Mid-Year Performance Review of the Banking Sector

Banking sector balance sheets expanded by 11.5% in H1CY24, driven by increased investments in government securities. While private sector advances slowed, SME financing showed signs of recovery.

The expansion in the asset base was mainly driven by investments. Domestic advances increased by 0.6% during this period; however, this growth primarily came from public sector advances, which grew by 3.9%, while private sector advances contracted by 0.6%.

What factors might influence future growth in private sector lending?

Despite the contraction in private sector advances, it was significantly lower than the 7.0 percent contraction observed in H1CY23, indicating a potential recovery as macroeconomic conditions gradually improve. On the funding side, deposits increased by 11.7% in H1CY24, reflecting a stable inflow of customer funds, although banks' reliance on borrowings remained noteworthy.

Asset quality dynamics remained steady, with a subdued uptick in gross non performing loans (NPLs). The total provisioning coverage improved with the introduction of IFRS-9, which required banks to create allowances for prospective future losses. By the end of June 2024, the total provisioning to NPLs ratio improved to 105.3% from 94.4% a year earlier, while specific provisioning also saw an increase to 85.5% from 83.6%.

Earnings did slow due to a deceleration in net interest income; however, non-interest ncome helped support overall profitability. The solvency position of the banking sector remained robust, with a Capital Adequacy Ratio standing at 20.0 percent compared to 17.8 percent in June 2023. Notably, the sector showed resilience in stress testing scenarios, indicating its ability to withstand severe economic shocks.

Domestic financial markets experienced relatively lower stress during H1CY24 compared to H1CY23, attributed to improving macroeconomic conditions and a reduction in country risk premium. A more stable foreign exchange market contributed to the overall calm, though the equity market did see increased volatility. Nonetheless, the money market functioned smoothly, with the State Bank of Pakistan's monetary policy operations effectively maintaining interest rates within the policy range.

GRAPHIC

Netanyahu claims that a 'victory' over Hamas is within reach, but the evidence suggests otherwise (according to a special report by CNN).

Hamas’ military wing, known as the Qassam Brigades, is divided into 24 battalions spread throughout Gaza, according to the Israeli military.

As of July 1, 2024; assessments reveal that only 3 out of 24 battalions are combat ineffective, having been destroyed by Israeli forces. This means 8 battalions remain combat effective, actively engaging against Israeli Occupation Forces (IOF) in Gaza to defend themselves during the genocidal campaign.

The remaining 13 battalions have been degraded, conducting sporadic and largely unsuccessful guerrilla attacks. These units have suffered significant losses, limiting their operational capacity.

Interestingly, the battalions in central Gaza are the least damaged, as they are believed to hold many Israeli hostages. Additionally, 7 of the 16 battalions targeted by Israeli forces have managed to partially rebuild their capabilities in the last six months, particularly in the heavily affected north.

The report does not cover southern Gaza due to insufficient historical data on the Hamas battalions there.

In case anyone wants to contribute (to the Palestine solidarity campaign on Macro Pakistani) and send data-backed content, please feel free to send an email to fakiha.rizvi@brandnib.com

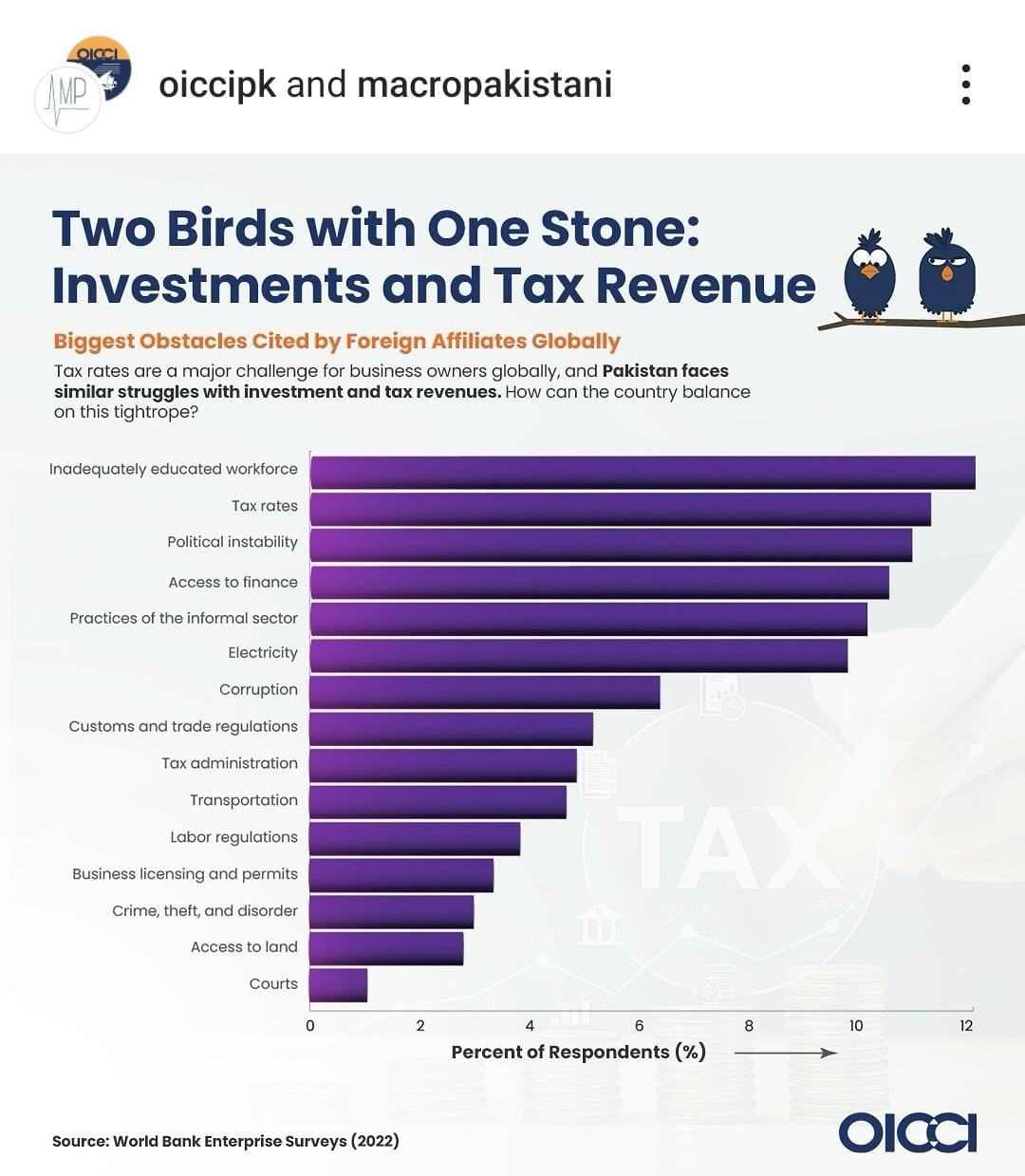

Tax rates are a significant challenge for business owners globally, and Pakistan faces similar issues with investment and tax revenues. Particularly, the informality of the economy, tax administration and high tax rates are deterrents for investors.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.