To Save or Not to Save?

The government of Pakistan plans to borrow PKR 11 trillion in 3 months from the domestic market.

In July this year, most Pakistani banks offered a rate of return of 19% on a savings account. Even better, the rate rose up to 20.5% in August 2023. On the other hand, mutual funds have been able to keep up an average of 19% of returns to their customers. This peculiar behavior in the banking sector can be attributed to a high policy rate determined by the SBP. Pakistan has a limited financial sector, with a low savings rate, and even more dismal private credit numbers. An interesting dilemma arises, how are banks providing a rate of return of 20% with no one to borrow at an interest rate of 23%+?

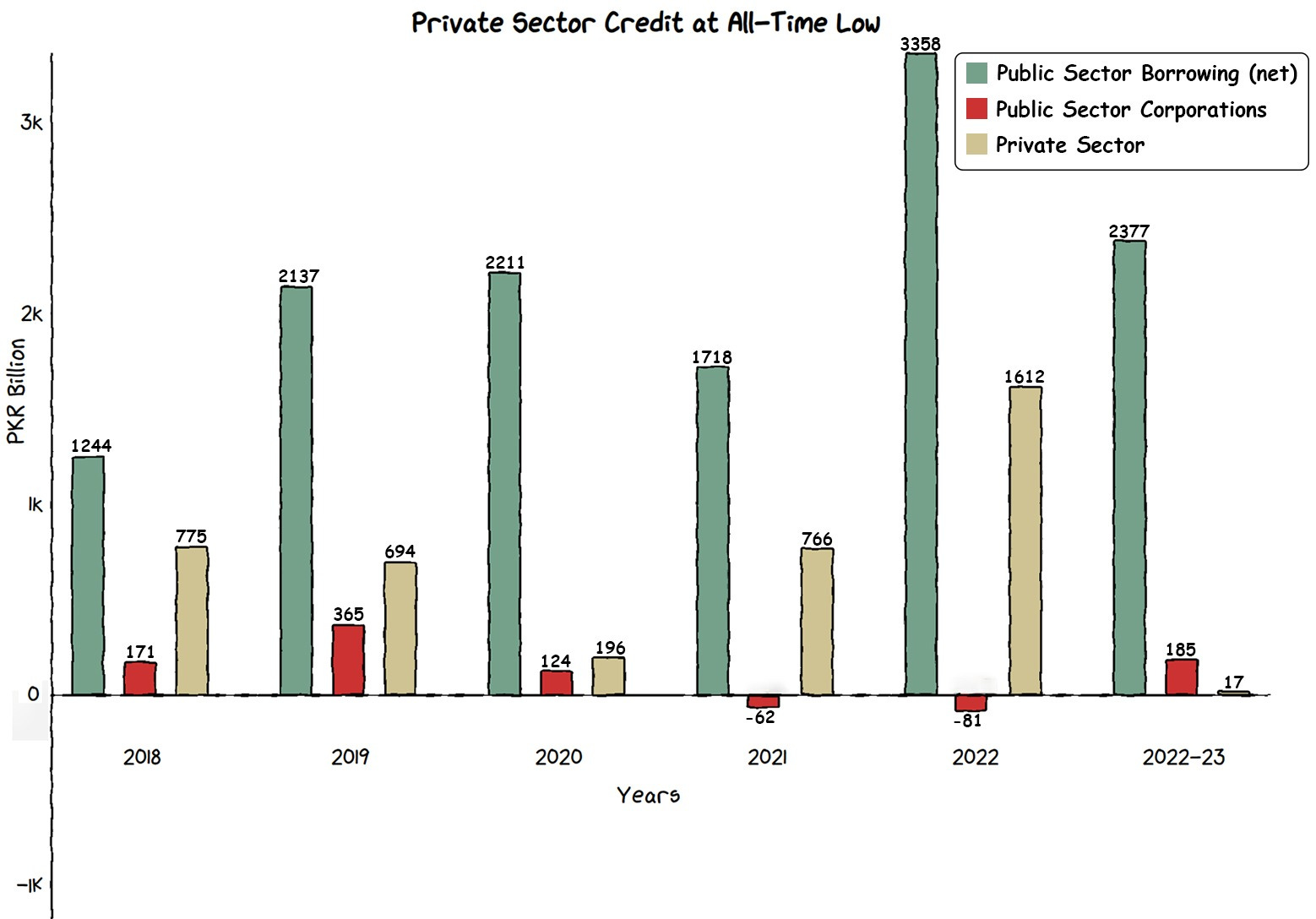

Ideally, in an efficient economy, banks enjoy the spread between the two numbers i.e., interest paid to savers, and interest earned through investors. The spread increased from 5.5% in March 2022, to 10% in March 2023. In an economy facing challenges, obtaining loans at elevated rates becomes a nearly impossible task. Hence, Pakistan has witnessed a decline in private-sector credit, contrasting with the upward trajectory of government borrowing from the public.

This trend, commonly referred to as the crowding-out effect, has far-reaching implications for the economy. According to some researchers, an increase in government borrowing by one percentage point results in a decrease of 8 basis points (equivalent to 0.08%) in private sector credit. Intuitively, this implies that lesser money is being directed towards "investment," while a larger portion of funds is being allocated to cover the fiscal deficit (in traditional economics, investment refers to “capital growth”). This trend indicates a shift in financial priorities and inefficient allocation of money.

Although encouraging savings holds significant importance for the economic progress of developing nations, it is crucial to consider whether capital growth is being realized. Failing to do so could result in banks benefiting while the common man’s plight stays the same.

Read more on government borrowing gimmicks here.

GRAPHIC

From an initial GDP growth rate of 7% to a modest 2% as Pakistan approaches its 76th year, the question arises: Who has been steering the course?

”As Pakistan heads into its 76th year of existence, it is accompanied by a reflection on regrets and heartaches, yet underscored by an undeniable optimism for the path ahead. May we live to see the Pakistan of our dreams, says Sharmeen Sajjad, Head of Content Research at Macro Pakistani.

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.