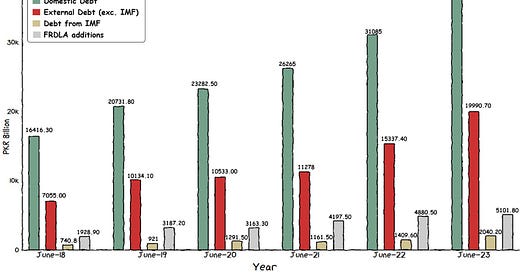

Pakistan’s Debt on the Rise

Public debt soars to PKR 73 trillion, with significant numbers added in the last year alone.

Pakistan's debt problem may appear unmanageable, and indeed, it is. In 2005, an attempt was made to help manage the problem. Specifically, the Fiscal Responsibility and Debt Limitation Act (FRDLA) outlines various elements of Pakistan’s fiscal matters and sets limits and targets for each factor. However, as one might expect, Pakistan has consistently failed to maintain its numbers in line with the FRDLA. The latest figures from Pakistan's debt management office, established following the 2022 amendment to the FRDLA, paint a gloomy scenario as well.

In FY23, Pakistan borrowed a total of PKR 6.5 trillion, mostly from domestic sources. In total, Pakistan’s overall debt stands at PKR 73 trillion which is approximately 87% of Pakistan’s GDP. Interestingly, the definition of debt laid by the FRDLA is rather narrow, causing the numbers to shrink when reported by the debt management office.

The debt management strategy published by the office is an interesting document as well. It covers several aspects including debt cost, maturity, and Pakistan's domestic capital market. Essentially, it outlines the composition of Pakistan's debt structure. But shouldn’t repayment be a component of the strategy as well? - especially for a country like Pakistan (this limitation is mentioned by the office itself)? Since the amount of debt is not a problem. For context, Japan’s debt-to-GDP ratio is 239%, but it’s not a problem since Japan has the ability to repay it. Therefore, using an IMF template without adaptation won't lead us anywhere.

Pakistan is facing multiple challenges regarding its debt situation. Alongside the need for transparency in managing debt matters and establishing a viable repayment plan, the lack of effective coordination among stakeholders also raises concerns. The current alarming state of the public debt, amounting to PKR 73 trillion (equivalent to 87% of GDP), should serve as a clear wake-up call for all parties involved.

GRAPHIC

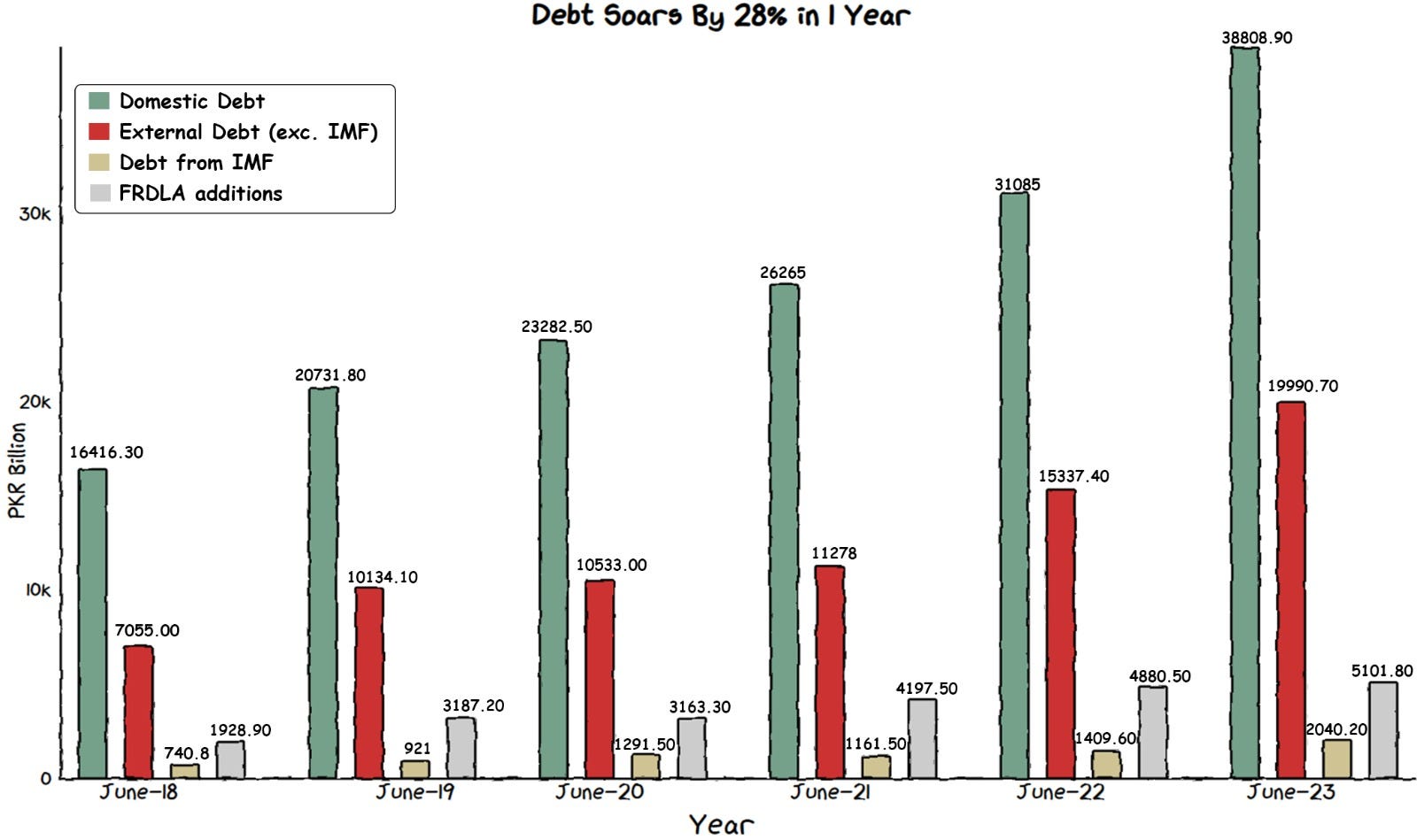

Pakistan’s most recent IMF bailout marks the 23rd time the country has went to the IMF for a lending commitment. Does this agreement hold the promise of stabilisation, or will it be just another throwaway lending commitment in its long running history? Find out what Waleed Ibrahim thinks of the relationahsip between the IMF and Pakistan.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.