Micro-Loans and Livelihoods

Microfinance banks face vulnerability due to high administrative costs and the profile of borrowers, leading to a 36% growth in losses in 2023.

The ongoing cost of living crisis has a disproportionate impact on the lower middle class, primarily because a significant portion of their spending is allocated to commodities with fluctuating prices. Yet, their incomes have restricted upward flexibility, leading to borrowing to meet basic financial needs. Previously, informal sources including family, friends, and lenders were the prominent lenders. Nevertheless, with the government's increased emphasis on microfinance institutions, borrowing for lower-income households has become somewhat more formalized and secure in recent times. On average, the size of loans has increased to PKR 64,853 for microfinance banks.

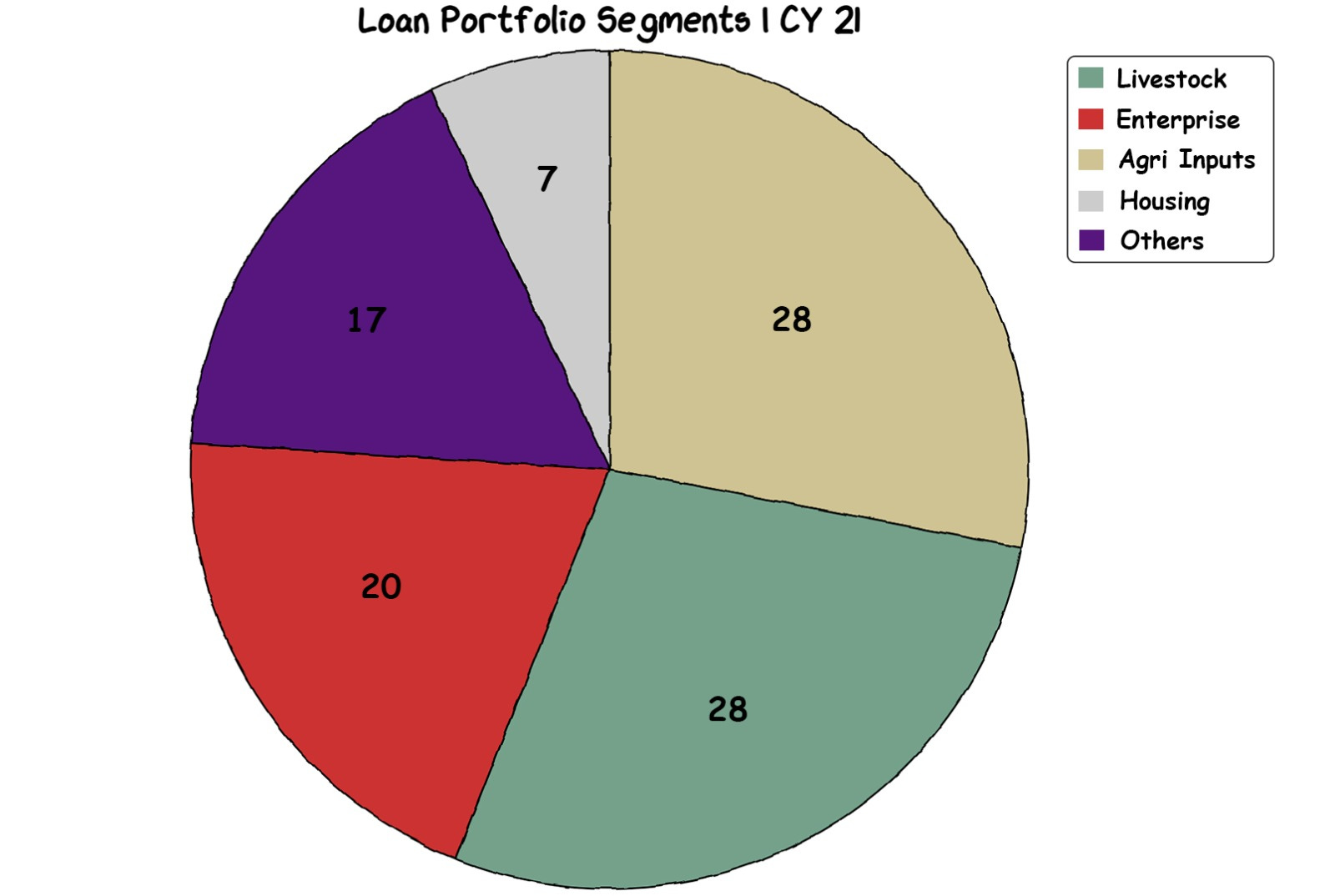

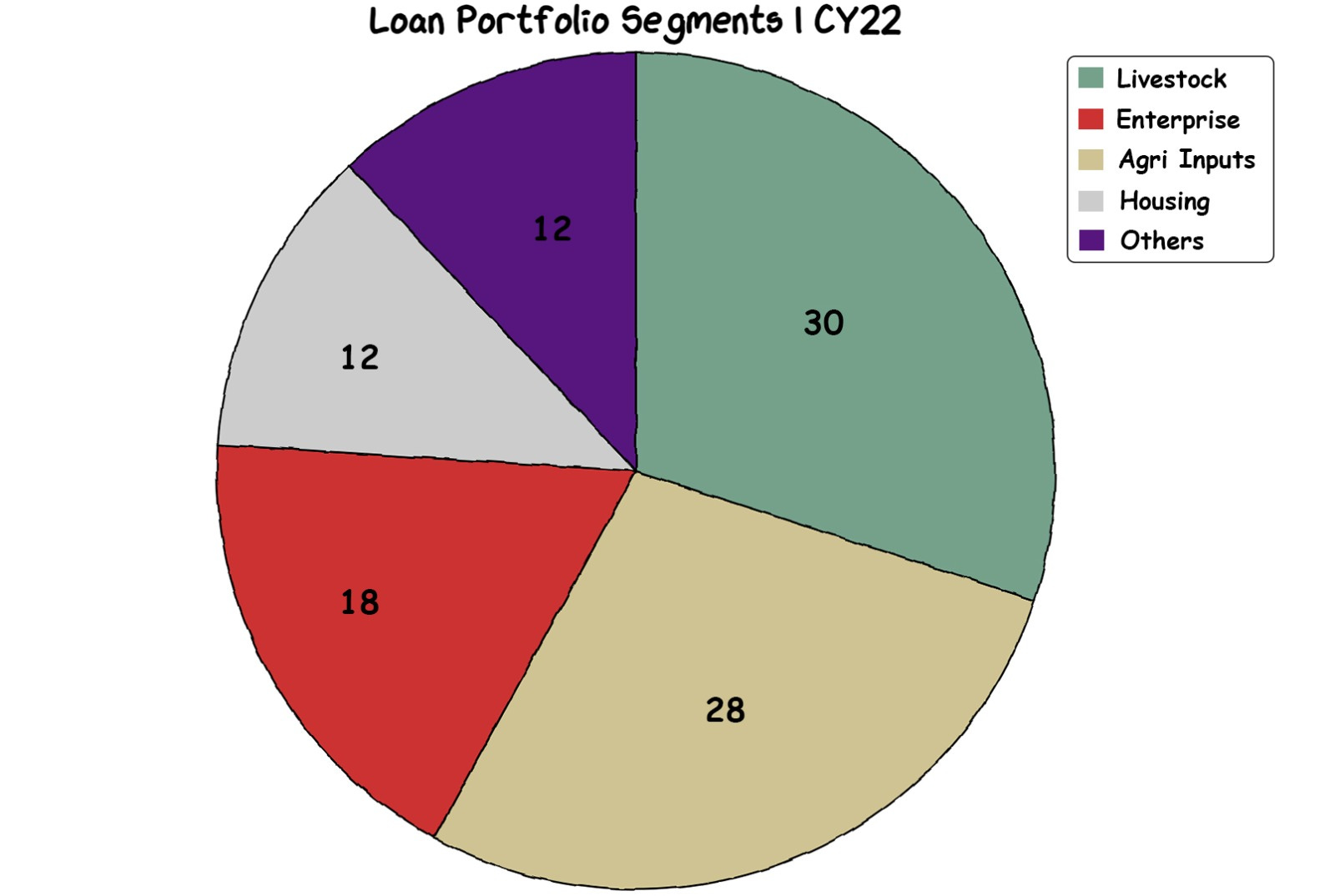

At the same time, the quality of credit has deteriorated, which can be observed by the increase in portfolio at-risk for microfinance banks. The primary purpose of microfinance loans in the developing world is the promotion of entrepreneurship which improves the livelihood of borrowers and simultaneously makes microfinance banks profitable. Interestingly, Pakistan’s microfinance borrowers are involved in agriculture or livestock; a sector vulnerable to economic turbulence.

Furthermore, there has been a decline in enterprise borrowing in the microfinance sector.This trend highlights the embedded vulnerabilities in the system. However, savings are a significant by-product of the exercise, which may provide returns in the long term. Yet there needs to be a policy focus on promoting non-agricultural enterprises among microfinance borrowers, to not only impact livelihoods but also diversify the economy.

GRAPHICS

This Macro Data Story is produced in collaboration with Openminds Consulting, a Karachi-based consulting firm that partners with leading businesses and groups in Pakistan to tackle their most significant challenges and capitalize on opportunities for growth.

The firm is founded by Mr. Asif Saad who is a contributing writer for ‘Profit’ and a strategy consultant. He has previously worked at various C-level positions for national and multinational corporations (including Lotte Chemical Pakistan Ltd, Dawood Hercules Corporation Ltd and K-Electric). Mr. Asif Saad was also elected as the Vice President of the Overseas Investors Chamber of Commerce and Industy (OICCI) back in 2014.

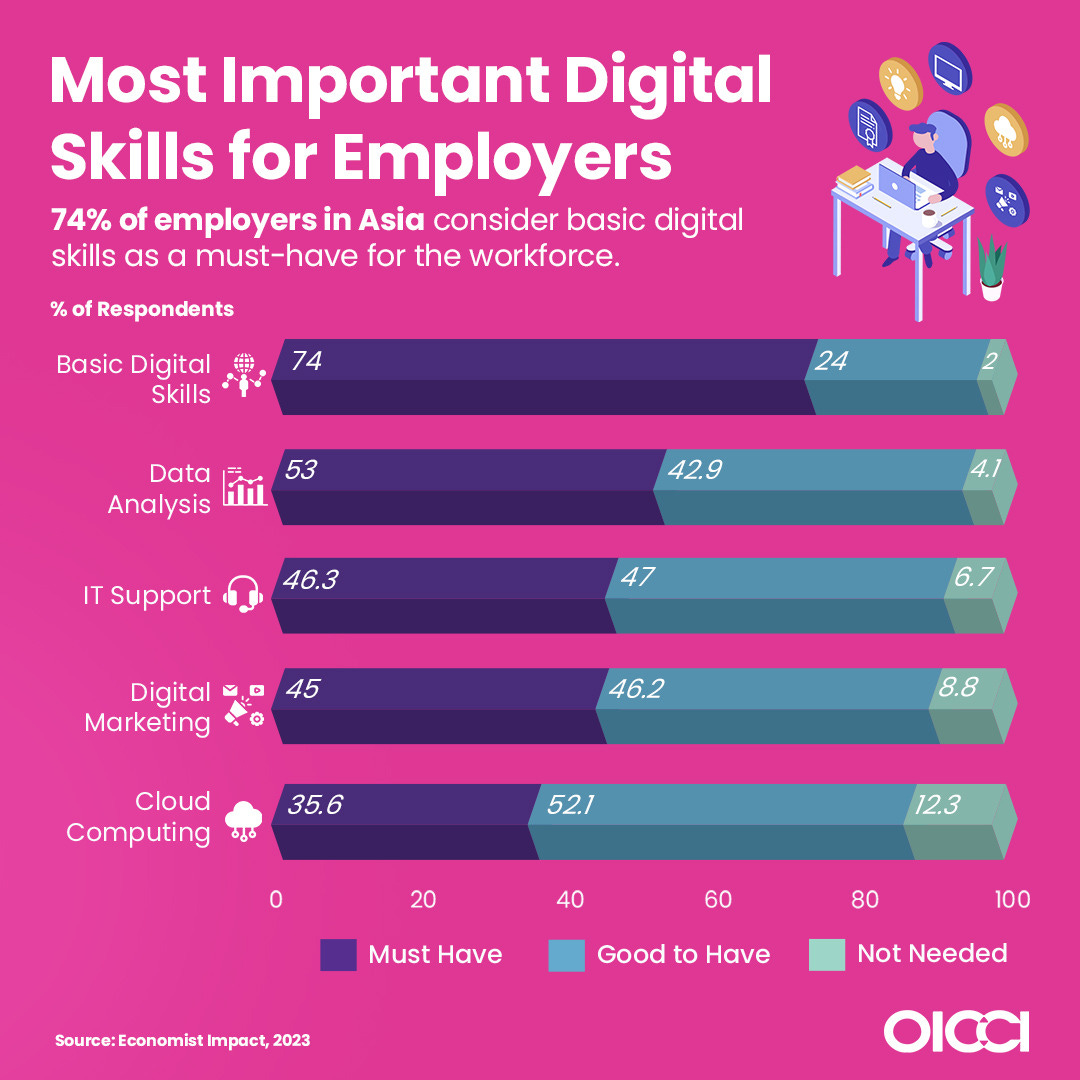

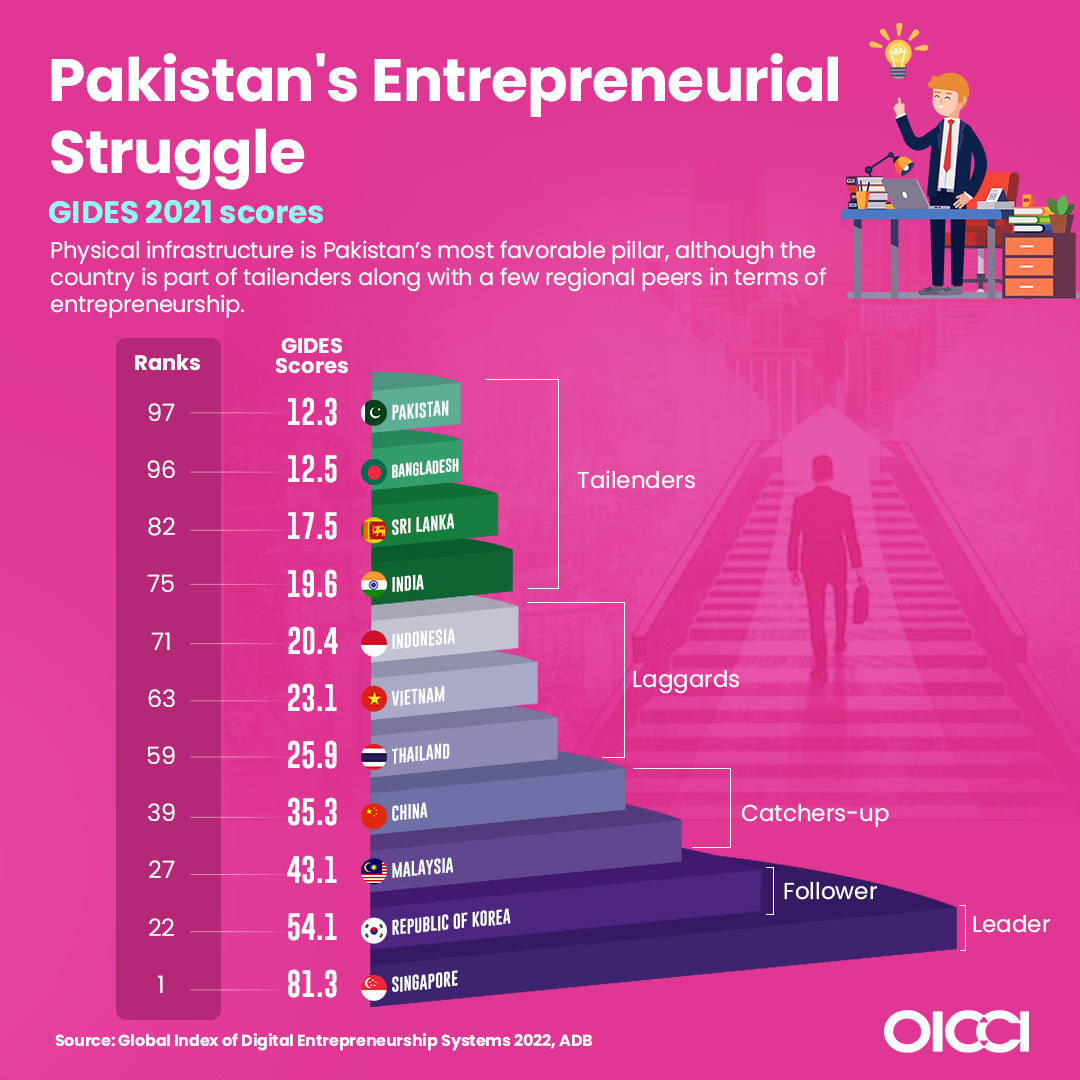

In Asia, basic digital skills are in high demand, with 74% of employers considering them as crucial skills in employees. Despite this challenge, Pakistan boasts a strong physical infrastructure. However, its entrepreneurship lags compared to regional peers. Still, Pakistan's burgeoning startup scene

has attracted significant investments, totaling Rs 15.43 billion, and the incubation network includes over 2300 women entrepreneurs.

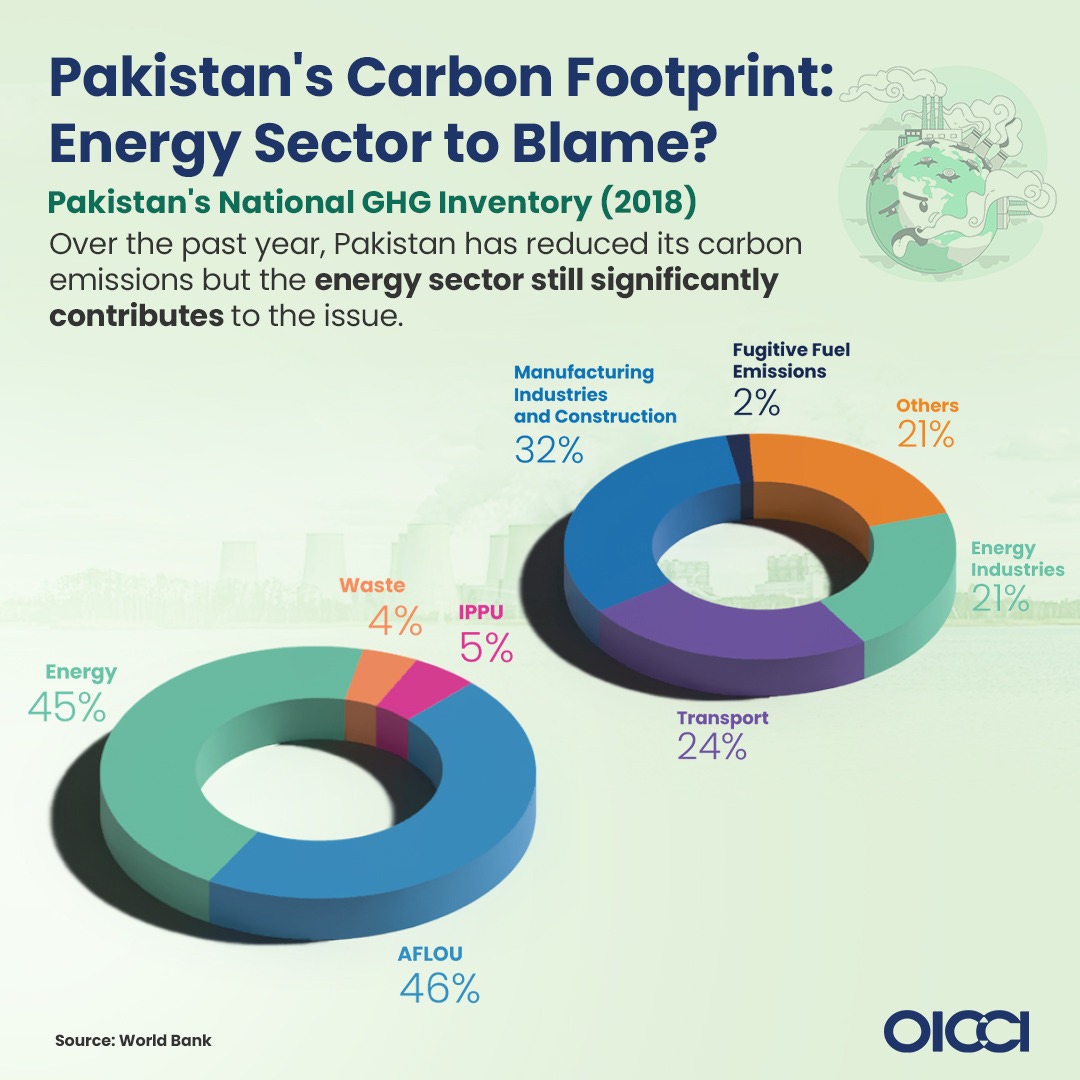

Despite reducing emissions over the past year, Pakistan's energy sector contributed a significant 45% to the country’s total greenhouse gas emissions.

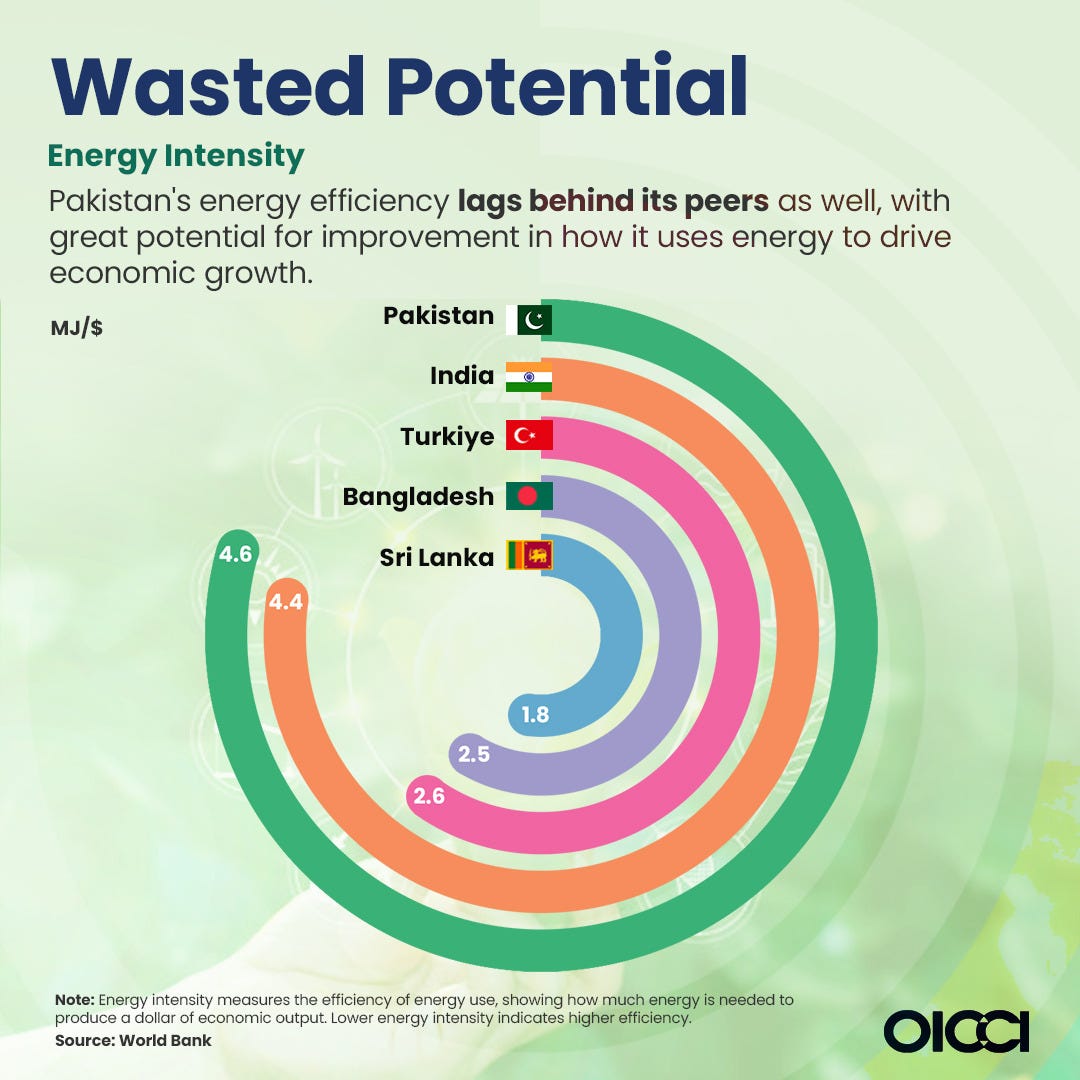

Pakistan also lags behind its peers in energy efficiency, offering substantial room for progress in utilizing energy for economic development. Not only is the structure causing environmental damage, but it also causes noteworthy GDP losses.

In a global context, the year 2023 marks a historic milestone with a record-breaking $1 trillion invested in renewable energy and efficiency. The OICCI urges collaboration between businesses and the government to enhance the energy sector's efficiency, which would allow green investment to flow into Pakistan.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.