Pakistan’s Power Puzzle

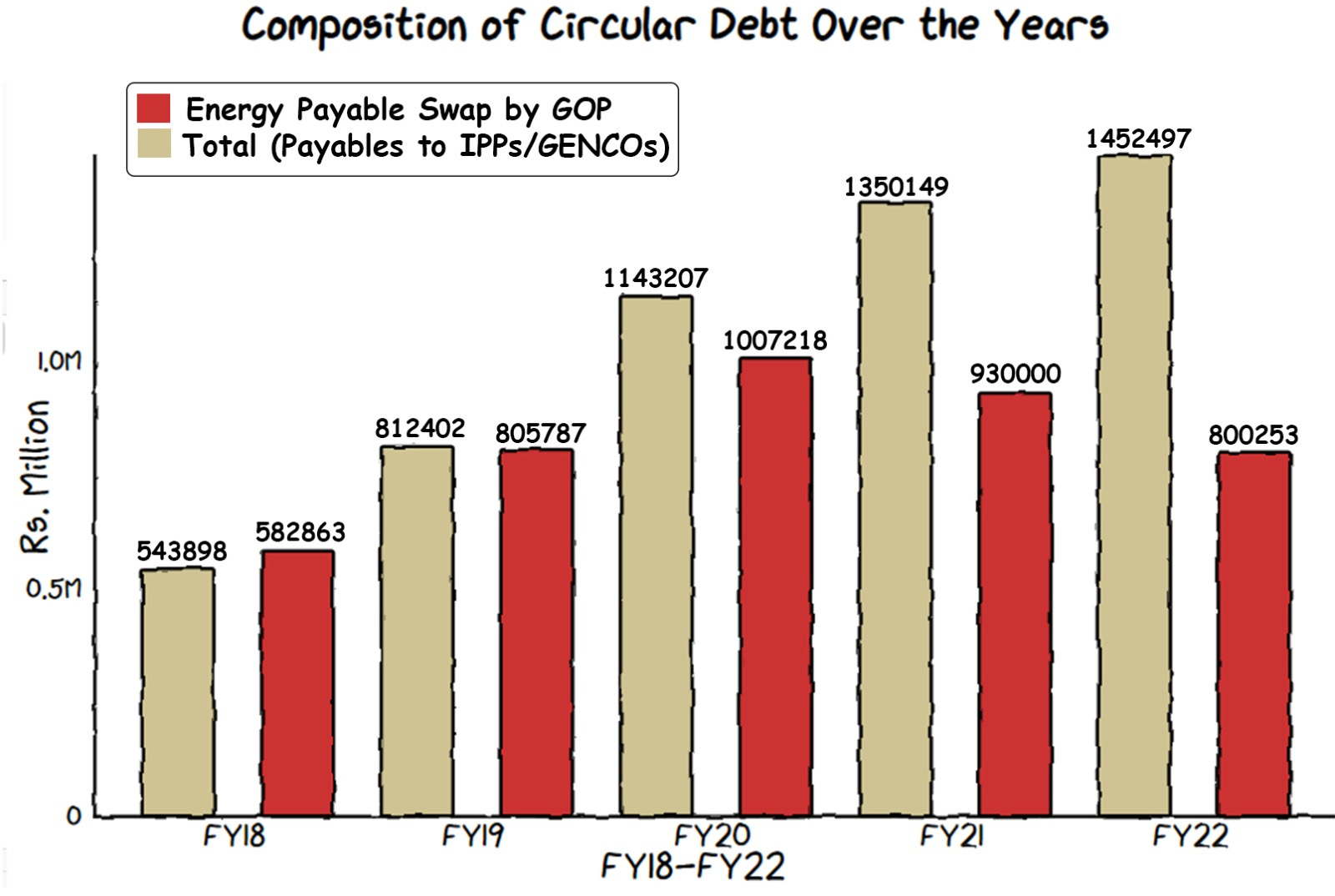

The government owes PKR 2.63 trillion to players in the energy sector, as of April FY 23.

The IMF has laid down strict requirements with regards to Pakistan paying its dues in the power sector.

Pakistan has an interesting energy sector composition, with shared responsibilities between the private and public sectors. The country faced significant supply deficits starting in 2006 resulting in a substantial economic loss of USD 18 billion (6.5% of GDP) by 2015.

Resultantly, the focus of energy production shifted to thermal energy in 2018 including the re-emergence of the infamous rental power scheme. Mismanagement of the consequent energy sector growth has resulted in issues including T&D losses, and recovery problems. The specter of circular debt encompasses all these problems.

Currently, the government owes around PKR 2.63 trillion to power generation companies mainly due to high generation costs, lack of payments by K-Electric, etc, and losses due to a shortage of collection. The IMF has laid down strict requirements with regards to Pakistan paying its dues in the power sector. However, it seems that the government treasury is still holding on to around PKR 108 billion worth of subsidies set aside for May-June 2023.

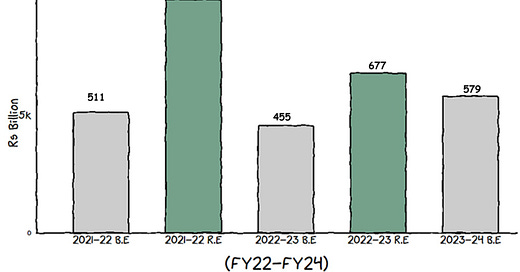

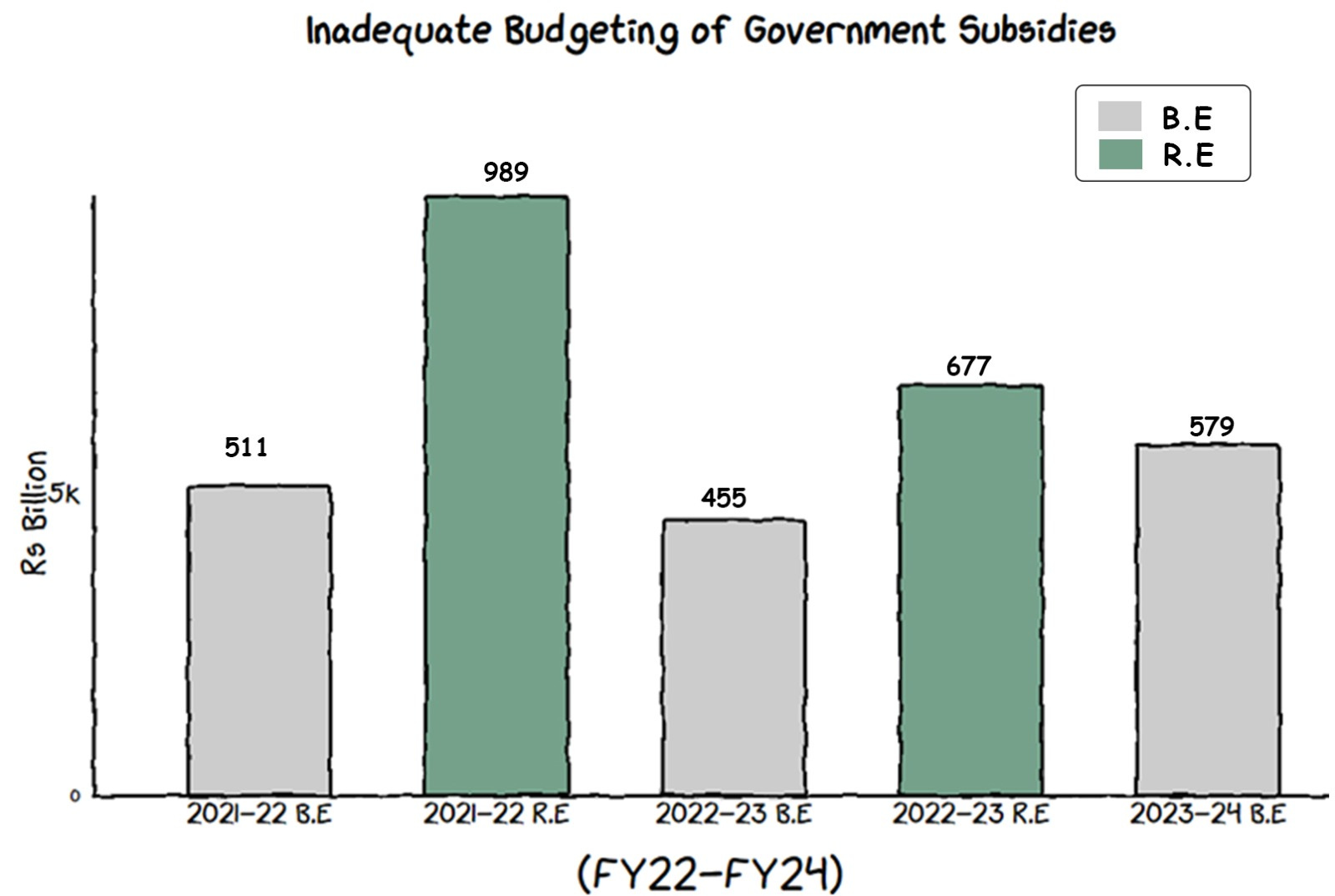

Pakistan’s action plan regarding the circular debt problem needs to shift from short-term solutions to long-term solutions. The inefficiency of high energy costs resulting from unnecessary taxation and fees in the electricity bill is acknowledged by NEPRA itself. Furthermore, there is an imminent need to shift power generation from coal and thermal to renewables by directing subsidies to this sector instead. As of now budgeted subsidies stay below the revised estimates, showing a half-hearted attempt at paying back the debt.

Pakistan's future course will be determined by the significance of current decisions, including whether the country will modify its energy plan to prioritize such solutions.

Finja Secures SECP’s Approval for Pakistan’s First P2P Investment Platform

Leading digital NBFC, @finja.pk has achieved a significant milestone with the granting of a commercial license by the Securities and Exchange Commission of Pakistan (SECP) to operate the country's inaugural P2P investment platform compliant with Shariah principles. This achievement follows rigorous testing within a regulatory sandbox framework.

As a digital NBFC, Finja has facilitated over Rs. 10 billion in financing through 200,000 loans disbursed to 25,000 SMEs across 35 cities. By forging partnerships with distributors, FMCG principals, agritech platforms, logistics companies, and more, Finja has created a robust supply chain-led financing ecosystem.

GRAPHICS

Subsidy to WAPDA/PEPCO

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.