Pakistan’s Debt Metrics

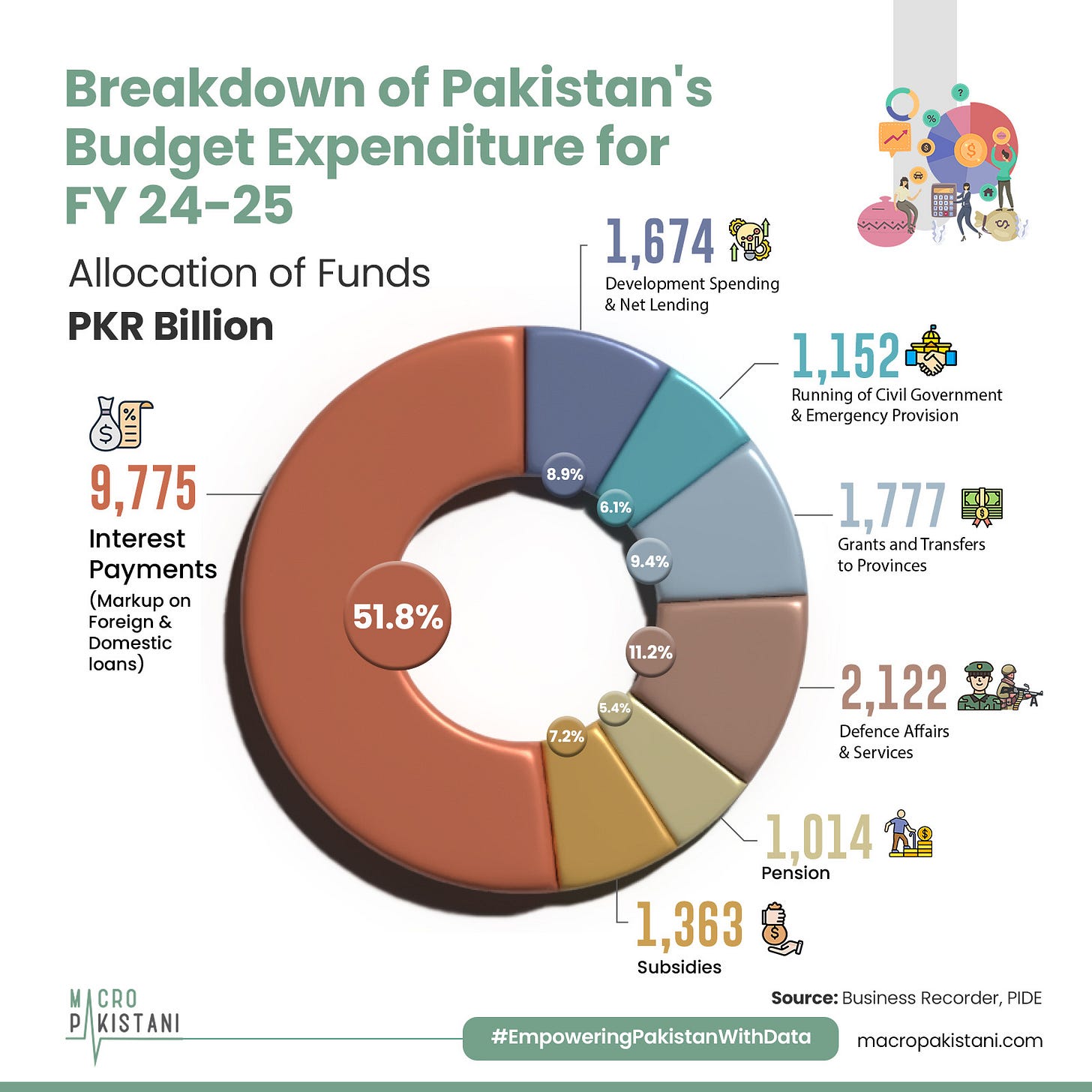

Pakistan's debt-to-GDP ratio decreased to a 6-year low of 70% in FY 2023-24, driven by higher nominal GDP growth.

The State Bank of Pakistan (SBP) reported a 3.4% rise in the country’s total external debt and liabilities. Public external debt, excluding foreign exchange liabilities, spiked by USD 2 billion in FY24. Despite the growth in external debt, the external debt-to-GDP ratio came down from 32% in SPLY, due to slower growth in foreign currency borrowings. Overall, Pakistan’s debt-to-GDP ratio fell to 70% in FY24 due to higher inflation-driven nominal GDP growth.

What fiscal policy changes are needed to ensure sustained growth in Pakistan?

As a short-term measure, Pakistan should explore bilateral debt restructuring to extend debt maturities, ease debt servicing burdens, and provide immediate fiscal relief. Implementing austerity measures, such as cutting government spending, can generate additional revenue and help reduce budget deficits. Ensuring transparency in debt management is crucial for building trust and confidence in government efforts. Long-term solutions should focus on boosting economic growth by enhancing productivity, fostering innovation, and improving access to international markets. A comprehensive public debt management framework, including evaluating loans based on their return on investment, is essential. Establishing a centralized debt office to oversee domestic and foreign debt would improve decision-making and risk management.

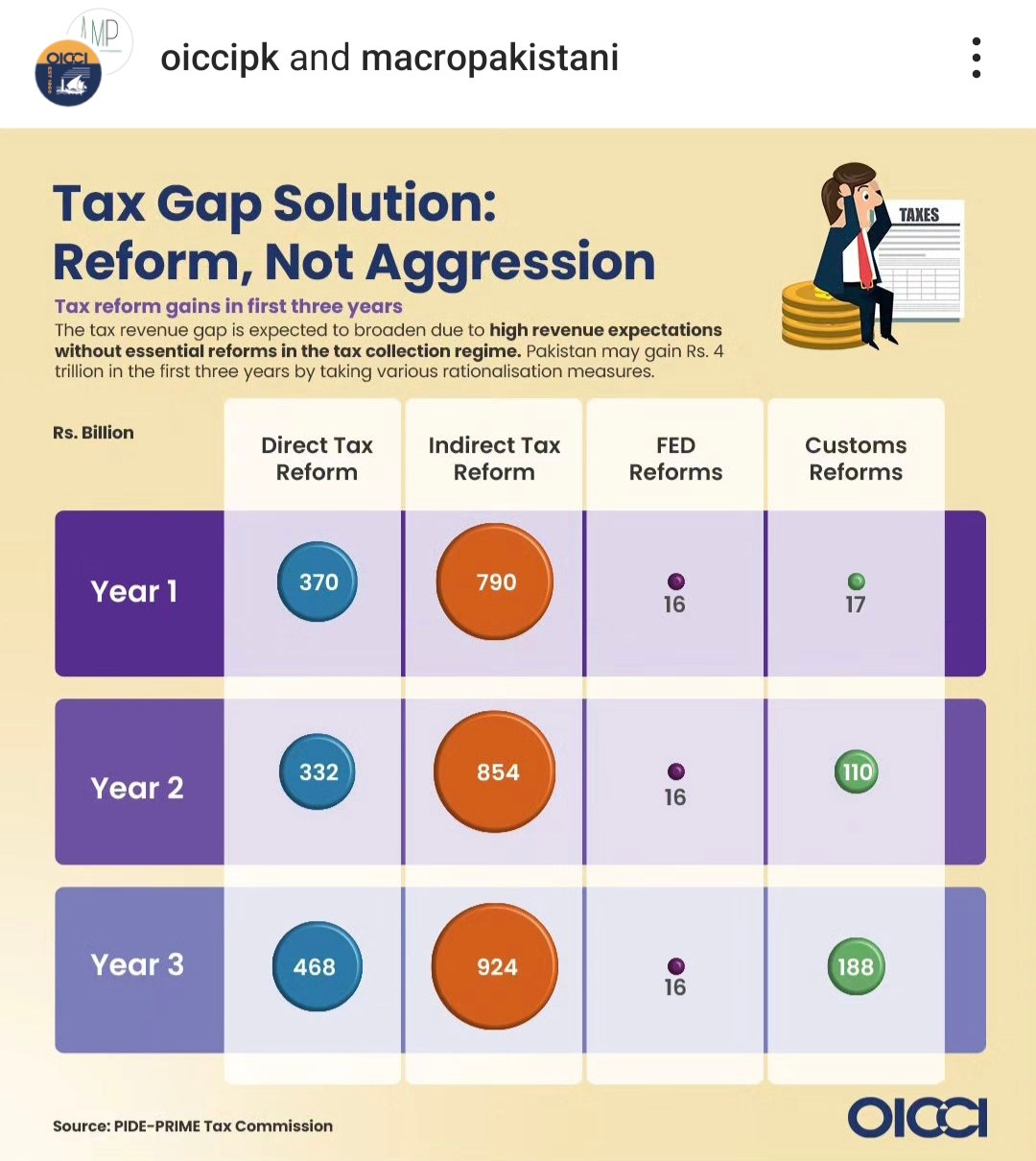

Pakistan's tax policy focuses too heavily on revenue targets, creating obstacles for investment and growth through complex structures and high compliance costs. Withholding taxes have increased administrative burdens, and revenue collection is concentrated in a few sectors. To foster a better economic environment, Pakistan needs a clear, consistent tax policy that balances revenue goals with investment and fairness.

The strategy should shift from overreliance on indirect taxes and phase out sectors with low revenue contributions. Tax filing should be mandatory for all eligible entities, with a gradual implementation to ease the transition for businesses and individuals.

GRAPHIC

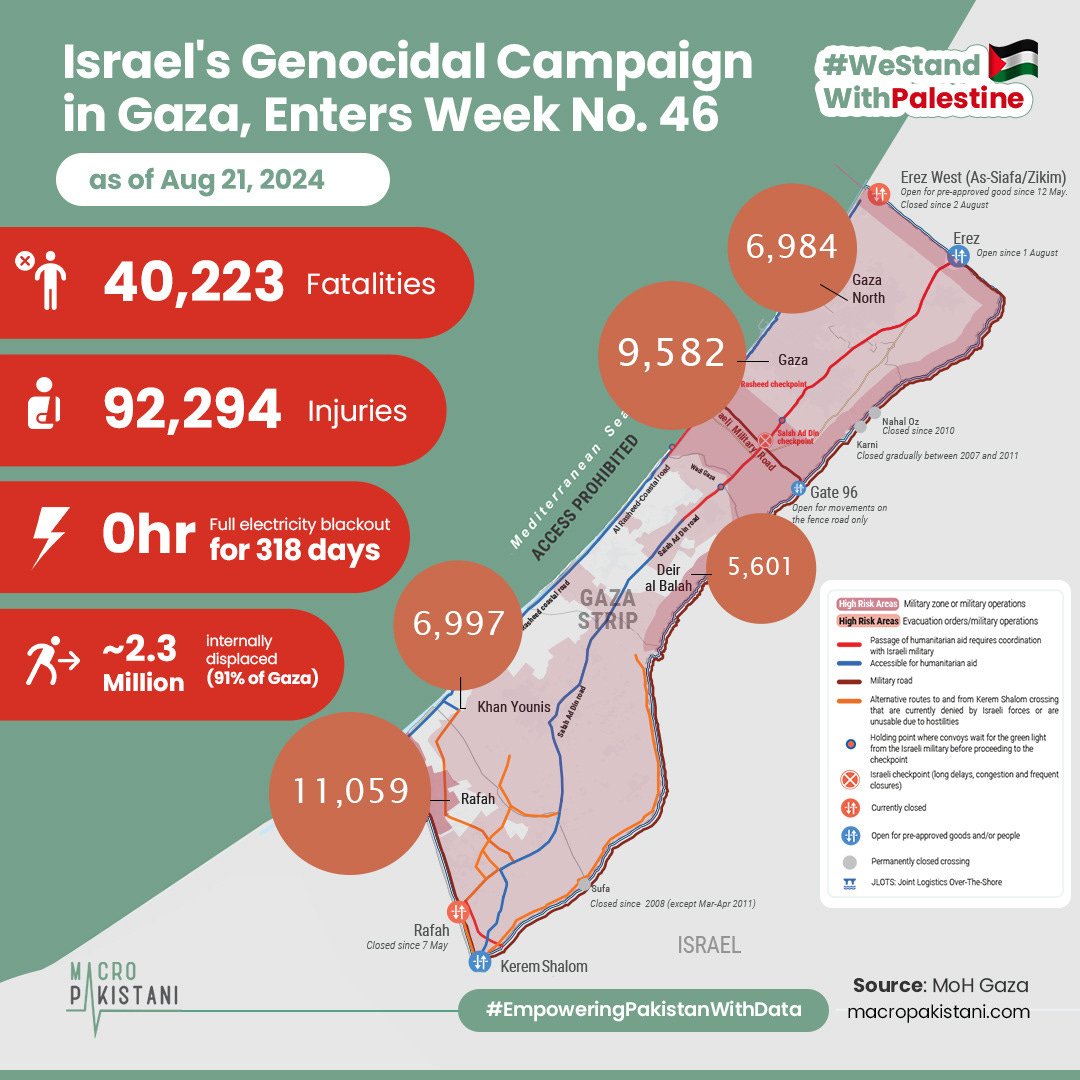

Israel is "deliberately suffocating 1.7 million Palestinian civilians" by confining them to a land area no larger than one-tenth of the Gaza Strip’s total size.

The Israeli Occupation Forces (IOF) are intentionally squeezing these civilians into an overcrowded zone, which constitutes part of their ongoing crime of forced displacement.

In case anyone wants to contribute (to the Palestine solidarity campaign on Macro Pakistani) and send data-backed content, please feel free to send an email to fakiha.rizvi@brandnib.com

The tax revenue gap in Pakistan is anticipated to widen due to high revenue expectations coupled with a lack of essential reforms in the tax collection system. Currently, Pakistan’s aggressive direct tax rates have led to a decline in voluntary income tax payments, while the reliance on indirect taxes, including the withholding tax regime, has created a regressive tax system.

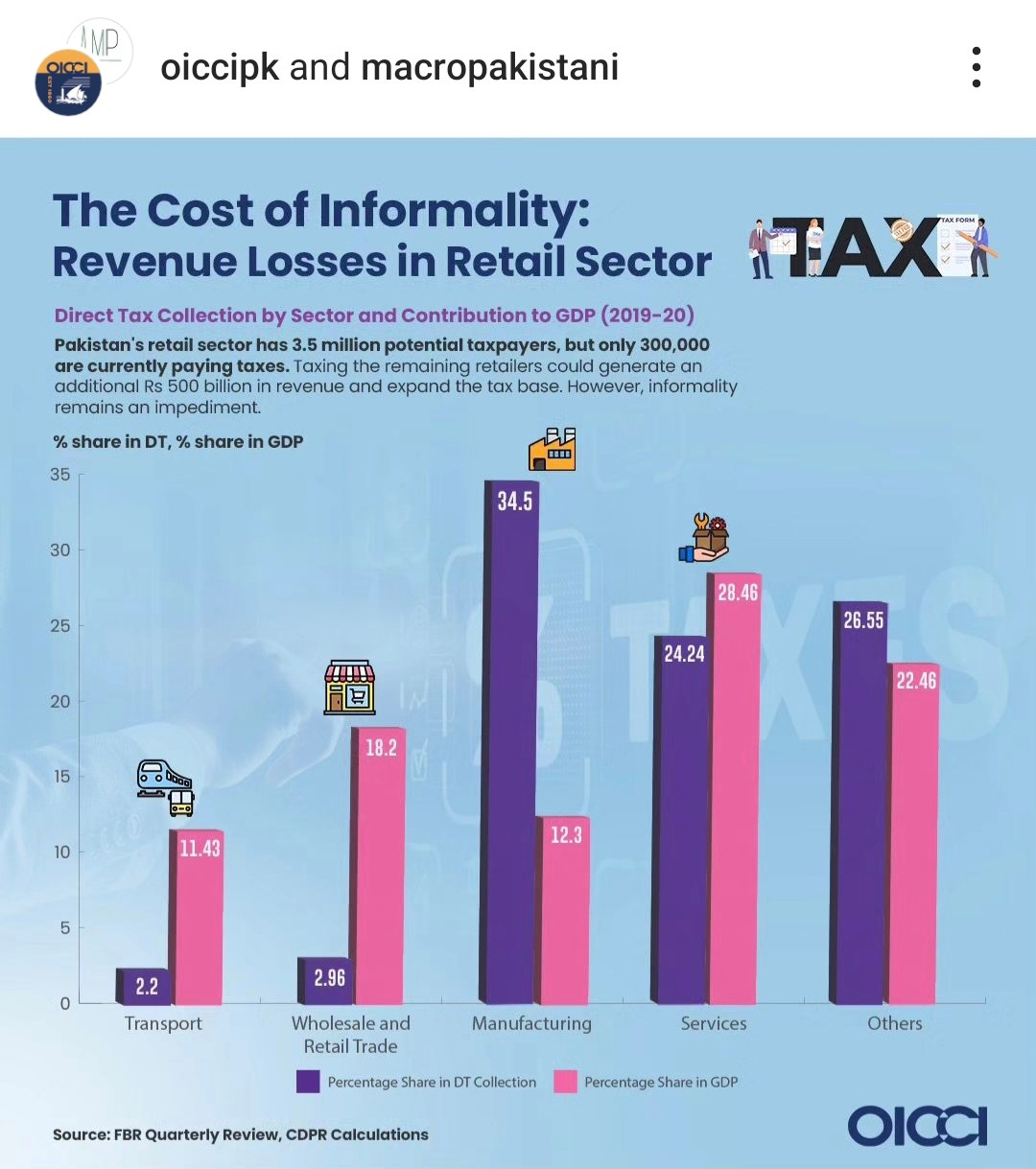

Pakistan's retail sector has 3.5 million potential taxpayers, but only 300,000 are currently paying taxes. Taxing the remaining retailers could generate an additional Rs 500 billion in revenue and expand the tax base. However, informality remains a significant obstacle. Countries like Indonesia and Ghana have successfully reduced informality through incentive-based and punitive interventions, such as Indonesia's one-stop shops for business licensing and Ghana's stamp tax, which contributes 27% of local government revenue.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.