A quick review of our current economic direction

Ensuring the public's well-being is paramount in pursuing a stable and prosperous society. Providing relief to citizens in need is crucial, especially in the face of high inflation, unemployment, and the threat of default. Public relief is an essential political and economic tool used often in the wrong way. But the government must think of public relief as the outcome rather than a mere target.

Here’s what we mean…

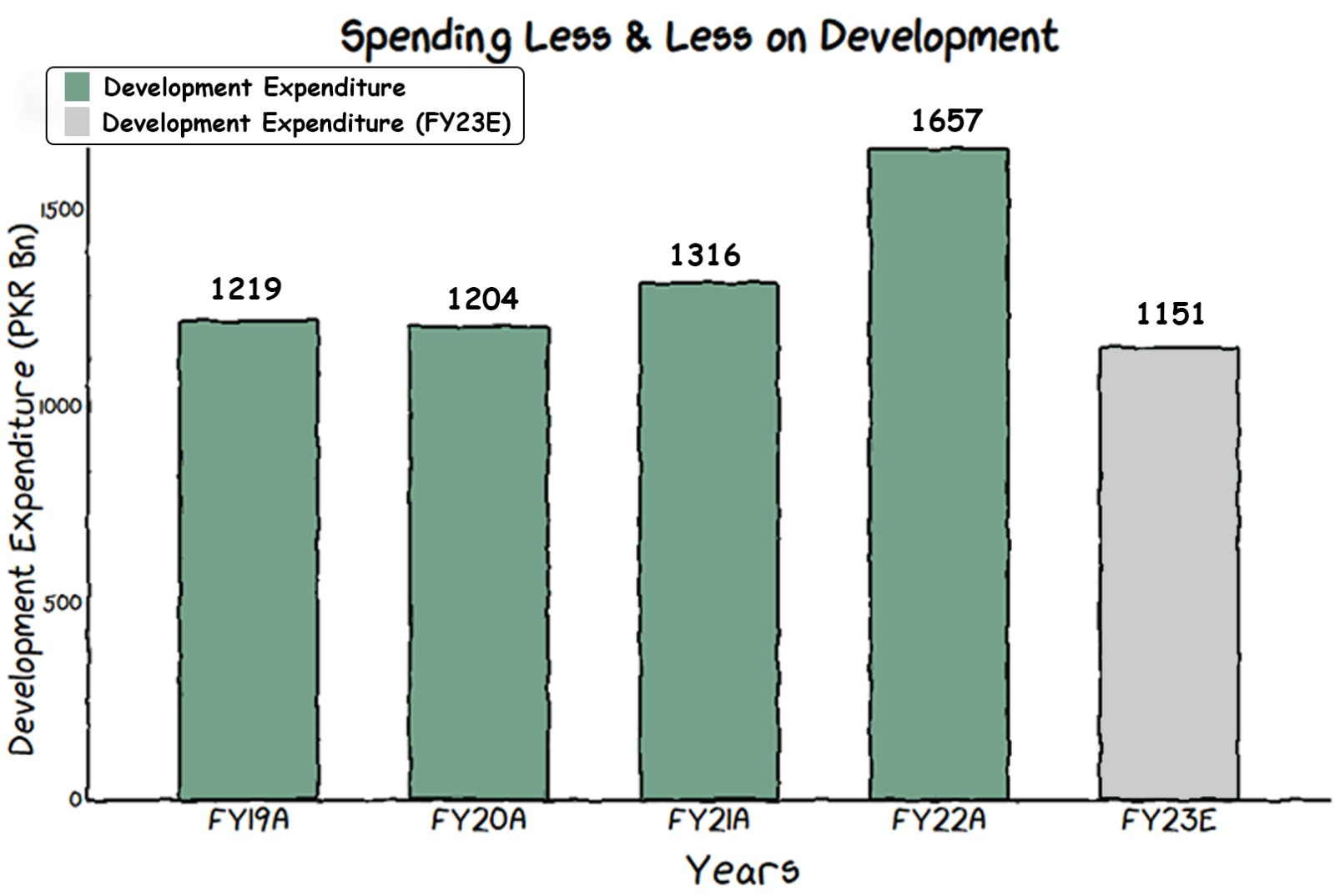

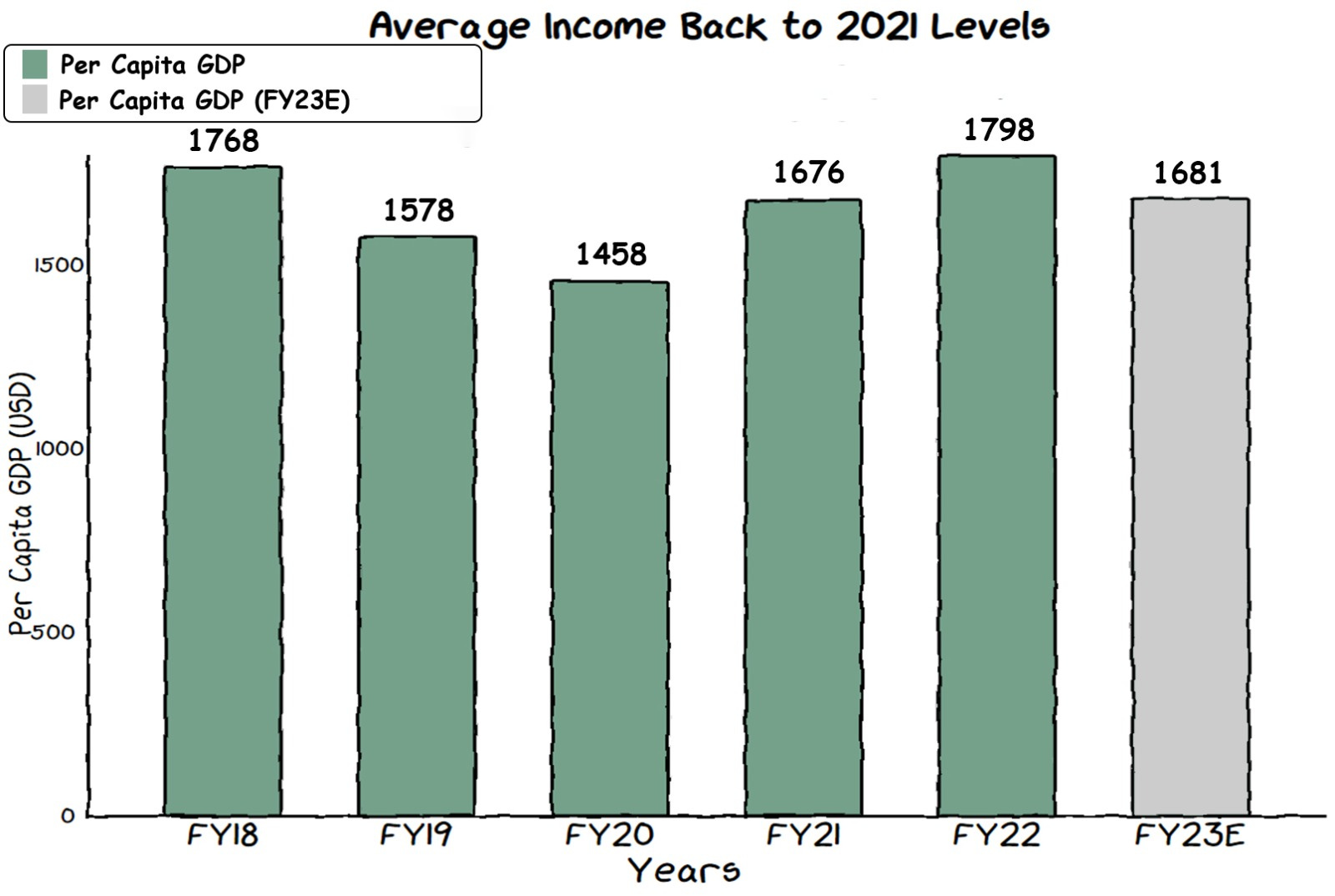

Pakistan’s headline inflation hit a record high of 38% in May 2023, amidst dollar-rupee turbulence and the new budget. It seems intuitive to offer relief to the public that has been crushed by the food affordability crisis. However, the government is taking an instant relief approach to a systemic and deep-rooted problem i.e., a lack of direction and complementary policies.

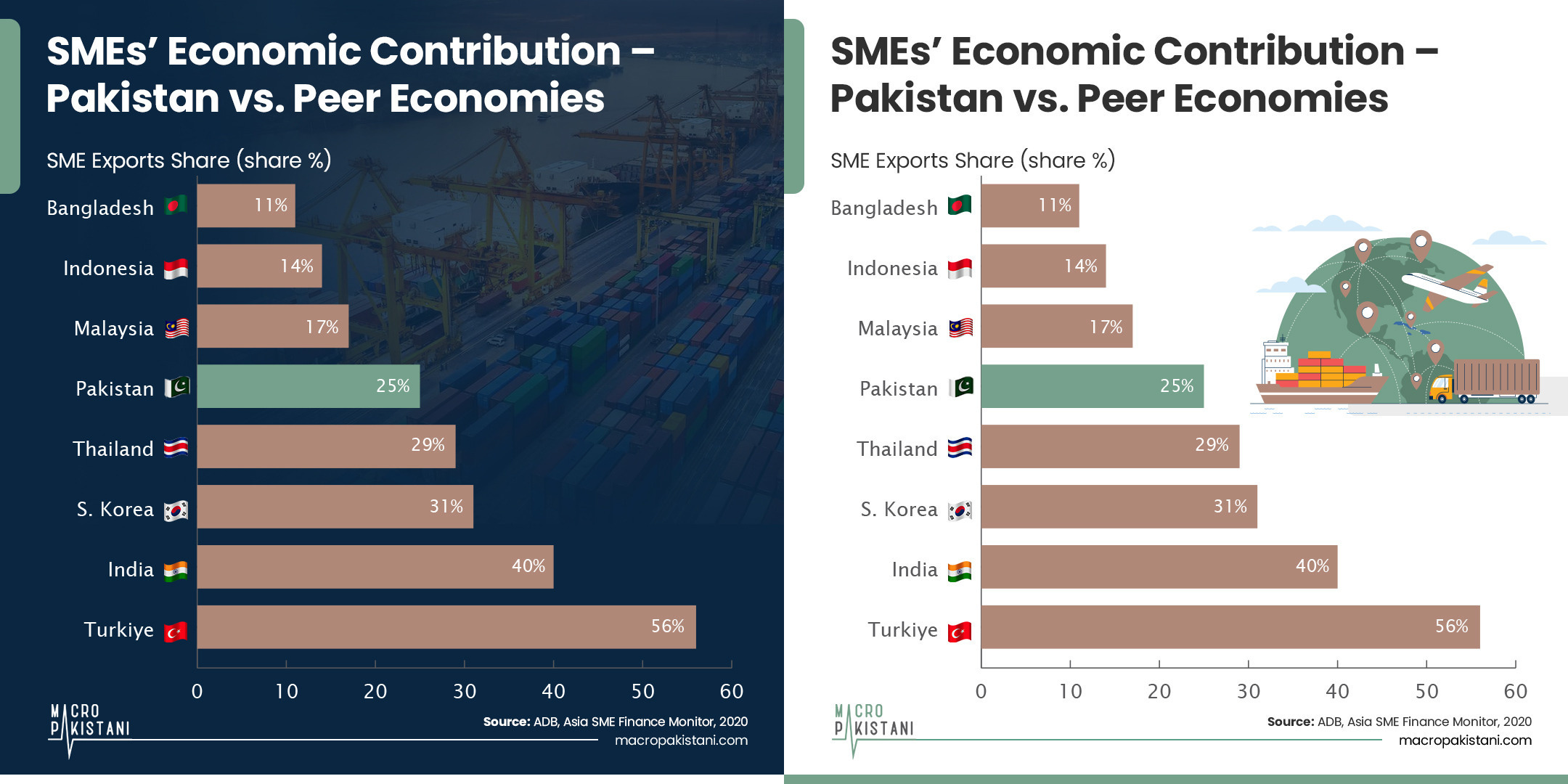

In the past month, the government has ensured the poultry businesses that subsidies will be given in the Budget 2023-24. Similarly, the prime minister has assured industries that measures will be taken to remove hindrances in industrial growth. Simultaneously, the textile industry is weary of tax proposals that will offset any growth that the sector may have been able to salvage. Such SMEs in all industries in Pakistan lack access to research and technology in addition to a lack of representation leading to a loss of confidence. Over 900 export businesses have closed so far.

Instead of providing fragmented relief to specific groups, Pakistan requires a comprehensive policy to align the country's efforts and address the needs of those most affected. The current approach creates inconsistencies and inequalities in the distribution of relief. For instance, in 2021, the UN reported that the elite in Pakistan consumed around USD 17.4 billion of Pakistan’s economy (through various means such as tax incentives, affordable input costs, increased output prices, or advantageous access to capital, land, and services).

It is crucial to consider who will bear the brunt of these shortcomings!

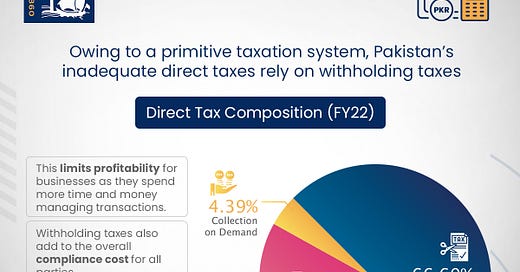

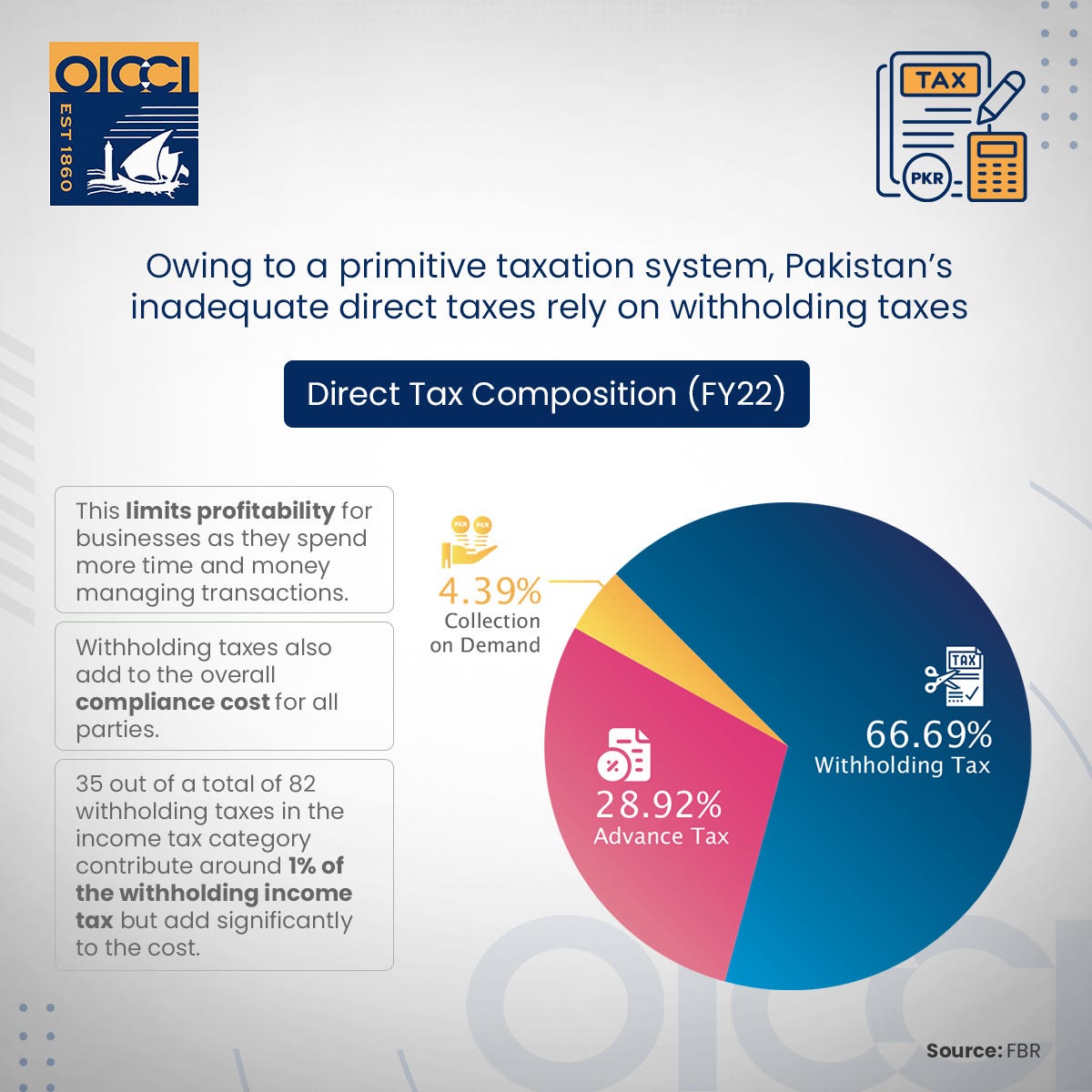

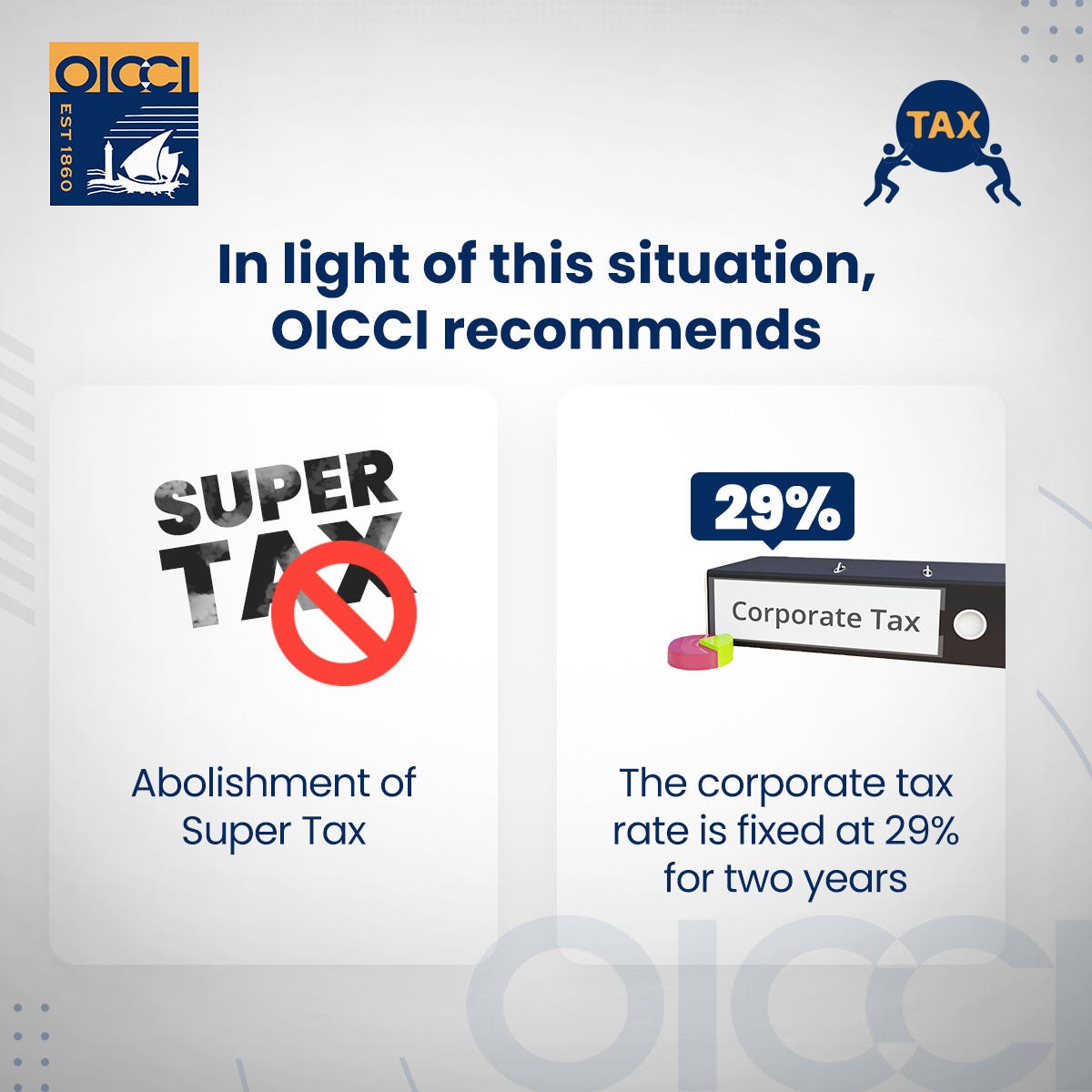

The OICCI in its Tax Proposals for Federal Budget 2023-2024 has recommended a revamping of the withholding tax regime, with a uniform, single rate under each section to simplify the structure and merge various WHT sections to reduce them to the required minimum.

Stay tuned to learn more about the Federal Budget 2023-2024 Recommendations shared by the OICCI.

FROM MACRO PAKISTANI INSTAGRAM ACCOUNT

Team @brandnib making new visualizations for Macro Pakistani followers, readers, and collaborators since November 2020. Growing strong with every passing day ✌️

GRAPHICS

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.