Mining Dreams in a Power-Starved Nation

Pakistan wants to mine Bitcoin with surplus power, but 54% of the population lacks internet access, and the country struggles with energy outages.

In an ambitious but arguably misplaced attempt to leap into the global digital finance race, Pakistan has established the Pakistan Crypto Council (PCC) and the Pakistan Digital Assets Authority (PDAA), with plans to regulate its $25 billion informal crypto market. The proposed uses of cryptocurrency in Pakistan include: establishing a strategic Bitcoin reserve as a sovereign asset; using 2,000 MW of surplus electricity to power Bitcoin mining and AI data centers; creating a FATF-compliant regulatory framework to govern digital assets; applying blockchain in governance and finance for improved transparency and record-keeping; promoting tokenization and decentralized finance (DeFi); and positioning the country as a global innovation hub for crypto, blockchain, and AI technologies.

While officials tout this as a step toward innovation, the initiative appears divorced from the on-the-ground realities. Pakistan's economy remains overwhelmingly cash-based, with digital infrastructure affected by slow internet, limited connectivity, and low financial inclusion. The idea of diverting excess energy to mine crypto, when traditional industries suffer from chronic underutilization and power shortages, raises serious concerns about the government’s priorities. Rather than addressing foundational issues in industrial capacity, energy distribution, and digital literacy, the government seems intent on riding a speculative wave without having a foundation.

Despite optimistic claims about the potential of blockchain and cryptocurrency to revolutionize Pakistan’s economy, the country’s digital foundation remains shockingly weak. According to the Pakistan National Human Development Report 2023/2024, Pakistan falls into the "moderate" digital development category, with a cumulative Digital Development Index (DDI) of only 0.205. More than half of the country's districts rank low on digital development, and 54.3% of the population does not have access to the internet due to inadequate infrastructure and an affordability crisis. This digital divide is both geographic and deeply rooted in socioeconomic and gender disparities. The richest income group enjoys fifteen times greater digital development than the poorest, while over 83% of women report that their phone ownership is dictated by a spouse or parent. In this context, the government’s decision to prioritize cryptocurrency mining, justified by the questionable notion of surplus energy, appears shortsighted.

That energy could instead support existing conventional industries, which remain underdeveloped and in need of reliable power. Without significant investments in digital access, infrastructure, and literacy, pushing high-tech financial solutions risks widening existing inequalities and excluding millions from any potential benefits.

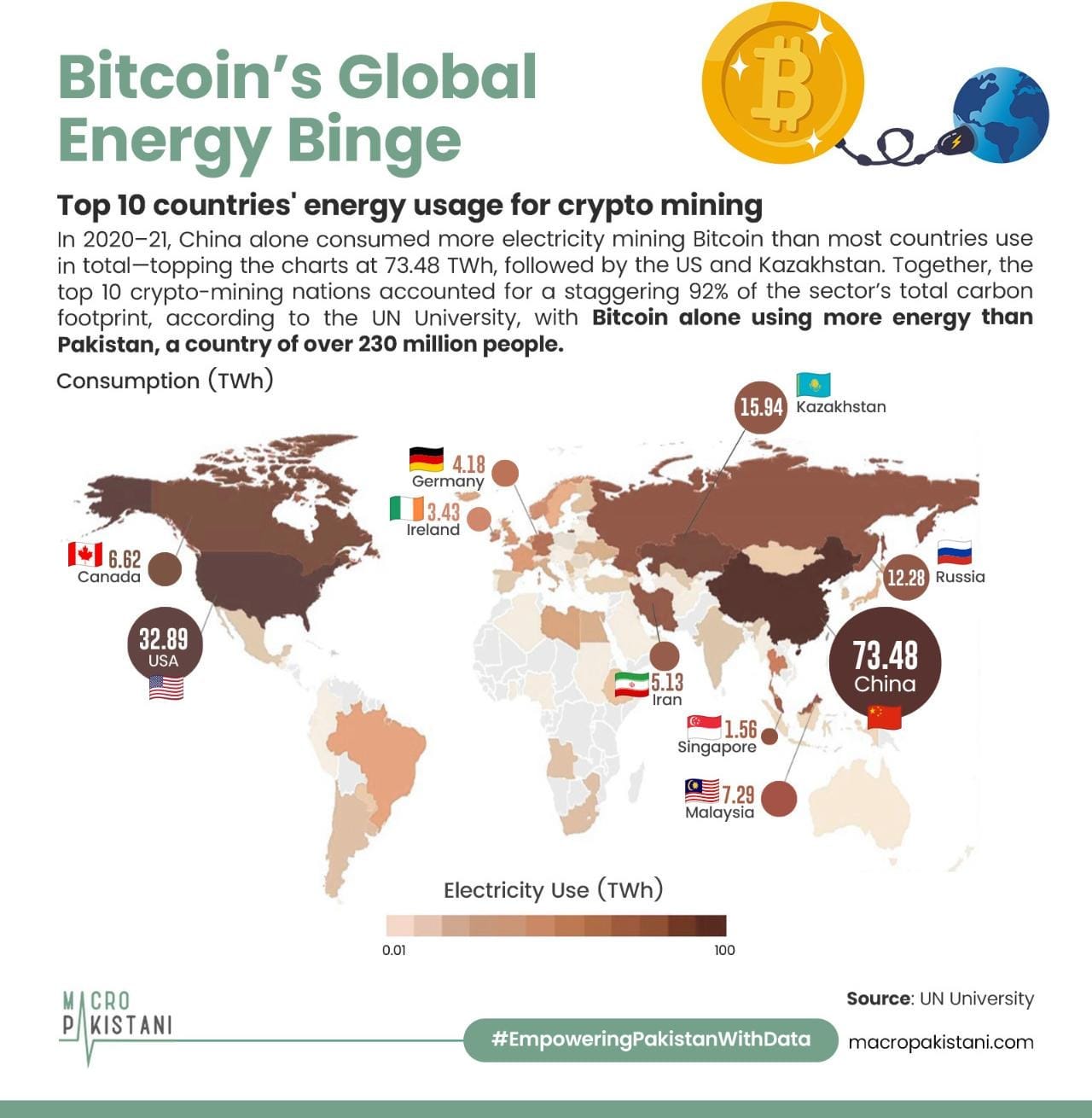

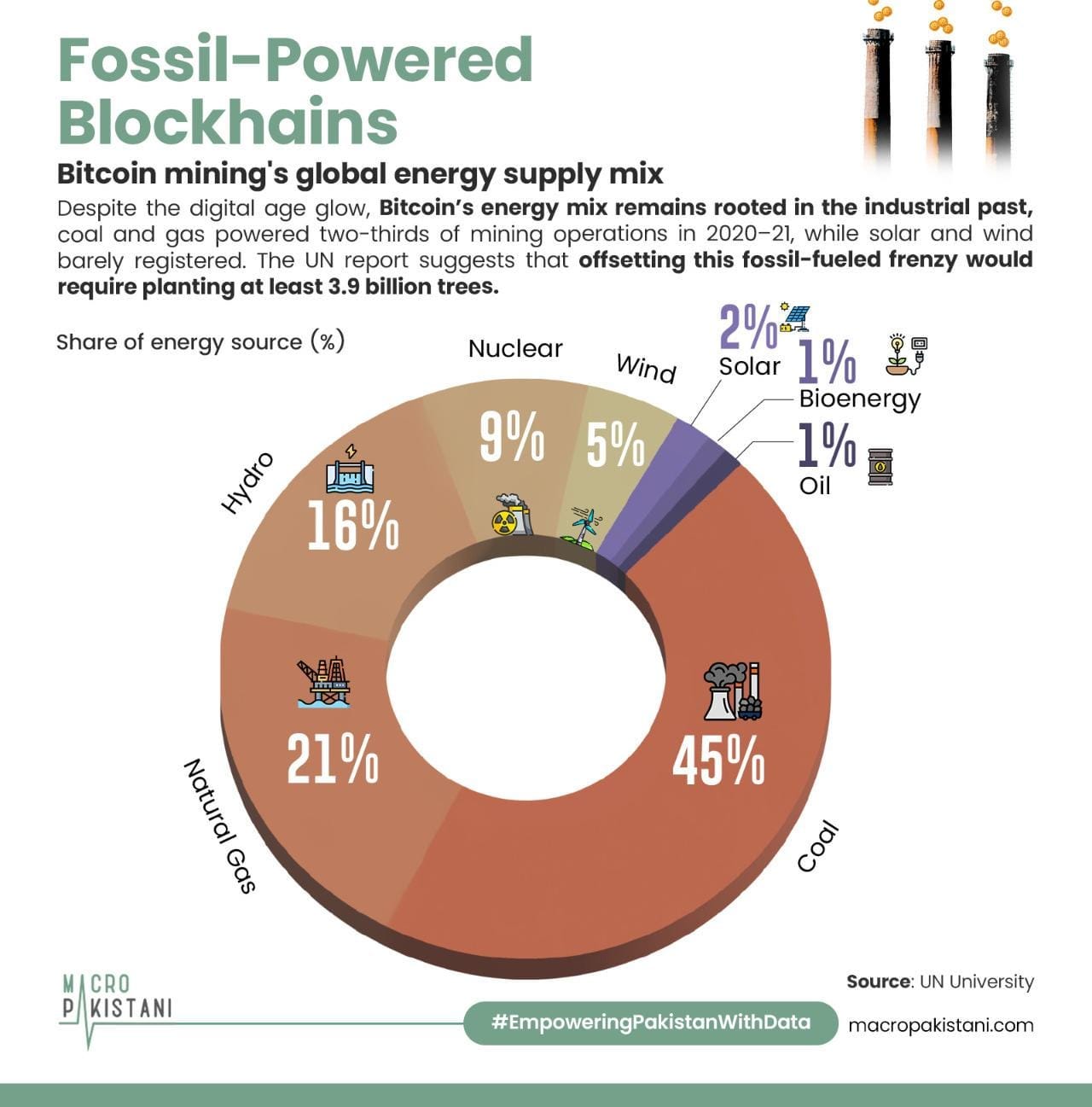

Finally, the environmental impact of crypto mining, especially for a country like Pakistan, is already facing severe climate challenges. Bitcoin mining now consumes more electricity annually than most countries, including Pakistan, with estimates of up to 172 terawatt-hours. It also produces up to 96 million tonnes of CO₂ per year, not to mention the water and land footprint (Watch this video on Meta’s data center’s impact on the environment). In a nation struggling with energy shortages, water scarcity, and environmental degradation, diverting resources to such a high-emission industry is questionable, to say the least.

P.S. So far, no cost-benefit analysis or feasibility study has been publicly released to justify the Crypto Council’s proposals.

GRAPHICS

Israel is expanding the genocidal campaign in Gaza and displacing Palestinians for the complete evacuation of Gaza’s population from conflict zones, including northern Gaza, to “collection camps” in the southern part of the enclave.

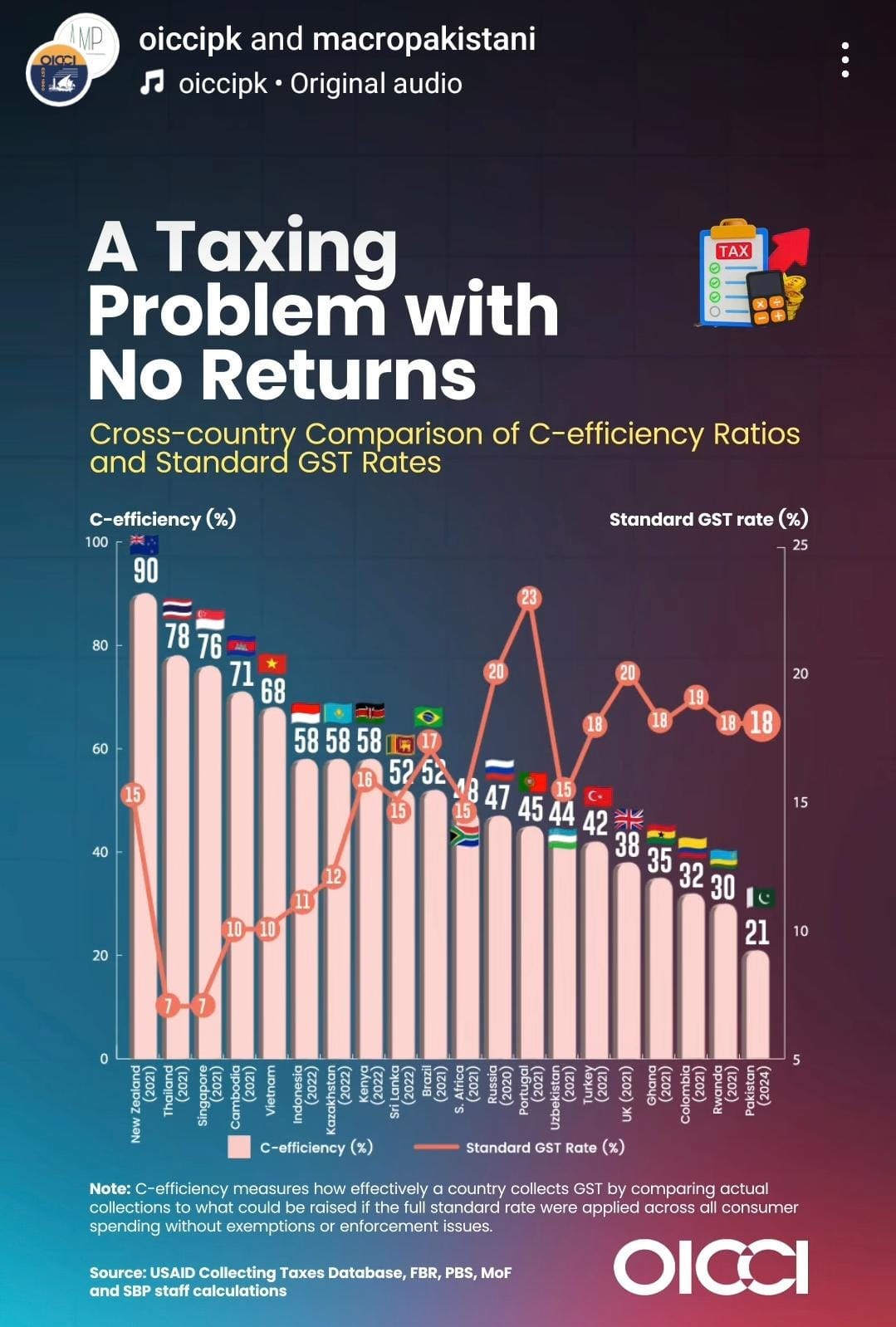

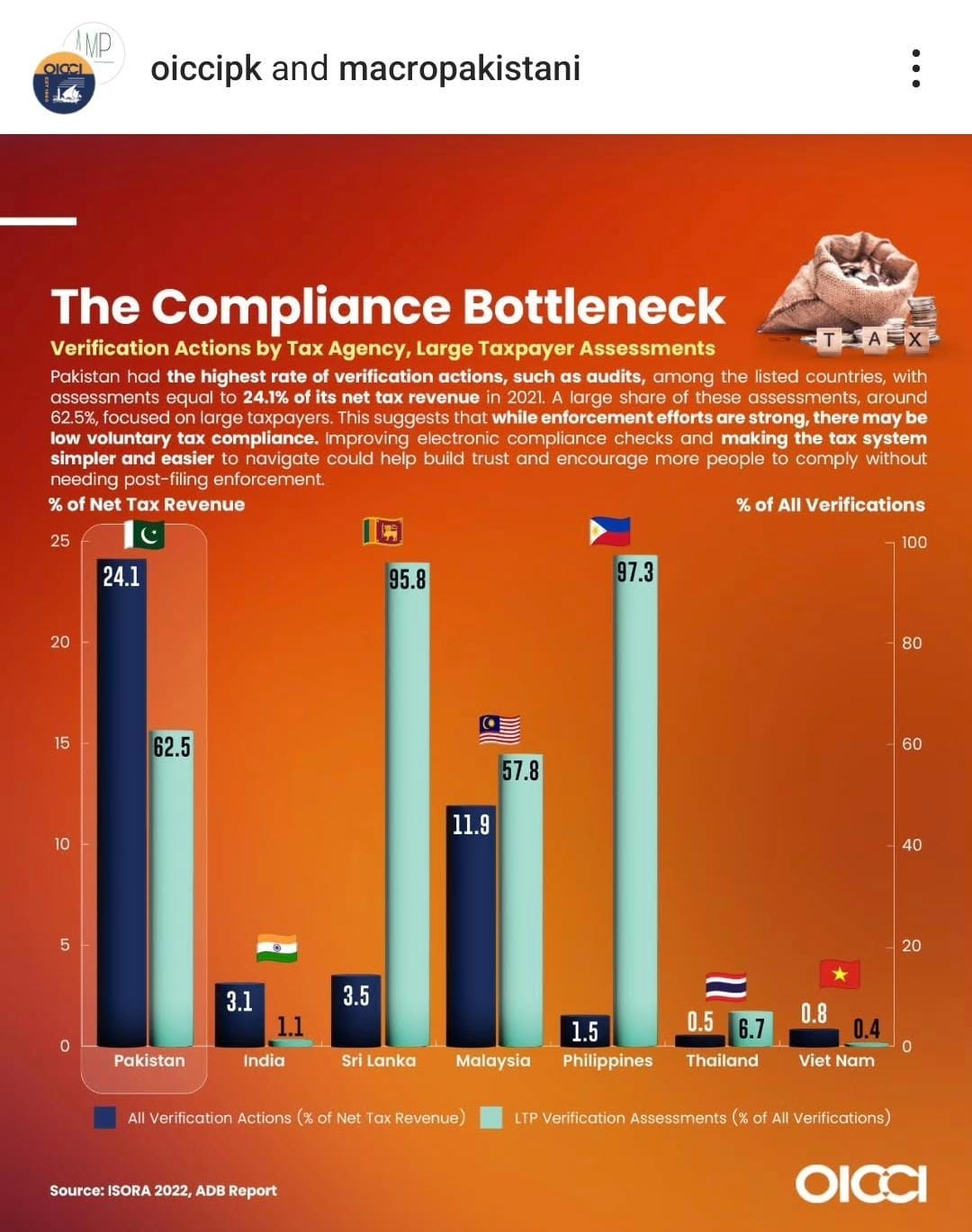

Pakistan’s C-efficiency ratio dropped to just 20.7% in FY24, down from 22.6% the previous year, signaling that the country is collecting far less sales tax than it potentially could. This low ratio reflects a narrow tax base, widespread exemptions, weak enforcement, and a large informal sector, issues that have led to a growing tax gap of over Rs. 1 trillion in 2022–23, equivalent to nearly 40% of the total tax collected and 1.2% of GDP.

Pakistan’s tax administration struggles with complexity and inefficiency, particularly in the World Bank’s General Tax Registration indicator, which requires clear, transparent information on registration fees, timelines, and updated taxpayer records, and Pre-Filled Tax Declarations, where tax authorities simplify filing by pre-populating returns with data from banks, employers, and customs.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.