On the Verge of Default…Again?

The hubbub of default rises again, as the Government tries to save face with Budget FY 2023-24.

Is the government’s current approach enough in spite of global pressures on low-income countries?

Pakistan finds itself at a critical juncture as it grapples with significant fiscal challenges, heightening concerns about the looming threat of default. However, the country’s finance minister seems to be occupied with “marketing gimmicks” when it comes to amplifying positive numbers. The IMF-Pakistan talks hit a roadblock in November last year for various reasons. Consequently, the government has taken measures to appease the IMF through interest rate hikes, ensuring help from friendly countries, etc. But is the government’s current approach enough in spite of global pressures on low-income countries?

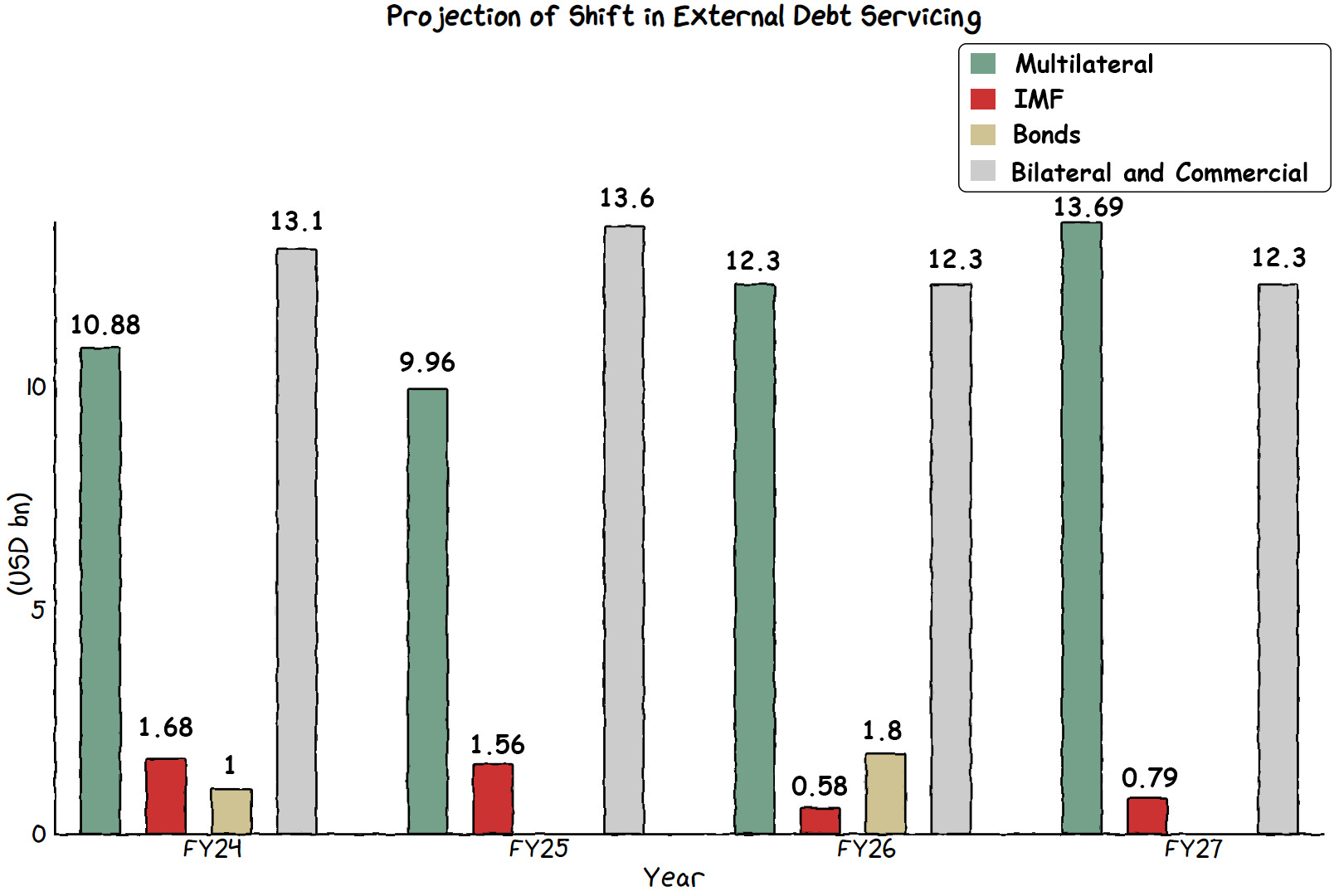

It seems as if Pakistan grossly misunderstands the weight of the situation, and overestimates its current ability to bear that weight. According to Arif Habib Limited’s report, Pakistan will face a shortfall of around USD 5 Billion even after China, KSA, and UAE rollovers.

To prevent this from happening, Pakistan is expected to increase the interest rate soon, which will not only exacerbate the effects mentioned in our previous Macro Bites but also aggravate the debt crisis.

In addition to Pakistan's internal pain points regarding default, it's important to consider global debt vulnerabilities. Factors such as rising exchange rates and subsequent devaluation, as well as slower restructuring programs in case of default, contribute to these external risks. Therefore, looking outwards for debt relief is quite sensible in addition to fixing internal problems.

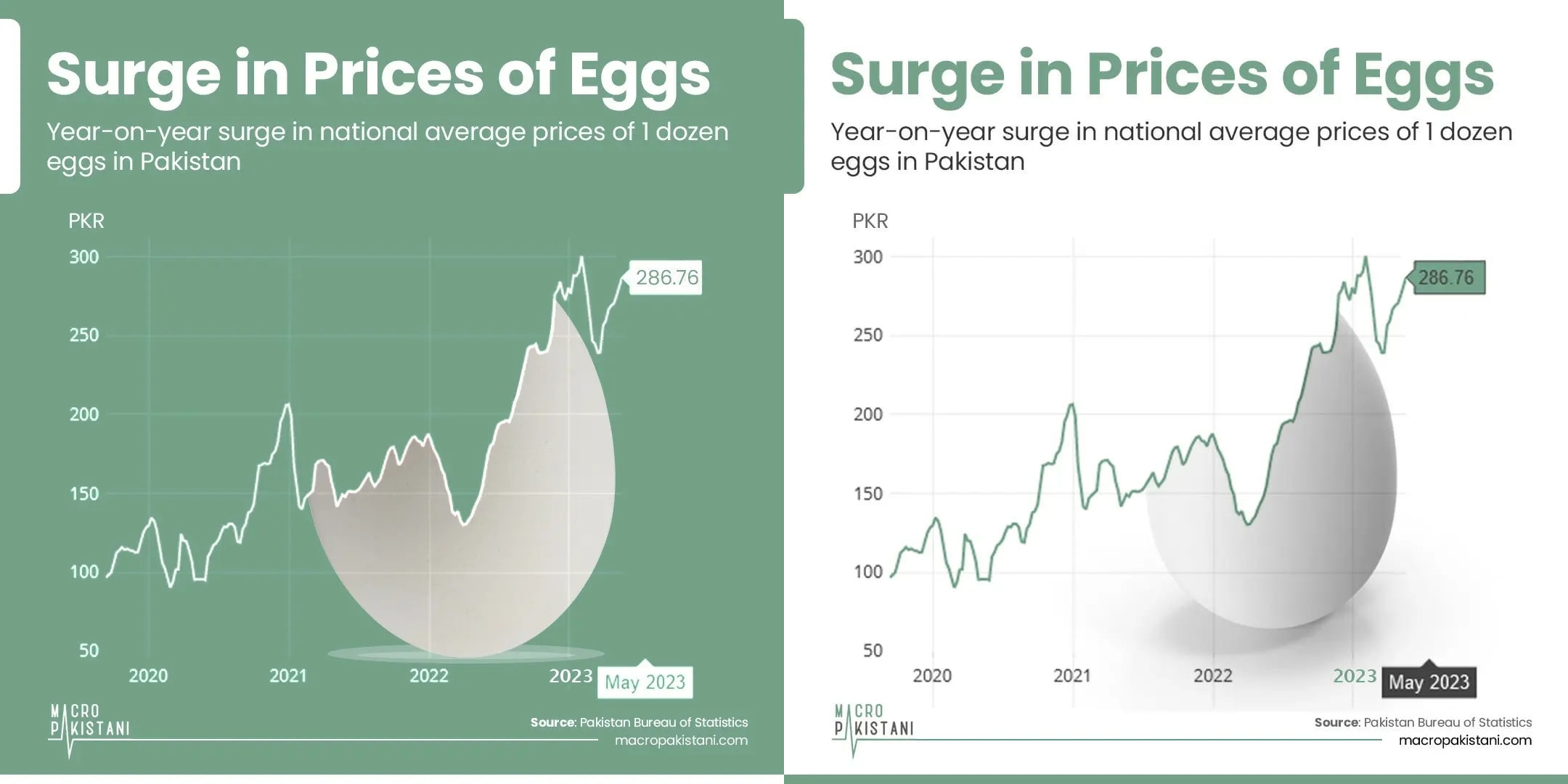

The Budget includes actions such as expanding the tax base and providing incentives to poultry farms to address the fiscal deficit and manage inflation. However, merely manipulating numbers without concrete action plans and effective economic policies will not prevent the risk of default. Expecting to avoid default by continuing with the same approach is an unrealistic dream that we need to wake up from.

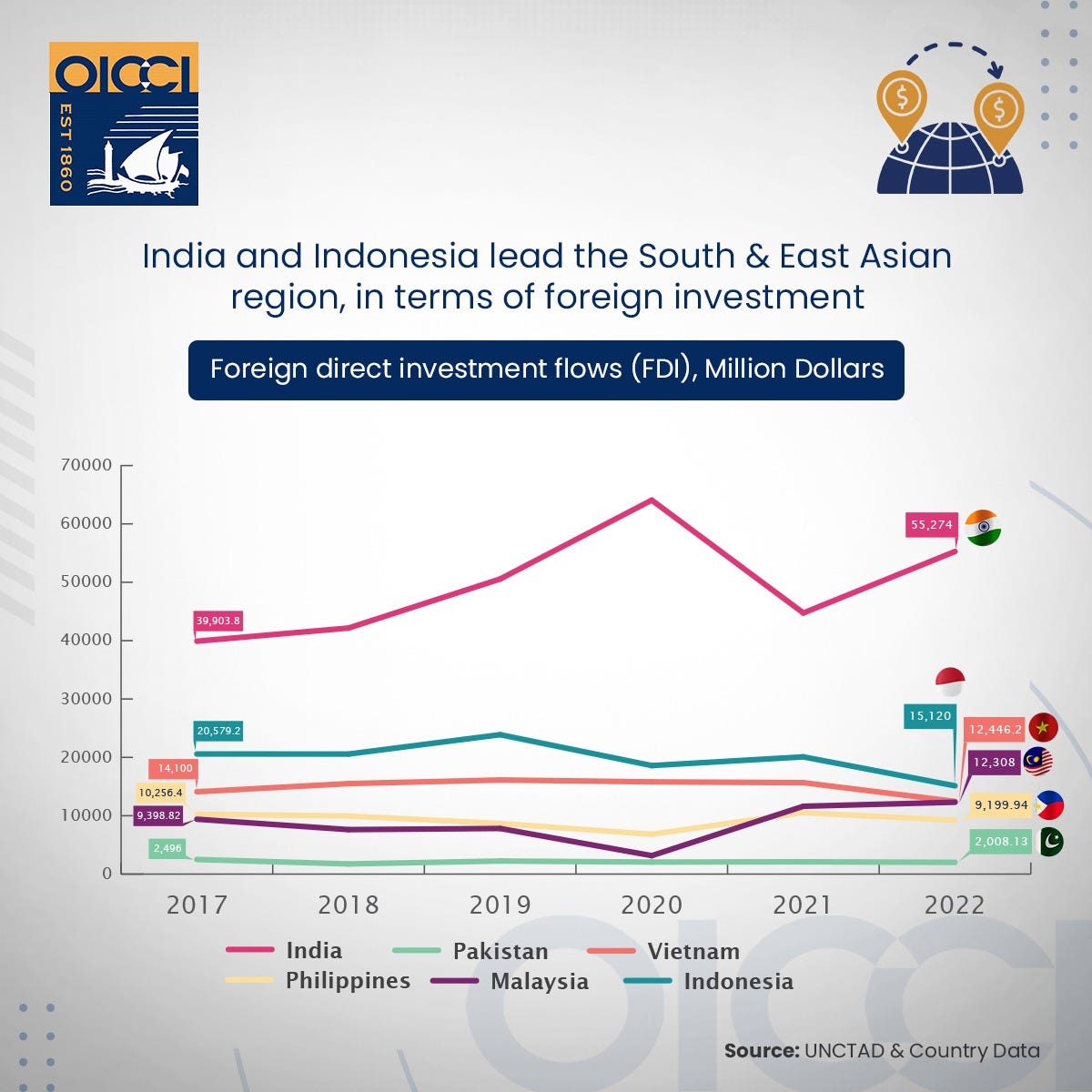

The link between local business climate and foreign investment is evident through the stories of ASEAN countries. Pakistan can build a case for itself too by focusing on elements that make the country an attractive investment destination.

Macro Pakistani is immensely grateful, pleased, and honored to be the official knowledge partner of OICCI in order to assist the oldest chamber in Asia to strengthen its social media presence!

Established in 1860 as the Karachi Chamber of Commerce, the Overseas Investors Chamber of Commerce & Industry (OICCI) serves as a platform to promote foreign investments thereby playing a major role in the growth of commerce and industry in Pakistan.

In its comprehensive function as a facilitator to foreign investors, OICCI plays a vital role on several fronts. The Chamber is frequently called upon to assist the government in policy formulation in the financial, commercial, and industrial sectors, particularly where it impacts foreign investment in Pakistan.

POPULAR GRAPHIC ON MACRO PAKISTANI INSTAGRAM HANDLE

Team @brandnib is always looking for ways to make the data look less scary!

GRAPHIC

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.