Pakistan’s ‘Macroeconomic Miracle’: Fact or Myth?

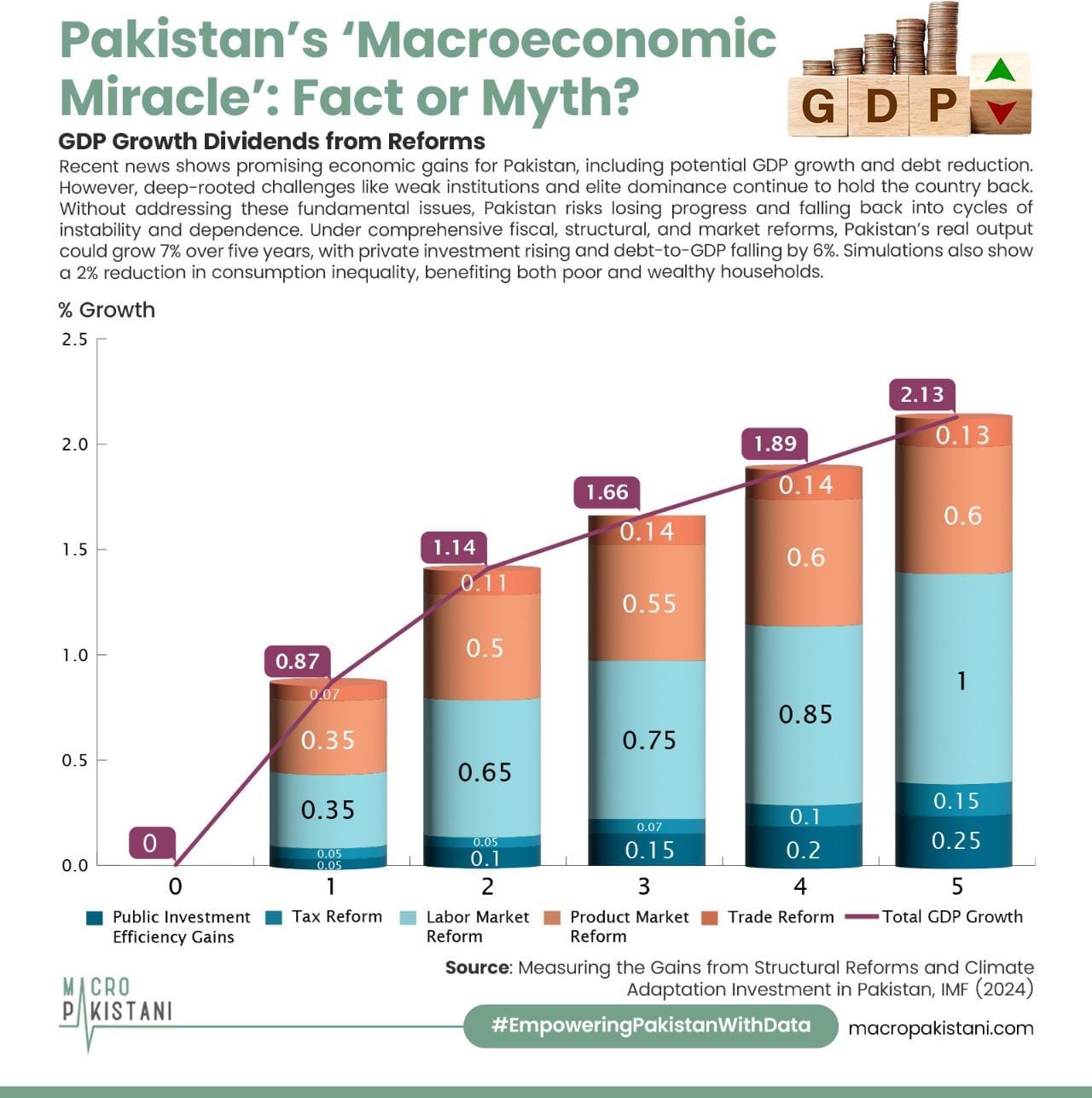

Pakistan’s economic rebound has sparked hope, but real structural change is the true test ahead. Data shows that with the right reforms, Pakistan could see its GDP grow by over 2% in five years.

Pakistan’s recent economic performance has been celebrated in financial circles, with inflation dropping from 40% to near zero, Eurobond prices doubling, and the KSE-100 index tripling. All signaling a macroeconomic turnaround hailed as a “macroeconomic miracle” by Barron’s report. This resurgence, enabled by the IMF’s Extended Fund Facility and a surge in external inflows, follows a near-default crisis in FY24 marked by policy failures, global shocks, and post-flood disruption. Yet, as the World Bank’s Pakistan Development Update (April 2025) cautions, stabilization has come at the cost of suppressed domestic activity, and underlying structural constraints remain deeply entrenched, from tax inequity and circular debt to regulatory bottlenecks and elite capture. Pakistan has seen such episodes before: temporary reprieves mistaken for transformation.

Without dismantling the systemic foundations of dependency and reform inertia that have characterized the country’s economic history since 1958, this moment too risks being remembered not as a turning point, but as another lost opportunity. Nobel Prize-winning economist Daron Acemoglu, co-author of Why Nations Fail, argues that the root of Pakistan’s economic stagnation lies not in geography, culture, or leadership choices, but in its deeply extractive institutions. These institutions are designed to serve elite interests and perpetuate instability by prioritizing short-term political gain over, long-term development. Acemoglu identifies three core institutional failures in Pakistan: fragmented economic governance, where successive governments frequently overhaul policies and weaken bureaucratic continuity; non-inclusive rules that entrench elite control over resources while stifling entrepreneurship and labor mobility; and weak enforcement mechanisms, marked by systemic corruption and poor tax compliance which is exemplified by agriculture’s meager 0.03% contribution to tax revenues despite employing half the workforce.

This institutional decay sustains Pakistan’s reliance on external assistance, such as the IMF, yet undermines the very reforms such support intends to promote. Despite entering 21 IMF programs since 1958, Pakistan’s tax-to-GDP ratio remains under 10%, and public debt continues to exceed 70% of GDP. Acemoglu contrasts this stagnation with countries like South Korea, where inclusive institutions, characterized by strong governance, secure property rights, and investment in public goods, have enabled sustained growth. Until Pakistan confronts these institutional failings at its core, it is likely to remain caught in a recurring cycle of crisis and dependency.

A recent IMF study finds that while recent reforms have improved confidence in Pakistan’s economy, a significant structural agenda remains unfinished. Simulations show that comprehensive reforms could raise real GDP by 2.13% over five years, reduce the public debt-to-GDP ratio by 6%, and cut consumption inequality by 2%. Yet these gains hinge on sustained reform. Investor optimism is encouraging, but Pakistan must now tackle tax inefficiencies, SOE losses, and labour misallocation to avoid sliding back into fragility and dependence.

GRAPHIC

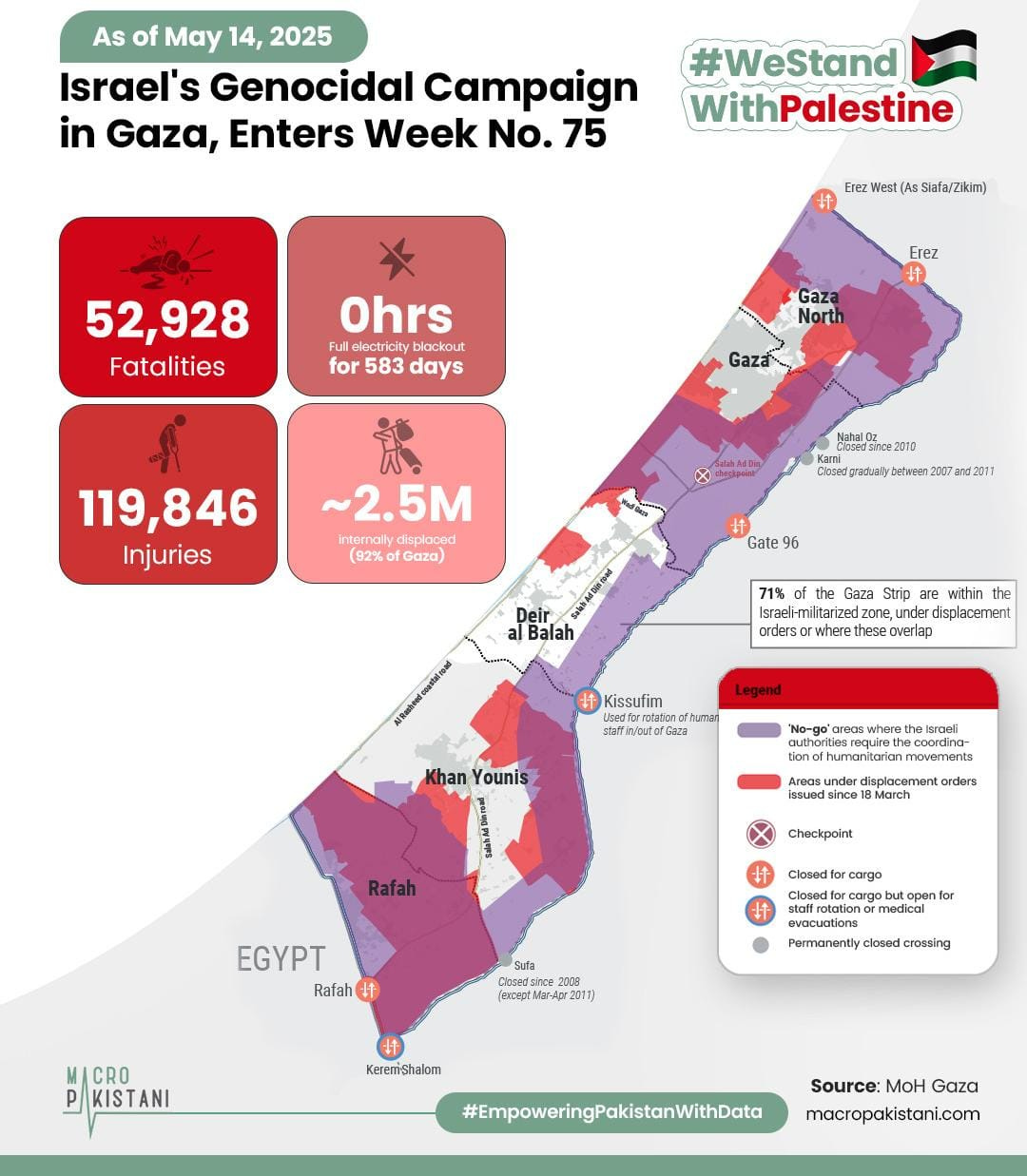

Gaza is under full blockade for the third month. 70% is now within Israeli-militarized zones, under displacement orders, or both. Innocent civilians are dying.

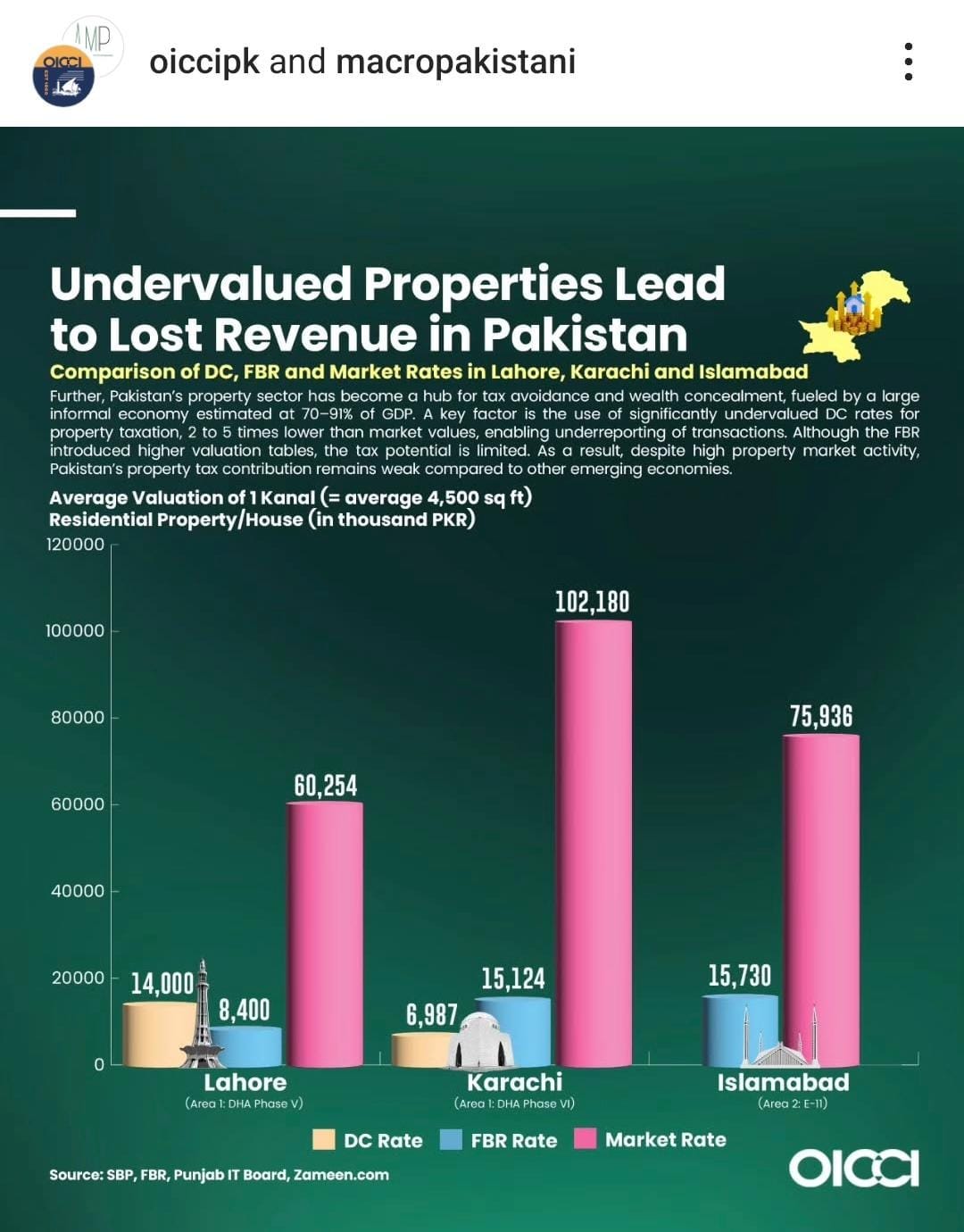

The informality of Pakistan’s real estate sector, which thrives on undervalued property rates, 2 to 5 times lower than market values, enables widespread tax evasion. The introduction of higher valuation tables by FBR has had a limited impact due to weak enforcement.

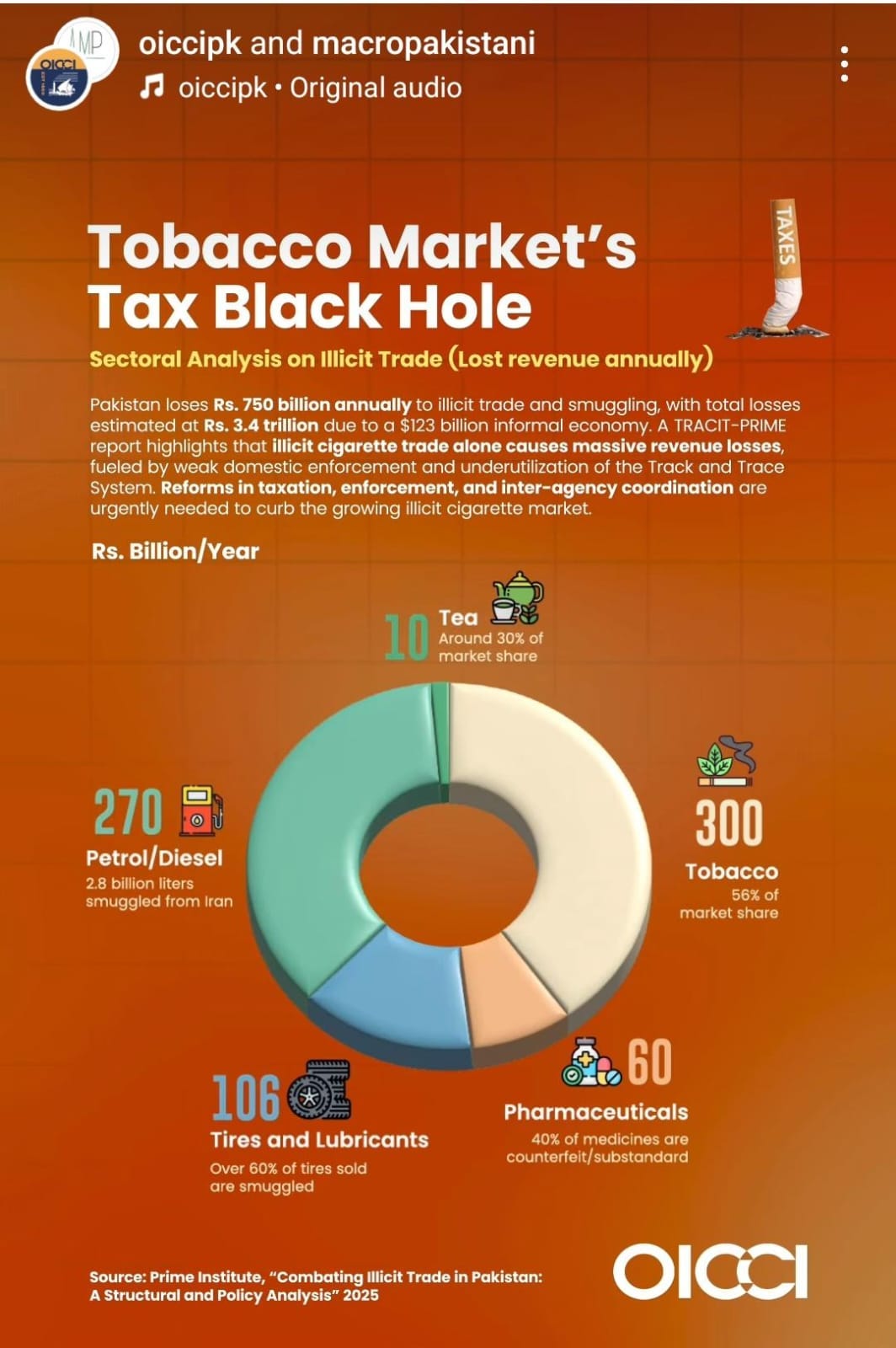

Pakistan faces a staggering annual loss of Rs. 750 billion due to illicit trade and smuggling, with the total losses from a $123 billion informal economy estimated at Rs. 3.4 trillion. The TRACIT-PRIME report highlights that the illicit cigarette trade, fueled by weak domestic enforcement and underutilization of the Track and Trace System, is a major contributor to these revenue losses.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.