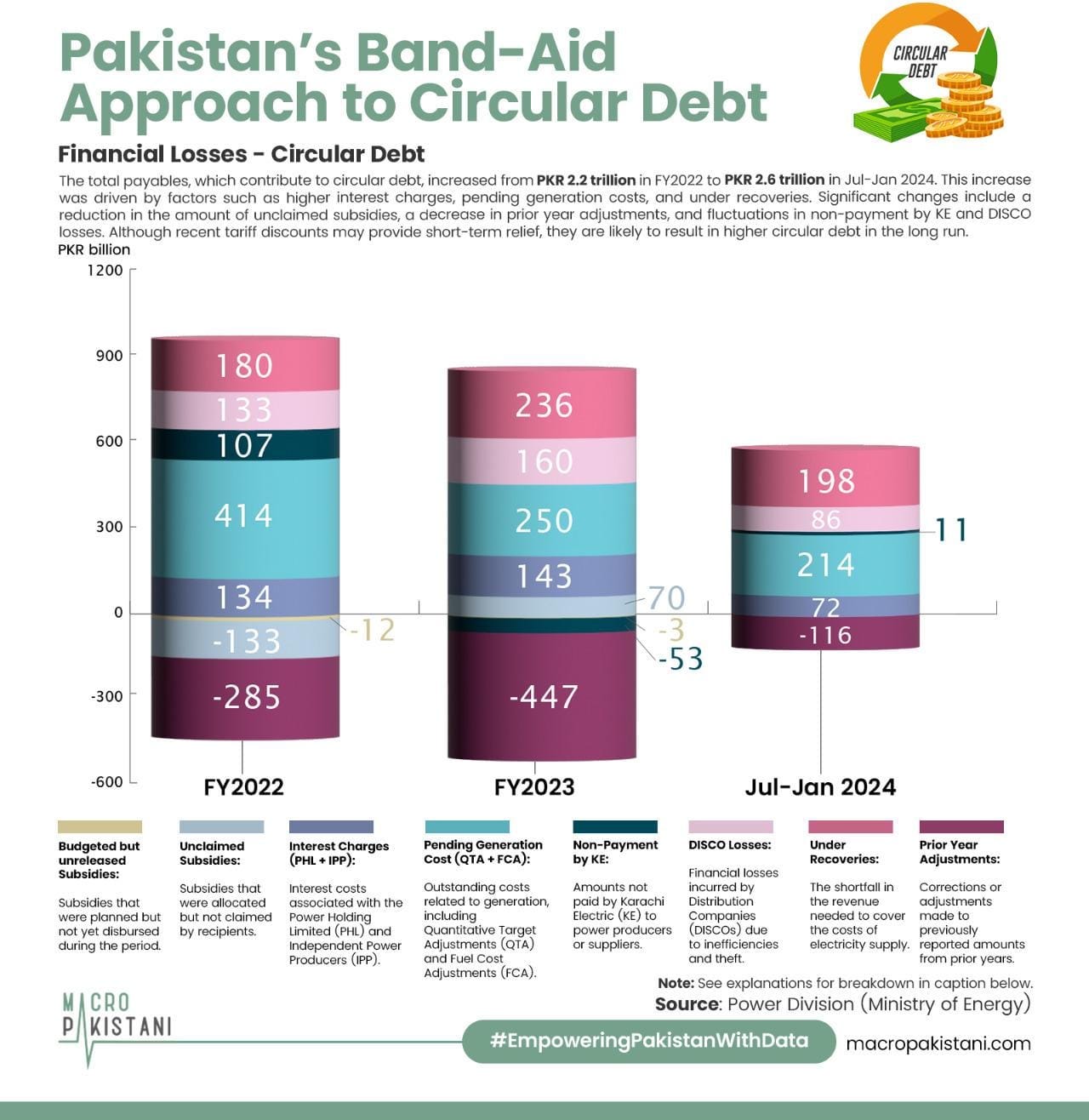

Pakistan’s Band-Aid Approach to Circular Debt

The government has announced a reduction in electricity tariffs by up to PKR 7.59 per unit for consumers, shifting the circular debt to the future.

Pakistan’s power sector is going through a phase of transformation, including regulatory challenges and financial constraints. In April 2025, NEPRA approved a temporary electricity price cut of PKR 1.71 per unit for domestic consumers, offering short-term relief amid broader systemic issues.

Concurrently, K-Electric's request to write off PKR 76 billion in unrecoverable dues from FY2017 to FY2023 has refocused the discussion over fiscal responsibility and consumer impact. As the sector grapples with escalating circular debt and demands for regulatory consistency, these updates are alarming for the average Pakistani who continues to bear the burden of Pakistan’s circular debt behemoth.

Electricity prices have come down in recent months, by as much as PKR 7 per unit for consumers, but this relief is primarily due to temporary factors, not long-term structural fixes. These include lower fuel costs (especially RLNG), quarterly tariff adjustment (QTA) reversals, and fiscal savings achieved by renegotiating capacity payments with Independent Power Producers (IPPs). However, none of these measures reflect a reduction in the actual cost of power generation or distribution. Meanwhile, the underlying issue of circular debt remains.

The government has announced a PKR 1.275 trillion loan facility to convert a portion of the existing PKR 2.4 trillion circular debt into a long-term liability of the Central Power Purchasing Agency (CPPA-G). This debt will be repaid over six years through the PKR 3.23/unit Debt Service Surcharge (DSS) that consumers are already paying. The DSS is tied to 10% of NEPRA's determined revenue requirement, but legislation is being prepared to remove this cap by June 2025 to allow increases in case of revenue shortfalls. While this restructuring offers fiscal breathing room and reduces interest charges on overdue IPP payments, it does not eliminate the burden, it simply redistributes it across time and consumers. Write-offs and financial engineering may stabilize the balance sheet temporarily, but the core inefficiencies in power generation, distribution losses, and governance still require serious reform.

In conclusion, Pakistan needs a strategic shift in its energy spending priorities. Rather than relying on short-term fixes, the country must invest in long-term solutions and demonstrate strong political will to tackle the circular debt crisis. Key actions should include reducing capacity payments to IPPs, upgrading billing systems with smart meters, and incorporating solar power.

GRAPHIC

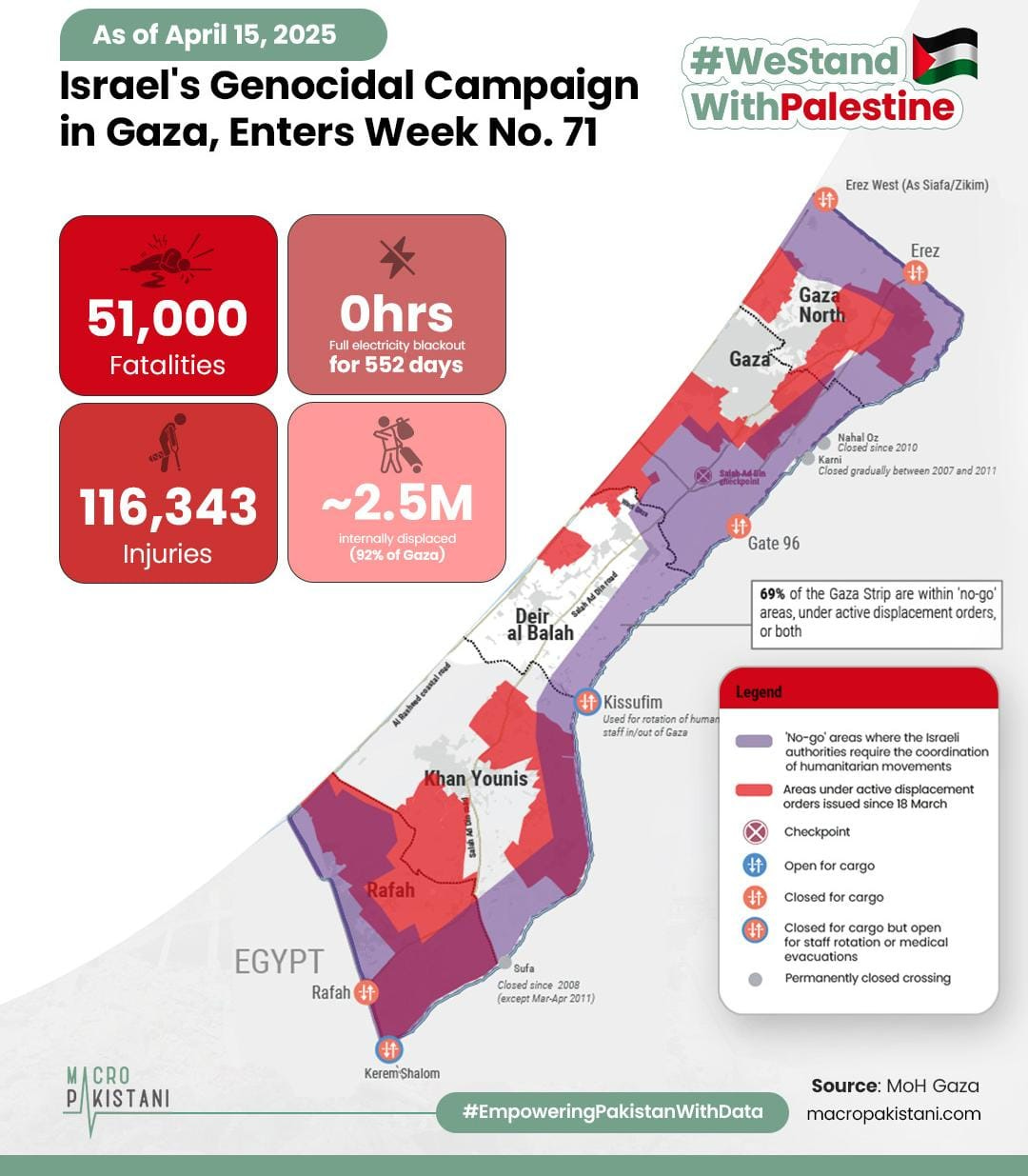

Over two-thirds of the Gaza Strip is either under active displacement orders or marked as no-go zones, leaving Palestinians with less than one-third of their territory to live in—and even that remaining area is fragmented.

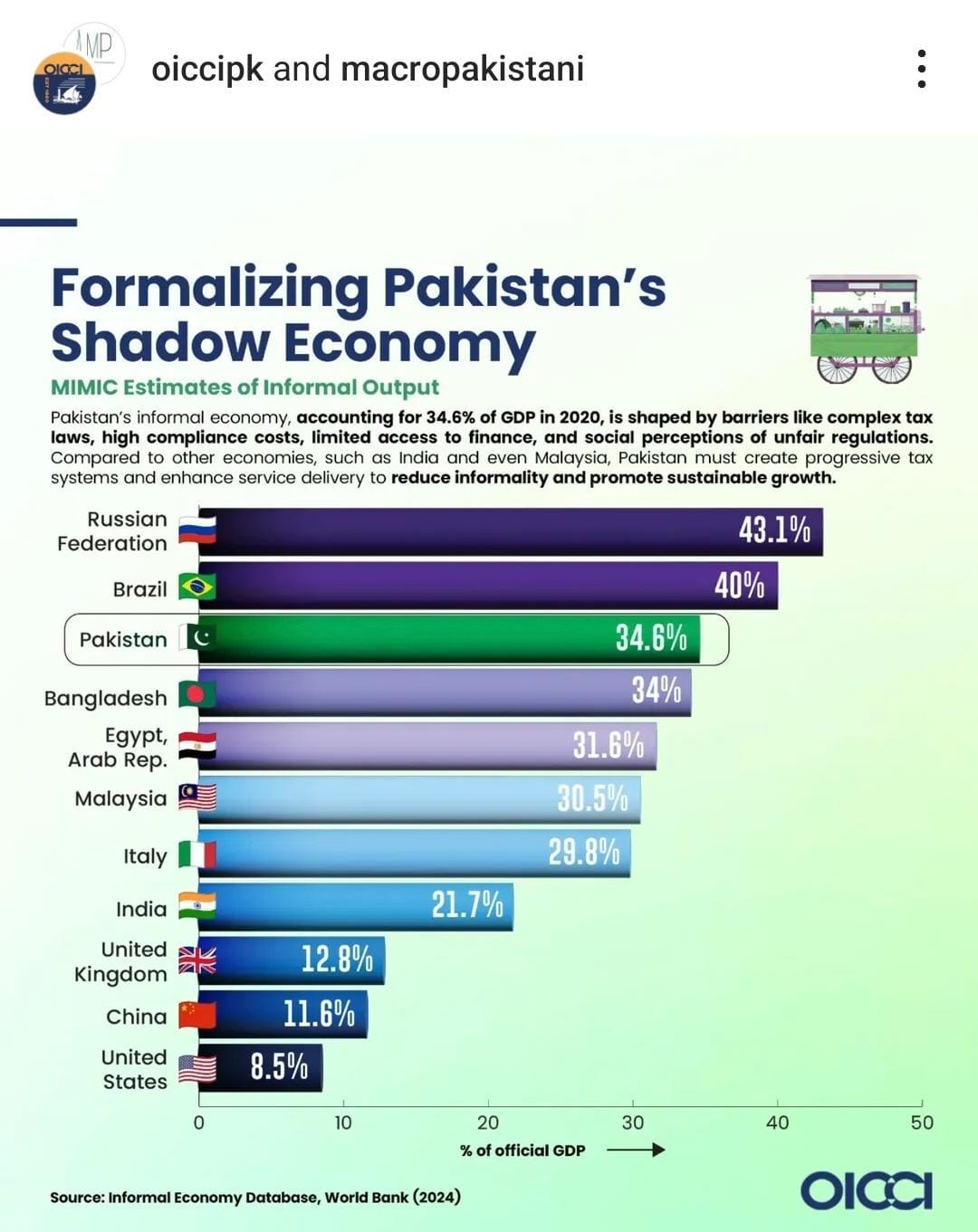

Pakistan’s informal economy, accounting for 34.6% of GDP in 2020, faces significant barriers such as complex tax laws, high compliance costs, limited access to finance, and social perceptions of unfair regulations. In comparison to other economies like India and Malaysia, Pakistan needs to create more progressive tax systems and improve service delivery to reduce informality and promote sustainable growth.

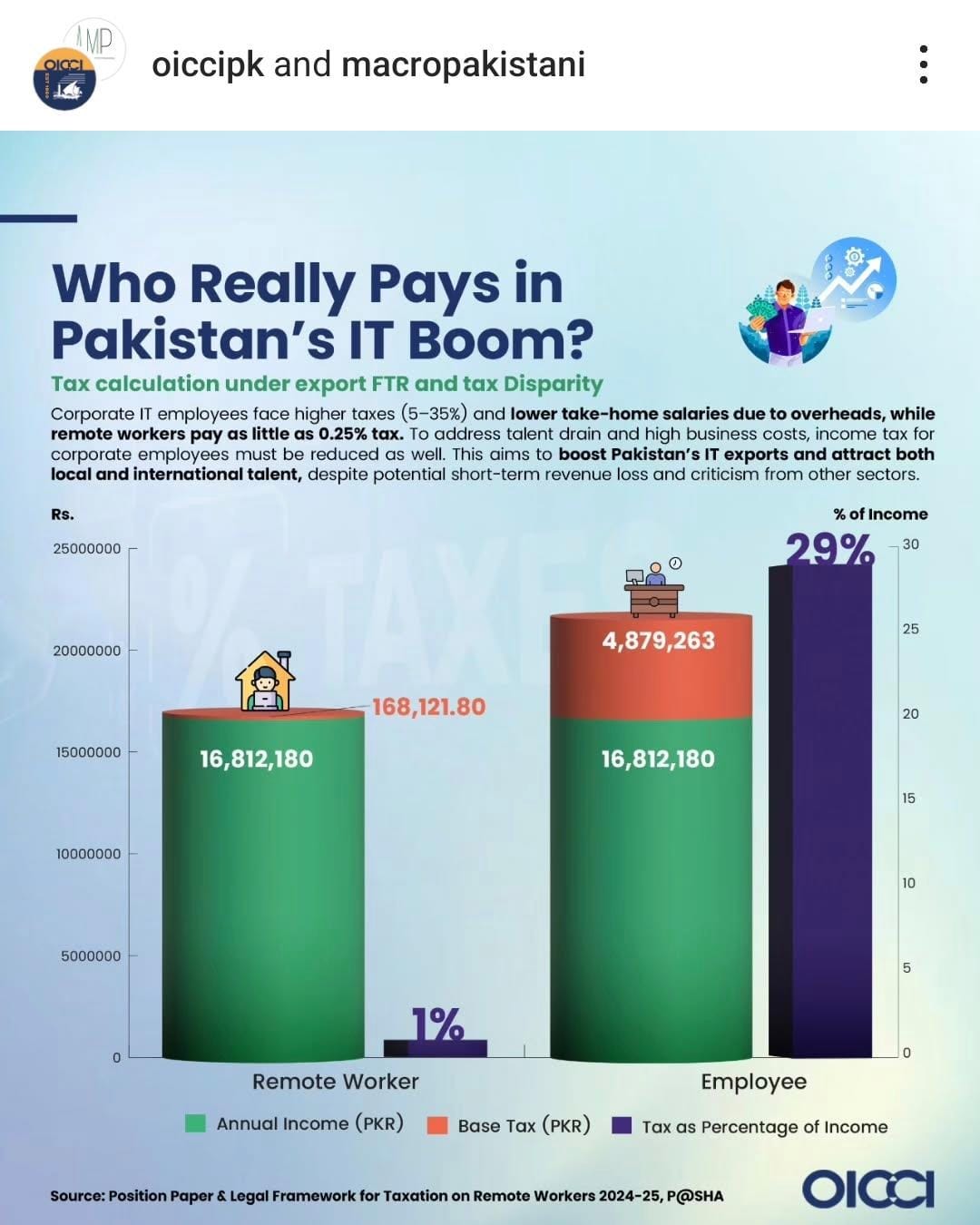

Pakistan’s IT sector stands at a pivotal moment as disparities in taxation and business costs threaten its global competitiveness. Corporate IT employees face significantly higher taxes, ranging from 5% to 35%, and reduced take-home salaries due to employer overheads, while remote workers pay as little as 0.25% under the export FTR regime, creating a widening gap that fuels brain drain and undermines the growth of domestic firms.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.