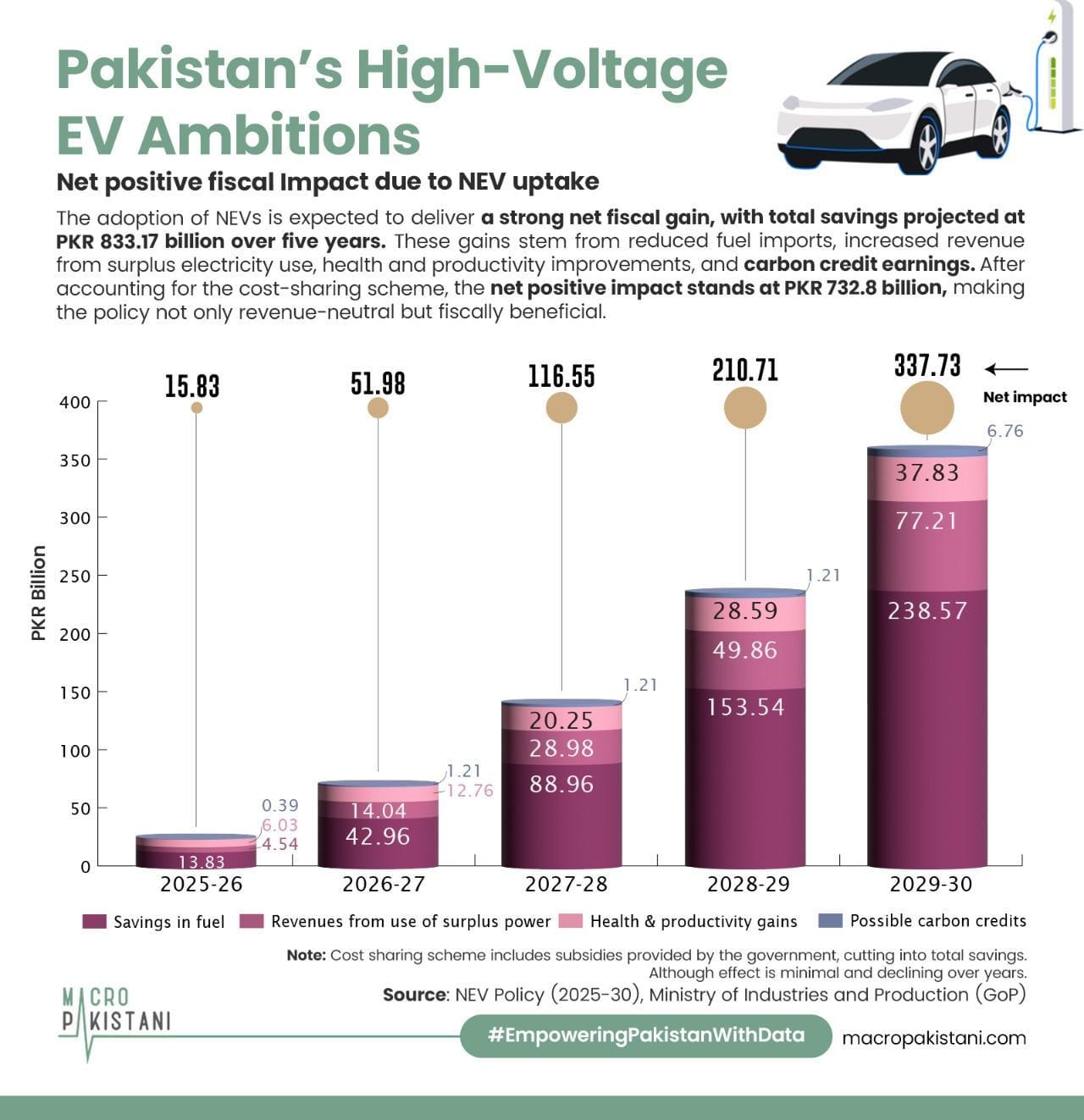

Pakistan’s High-Voltage EV Ambitions

Pakistan’s New Energy Vehicles Policy targets PKR 732 billion in savings and a budget intervention hopes for 4.5 million-tonne cut in carbon emissions by 2030.

Sponsored by Pakistan Chemical Manufacturers Association & PCE.

Pakistan’s transition to electric and hybrid mobility is both a climate imperative and an economic opportunity. As the transport sector contributes nearly 80% of the country’s oil consumption and is a major source of urban pollution, a shift toward New Energy Vehicles (NEVs) can significantly reduce emissions, improve air quality, and cut costly oil imports. The newly launched NEV Policy 2025–30 aims to address these issues through ambitious targets; hoping to save a total of PKR 732 billion over the next 5 years. However, the policy’s success hinges on making NEVs financially accessible, and that is the problem facing Pakistani consumers in the automobile market. Despite a growing preference for hybrids and plug-in hybrids (PHEVs), due to their cost-saving propositions, affordability remains a major deterrent. According to a prominent automobile manufacturer, hybrid SUVs often carry a 10–30% price premium, with payback periods stretching beyond 7 years which undermines their fuel-saving appeal. Additionally, expensive batteries requiring replacement after 15-20 years are also a deterrent for Pakistanis considering Pakistan’s local market lacks such technology. The policy proposes four key interventions: increasing the supply of affordable quality NEVs, developing charging infrastructure, incentivizing demand, and creating institutional support.

Can Pakistan become part of the EV adoption wave led by countries like India and Vietnam?

The Federal Budget for FY25-26 also includes key measures such as a PKR 9 billion subsidy to support 116,053 electric bikes and 3,171 rickshaws, with 25% of this reserved for women. The policy alone targets an annual fuel saving of 2.07 billion liters, $1 billion in foreign exchange savings, a 4.5 million-tonne reduction in carbon emissions, and $405 million in annual healthcare savings. To support adoption, 40 EV charging stations will be installed along motorways, with added initiatives like battery swapping, vehicle-to-grid (V2G) tech, and EV-ready building codes. With over 90% local part production for two- and three-wheelers, the policy offers tax exemptions and SME support to boost localization. Long-term projections estimate PKR 800 billion in savings and PKR 15 billion in carbon credit revenue. Users of e-bikes or rickshaws can recoup additional purchase costs within two years due to lower charging expenses.

This policy is rooted in ground-level realities of transport in Pakistan, thereby providing benefits to a large percentage of the population. However, there is an evident lack of policies or programs to support the car industry in localizing electric vehicles and their parts. This is closely linked to the affordability crisis for electric-powered cars. Pakistan’s transition to electric vehicles, driven by the urgent need to address air pollution and reduce fossil fuel dependency, faces many hurdles. Notably current adoption remains minimal at just 1% of new registrations despite initial progress with locally manufactured electric rickshaws. Regional examples are plenty, for instance, India boosted electric two-wheeler adoption with its FAME scheme, offering subsidies of up to INR 20,000 and meeting 75% of its targets, while Thailand balanced affordable EV imports like the $15,600 Neta V with local manufacturing. For Pakistan, success will hinge on similar coordinated steps; targeted subsidies as proposed by the IMF, international partnerships, expanded charging networks, and integrated policies that support not only demand but also industry.

GRAPHIC

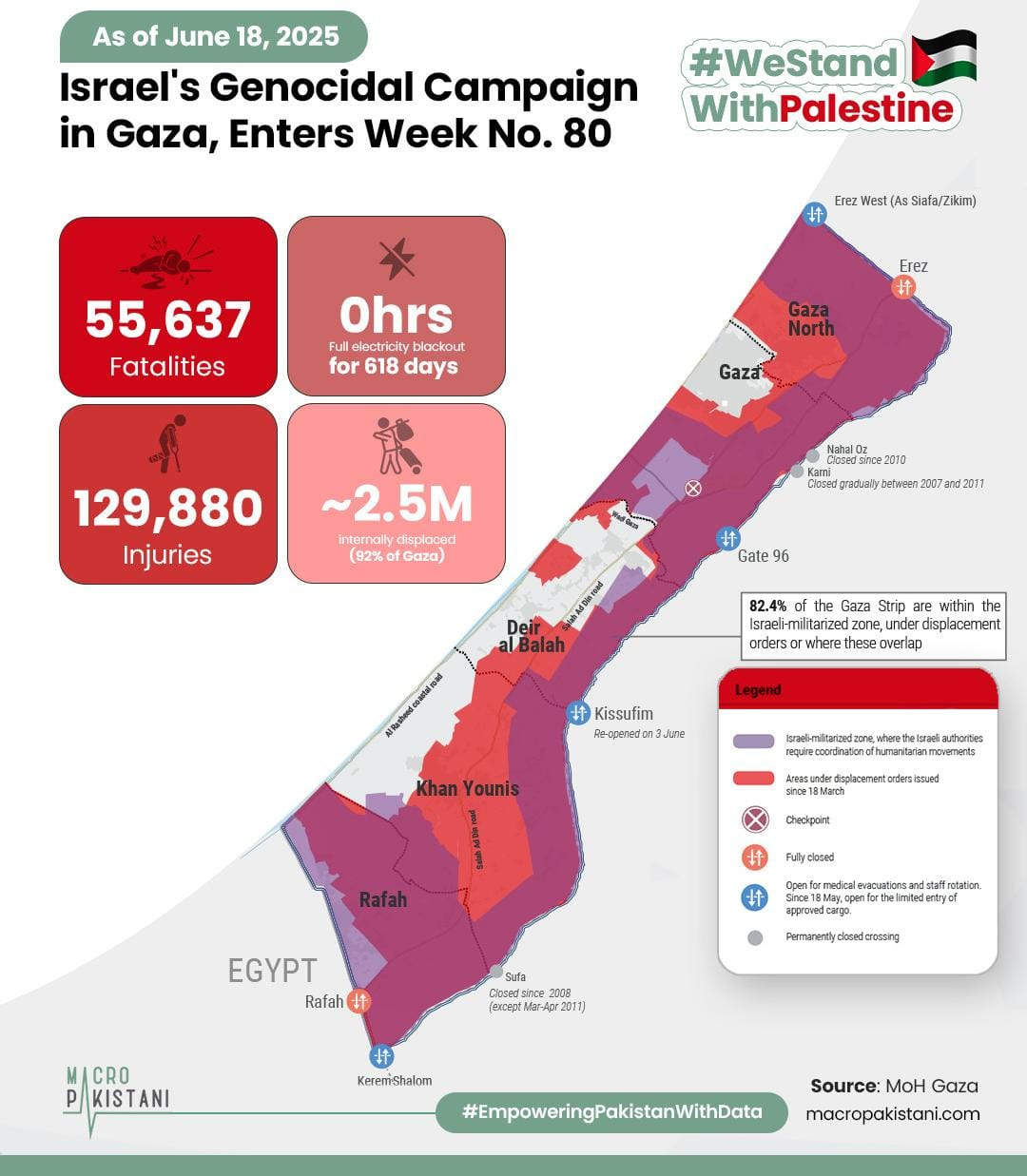

As Israeli forces continue to freely butcher Palestinians in Gaza, Israel’s war with Iran is costing the country an estimated $200 million per day, according to early assessments reported by The Wall Street Journal—a staggering figure that is quickly becoming a major constraint for Israel. The Aaron Institute for Economic Policy estimated that a month-long war with Iran could cost Israel $12 billion.

Pakistan’s stock market emerged as Asia’s top performer in FY 2025, with the KSE-100 index soaring by 50.2%, driven by declining inflation, improved macroeconomic stability, strong corporate earnings, and renewed investor confidence following a favourable budget for successful IMF engagement.

Reforming Pakistan’s power sector requires a strategic, multi-pronged approach aligned with the URAAN Pakistan agenda. This includes retiring inefficient, imported-fuel-based plants, where feasible while considering their essential grid-stability roles. The government’s Circular Debt Management Plan (CDMP) successfully limited debt growth to just Rs. 2 billion in 9M-FY2025, signaling improved fiscal discipline and significantly reduced GENCO payables.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.