Geopolitics and Investment Opportunities

State-owned funds invested over $65 billion in emerging markets last year, marking a 17.3% increase from the 2022 figures.

While Pakistan’s government struggles with making ends meet, sovereign investments in developing economies soared to USD 65 billion in 2023. These sovereign funds and public pensions have become huge sources of capital investment in developing economies, investing a total of USD 205 billion globally. In fact, the total assets managed by such funds will grow to USD 50 trillion by 2030. Since these investors manage huge funds and mainly invest in developing economies, they can contribute significantly to meet the investment requirements of such countries due to geopolitical factors.

But is Pakistan ready to welcome such inflows for privatizing state-owned enterprises?

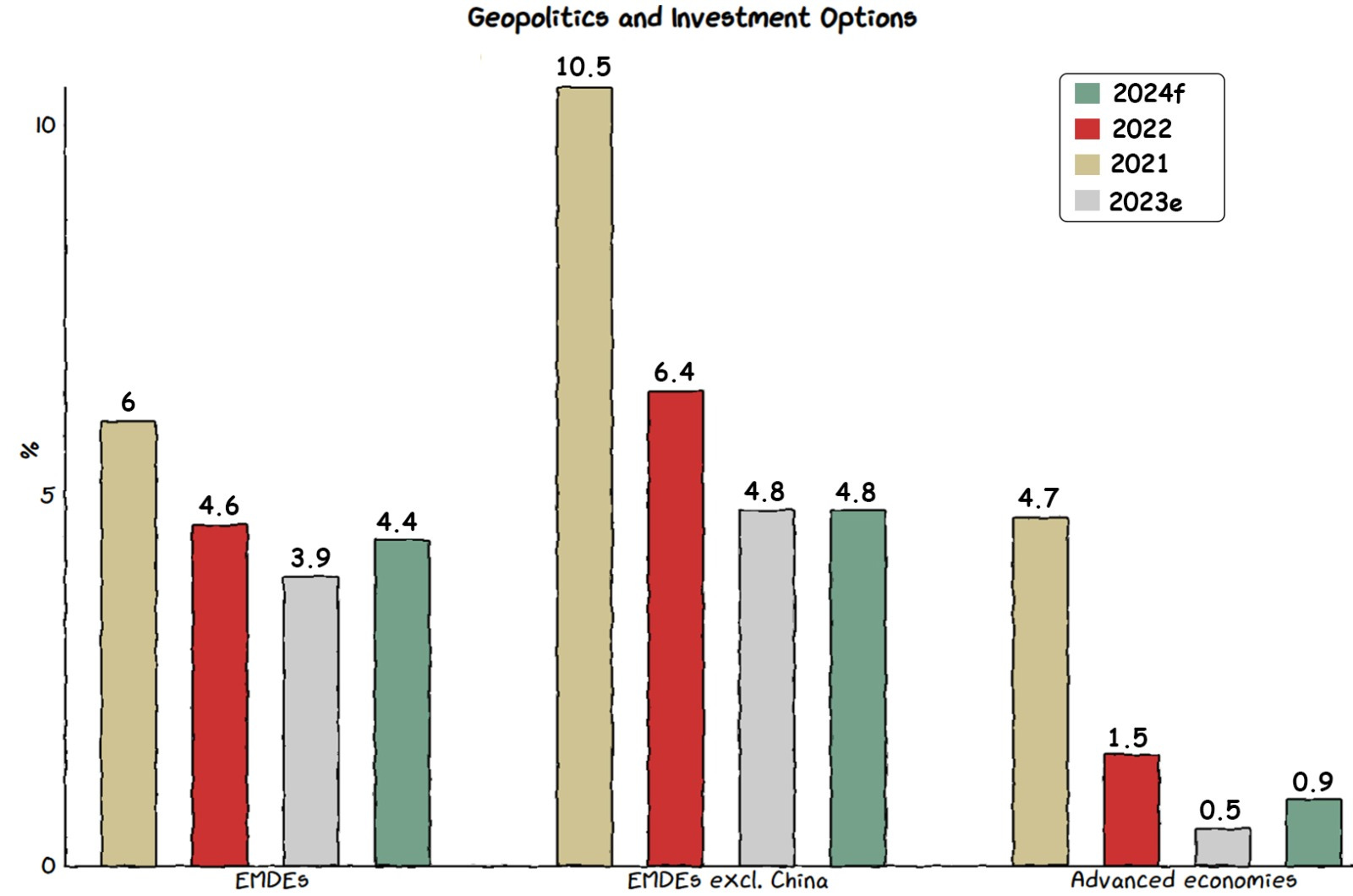

According to the World Bank, investment accelerations — ‘periods in which there is a sustained increase in investment growth at a relatively rapid rate’ — are absolutely crucial for emerging markets and developing economies. Furthermore, such consistent investment boosts output growth which typically surges during investment acceleration. World Bank's research shows that in Emerging Markets and Developing Economies (EMDEs), the annual output growth peaks at 5.9% during these accelerations from 1950 to 2022. This rate is 1.9% higher than in non-acceleration years. The rapid growth results in a nearly 40% expansion in GDP over six years, surpassing the growth observed in a similar timeframe outside of acceleration years by one-and-a-half times.

Currently, Pakistan is struggling to privatize its loss-making SOEs due to low interest in the domestic market. Transparency of governmental sales is crucial to observe the distributional impact of state-owned enterprises in the economy. However, recently Pakistan government has been favoring government-to-government transactions causing issues in the functioning of such enterprises. Examples of such transactions range from PTCL to Karachi Port Trust.

Retrospectively Pakistan can observe that it hasn’t handled such state-to-state transactions well. Therefore, for the privatization schemes in the pipeline, Pakistan needs to go the transparency route to ensure the people’s best interests and not just the current administration’s.

GRAPHIC

Pakistan has attracted significant investment in renewable energy, with debt constituting 90% of the commitments. However, the country budgets only 0.05% of its average budget for climate-related expenses.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.