Influences on the Monetary Policy

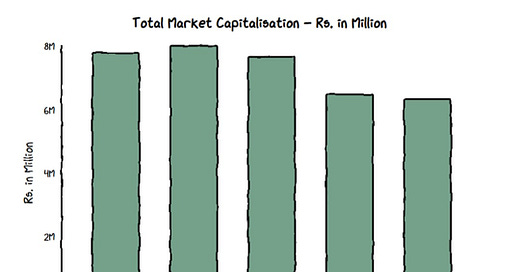

Only 526 companies are listed on the Pakistan Stock Exchange, as of February 2023.

The stock market channel impacts monetary policy, which in turn impacts the prices of stocks and in general output, employment, and inflation.

Central bank independence is purported as a crucial hedge against monetary disturbances. Post-1980s, especially in the aftermath of global oil shocks, empirical analyses showed how the independence of central banks was inversely related to inflation. This trend was consistent across developing and developed countries. But the question arises, can Pakistan as a political economy get along with a truly independent central bank? (More information on political economies in this short IMF video).

One of the most persistent conflicts in Pakistan’s case has been the infamous policy rate (yes, the one that just jumped to 20%). The interdependence of the Ministry of Finance and the State Bank results in politics-oriented decisions. Considering the short political cycles in Pakistan, these decisions tend to solve short-term solutions or can be deemed as quick fixes. Since money ties all economic actors together, we can imagine the impacts of such decision-making.

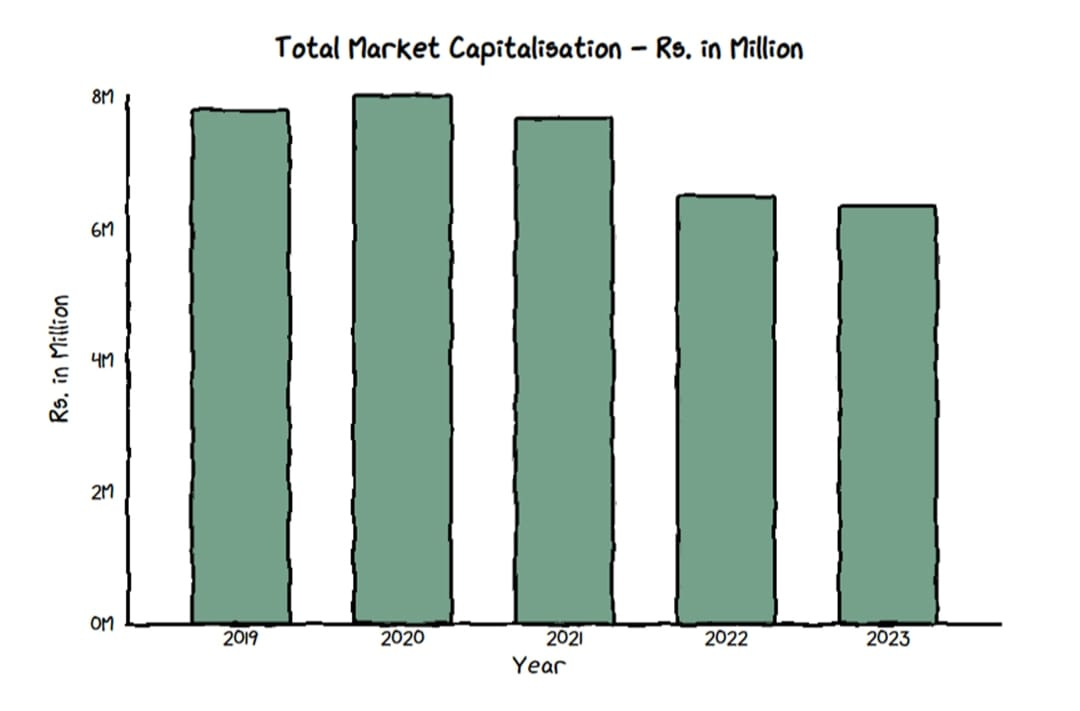

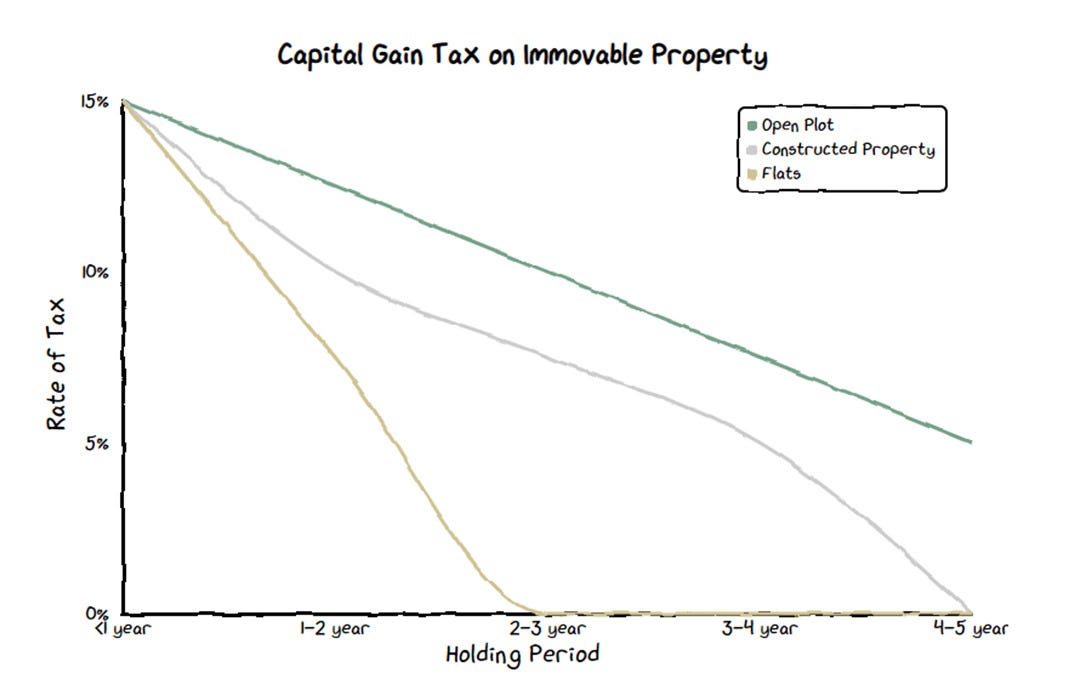

For instance, the stock market channel impacts monetary policy, which in turn impacts the prices of stocks and in general output, employment, and inflation. Furthermore, tax policy-based shocks greatly impact the market for instance the capital gain tax. Over the past few years, the number of investors in stock exchanges has remained relatively stagnant due to understandable environmental hindrances.

On the contrary, the monetary policy minimally impacts real estate. Considering its safe rates of returns and lower capital gains tax, real estate remains a far more accessible option. Other options, apart from stocks and real estate, including depositing cash and bonds, however, have observed a downward trend as well. Overall, the current state of economic and political affairs points toward real estate, especially construction, as one of the safe investment hedges against inflation and economic vulnerability.

Monetary Theory in Pakistan

Have you ever wondered why your parents could buy a whole lunch for Rs. 5, and you can’t even afford candy for that price? Well, we have some answers for you that stretch far beyond the rudimentary explanations of how inflation works.

READ MORE

GRAPHICS

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We have previously done/are doing successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.