State Immersion Syndrome

Government expenditure is not the only metric to estimate the government’s involvement in the economy.

The Government of Pakistan has a 43% share in the economy of Pakistan according to one estimate.

The IMF and major lenders have been expressing concern over Pakistan's fiscal balance for quite some time. Can Pakistan attain stability through its fiscal policy, and is it feasible to expect repayment of borrowed funds? However, certain intangible measures are being overlooked as they lack widely accepted quantitative metrics. For example, what impact does state-owned enterprises' dominance have on private competition, and in particular, are the government's borrowing practices crowding out the private sector's investment?

These factors are important in determining the overall impact of the government on the economy. Firstly, it is quite surprising to observe the government's involvement in all major sectors of our economy. For example, the government has a 78% share in the oil and power sector which accounts for a 1.4% share in the economy. All in all, either through public sector companies or state-owned enterprises, the government has a 43% share in the economy according to one estimate.

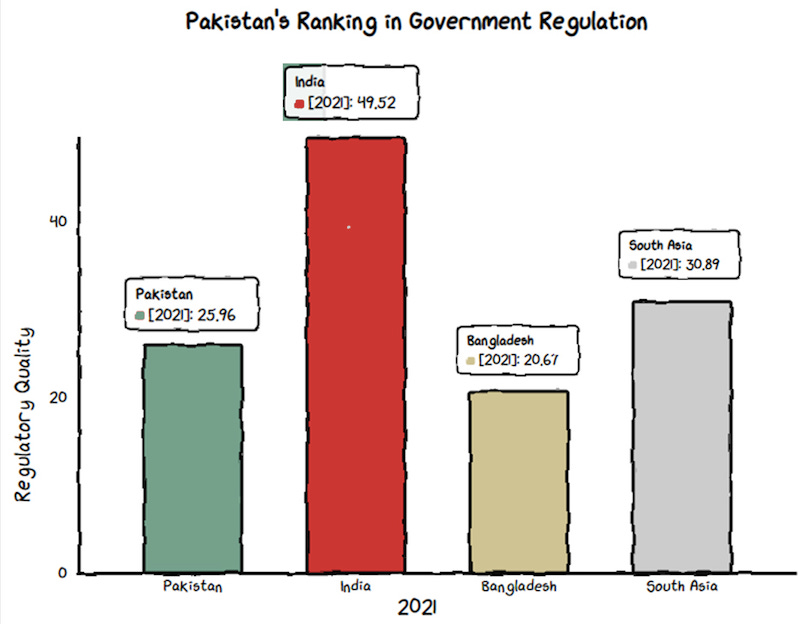

Due to various global factors, such as inflation, the government’s requirement for loans has increased substantially. In the past, it has meant excessive additional lending and higher outflows in the name of interest payments. This has often led to a ‘crowding effect’ in the economy. Private investment and ownership have been negatively affected by inadequate regulatory measures and limited access to loans in the country (since the government has eyes on most of it).

Fortunately, the initial steps have been taken toward the liquidation or merger of the 200 SOEs, which would be a better way to address the situation. Moreover, the government needs to realize its role as a sensible administrator and a guiding power. This would allow for a more efficient allocation of resources and promote private sector growth, with the government serving as a facilitator rather than a competitor.

Most households in Pakistan (around 63%) borrow money to buy food opposed to the Western notion of buying houses or cars. Considering how Ray Dalio considers credit one of the cornerstones of his ‘economic machine’, where does Pakistan stand in this model? Read our latest article in collaboration with DAO PropTech to find out.

Note: 😔We are sorry for the delay in sending out this Macro Bite, it was a tough week for Pakistan. Social media is still down in some parts of the country even after the resumption of mobile internet (after 3 days).

The Macro Pakistani team had a tough week too. How did you manage things during this week?

Investing in Pakistan’s workforce is not just a moral imperative; it's also an economic necessity. Join Unilever Pakistan and Macro Pakistani to advocate for living wages that can unlock a virtuous cycle by investing in our most valuable asset - ‘people’. By providing living wages, opportunities for skills development, and a supportive work environment, we can maximize our human capital and create a brighter economic future for all.

GRAPHICS

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.