No Eureka Moment in Sight

Inflation for FY24 is expected to hover around 25%, therefore no policy rate cuts expected till June. But what about the accumulating interest payments…?

In the first half of FY24, the pace of public debt accumulation decelerated slightly to 7.1%, down from 7.2% during the same period last year. However, the government continued to borrow from the scheduled banks at a rate higher than the same time last year. At the same time, in preparation of upcoming debt maturation, the government has built up its cash reserves with the State Bank of Pakistan. Another SBP report indicates that government borrowing from banks soared to PKR 6.196 trillion during the July-April period of FY24, more than doubling from PKR 2.97 trillion in the same period last year.

But there’s no significant effect from currency depreciation… then who’s the culprit this time around?

The change in public debt is primarily due to rising fiscal deficit, as the IMF has projected a fiscal deficit of 7.4% of GDP for the current fiscal year 2023-24, exceeding almost 1% from the government’s target of 6.5%. Hence leading to increased borrowing from scheduled banks which is in In contrast to H1-FY23, as debt was sourced from scheduled banks, mainly through PIBs and GoP Ijara Sukuks. This regime of relying on domestic debt has serious repercussions for Pakistan’s national accounts. Since around 72% of the domestic debt stock comprised of floating rate instruments, the elevated policy rate of 22% had a direct impact, leading to increased domestic debt servicing. In fact, interest payments on domestic debt surged by 63.5% in the first half of FY24 as a result of this high policy rate.

On the surface it seems as if Pakistan’s monetary and fiscal managers fail to coordinate on the matter of the country’s finances. Furthermore, the IMF’s supposedly contradictory statements lead to further misdirection ultimately throwing a monkey wrench into the situation.

Finding a solution to Pakistan's problems won't come from a single "Eureka moment"; instead, it demands ongoing coordination and sustained efforts.

🎉The ‘Eureka Moment’ of this week for Macro Pakistani is that Sharmeen Sajjad (Head of Content Research) has written 100 different Macro Bites so far (this is the highest number of Macro Bites written by anyone at Macro Pakistani in any capacity).

1️⃣0️⃣0️⃣If you are a regular reader of this weekly newsletter, this is the 100th Macro Bite drafted by Sharmeen, landing in your inbox!

Sharmeen has also successfully defended her thesis this week, centered around ‘Microfinance Access and Women Entrepreneurs’ Business Performance’, as part of securing a Bachelor's degree in Economics from NUST, Islamabad. We pray and hope that she succeeds with flying colours in all that she intends to do and continues the amazing work she has done for Macro Pakistani since August 2022 (while juggling her academic commitments with her content research for Macro Pakistani).

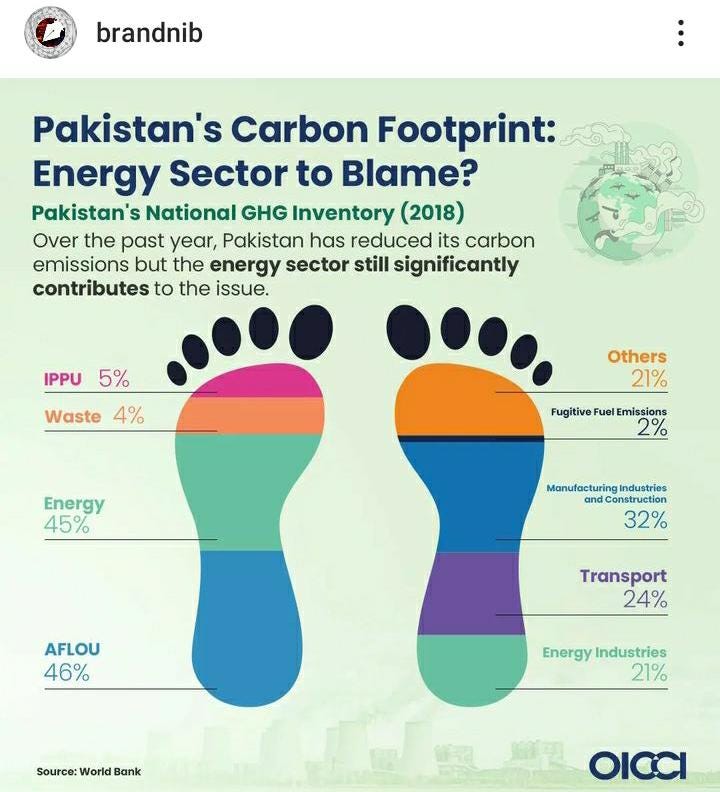

GRAPHIC

The Israeli occupation of Palestinian lands is a multifaceted endeavor involving territorial control, demographic engineering, and systemic displacement. This long-standing policy not only alters the demographics of the region but also perpetuates a cycle of conflict and dispossession that has far-reaching implications for peace and stability in the Middle East.

To date, Rafah has emptied of at least 600,000 people in just the last week, and another 100,000 have been uprooted from the north of the enclave, amid fresh evacuation orders by the Israeli Occupation Forces (IOF).

Some sample work and rejected visuals that never made it to the client’s social media pages... No Eureka Moment for Brand Nib! But the data is correct!

Firms in Pakistan face significant hurdles due to tax administration and rates, unlike their counterparts in other South Asian countries. Simplifying taxes, particularly through digitalization, could boost Pakistan's tax revenue by roughly Rs. 999 billion in 2025.

To understand how the economy can benefit from more comprehensive tax reform, read the OICCI Tax Proposals 2024 here:

🔗 oicci.org/app/media/2024/05/OICCI-Taxation-Proposals-2024-25-Final-1.pdf

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.