Just Print More Money?

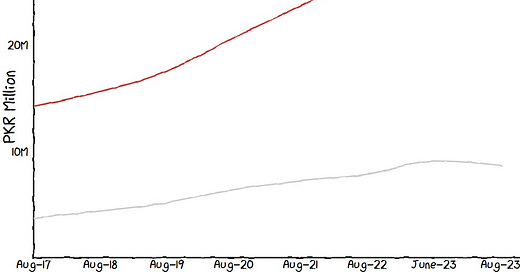

Inflation increased to 27% in August 2023 (YoY), whereas money supply increased by 15%

Pakistan's external account is under immense pressure, driven by a combination of factors including dwindling exports and the phantom of smuggling schemes. One cannot ignore the potential shortage looming on the horizon. It's worth noting that Pakistan's strategy to address this issue centers around a single crucial element; consumption. In the context of Pakistan's financial difficulties, where both the nation and its people are grappling with economic constraints, the question arises: Is excessive consumption the underlying problem, or is controlling it merely a temporary ‘Band-Aid’ until the next IMF bailout?

The invincibility complex apparent in Pakistan’s policies is immature at best, and lethal at worst. Currency in circulation increased by 21% in July 2023 as compared to the same time last year, reaching a staggering PKR 9 trillion.

On one hand, there is significant pressure to curb consumption through higher taxes, interest rates, and overall restrictions on imports. However, the increase in money supply inherently encourages consumption. The circulation of currency appears to be heading in a different direction, similar to an unsteady car veering off course.

There has been significant pressure on the government to take active measures to demonetize the economy. This suggests that instead of money primarily being utilized for immediate consumption (in the form of cash), Pakistan has the opportunity to redirect it towards investments using established banking channels. Therefore, any further growth in the currency will be matched with a sufficient increase in the value of goods in the economy.

Consequently, a rise in the money supply won't trigger inflation, as it often does in Pakistan. Pakistan’s informal economy is a huge part of the discussion, and an unprofessional attempt at demonetization will only worsen matters for the citizens. Therefore, it's imperative for the government to streamline its policies, because while Pakistanis may be patient, the IMF won’t be!

GRAPHIC

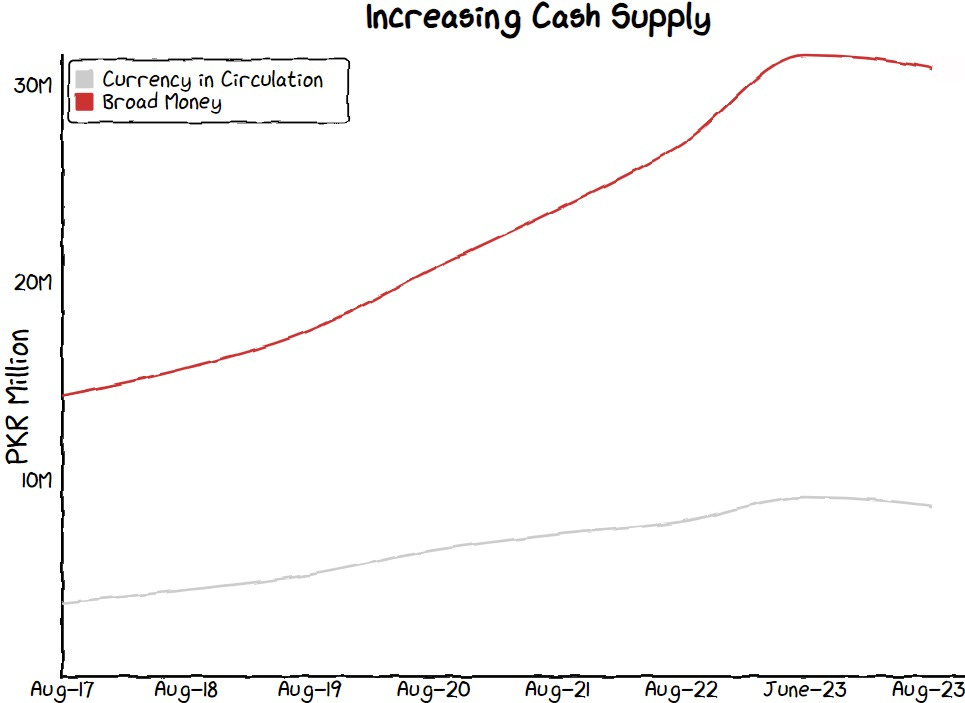

Petrol Prices Have Doubled Since April Last Year

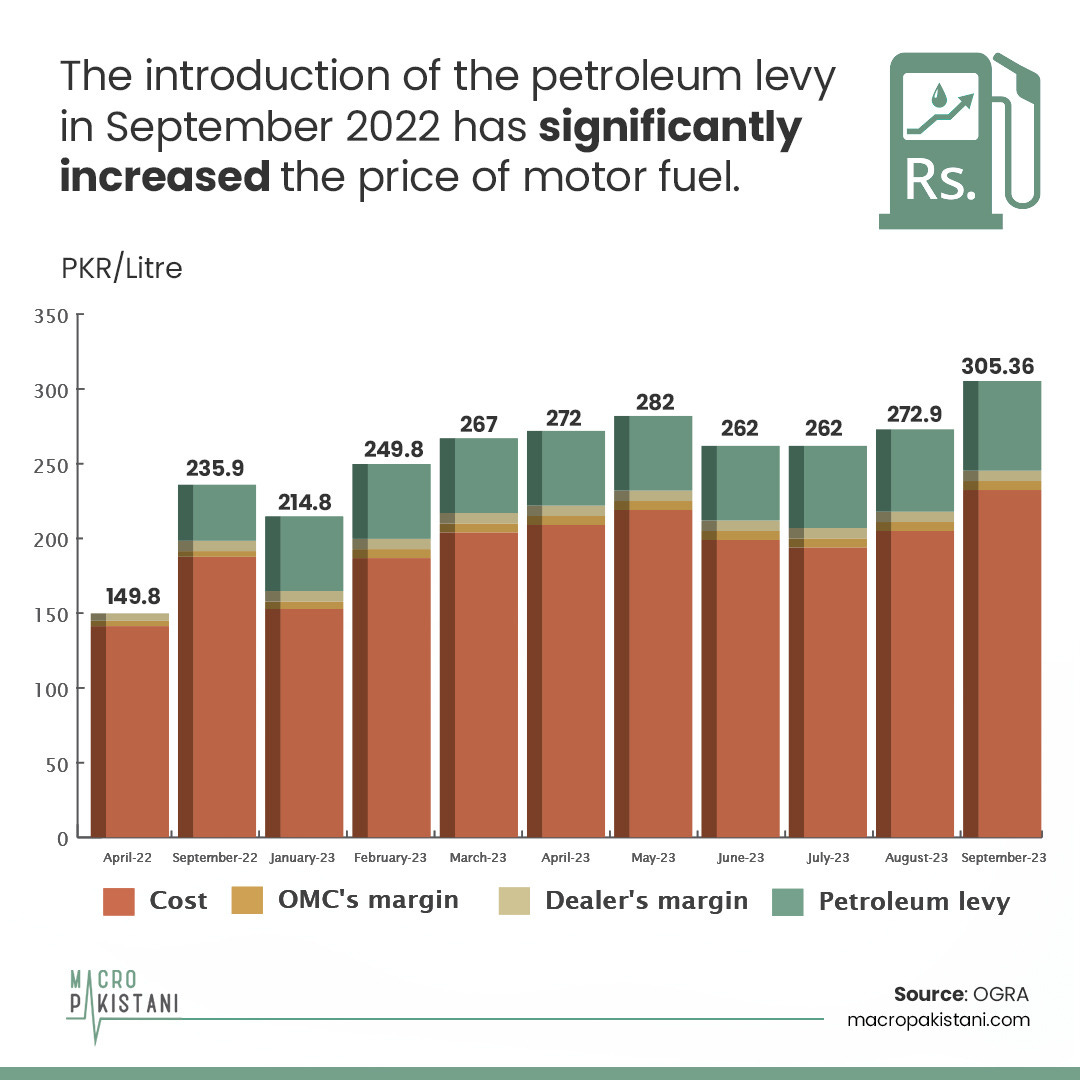

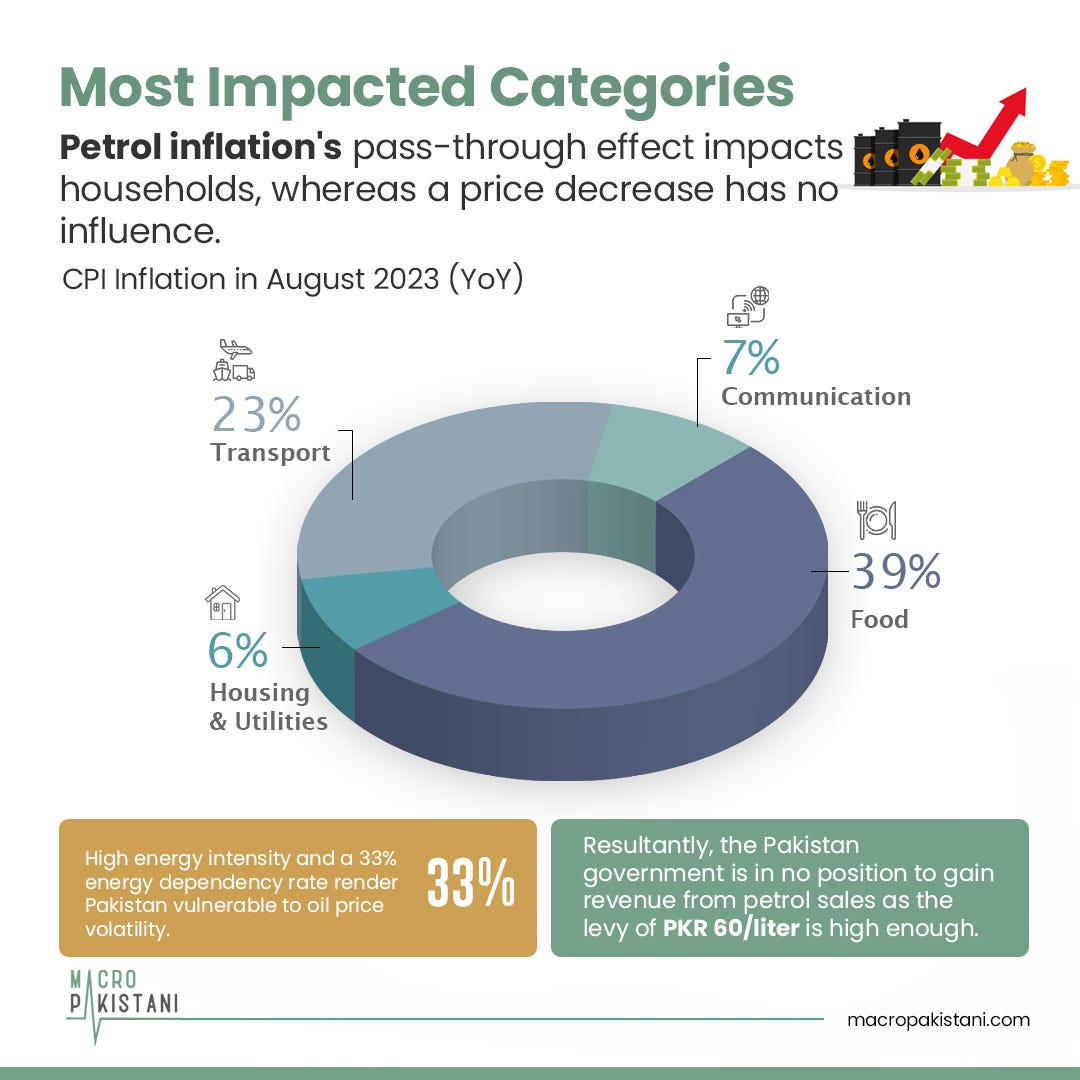

Petrol prices⛽ have seen a remarkable doubling 🔺️ since April 2022, and the introduction of a petroleum levy in September 2022 has only added to the financial burden faced by the average Pakistani🇵🇰

Despite the persistent inflation, government consumption hasn't shown a substantial decline.

Consumers are bearing the brunt of the impact, and accessing the following has become increasingly challenging due to the surging inflation in these categories:

● Food: 39% 🥘

● Housing & Utilities: 6% 🏠

● Transport: 23% 🚌

● Communication: 7% 📩

In these challenging times, the economic landscape demands a closer look at how these factors are impacting households and different sectors of the economy. Policy making should always have people at the center.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.