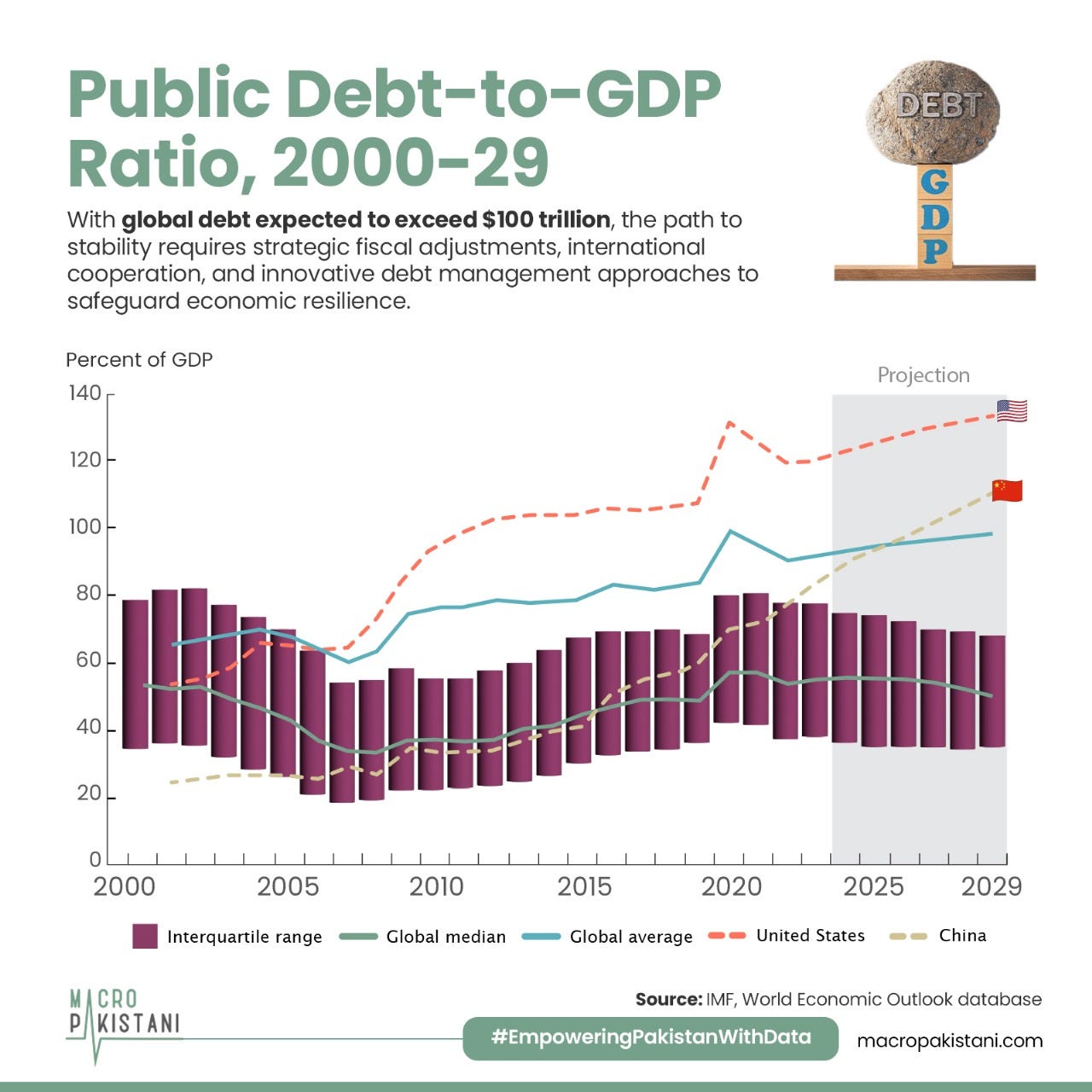

Global Debt at Risk

With global debt expected to exceed $100 trillion, the path to stability requires strategic fiscal adjustments, international cooperation, and innovative debt management approaches.

The debt-to-GDP ratio is expected to stabilize or decline in many countries but will remain above pre-pandemic levels in others, particularly in nations that account for over half of global debt and about two-thirds of global GDP. Future debt projections could be underestimated due to increased government spending demands, political reluctance to raise taxes, and ongoing challenges, such as the green transition and aging populations.

Do you think more stringent global fiscal policies could realistically prevent these rising debt levels?

The “debt-at-risk” framework reveals that debt projections vary widely by country and could exceed expectations if adverse economic conditions occur, with global debt reaching as high as 115% of GDP by 2026 in extreme scenarios.

Advanced economies face slightly lower risks, while emerging markets are more vulnerable to shifts in financial conditions, reflecting their large deficits and reliance on external funding. Additionally, an unexplained component of debt, termed “unidentified debt,” arises from factors such as contingent liabilities and fiscal risks, further increasing debt unpredictability.

To address debt challenges, countries need substantial fiscal adjustments and credible long-term fiscal plans to stabilize or reduce debt levels. Adjustments should aim for a 3.0–4.5% GDP reduction through strategies tailored to each country’s needs, such as tax system reforms in emerging economies and expenditure reprioritization in advanced economies. Gradual fiscal adjustments, reinforced by fiscal governance and transparency, are advised to balance debt management with economic growth, especially in high-risk nations.

Debt restructuring and concessional financing are also critical for countries facing severe debt distress, supported by ongoing reforms and international cooperation.

GRAPHIC

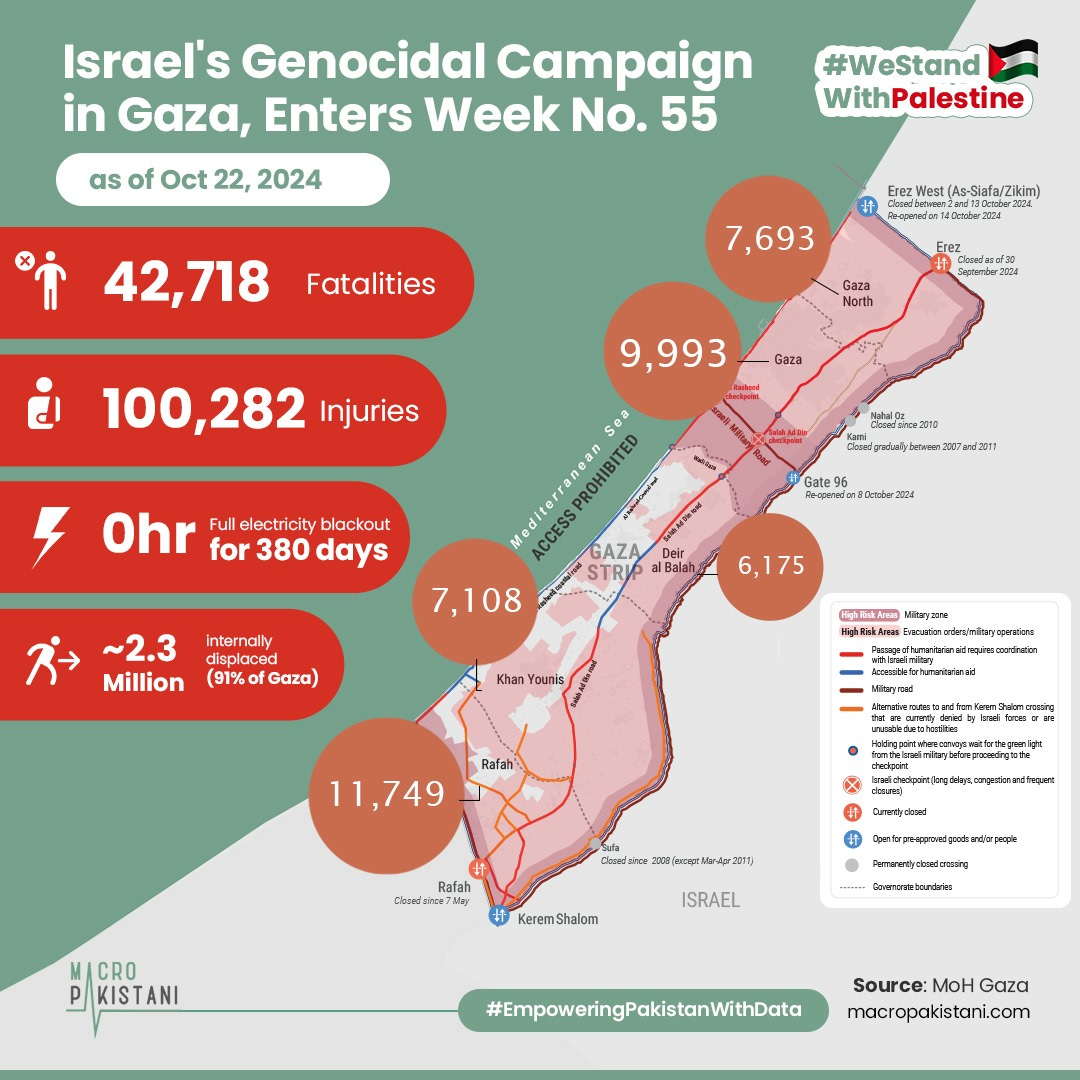

The massacres being committed in the northern Gaza Strip and the criminal bombing focused on homes, and the demolition of residential blocks over their residents is a Zionist insistence on Israel's ethnic cleansing campaign taking place in Gaza for more than a year now!

Pakistan’s current tariff policy, characterised by high taxes on a broad range of imported goods, has created economic distortions, costing the economy Rs. 1.77 trillion or 0.6% of GDP in 2023. While these tariffs protect domestic industries by making foreign goods more expensive, they also limit competition and stifle export sectors, reinforcing an anti-export bias.

Pakistan’s peer economies have achieved stable export-oriented growth over the past 30 years, while Pakistan’s share in the global market has declined by 32%. A key factor in this downturn is the declining productivity of its industries, which hampers economic growth and deters export-oriented foreign direct investment (FDI).

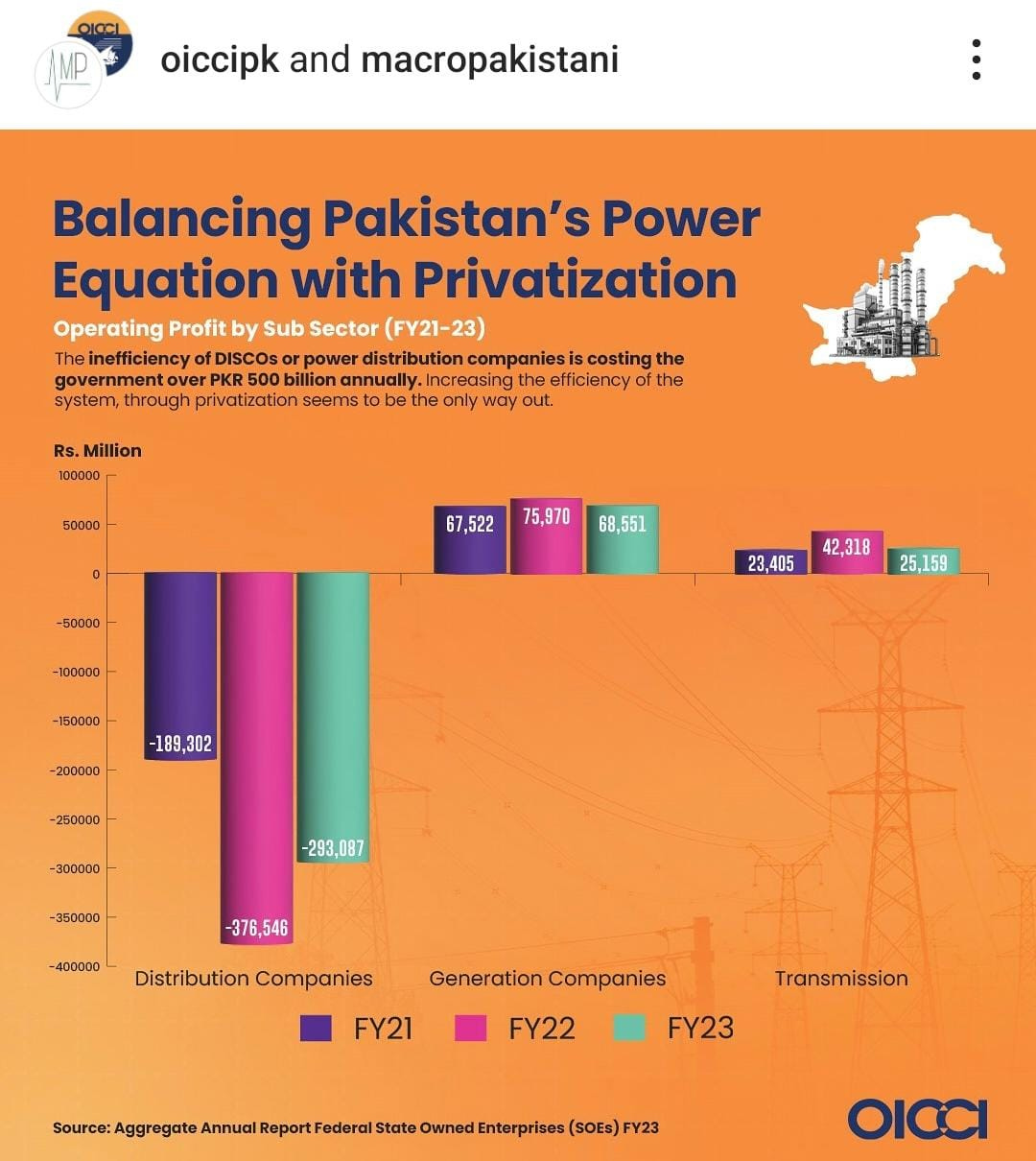

The inefficiency of DISCOs, or power distribution companies, is costing the government over Rs. 500 billion annually, making increasing the system’s efficiency through privatization seem to be the only viable solution.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.