Old Financial Habits Die Hard

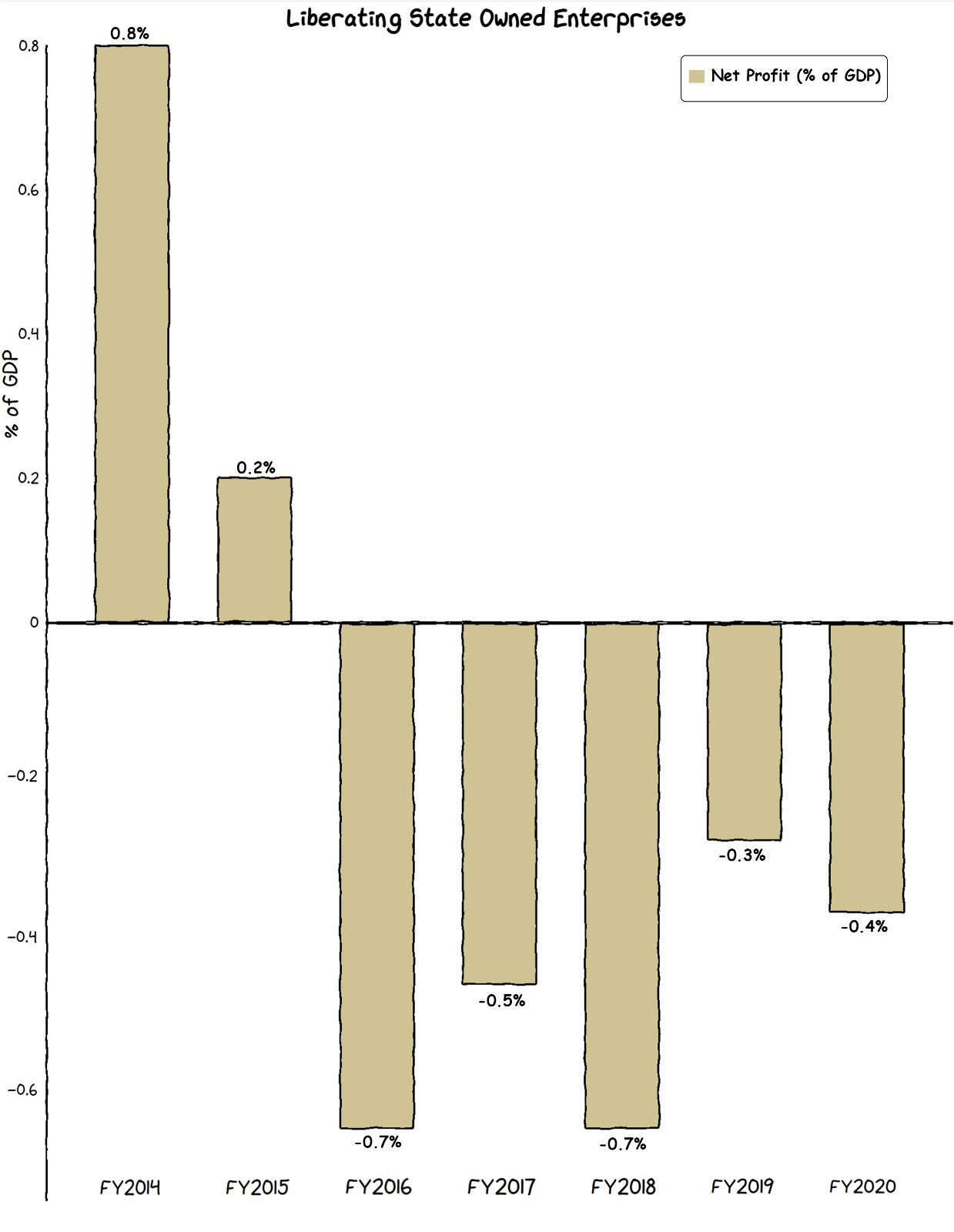

From 2018 and 2021, a total of PKR 2.5 trillion was allocated for State-Owned Enterprises, with 40% of this funding provided in the form of budget subsidies.

The Government of Pakistan is persisting in its efforts to privatize, having recently offered the sale of three significant companies. Among them, Pakistan International Airlines (PIA) is being fast tracked to prevent incurring further losses that amounted to PKR 12.8 billion, monthly. Additionally, Pakistan Steel Mills has been deemed an irrecoverable case, while the World Bank has urged the government to divest multiple DISCOs by offering shares to the public. Nonetheless, the government is still employing a specific strategy to "manage its finances," which involves holding companies.

Previously, the government has parked most of its circular debt in Power Holding Private Limited. This led to significant objections from the IMF, and the government was advised to settle the guaranteed debt within a ten-year timeframe. Now a similar approach is being taken by the government to make the Pakistan International Airlines Corporation more attractive for potential investors. The strategy involves selling off PIAC’s core assets and only its current liabilities whilst parking its legacy liabilities in a holding company. As of December 2022, PIA has accumulated debt and liabilities amounting to PKR 743 billion, which is 5 times higher than the combined value of its assets.

It seems like Pakistan government is still bearing a huge cost to privatize PIA. But it seems like Pakistan doesn’t have many options left. Delaying the privitization of the state-owned enterprises process has already made several holes in the boat. With Pakistan’s fiscal deficit expected to hit 7.6% of the GDP this year, Pakistan might have to expedite its fiscal processes no matter how inefficient they might be. PIA has costed a total of USD 7.1 billion since 2012, to cover its operational expenses.

Considering that Pakistani SOEs have only made losses since FY2016, it’s important to redirect the money elsewhere as soon as possible.

GRAPHIC

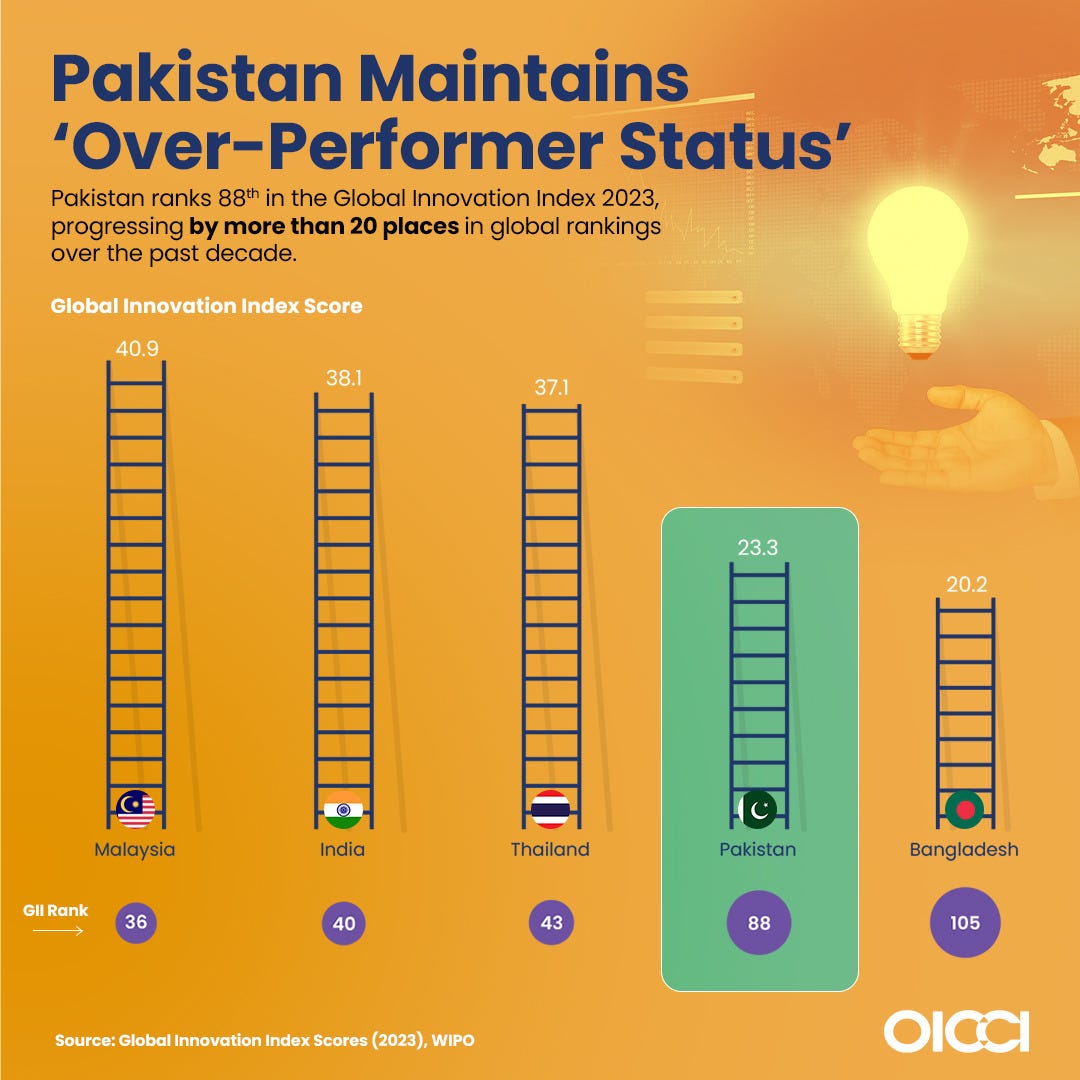

Pakistan has improved by more than 20 positions in global innovation rankings, currently holding the 88th place in the Global Innovation Index (2023). However, Pakistan's infrastructure, currently ranked 120th out of 132 countries, presents a significant obstacle to the nation's innovation and development prospects.

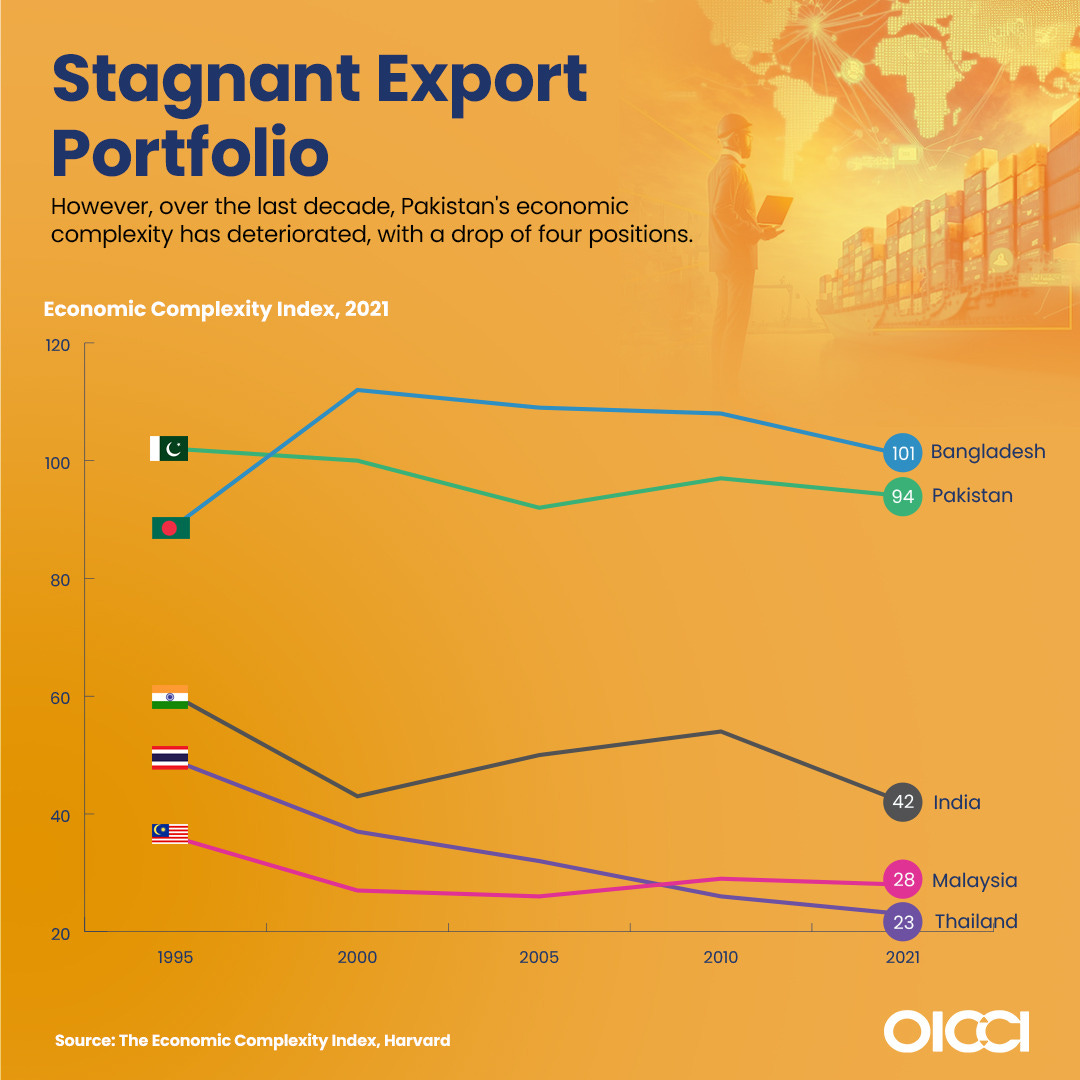

In the past decade, Pakistan's economic complexity has regressed, dropping four positions in global rankings. It must be noted that Pakistan's global trade remains predominantly focused on textiles, restricting its ability to diversify its product range.

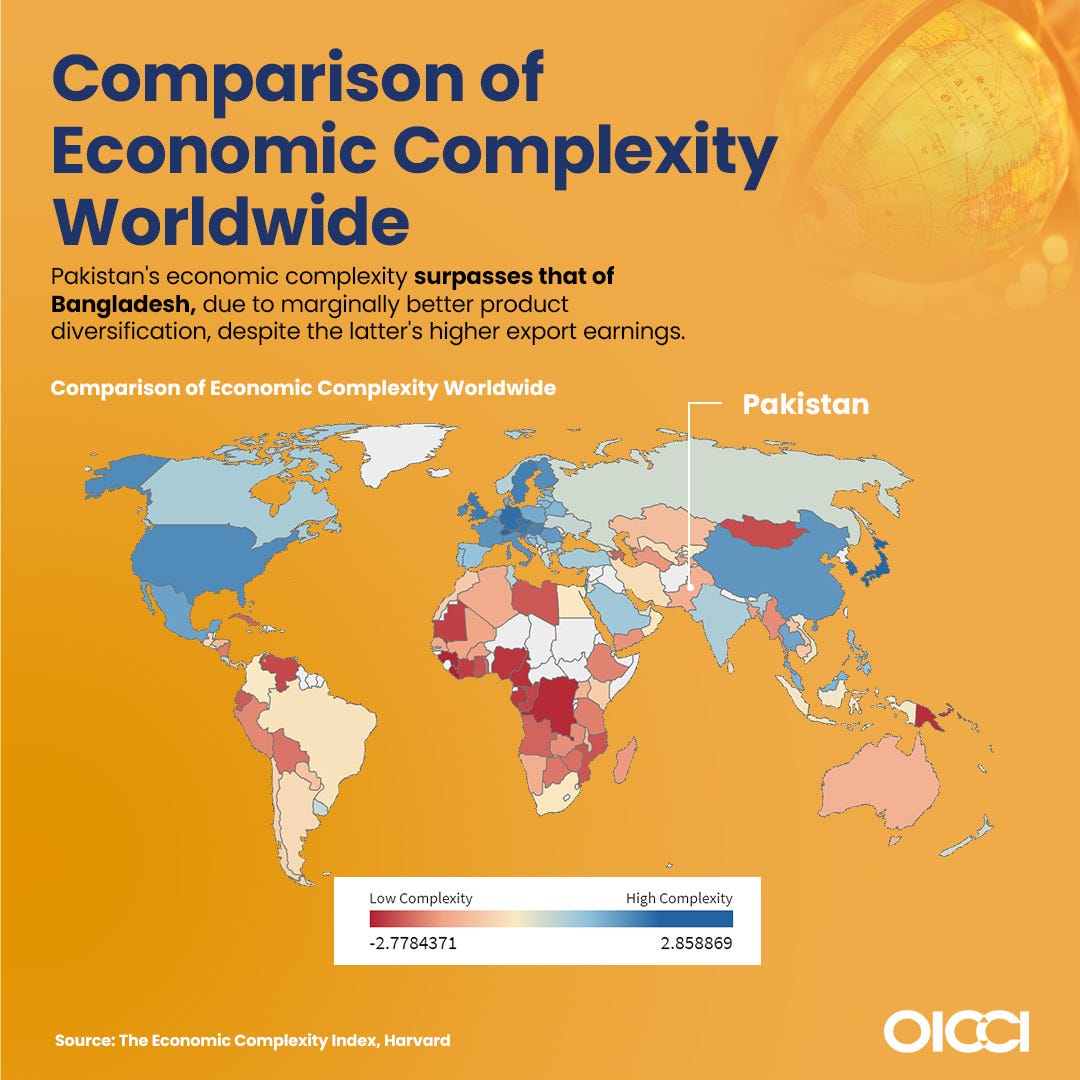

Pakistan’s economic complexity in comparison to the rest of the world:

Team @brandnib, always looking for better ways to visualize data!

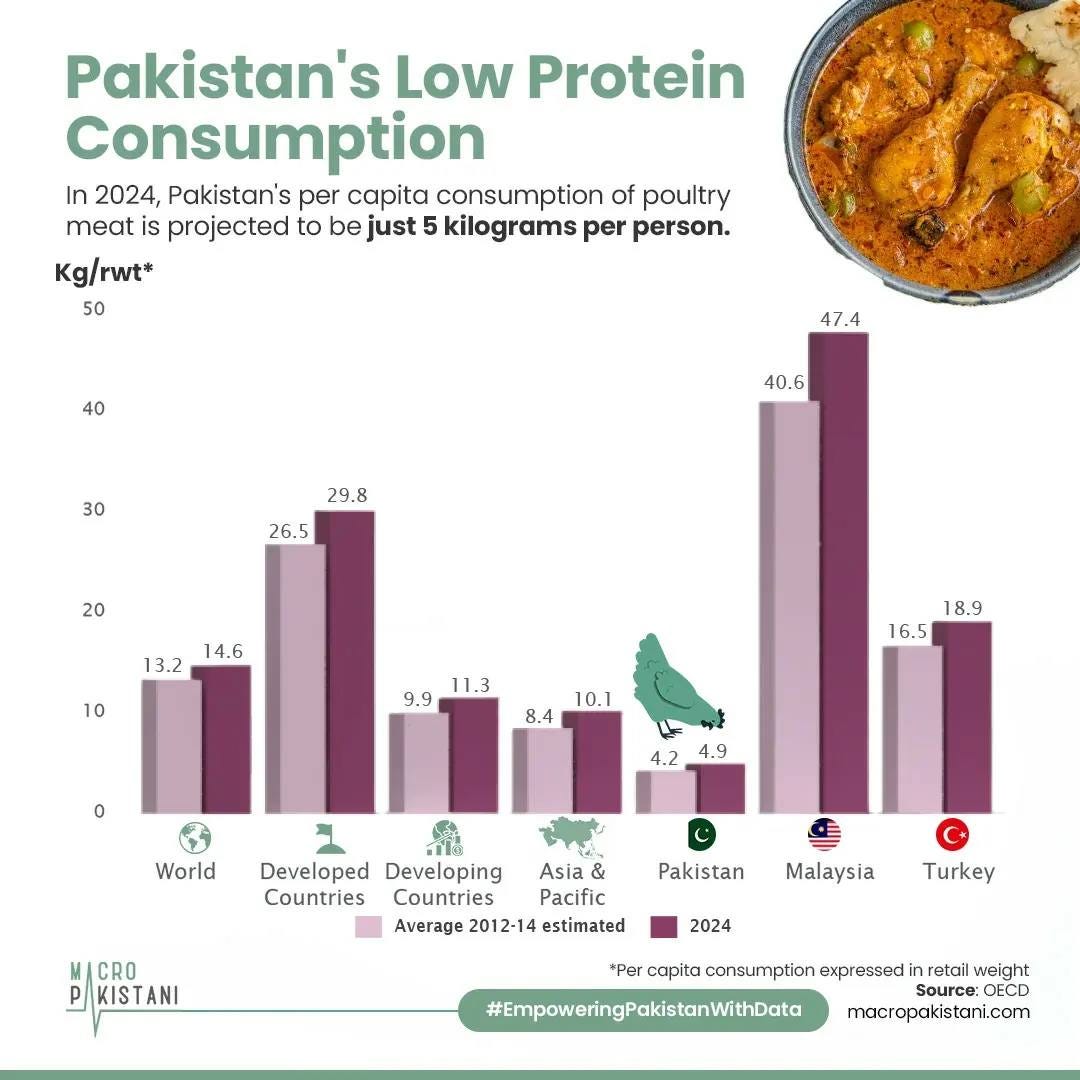

In 2024, Pakistan's🇵🇰 per capita consumption of poultry meat is projected to be just 5 kilograms per person which is considerably lower than the Asian average of 10 kilograms 😯. Food insecurity is a pertinent issue in all underdeveloped countries, and Pakistan🇵🇰 is no different. Access to nutritional food is quite limited resulting in malnutrition and high health costs. 🏥

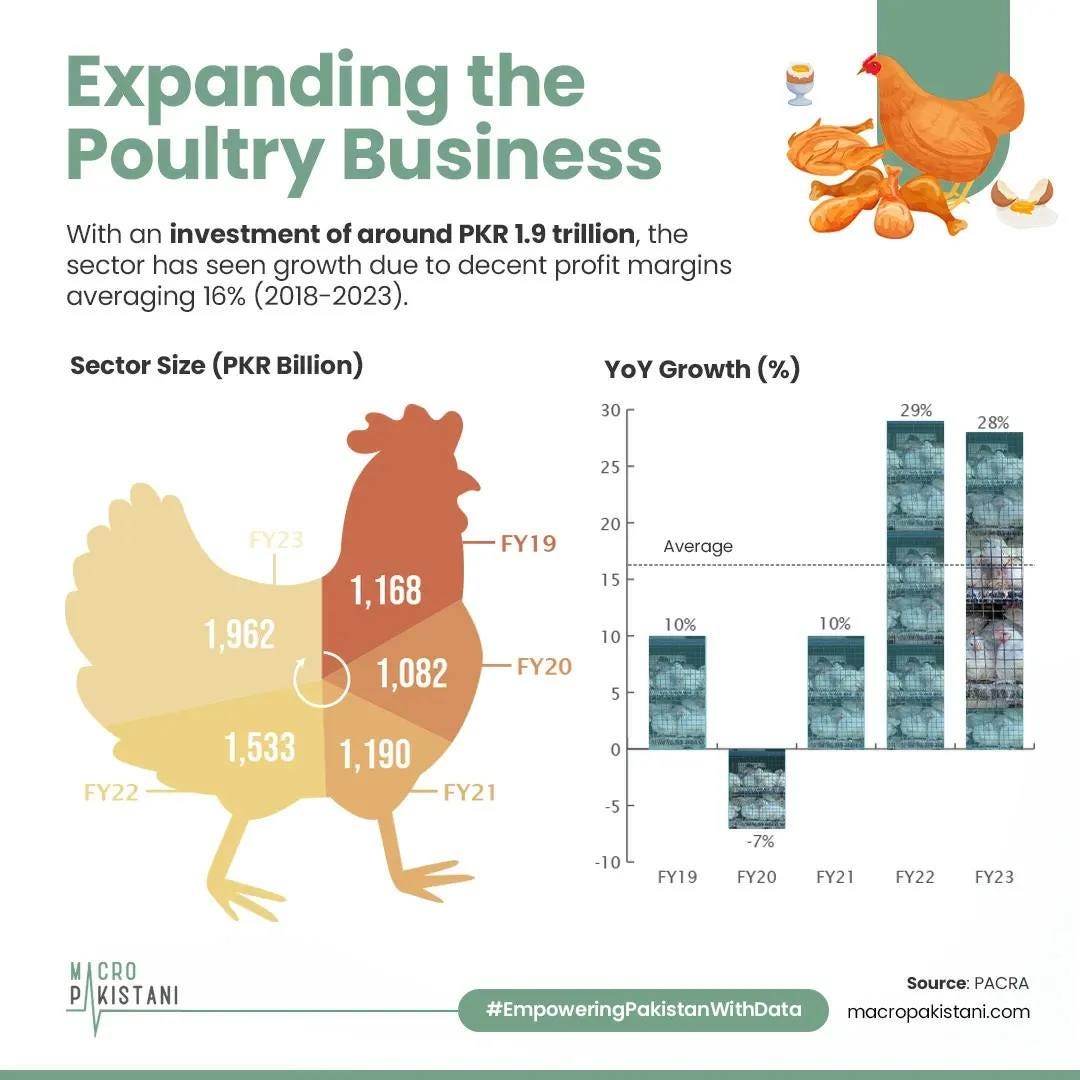

However, with an investment of around PKR 1.9 trillion, the poultry sector has seen growth due to decent profit margins averaging 16% (2018-2023) 🐣. One might question the inequality in acquiring the most accessible form of protein in the country i.e., chicken. 🐔🤔

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.