SBP Cuts Interest Rate to 12%

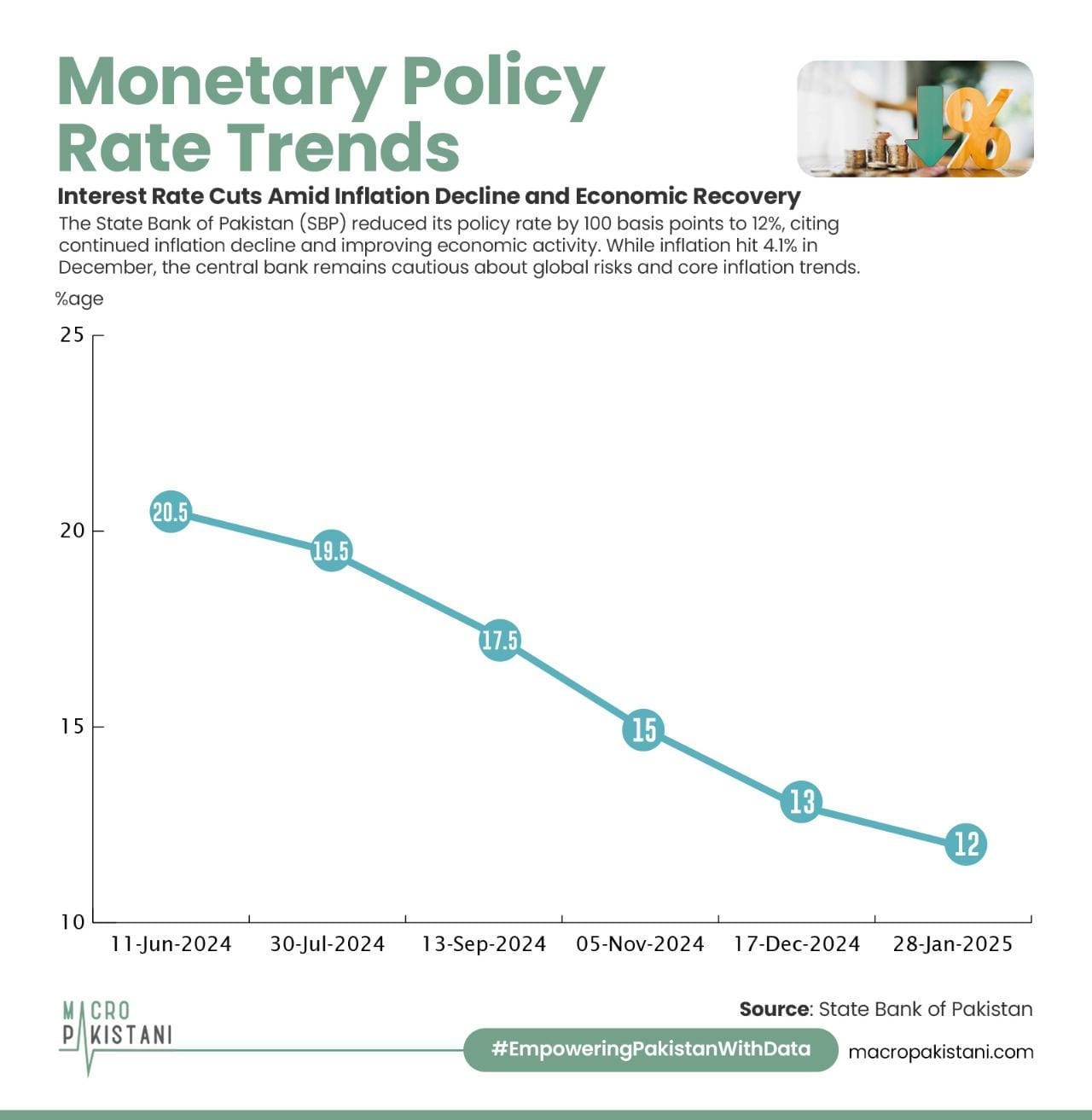

The SBP reduced its policy rate by 100 basis points to 12%, citing continued inflation decline and improving economic activity.

The State Bank of Pakistan (SBP) has reduced its policy rate by 100 basis points to 12%, effective January 28, marking a cumulative 1,000 basis point cut since June 2024. The decision follows a steady decline in inflation, which reached 4.1% year-on-year in December, driven by easing demand, stable exchange rates, and favorable base effects. While core inflation remains elevated, high-frequency indicators suggest a gradual recovery in economic activity.

The central bank believes that previous rate cuts will continue to support growth while maintaining price stability. With inflation expected to rise slightly in the coming months before stabilizing within the 5.5-7.5% target range for FY25, is the SBP striking the right balance between economic growth and inflation control?

Pakistan’s external sector has shown improvement, with a current account surplus of $600 million in December, bringing the cumulative surplus to $1.2 billion for the first half of FY25. Export growth, led by high-value-added textiles, remains strong, while remittances have continued to rise, offsetting the widening trade deficit caused by higher imports. However, financial inflows have remained weak, and the central bank’s foreign exchange reserves declined due to high debt repayments. Nonetheless, the SBP expects reserves to surpass $13 billion by June 2025, as planned inflows materialize.

Despite improving economic indicators, fiscal challenges persist. Tax revenue grew by 26% in the first half of FY25 but still fell short of the government’s target, requiring an accelerated increase to meet annual projections. While lower interest payments may help contain the overall fiscal deficit, achieving the primary balance target remains difficult. The SBP also noted risks such as volatile global commodity prices, protectionist trade policies, and energy tariff adjustments, which could impact inflation and economic stability. Given these dynamics, the central bank’s cautious approach aims to balance economic recovery with long-term price stability.

GRAPHIC

Pakistan has a unique opportunity to revitalize its private sector and critical sectors such as food, energy, and mobility through climate finance. The Climaventures Programme, aiming to cut 3.5 million metric tons of CO₂ and support 6 million vulnerable people, exemplifies how local innovation can shift Pakistan from aid dependency to sustainable, homegrown solutions.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.