Pakistan’s Economic Recovery

A stabilizing economy, declining inflation, and rising investor confidence. Pakistan navigates its path to sustainable growth in 2025.

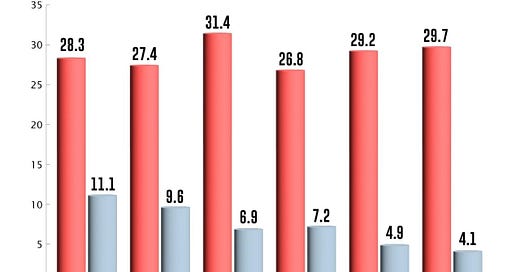

Pakistan’s economy has shown remarkable resilience in the first half of FY2025, building on the stabilization efforts of the previous year. After a modest GDP growth of 2.5% in FY2024, the country has managed to sustain momentum through sound macroeconomic management, declining inflation, and improved fiscal discipline. Inflation, which was a staggering 28.8% last year, has dropped significantly to 7.2%, driven by global price stabilization, monetary easing, and a controlled exchange rate. Additionally, the agriculture sector, which had seen robust growth of 6.2% in FY2024, continues to benefit from increased investment, favorable weather, and enhanced credit access. However, the industrial sector remains a concern, with mixed results while textiles show signs of recovery, other manufacturing sub-sectors are struggling due to high production costs and weaker domestic demand.

How has the decline in inflation and improved fiscal discipline impacted overall economic activity in the first half of FY2025?

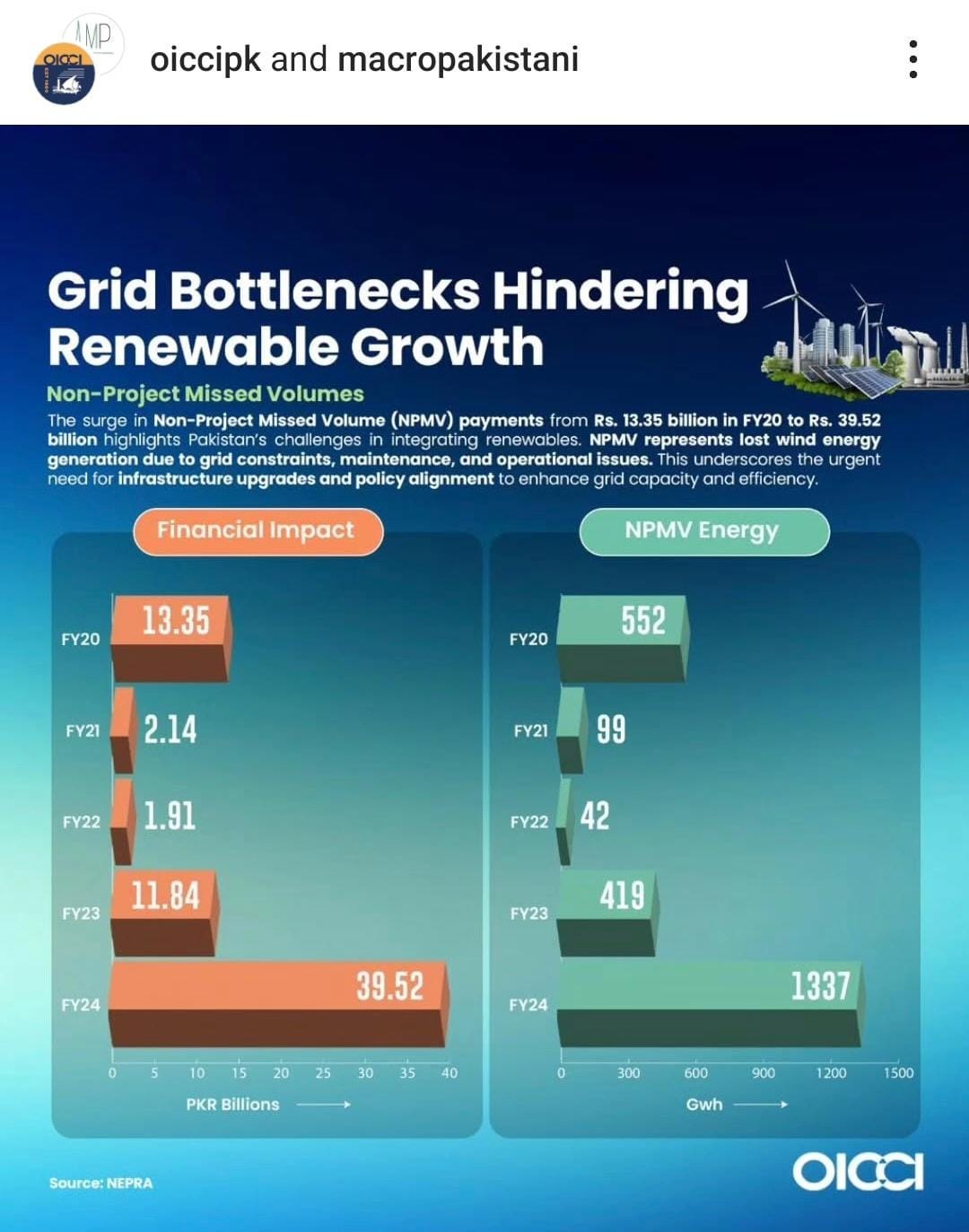

The external sector has also witnessed notable improvements, with the current account posting a surplus of $1.21 billion in the first half of FY2025. Foreign Direct Investment (FDI) surged by 20%, particularly in the power and oil sectors, and remittances saw record inflows, helping balance the trade deficit. The Pakistani rupee appreciated by 1.2%, supported by IMF disbursements and international financial assistance, strengthening investor confidence. On the fiscal front, the government has significantly reduced the deficit to 0.04% of GDP, compared to previous years’ higher shortfalls. Increased tax revenue and controlled spending have helped stabilize public finances, but structural challenges in revenue collection and debt management persist. Meanwhile, the government has launched the URAAN Pakistan economic transformation plan, aiming for long-term sustainability through inclusive growth, infrastructure development, and digital expansion.

Looking ahead, Pakistan’s economic outlook remains cautiously optimistic. With strong policy measures in place, including monetary easing and export facilitation, the country is well-positioned for continued recovery. However, persistent risks such as global economic volatility, fiscal rigidity, and sector-specific weaknesses demand sustained reforms. While inflation is projected to remain under control, ensuring stable growth across all sectors will be crucial. The government’s commitment to fiscal discipline and structural adjustments, alongside favorable global trends, is expected to support economic resilience.

If these positive trends continue, Pakistan may be on a path toward sustainable growth, improved investor confidence, and a more stable financial environment.

GRAPHIC

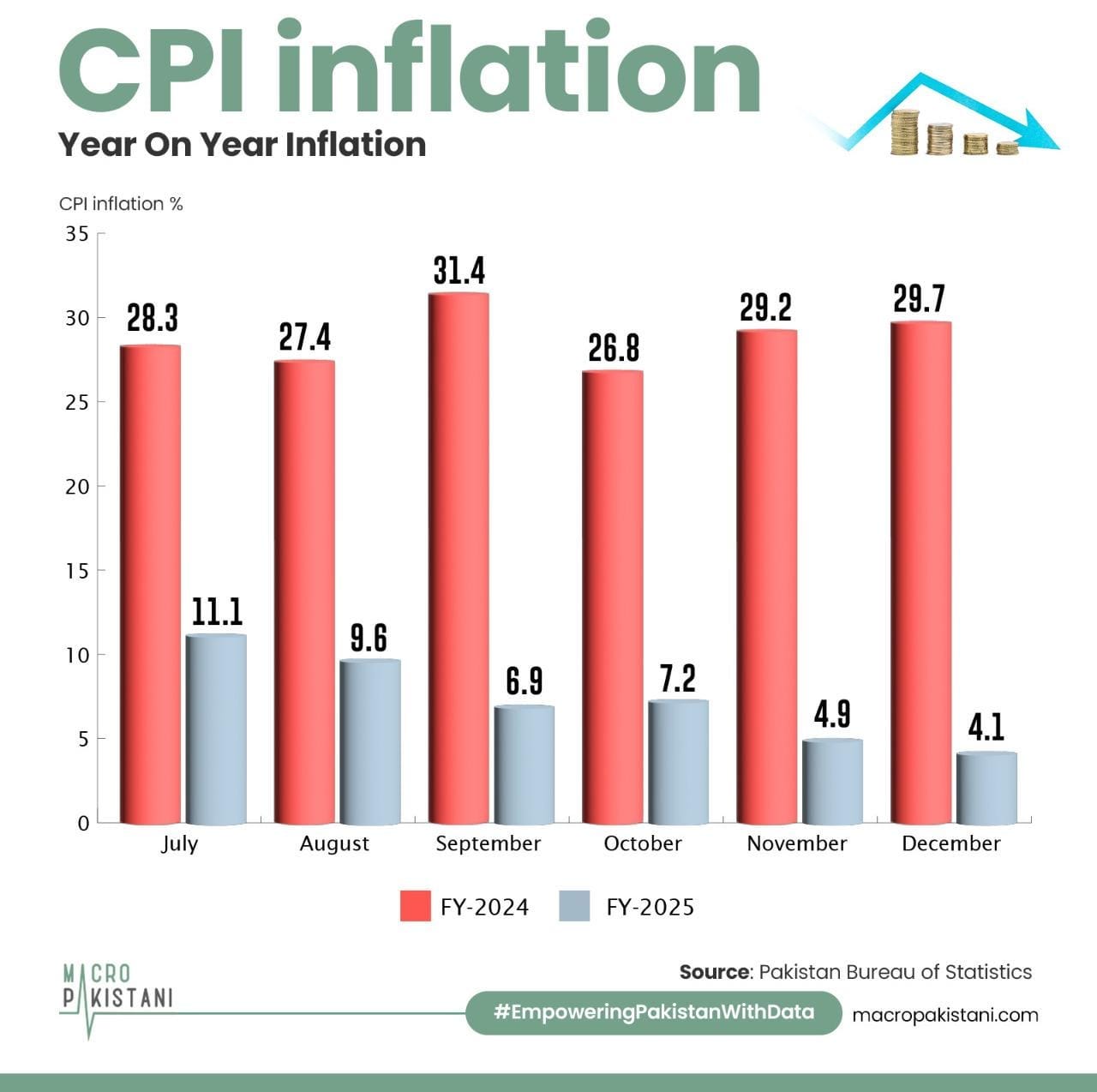

Pakistan's power sector faces a critical juncture as inefficiencies in generation, transmission, and distribution continue to strain the economy and burden consumers. The alarming rise in Part Load Adjustment Charges (PLAC) and Non-Project Missed Volume (NPMV) highlights systemic flaws.

While digital FDI in Pakistan grew between 2018 and 2024, fluctuations led to net outflows in 2023-2024. The telecom sector, historically a key driver, recorded a $29 million net outflow in FY 2022, partly due to spectrum pricing and currency fluctuations.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.