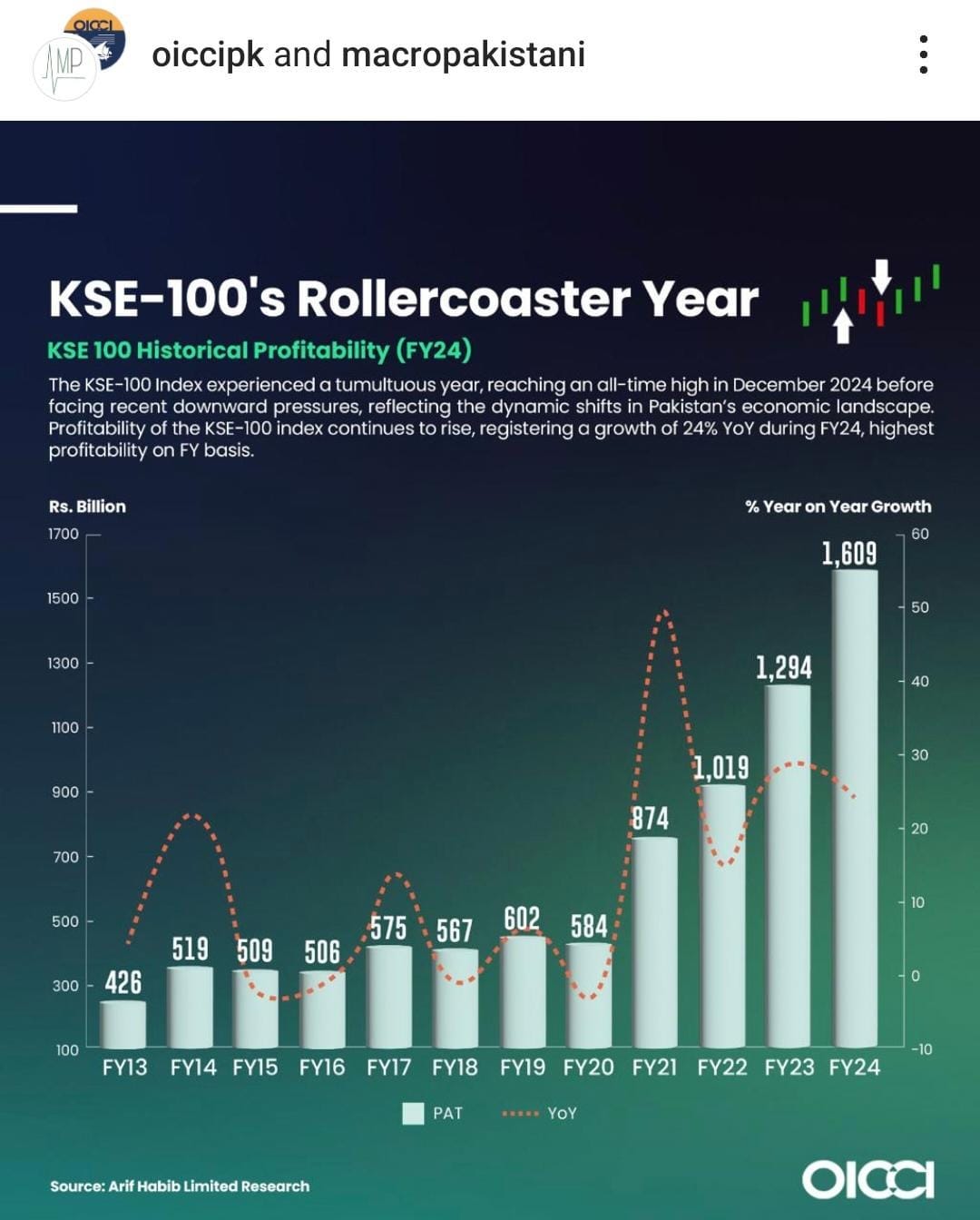

KSE-100 reached the 100,000-point level, a significant indicator of Pakistan’s financial market growth and recovery. It presents this achievement as a reflection of resilience and an opportunity for Pakistan to harness its capital markets for broader economic development. Several factors contributed to this surge, including a recovery in corporate earnings, export competitiveness due to currency devaluation, and political stabilization, which improved investor confidence.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.