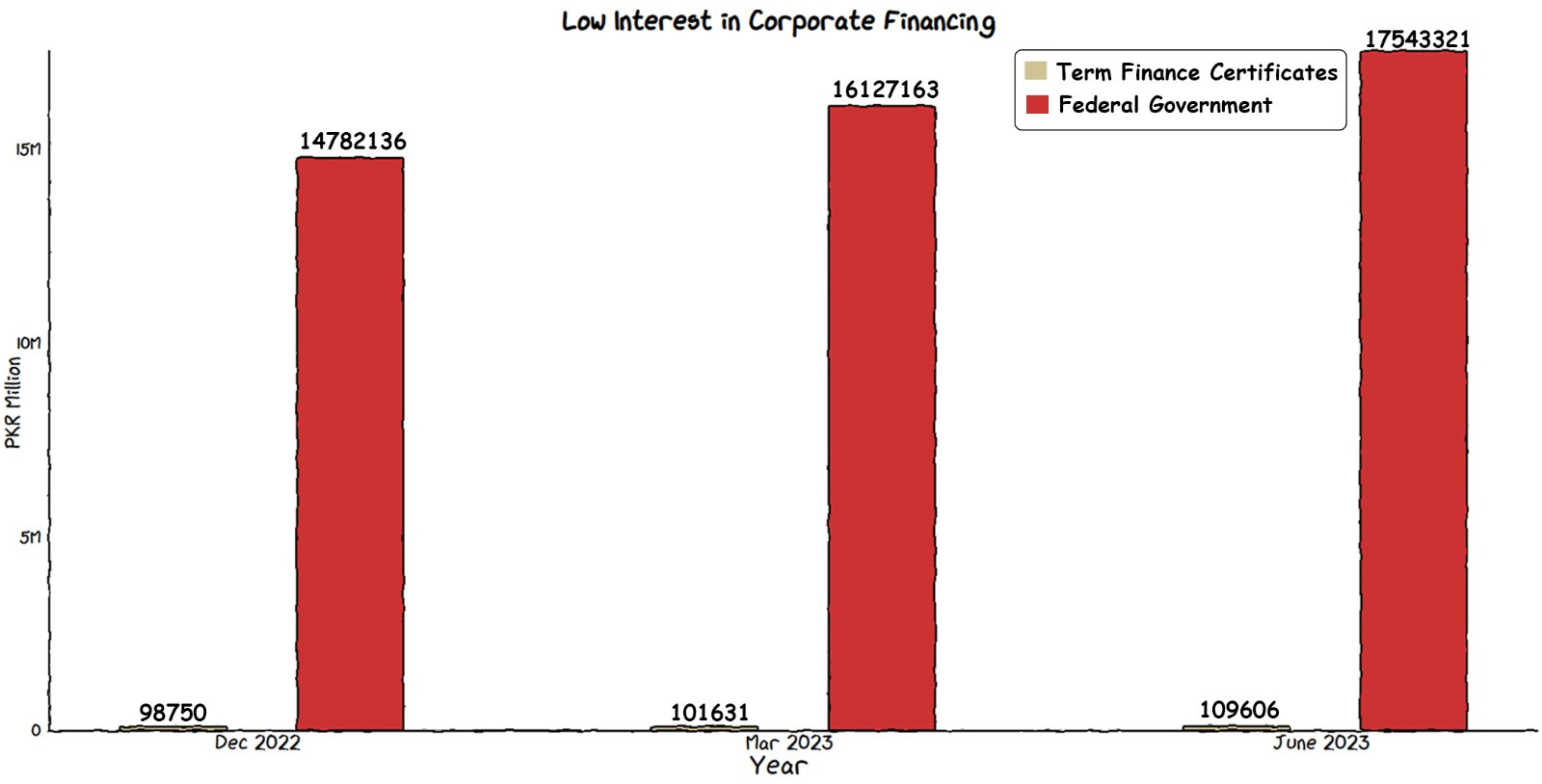

Limited Avenues for Corporate Financing

Pakistan government’s bonds dominate the landscape, leaving little room for corporate financing growth.

Pakistan has a limited bond market, especially due to the recent domination by the government over the market. Securities and the Pakistan investment bond are the most prominent sources of the government’s revenues, along with the National Savings Scheme, however, limited corporate bonds are available in the form of term finance certificates. Despite the recurring challenges of Pakistan's debt burden, there has been a nearly twofold increase in its bond levels since late May. This surge is attributed to optimism surrounding anticipated support from the International Monetary Fund (IMF).

Why not encourage more corporate bonds if the market continues to show an appetite?

The issue of crowding out has been discussed at length, however, its impact on a potential corporate bond market has been ignored. For one, an obstacle to the corporate bond market is the government's dominance in borrowing, which competes with the private sector for available savings. The government holds an advantage as lending to it is perceived as risk-free. The government attracts retail savings through various National Savings Schemes and institutional investors through Pakistan Investment Bonds and Market Treasury Bills. These are undoubtedly safer investments when compared to high-risk term finance certificates. Furthermore, the lack of a well-developed secondary market for government bonds distorts the actual demand for securities.

For long, banks and the equity market have functioned as the primary source of finance for businesses, with term finance certificates lagging. However, this prevents corporations and firms from accessing long-term sustainable financing that can be utilized for expansion. There are various impediments faced by a business looking for financing through the bond market, including a long process and the unavailability of data. The government should consider limiting its footprint in the bond market to improve corporate bonds in the market. This will further broaden the horizons of the investor base.

GRAPHIC

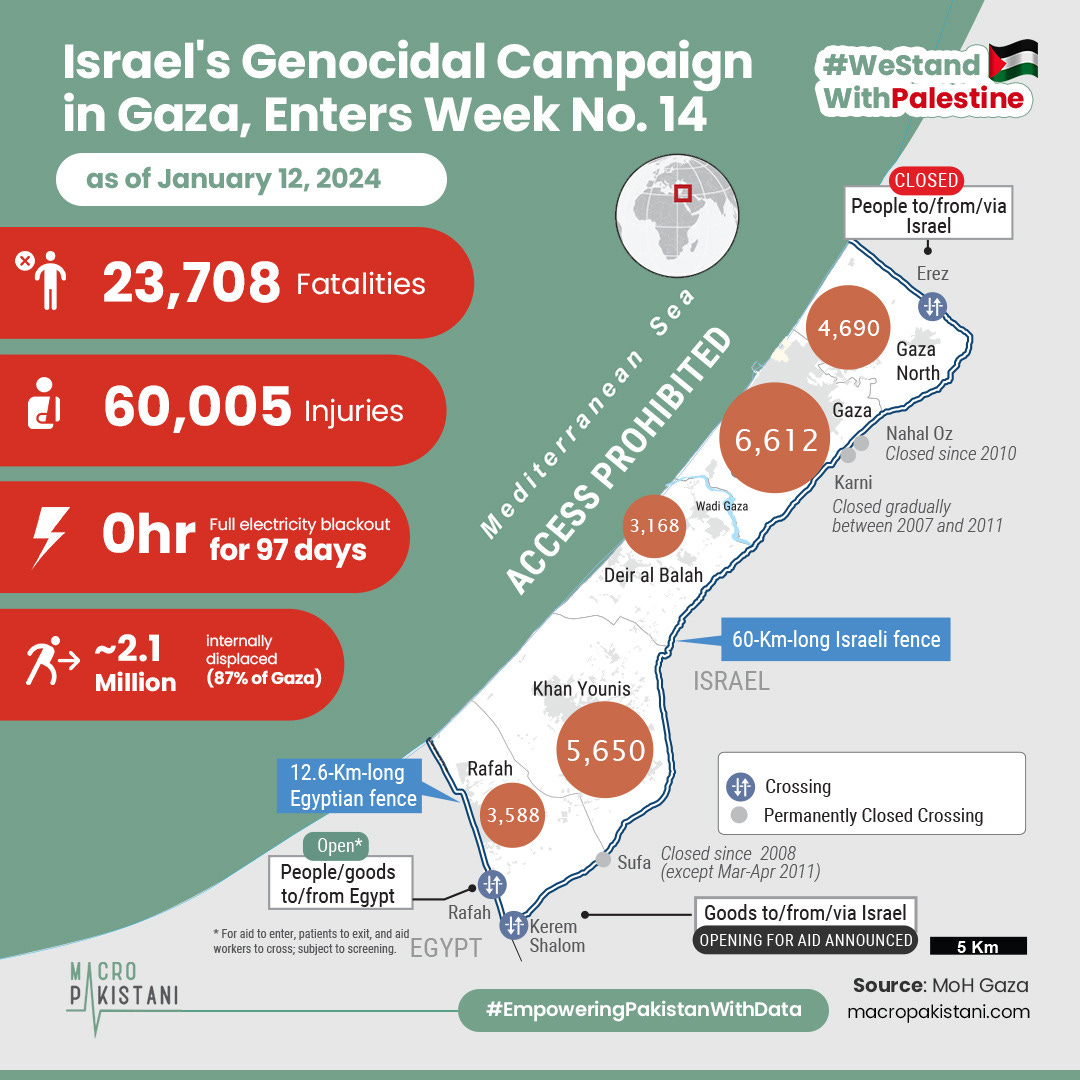

In just over two months, researchers say the offensive has wreaked more destruction than the razing of Syria’s Aleppo between 2012 and 2016, Ukraine’s Mariupol or, proportionally, the Allied bombing of Germany in World War II. It has killed more civilians than the U.S.-led coalition did in its three-year campaign against the Islamic State group.

Pakistan’s high tax potential is driven by an unequal taxation system, with the manufacturing sector facing a disproportionate tax burden despite its substantial contribution to GDP. Pakistan falls into the category of nations with low tax effort and low taxation, suggesting room for a potential 10% improvement in tax collection relative to GDP.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.