Pakistan’s Fiscal Roller coaster

Policy miscalculations have resulted in an estimated PKR 2.4 trillion gap in Pakistan’s budget for FY24.

Pakistan has experienced a significant amount of instability in the past year. Besides the financial burden placed on its citizens, these developments have disturbed the fiscal projections made for the year. A recent example of this phenomenon is the emergence of an approximately PKR 2.4 trillion obligation in Pakistan's expenditure, in interest payments. This could push Pakistan’s debt servicing bill for 2024 above PKR 8 trillion. With the upcoming IMF review drawing near, the finance ministry could potentially find itself in trouble.

This sudden emergence of extra expenditure can be traced to the rising policy rate. Since June 2022, it has experienced a 7% increase, primarily impacting the government's interest payments and causing a reduction in private lending. However, it has been unable to stop inflation. Therefore, it is safe to assume that this increase in policy rate has done more harm than good. It makes one wonder why the insistence on increasing it further continues to prevail.

One possible explanation is the IMF’s assertion of making the central bank independent. Since 2021, the Monetary and Fiscal Policies Coordination Board has been abolished resulting in a narrow approach to achieving price stability. The World Bank has also highlighted these discrepancies, as an increase in the policy rate occurs concurrently with an expansion of the monetary base. This cycle is an interesting reflection of Pakistan's economic policies: creating a problem, addressing that problem, yet inadvertently generating additional issues in the process.

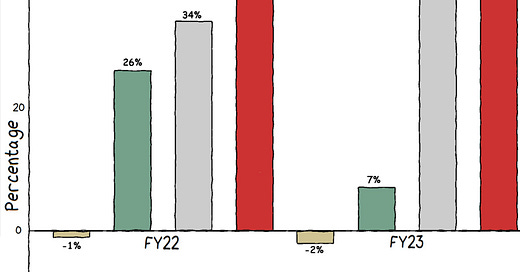

GRAPHIC

Did You Know?

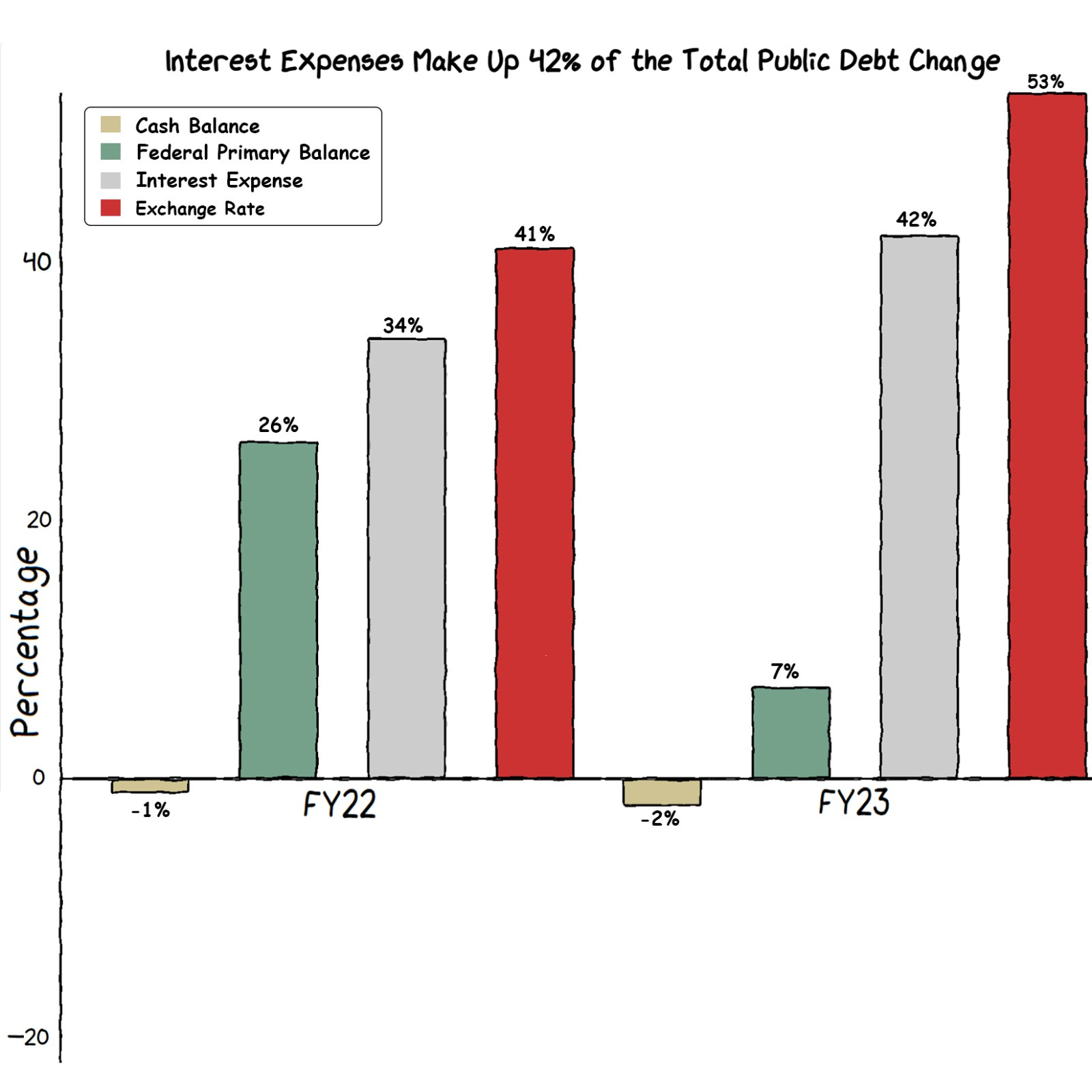

Solar electricity generation is increasing rapidly in South Asia.

Pakistan 🇵🇰 is among the 5 Emerging & Developing Economies (EMDEs) with the largest public investments in renewable energy

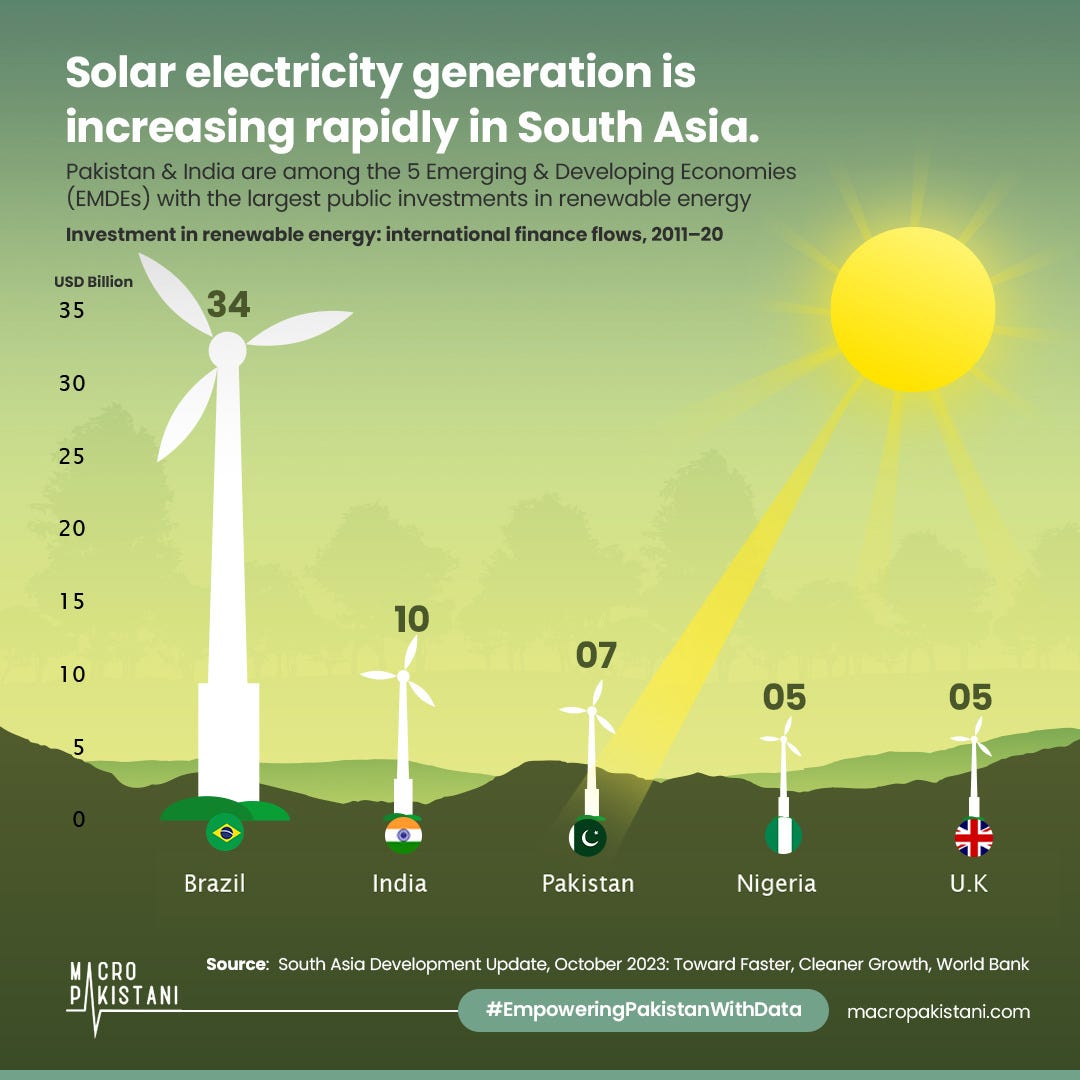

📅 During FY23, the Pakistani government borrowed an average of PKR 41 billion daily to meet operational needs. This relentless borrowing pushed the boundaries set by the Fiscal Responsibility and Debt Limitation Act, which caps debt at 60% of GDP. ⛔

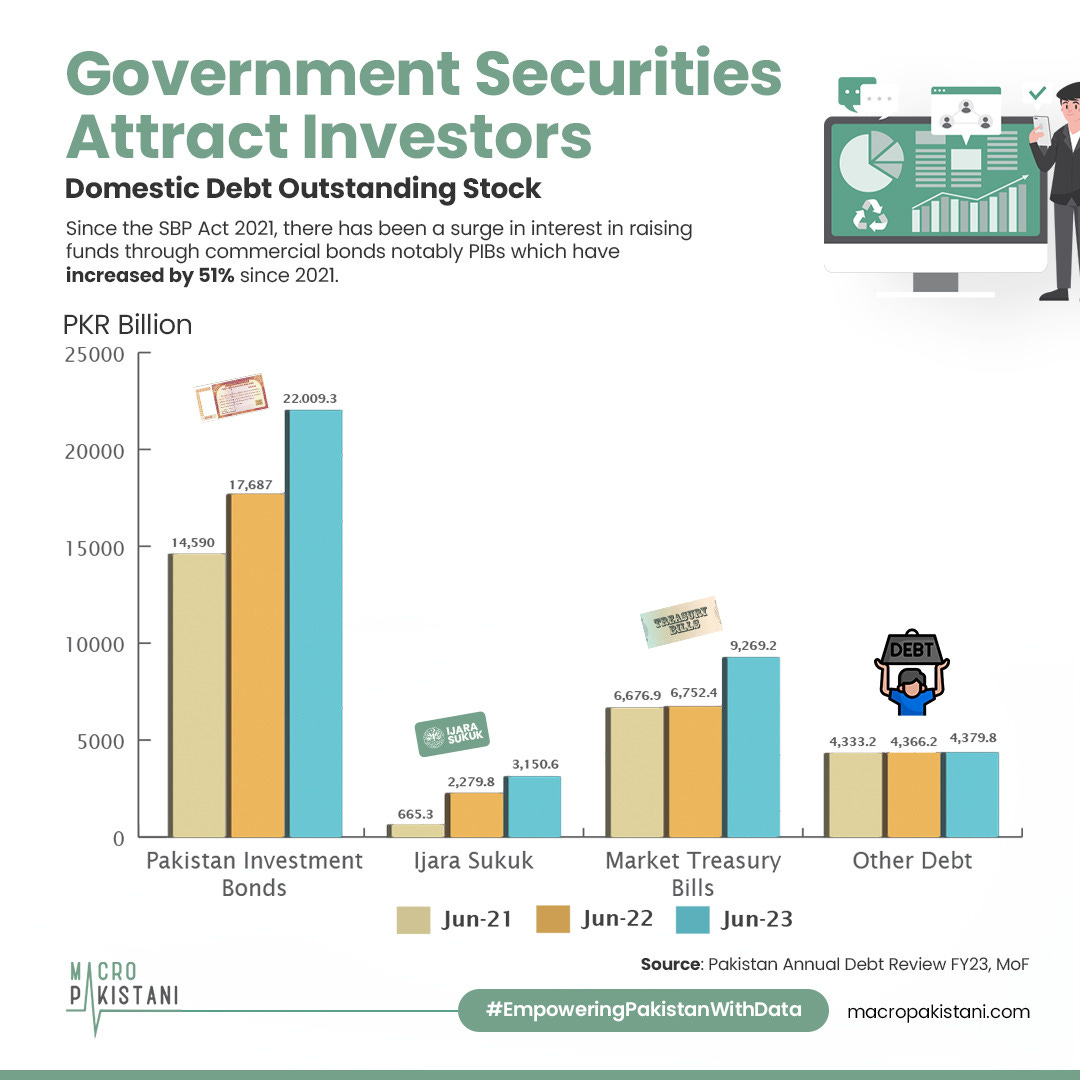

📈 This surge in debt has been partially driven by a heightened interest in commercial bonds, notably Pakistan Investment Bonds (PIBs), which have experienced a remarkable 51% growth since the implementation of the SBP Act in 2021.

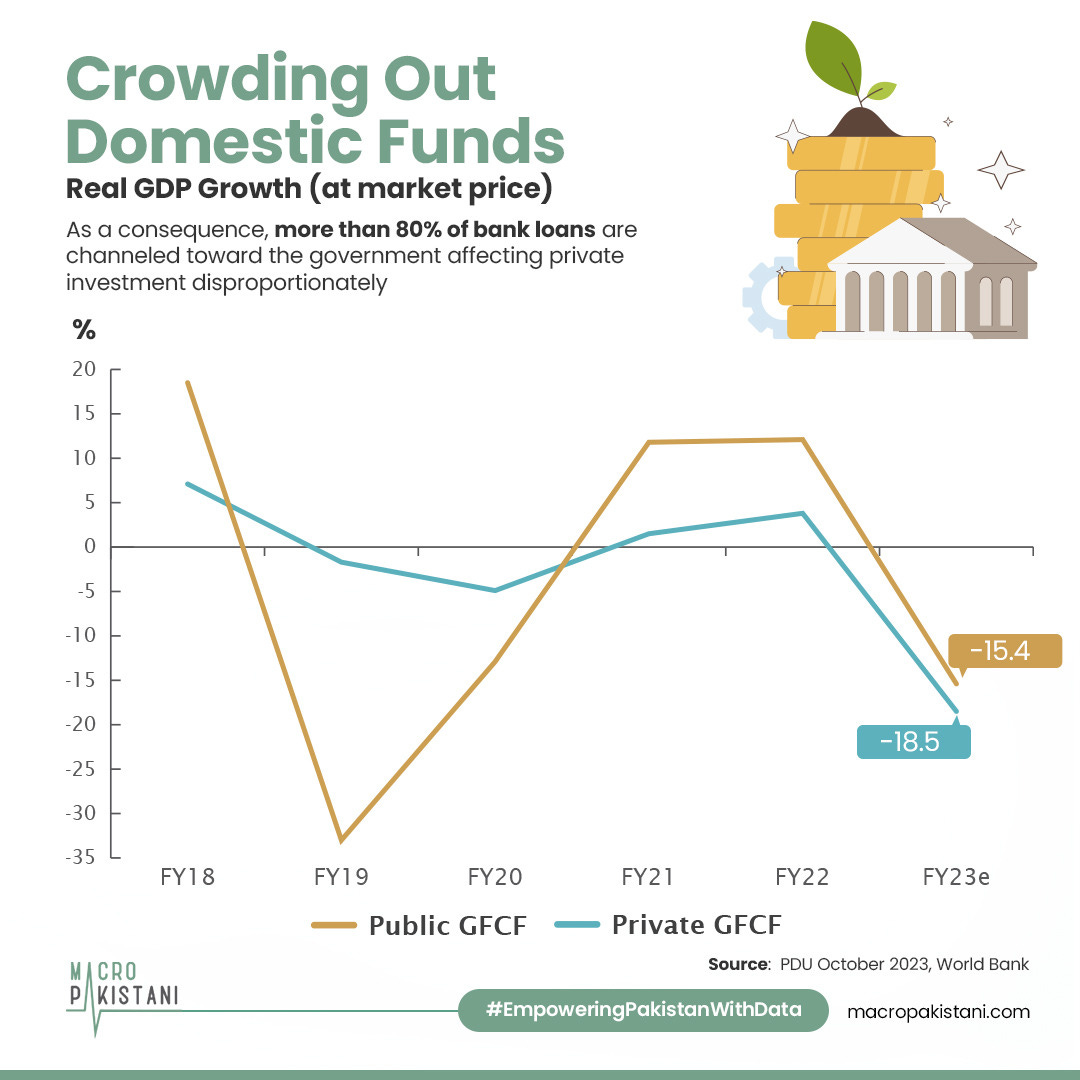

Unfortunately, this increased government borrowing has had a detrimental impact on private-sector investment 🏭, with more than 80% of bank loans being funneled toward the government. 🏦

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.