Taxed and Stunted

FBR collected around PKR 4.46 trillion in the first half of FY24, supported by high utility taxation and inflation.

Pakistan’s tax collection for the first half of FY24 has surpassed its target. In a ‘historic feat’, the Federal Board of Revenue has collected PKR 4.46 trillion thus far primarily through increased domestic taxation. The increase of almost PKR 1 trillion from the same period last year is particularly notable, primarily attributed to enhanced domestic taxation and rising inflation. Despite the FBR rejoicing in its achievement of collecting high revenues, the overall outlook remains lackluster as most of these funds will be utilized to pay off debts and not to improve anything substantial. The World Bank has questioned if revenue targets and collection is a good performance indicator at all, instead suggesting the tax gap as a better estimate of the country’s tax performance.

Does high taxation, of this sort, support the government or merely stifle the economy?

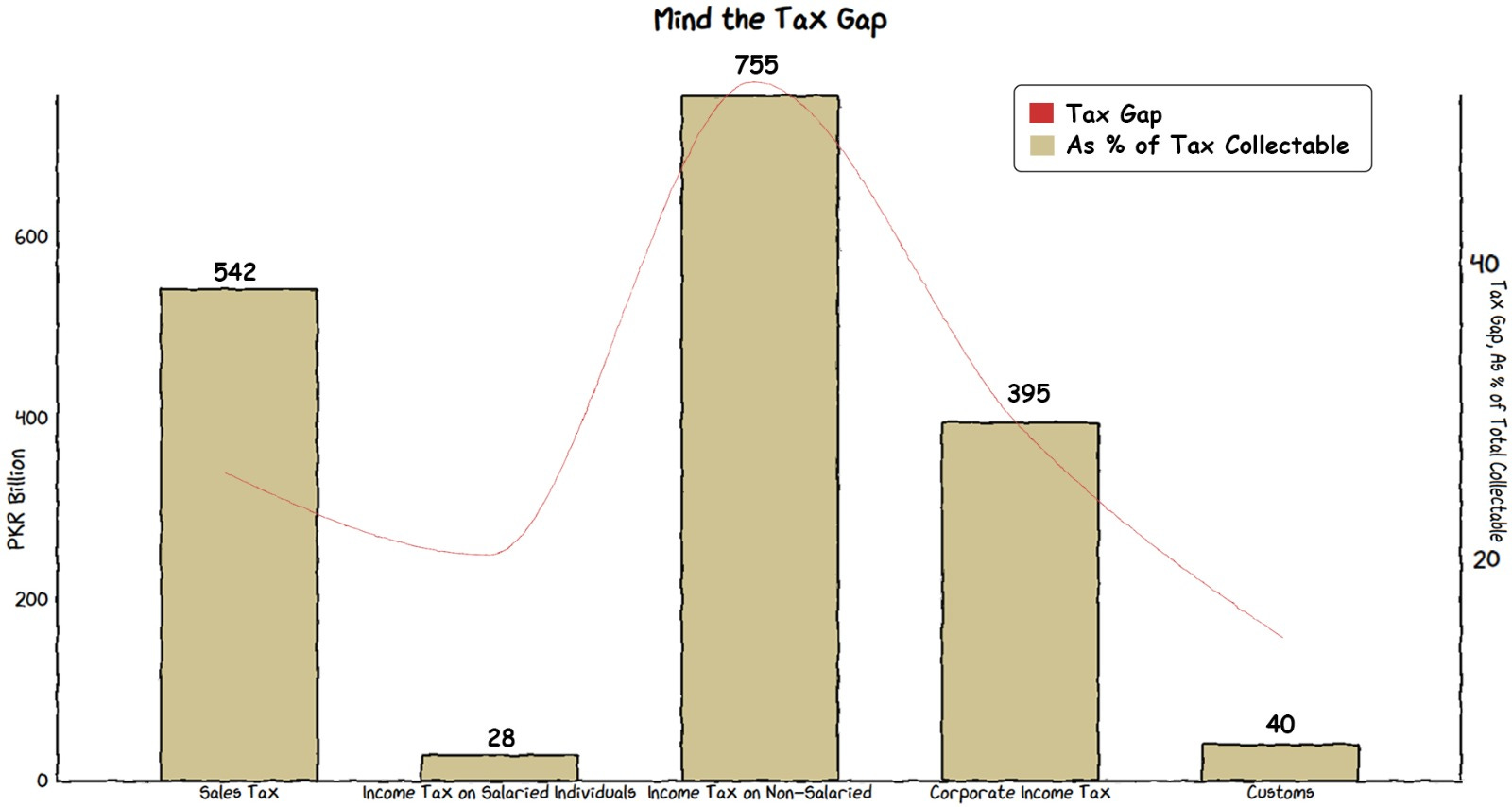

In its first Tax Gap Report (2022), the FBR reports a tax gap of PKR 1.29 trillion across sales tax, income tax, and customs duty. The highest tax gap exists for income tax, standing at PKR 730 billion whereas the tax expenditure for the same is around PKR 448 billion. So far, compliance has been an issue for Pakistan’s tax system, whether it be because of an undocumented economy or a general trend of tax avoidance and evasion. What needs to be understood here is that Pakistan’s taxation depends on its tax rates and its tax base. However, high tax rates, as is customary, also erode the tax base.

As a result of this connection and an informal economy, the tax administration is left with no choice but to shift the tax burden onto whoever is nice enough to pay their taxes willingly.

In various economies with similar issues, documentation has proven to be a great driver of tax revenues. For instance, value-added tax, a kind of consumption-based tax, has been employed to record the economy and encourage documentation. However, Pakistan is still struggling to improve its flat GST-based approach and compliance. In fact, the VAT gap in Pakistan is currently 51% of the total tax collections due to high tax expenditure.

As we’ve talked many times before, taxation is one of the most crucial tools the government can use. It must be used to support the economy and businesses, instead of the FBR acting solely as the government’s prudent financial manager.

GRAPHIC

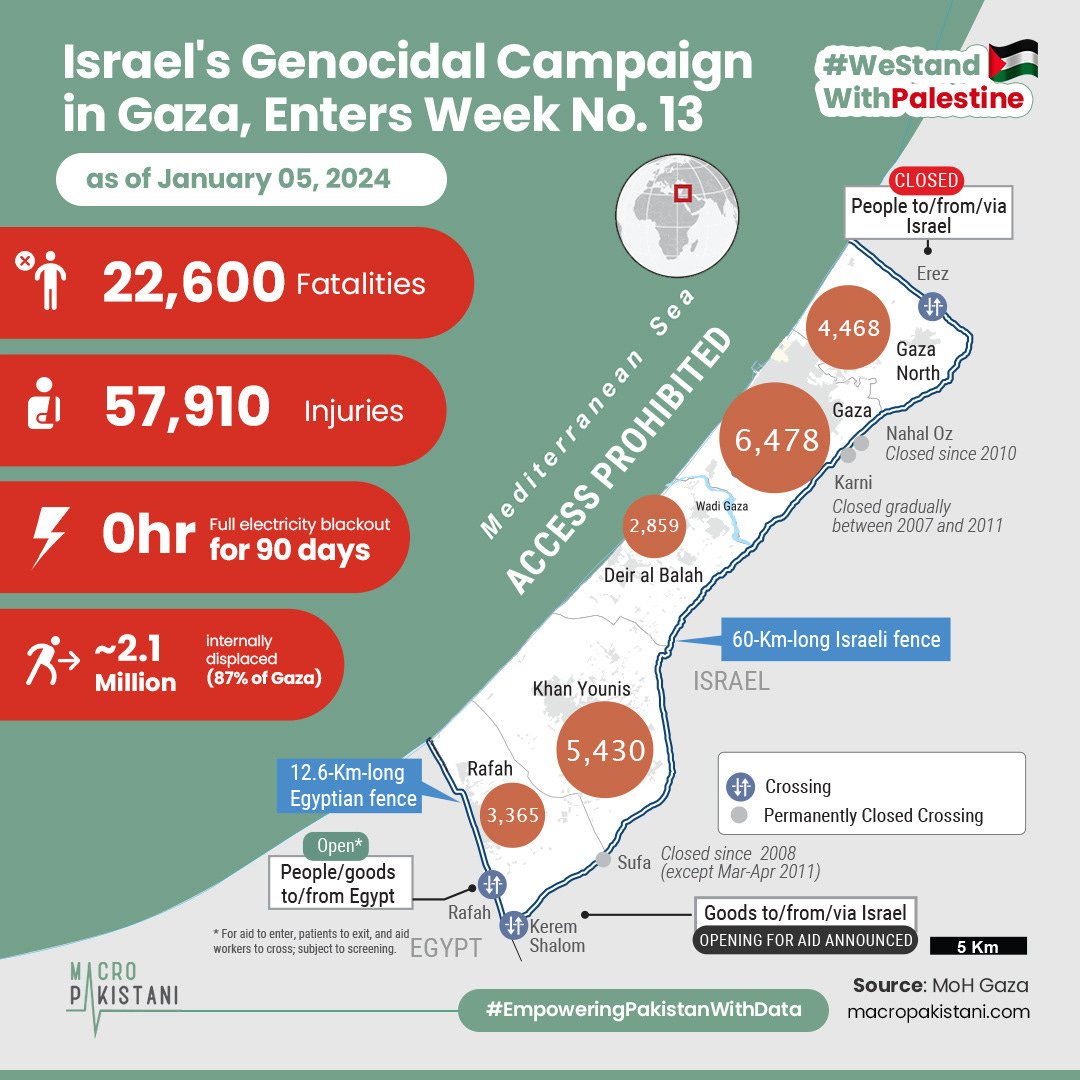

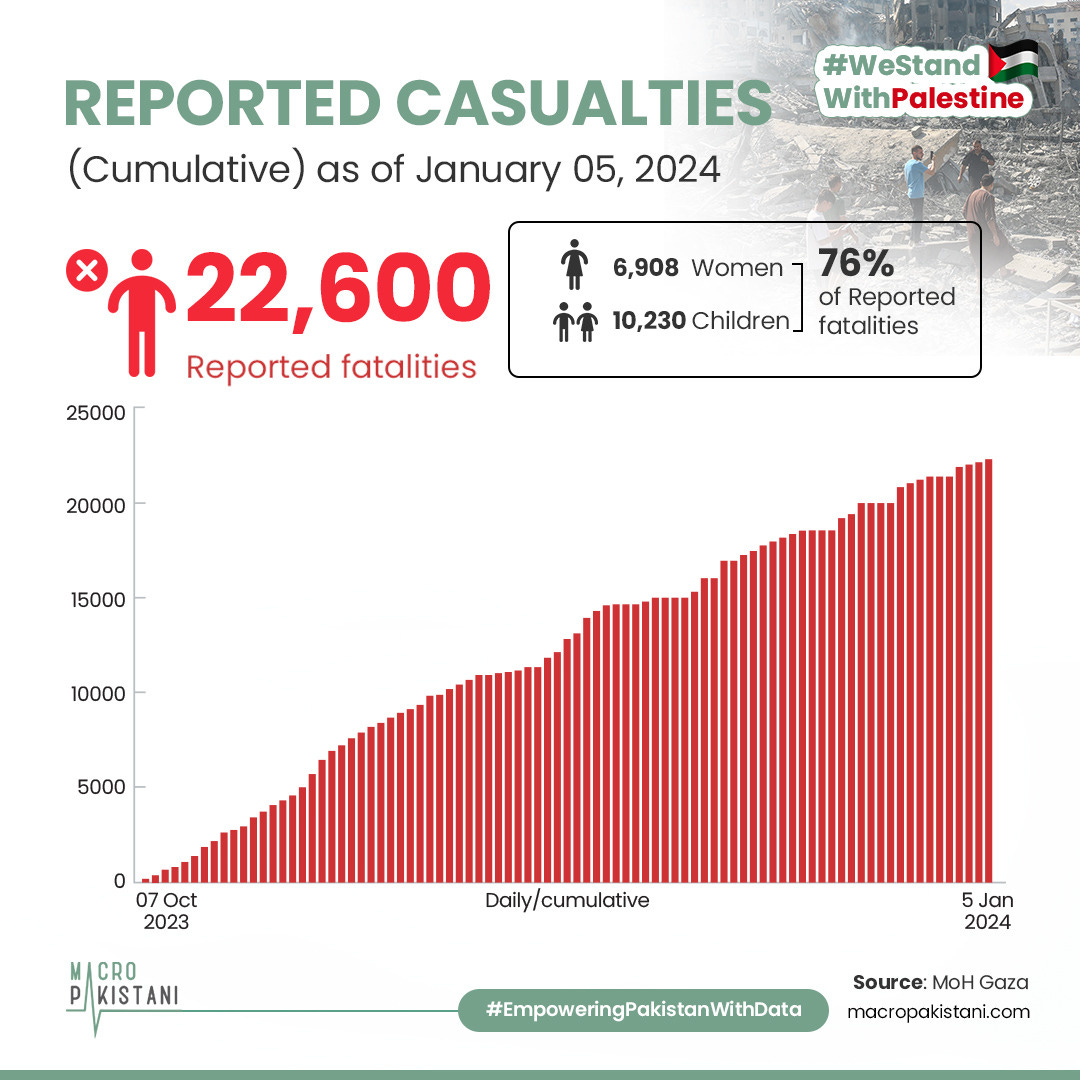

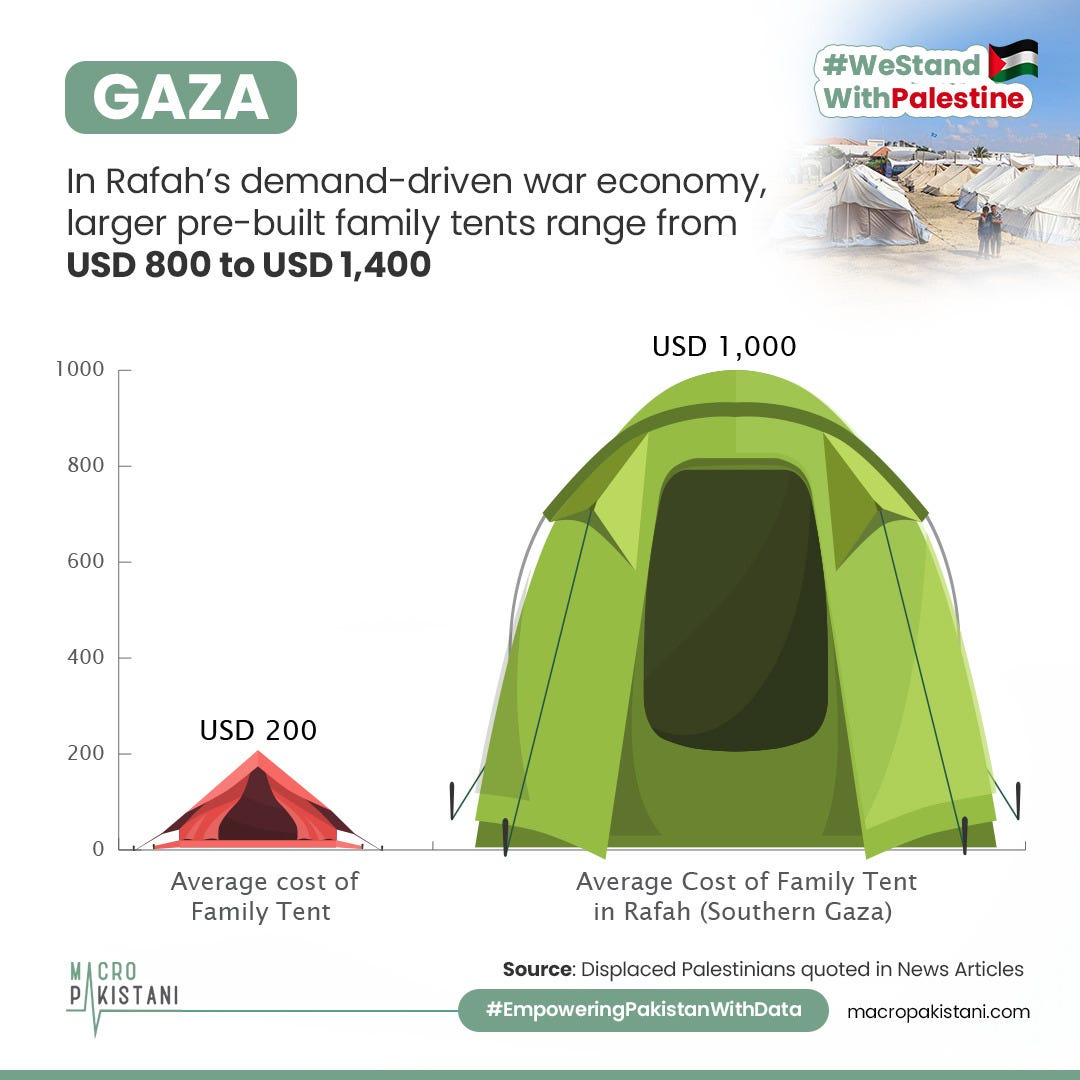

Israel’s maintains the onslaught as its genocidal campaign in Gaza enters Week No. 13. The cost of essential goods has skyrocketed, causing severe hardships for the innocent Palestinians. The region is grappling with critical shortages of food/water, medicine, tents and relying heavily on humanitarian aid or shipments entering through two key crossings – one from Egypt and the other from Israel.

Alarming reports from the United Nations reveal that over half a million people in Gaza are currently experiencing starvation as of late December, 2023.

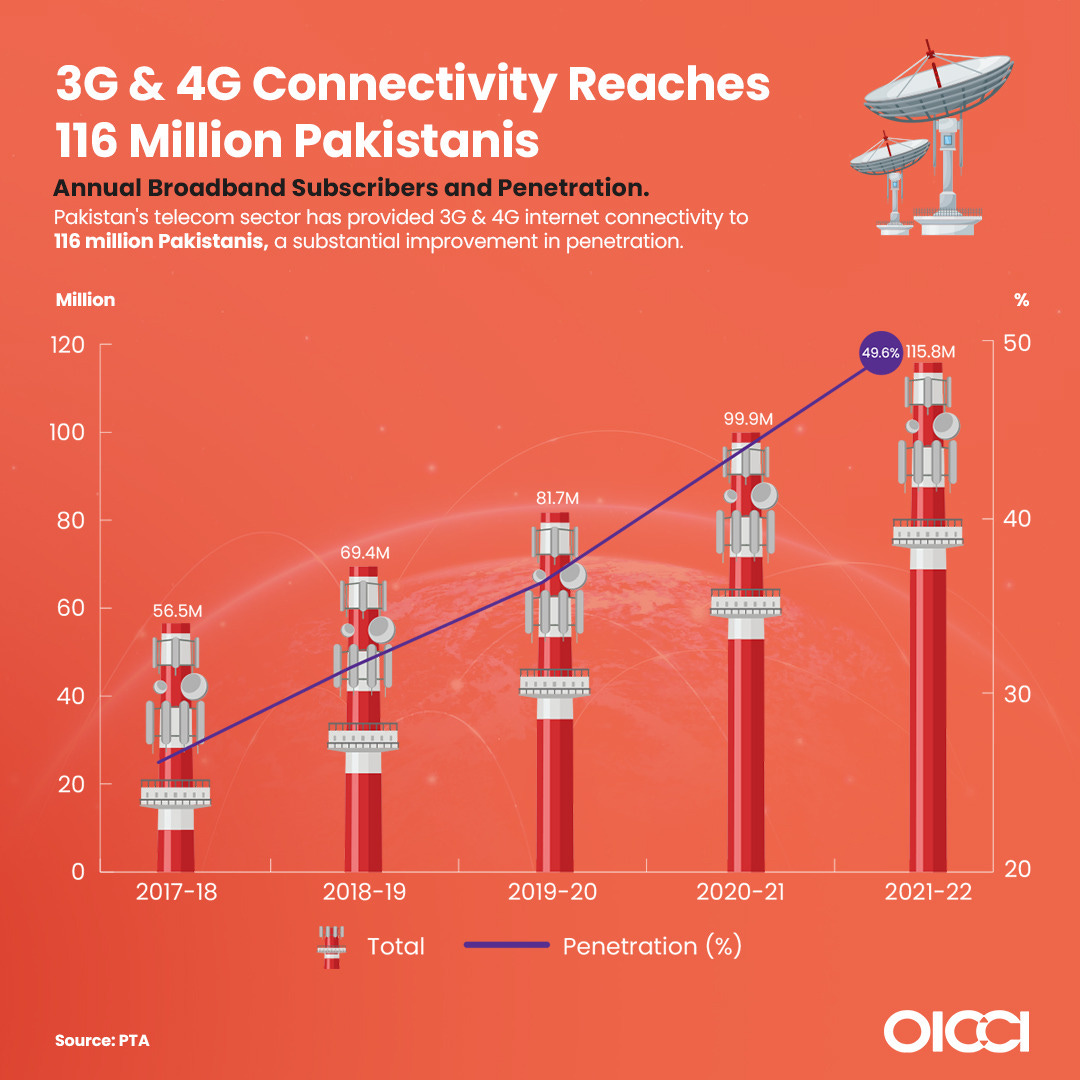

Despite the remarkable achievement of providing 3G and 4G internet connectivity to 116 million Pakistanis, the telecom sector faces substantial challenges. While contributing an impressive Rs. 1.2 trillion to the national exchequer since 2017, the sector faces low revenues and investment. This becomes evident when comparing Pakistan's revenue per user, a meager $0.80, with the figures in India and Bangladesh, where revenues stand at $1.7 and $1.6, respectively.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.