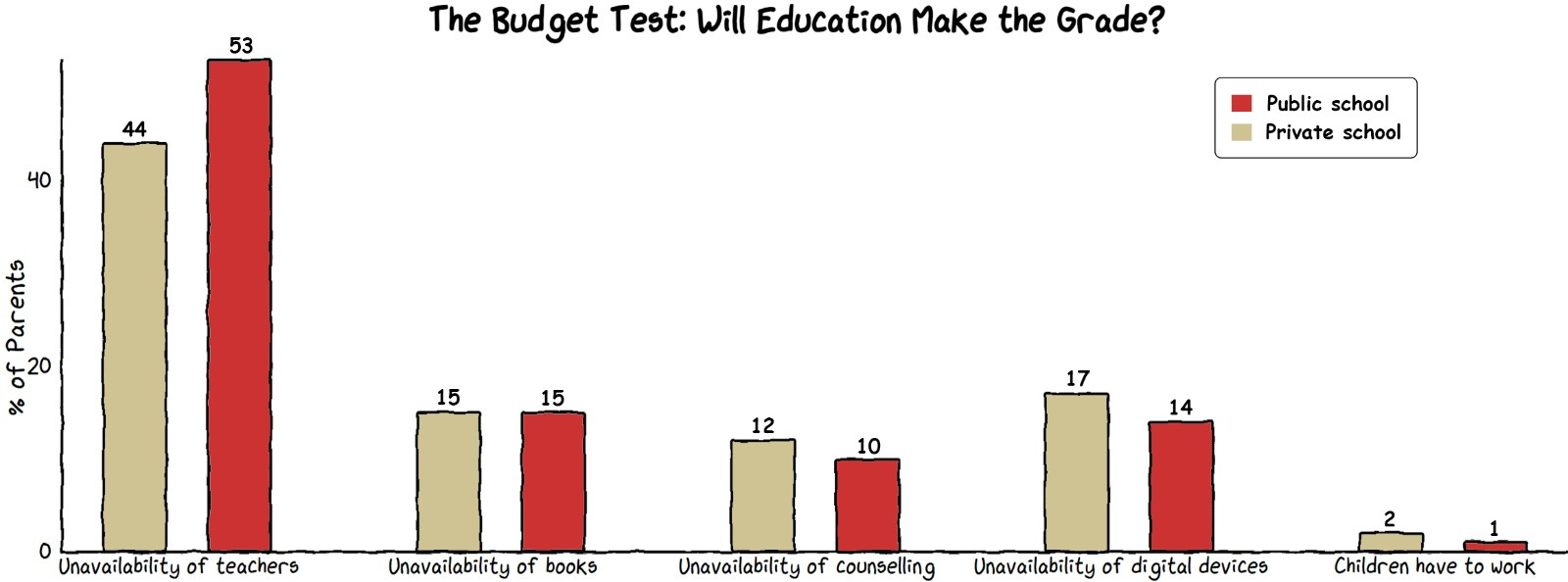

The Budget Test: Will Education Make the Grade?

Pakistan needs to allocate at least 5.4% of its GDP to address the issues of out-of-school children and learning poverty.

For the FY25 budget, Pakistan’s federal government has finalized a Public Sector Development Program totalling PKR 1.221 trillion. This budget is at least 30% higher than last year’s, with the majority of the spending once again directed towards power, infrastructure, science and technology, and sustainable development goals. On the other hand, social sector funding has been reduced by 59% in an effort to devolve the responsibility to the provinces. As a result, health and education-related spending will be a part of the provinces’ PSDP budgets. This year's annual plan features a PKR 700 billion Annual Development Plan (ADP) for Punjab and a substantial PKR 763 billion for Sindh, a particularly notable increase when considering the overall revenue proceeds of these two provinces. At the same time, Khyber Pakhtunkhwa is expected to receive around PKR 627 billion.

Without a central authority to provide direction or enforce accountability, will the provinces make additional invetments in social sectors?

So far, only the KP government has presented its budget which includes a mere 13% increase in the health and education expenditure. Time and again, research in Pakistan has proven the benefits of increasing spending on education. However, primary education expenditure per child in Pakistan is USD 287 (PPP), which is 68.8% below the average for the South Asia region and 64.5% below the average for lower middle income countries. This leads to poor infratructure, unskilled teachers, and high household expenditure on textbooks and extra tuitions. Resultantly only one out of four Pakistani students met the minimum international proficiency standard for mathematics and science in TIMMS 2019. Increasing expenditure from 2% of GDP to at least 5.4% of GDP, is one of the most crucial steps to eradicating learning poverty in Pakistan.

Through devolution, ideally the spending on education can be specified according to each school’s needs. Improved spending not only improves educational outcomes for the public schools, but also for private schools in the vicinity through ‘education multiplier effect’. However, Pakistan is yet to see any positive outcomes of the 18th ammendment on education. The country needs a concerted effort to improve the quality and accessibility of education for its young and blooming population.

GRAPHIC

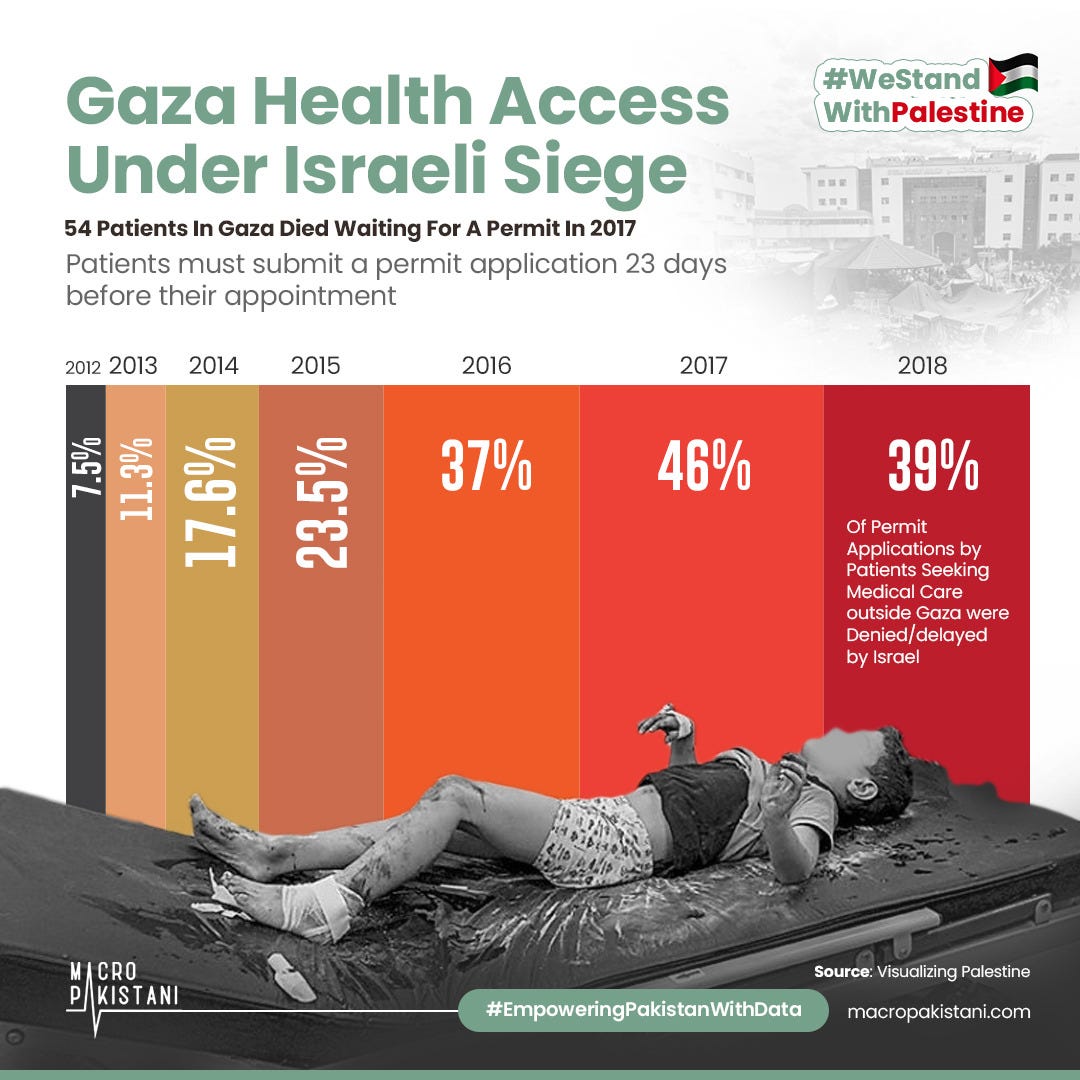

The Right to Health for Palestinians Under Blockade in Gaza

The right to the highest attainable standard of physical and mental health is protected under international human rights law and international humanitarian law. As the occupying power, Israel is obligated under international law to guarantee the right to health for Palestinians. However, according to data from the World Health Organization (WHO), Israel has consistently denied this right to millions of Palestinians living under blockade in Gaza.

Key Data Points from WHO:

1- Access to Medical Care:

Over 40% of medical permit applications for patients needing treatment outside Gaza were either delayed or denied by Israeli authorities even before the current genocide while over 89.5% of the critically injured Palestinians during the current genocide are still waiting for their permits

The average waiting time for those who eventually received permits was over two weeks even before the current genocide and is now around 4 weeks, causing critical delays in accessing necessary treatments.

2- Health Infrastructure:

50% of essential drugs and 35% of medical disposables were reported to be at zero stock levels in Gaza.

Damage to healthcare facilities from repeated conflicts has left many hospitals and clinics operating below capacity.

In case anyone wants to contribute (to the Palestine solidarity campaign on Macro Pakistani) and send data-backed content, please feel free to send an email to fakiha.rizvi@brandnib.com

Team Brand Nib (@brandnib)

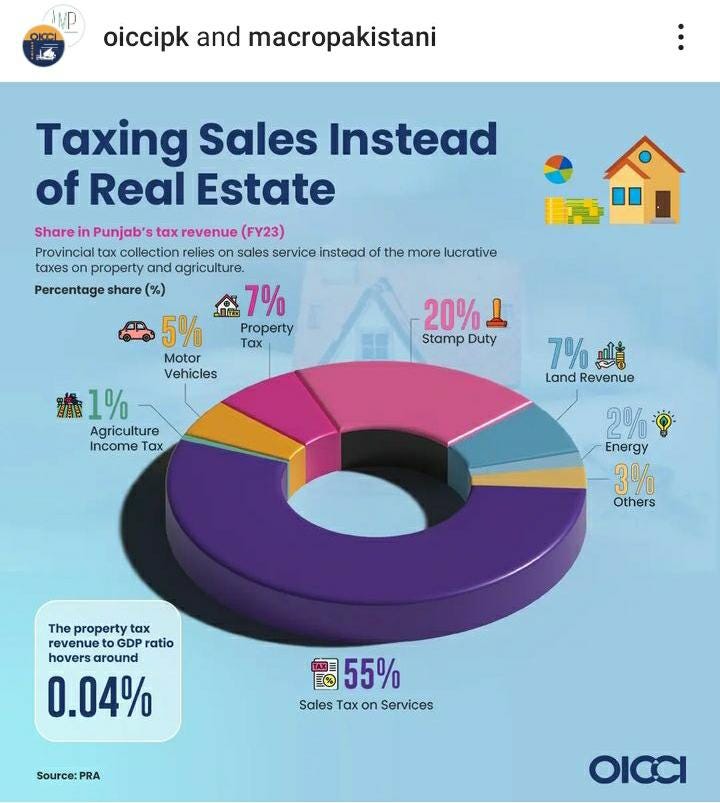

The collection of property taxes, a provincial matter, is in dire need of reform as it currently relies on archaic methodology and poor tax administration. The World Bank’s analysis shows that low-income countries collect property taxes equivalent to 0.30% of GDP, highlighting the potential for improvement.

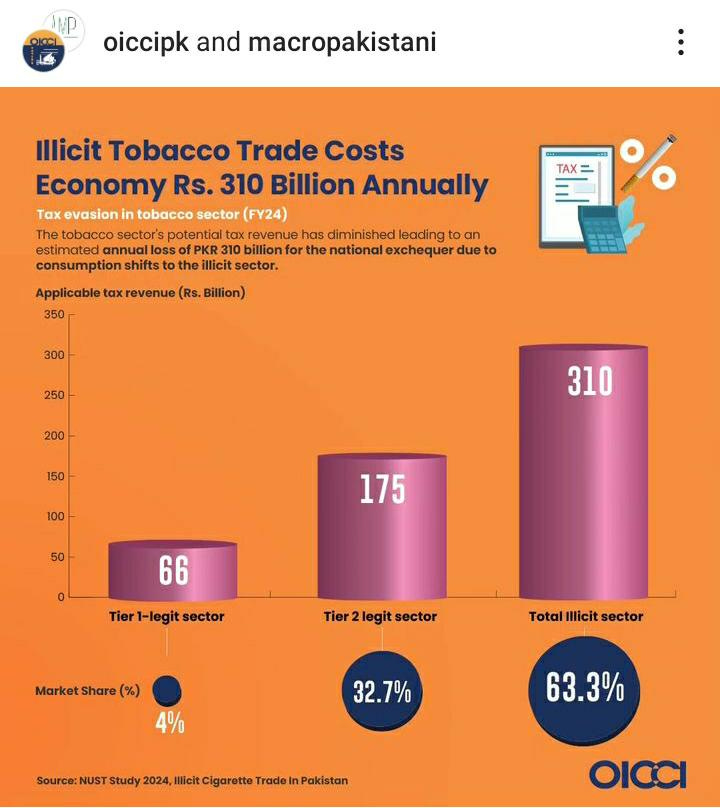

Pakistan 🇵🇰 has lost PKR 567 billion in tobacco taxes over the past decade due to a multi-tier excise structure and pitfalls in the tax structure. Not only has this affected Pakistan’s ability to prevent deficits, but the tax system has also failed to curb smoking trends.

Through proper tagging, the country can collect additional revenue and deter underage smoking.

In addition to tax structure issues, illicit trade is a significant problem, comprising 63% of Pakistan's cigarette market, causing annual losses in tax amounting to Rs. 310 billion. This trade is dominated by untaxed local packs, smuggled cigarettes, and counterfeit tax stamps.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.