The Great Payment Shift

With only 1% of personal expenditure via cards and fewer than 1,000 payment locations per million people, Pakistan's digital transactions remain low. Could Google Wallet's launch help?

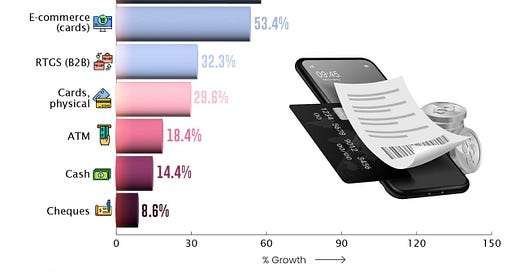

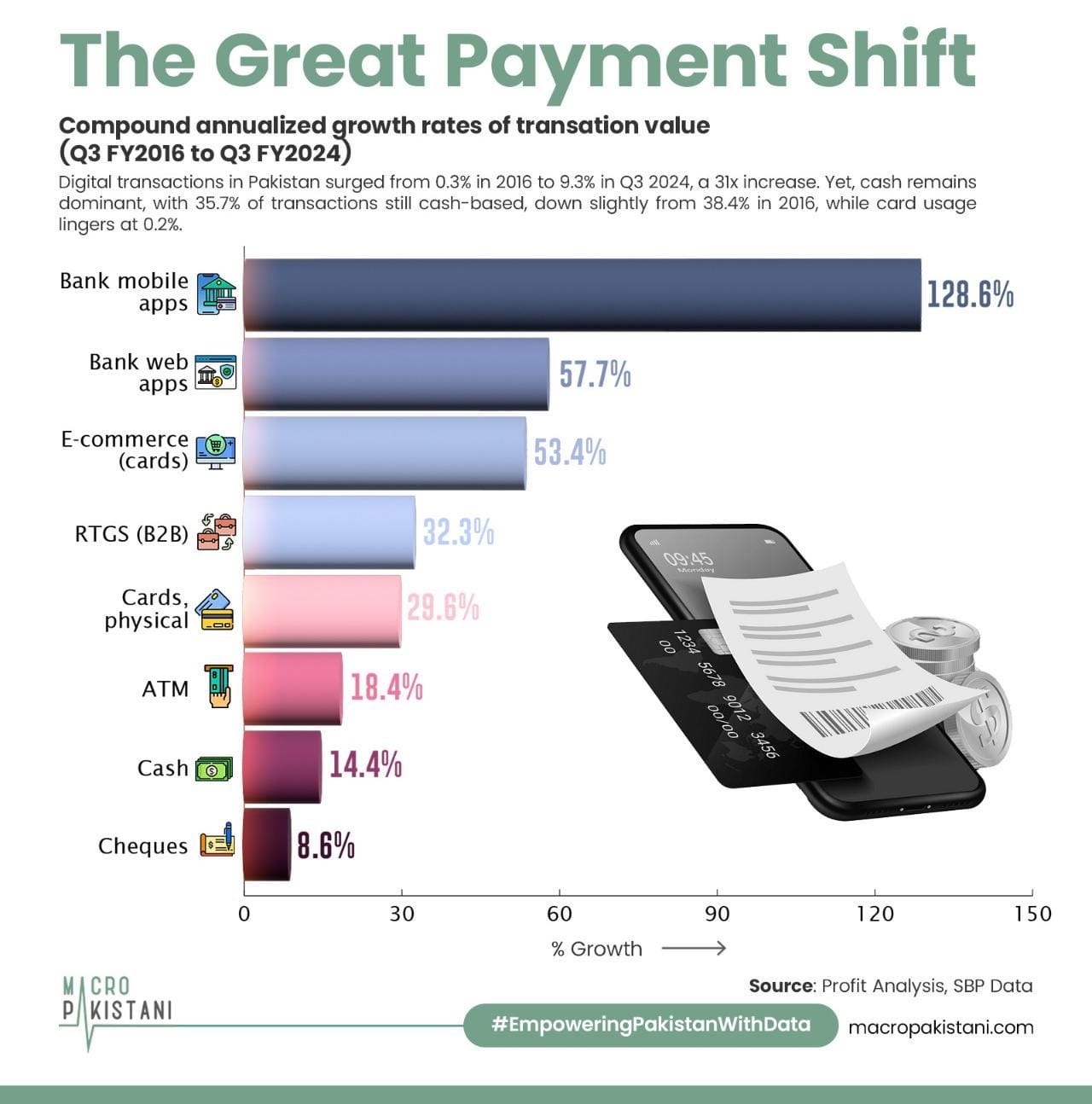

Great efforts are being made in Pakistan's banking industry, with the launch of its first digital bank and record profits in the preceding year. At the same time, the introduction of Google Wallet opens new doors for Pakistan’s digital financial system and innovation. The rise of electronic payments in Pakistan is evident, with digital transactions increasing from 0.3% of total transaction value in 2016 to 9.3% in the third quarter of 2024, a nearly 31x growth, according to the State Bank of Pakistan. However, despite this surge, the expected decline in cash usage has not materialized to the same extent. According to Profit, purely cash-based transactions accounted for 35.7% of total transaction value in Q3 2024, only slightly down from 38.4% in 2016 while physical cards lingered at 0.2% only.

Can Pakistan mimic the fast adoption of digital payment systems as demonstrated by China and India?

India's rapid adoption of digital financial systems is evident in the rise of digital transactions from INR 2,071 crore in 2018 to INR 13,462 crore in 2023, with the total transaction value reaching US$ 40.1 trillion.

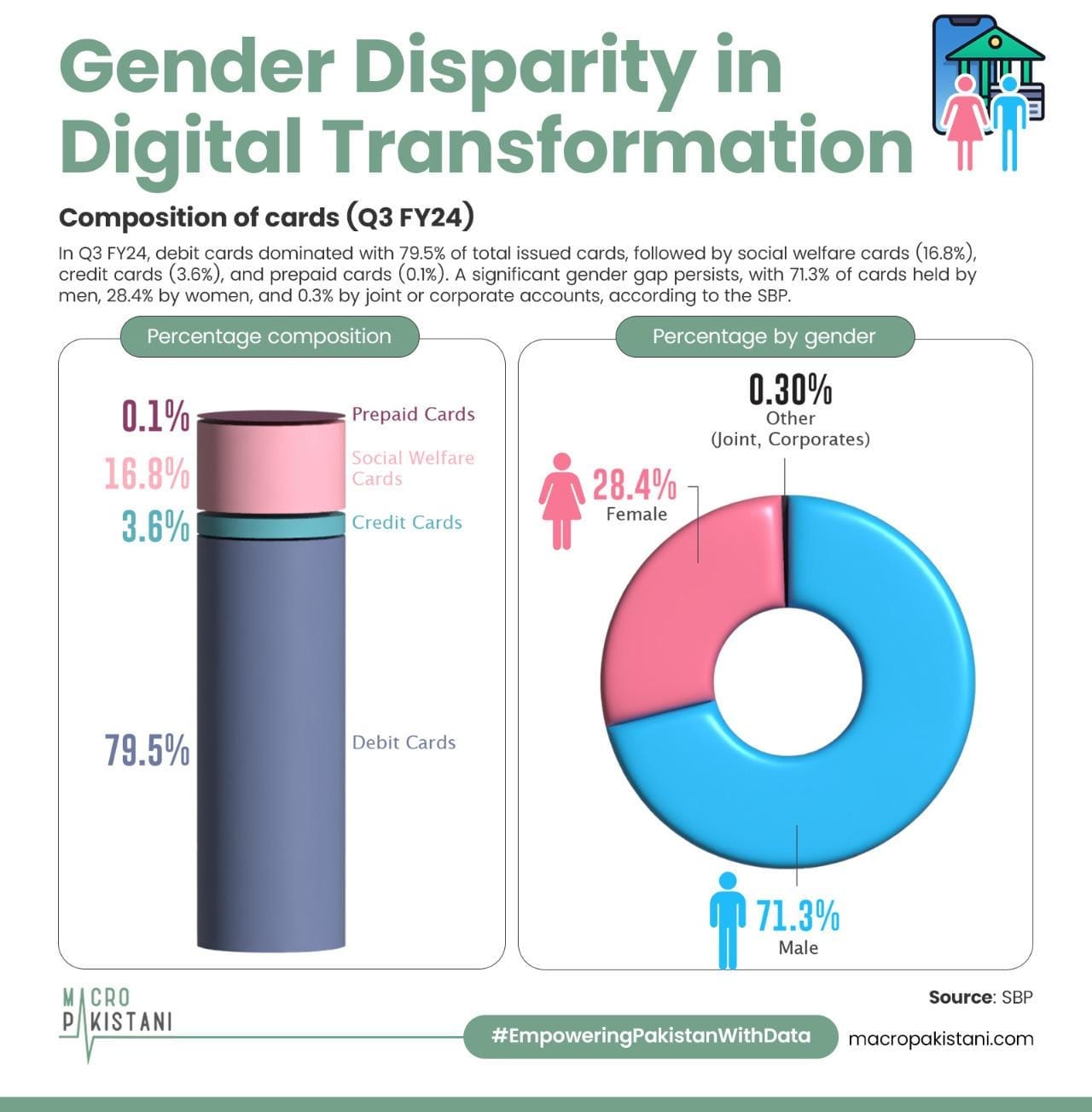

Mobile wallet payments alone surged at a CAGR of 72.1%, reaching US$ 2.5 trillion in 2023, and are expected to grow further to over USD 6.3 trillion by 2028. China has achieved similar success, although it is unparalleled by any other country. However, major obstacles prevent Pakistan from joining its Asian neighbours. For one, Pakistan’s population is yet to shift to using smartphones, despite having 195 million mobile cellular subscribers. Secondly, the country only had 57 million payment cards issued by banks, MFBs, EMIs, and BB players. Debit cards made up 79.5%, credit cards 3.6%, social welfare cards 16.8%, and prepaid cards less than 0.1%. Further analysis has shown that 80% of usage is made through ATMs and not point-of-sale machines.

The launch of Uraan Pakistan and the new Digital Nation Pakistan Bill, 2025 marks a pivotal step toward accelerating digital transactions. Uraan Pakistan aims to enhance financial inclusion by expanding infrastructure, while the Digital Nation Pakistan Bill provides a regulatory framework to foster innovation and security in fintech. With digital transactions already rising from 0.3% in 2016 to 9.3% in Q3 2024, these initiatives could further drive cashless payments. By enabling broader smartphone adoption and digital wallets, Pakistan has the potential to follow India’s trajectory and significantly reduce cash-based transactions in the coming years.

GRAPHICS

Pakistan's low export values stem from limited R&D, reliance on conventional products, and incentives favouring incumbents over innovators. Poor product quality further reduces value addition.

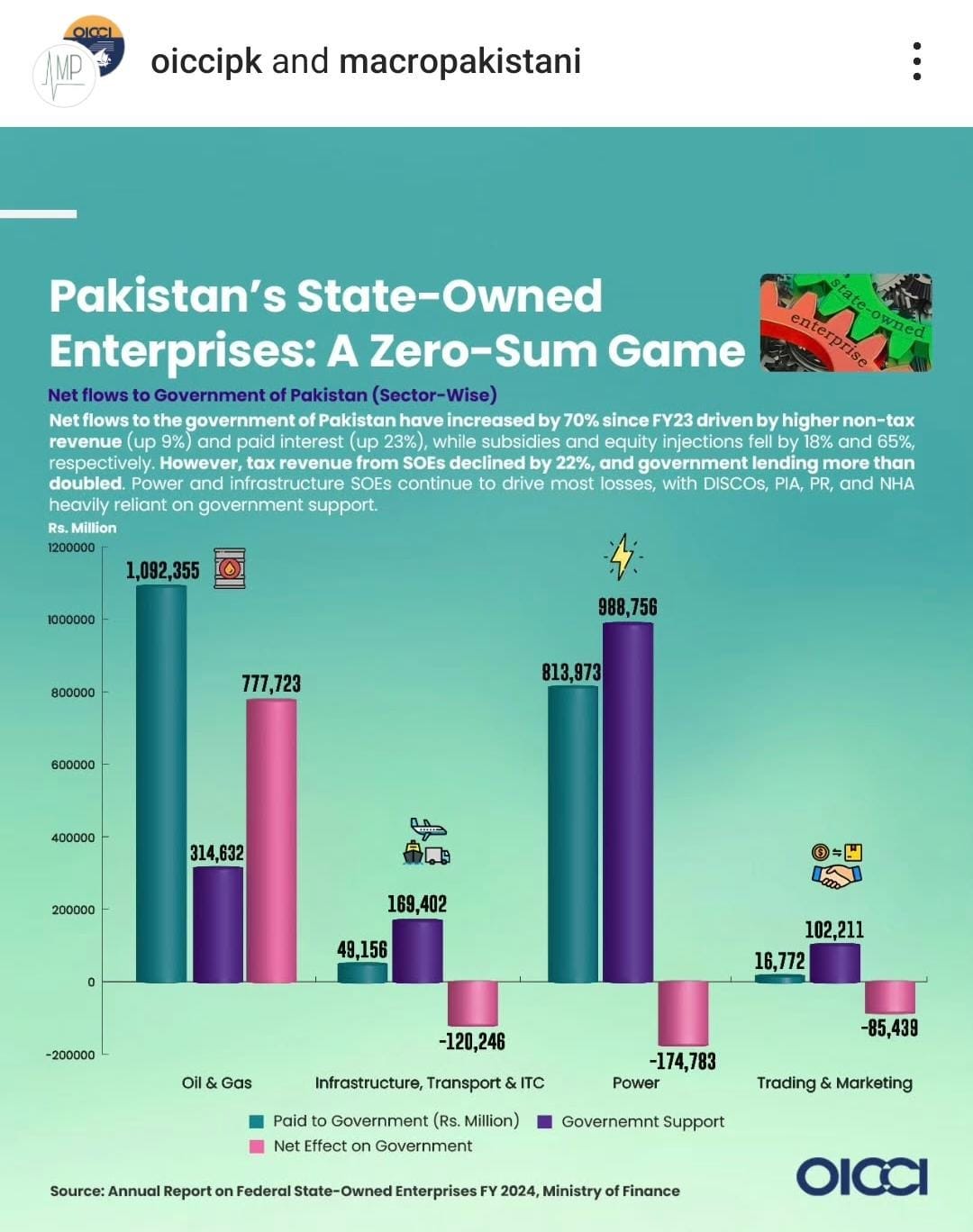

Despite Rs. 1.58 trillion in government support, Pakistan’s SOEs still posted a Rs. 30.6 billion loss, with power (Rs. 223.8 billion loss) and infrastructure (Rs. 361.9 billion loss) among the worst performers. While many countries have reformed SOEs for efficiency, Pakistan continues to prop up failing enterprises.

Pakistan’s state-owned enterprises (SOEs) continue to be a financial black hole, with the government’s net inflows rising by 70% since FY23, thanks to higher non-tax revenue and increased interest payments. Meanwhile, subsidies and equity injections have been slashed, yet tax revenue from SOEs has taken a hit, dropping by 22%, while government lending has more than doubled.

Macro Pakistanis who read this newsletter can directly give us feedback via Substack chat:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.