Surplus Surprise!

Pakistan’s current account surplus in March; a number game or positive for stability?

Intentional policies including high custom duties, hurdles in the issuance of letters of credit, and other moves have resulted in Pakistan recording a current account surplus for March FY 23.

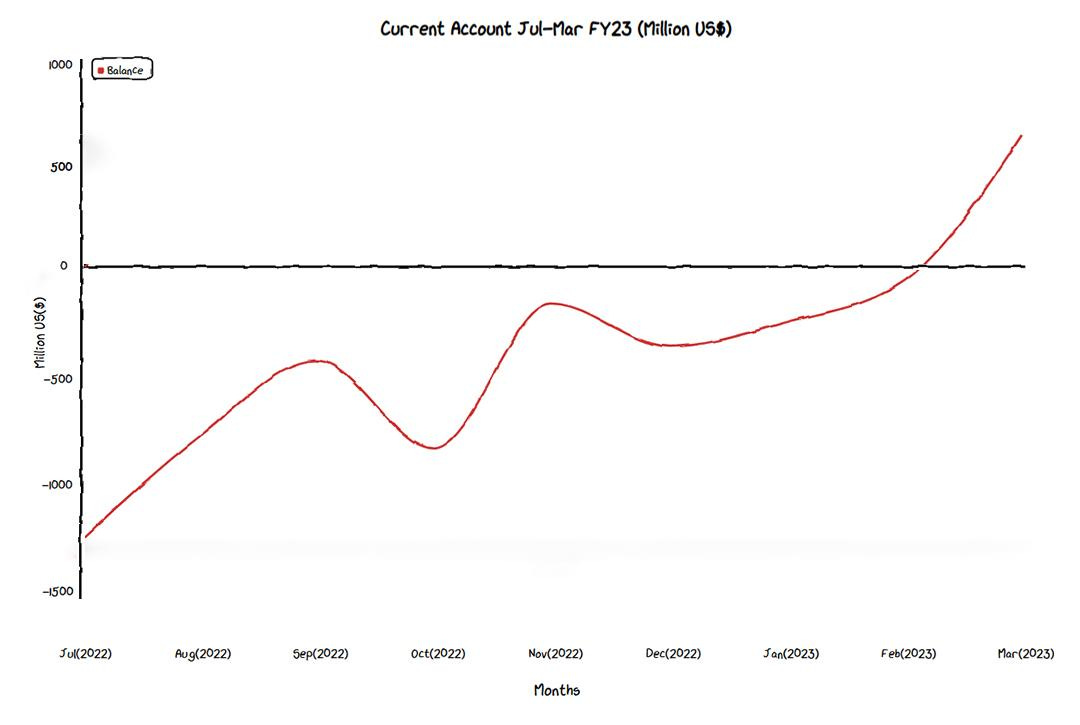

The Finance Minister of Pakistan, in a tweet, announced the country's current account surplus of USD 654 million in March 2023. Many rejoiced at the news and took it as a sign of improving external account numbers. The positive number comes as a respite for the government after inheriting a huge deficit in addition to interest payments in the current year. The numbers show a rosy image of the state of Pakistan’s economic affairs, but is the future actually rosy?

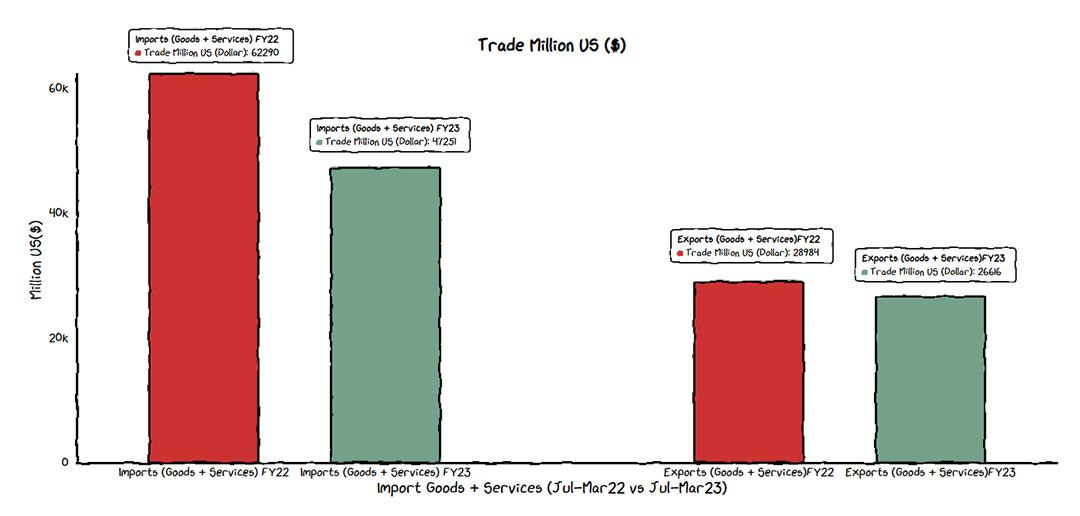

The main factor in this surplus is a decline in Pakistan’s imports. Particularly, the import of goods and transport services fell over July-March in FY 23 as compared to FY22. Intentional policies including high custom duties, hurdles in the issuance of letters of credit, and other moves have resulted in Pakistan recording a current account surplus for March FY 23. On the other hand, exports have declined by around USD 2 Billion. Additionally, large-scale manufacturing declined by 4% in H1 FY 23.

A clear example of these effects is the shutdown of various automobile manufacturing plants. These plants rely on imports of input material and therefore, have suffered the most due to the stark decline in imports. All these factors combined make one wonder if the management of the current account has been a mere number game or a carefully thought out ‘economic plan’.

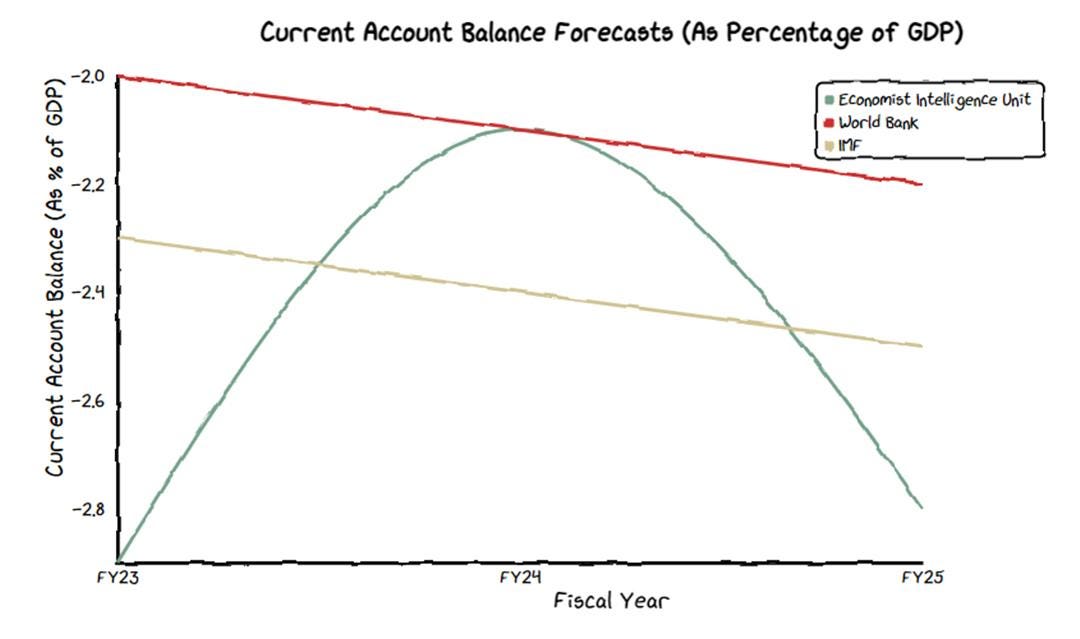

Pakistan needs a more endogenous method to resolve the current account deficit. Since the current methodology is short-lived and quite unsustainable, as can be seen through the projections by major economic institutions (scroll down to find out).

A wholesome effort spanning the investment procedure in Pakistan, along with the promotion of export-oriented industries is pertinent. Furthermore, the country needs deliberate research on trade competitiveness and technological solutions to improve terms of trade. Instead of treating the current account deficit as an accounting problem, Pakistan should devise an economic roadmap to strategize ‘growth’.

GRAPHICS

1- Economist Intelligence Unit

2- World Bank

3- IMF

The @StateBank_Pak welcomed the OICCI’s advice to ensure the sustainability of global investors’ interest & investment in Pakistan and has committed to supporting recommendations for investing pending dividends with accumulated profits and principals eventually being repatriable. The option to allow companies that are interested, to use pending dividends to invest in their own or companies’ shares was also discussed by the State Bank.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.