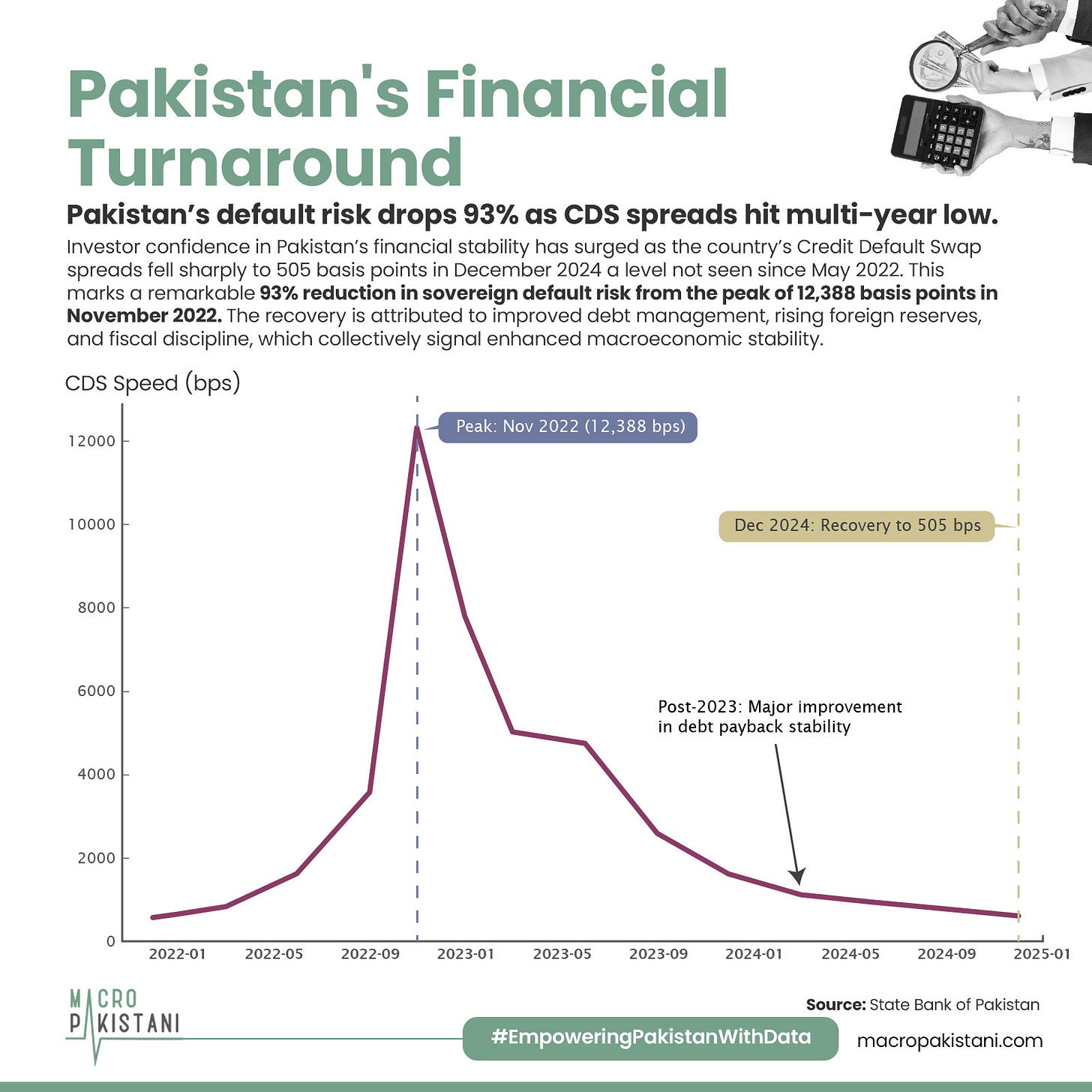

Pakistan's Financial Turnaround

Pakistan’s default risk drops 93% as CDS spreads hit multi-year low.

Investor confidence in Pakistan’s financial stability has surged as the country’s Credit Default Swap spreads fell sharply to 505 basis points in December 2024 a level not seen since May 2022. This marks a remarkable 93% reduction in sovereign default risk from the peak of 12,388 basis points in November 2022. The recovery is attributed to improved debt management, rising foreign reserves, and fiscal discipline, which collectively signal enhanced macroeconomic stability.

With global interest rates declining, is Pakistan poised to leverage this opportunity to re-enter international capital markets at more favorable borrowing terms?

The sharp decline in CDS spreads has been accompanied by a rally in Pakistan’s international bonds, reflecting growing optimism among global investors. Analysts credit this turnaround to the successful implementation of IMF-backed reforms under the Extended Fund Facility (EFF), which addressed fiscal vulnerabilities and strengthened external buffers. The improved credit profile not only places Pakistan ahead of several emerging and frontier markets in terms of risk premiums but also enhances its appeal as a destination for foreign investment. However, sustained structural reforms are critical to preserving this momentum, with the IMF underscoring the need for a broader tax base, private sector-led growth, and prudent debt management.

Pakistan’s dramatic improvement in its sovereign credit profile presents a timely opening for re-entry into global financial markets. Lower borrowing costs and increased liquidity provide an opportunity to secure funding on favorable terms, easing external pressures and supporting economic recovery. The country’s current position enables it to capitalize on favorable market conditions and attract investment flows, thereby bolstering financial stability. While the turnaround is significant, maintaining long-term resilience will require consistent policy efforts to build investor trust and foster sustainable economic growth.

GRAPHIC

Israel's absurd war has resulted in nothing but destruction and loss, further entrenching the injustices against Palestinians that are widely recognized by the international community.

This senseless violence only deepens the suffering and will inevitably lead to more chaos and instability, not just in the region, but across the world.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.