Time to Reimagine Agriculture Subsidies

Despite the allocation of PKR 30 billion for fertilizer subsidies in the current year's budget, farmers continue to struggle with inflated prices in black markets.

The fertilizer industry in Pakistan is poised for remarkable profitability, as profits are expected to reach PKR 25 billion for the fourth quarter of FY2023. This substantial growth trajectory is part of a broader trend, with after-tax earnings for the entire year 2023 set to rise by 63% compared to the previous year, reaching PKR 63 billion. Key drivers of this surge include increased prices and a notable uptick in Diammonium Phosphate (DAP) sales. However, the sector still enjoys billions in the form of gas subsidies, the benefits of which are concentrated among the informal sector. Despite the discussion of canceling these subsidies, the matter is complicated as the issue directly affects farmers' costs, potentially leading to food price hikes, inflation, and general social unrest. Additionally, it could worsen trade and fiscal deficits and disrupt supply chains.

How will Pakistan balance the trade-off between supporting farmers' welfare and addressing subsidy mismanagement, which contributes to increased profits?

Since the 1970s there has been a special focus on urea production in Pakistan due to ample gas resources. This has resulted in increased availability of nitrogen nutrients from local sources, consequently reducing reliance on imported nitrogen fertilizers whilst meeting demand. Indirect subsidies on feedstock gas provided to the urea industry have resulted in low urea prices when compared with the international market. This has resulted in savings in foreign exchange reserves and enhanced capacity to meet increasing demands for nitrogen fertilizer over time. Nonetheless, the country still relies on imports for certain fertilizer products such as diammonium phosphate and even urea this year. At the beginning of 2024, approximately 220,000 tonnes were imported as buffer stock with the provincial governments expected to bear the financial burden for the import.

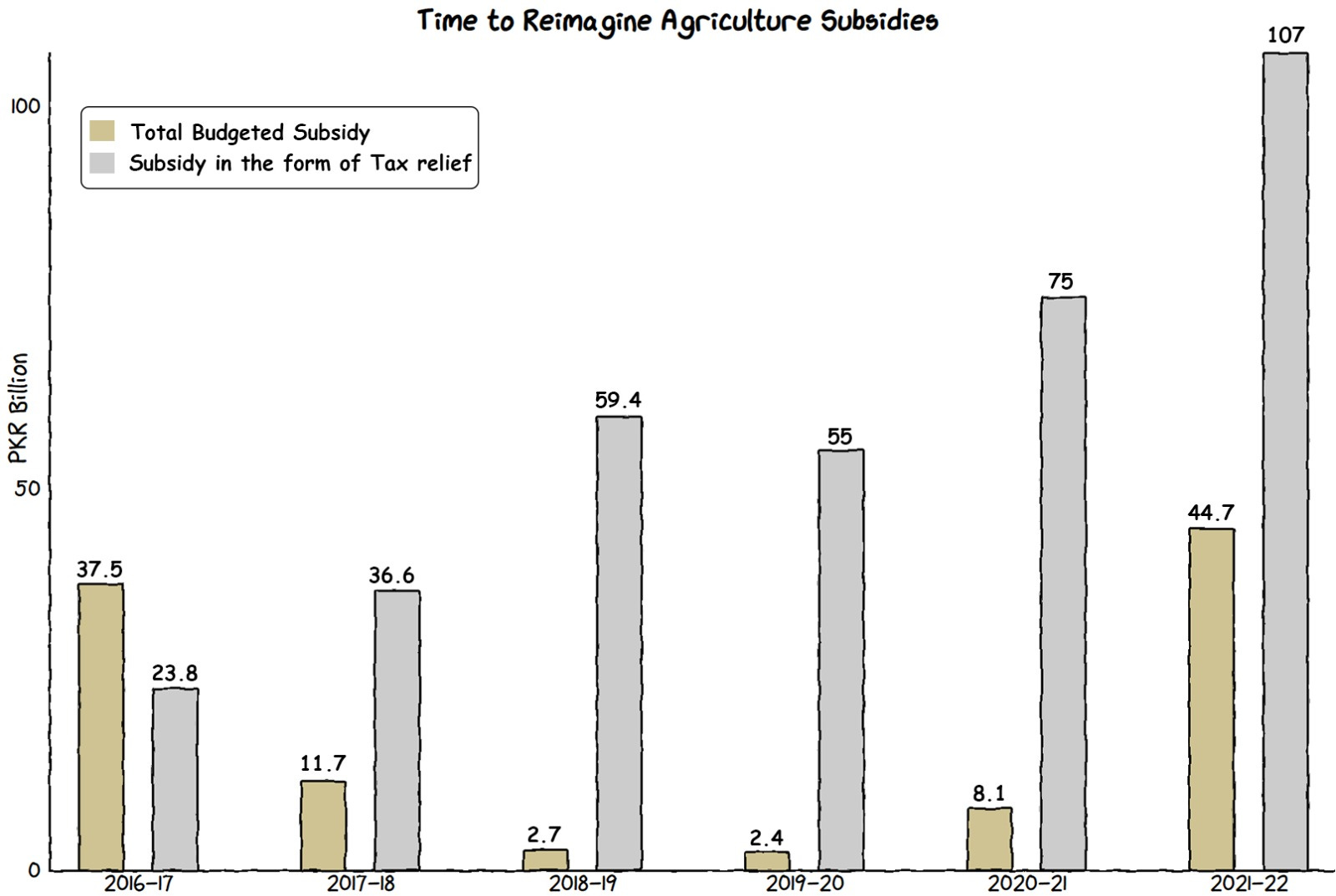

Pakistan has spent generously to support the fertilizer industry while forgoing tax revenue. However, the approach has not reached the farmers as many of these subsidies have turned into profits over the course of the past few years. The recent change in the gas tariff policy is expected to boost government revenues while eliminating subsidies across the industry entirely could potentially increase revenues by PKR 150 billion. These additional funds could then be redirected towards areas such as research and development, farm mechanization, and improving seed quality.

Gone are the days when the government provided stimulus to bolster a firmly established industry. Instead, the current priority lies in offering direct support to grassroots farmers who are the backbone of the country.

GRAPHIC

A United Nations expert told the global body's Human Rights Council on Tuesday that she believed that Israel's military campaign in Gaza since Oct 7 amounted to genocide and called on countries to immediately impose sanctions and an arms embargo. Israel, which did not attend the session, rejected her findings.

"It is my solemn duty to report on the worst of what humanity is capable of and to present my findings," Francesca Albanese, the U.N. Special Rapporteur on human rights in the Occupied Territories, told the U.N. rights body in Geneva, presenting a report called "The Anatomy of a Genocide".

Pakistan faces a unique fiscal challenge with its interest expenses surpassing those of most nations. This is especially concerning due to a lack of planning on the government's part.

Notably, in FY2024, more than half of Pakistan's total current expenditure is allocated to interest payments, a concerning figure despite substantial investment in development.

Approximately $45 billion flowed into South Asia as climate finance, with a significant portion coming from private investment. With rising requirements for climate-oriented investment, Pakistan needs to play its part to attract investment specifically for climate change.

For climate-related startups, funds remained evenly distributed among energy storage, mobility, and renewables despite a slight decline in capital investments in 2023. However, Pakistan experienced a substantial 77.2% decrease in total startup funding, with only $75 million across 37 deals, primarily concentrated in e-commerce.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Grateful for the ever-growing list of collaborators!

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.