The Dilemma of Public Enterprises

Fiscal burdens and the government's social responsibility in the form of 197 State Owned Enterprises.

According to the SBP, the government earned around 0.4% of GDP on average between FY 13 and FY 16 through state-owned enterprises.

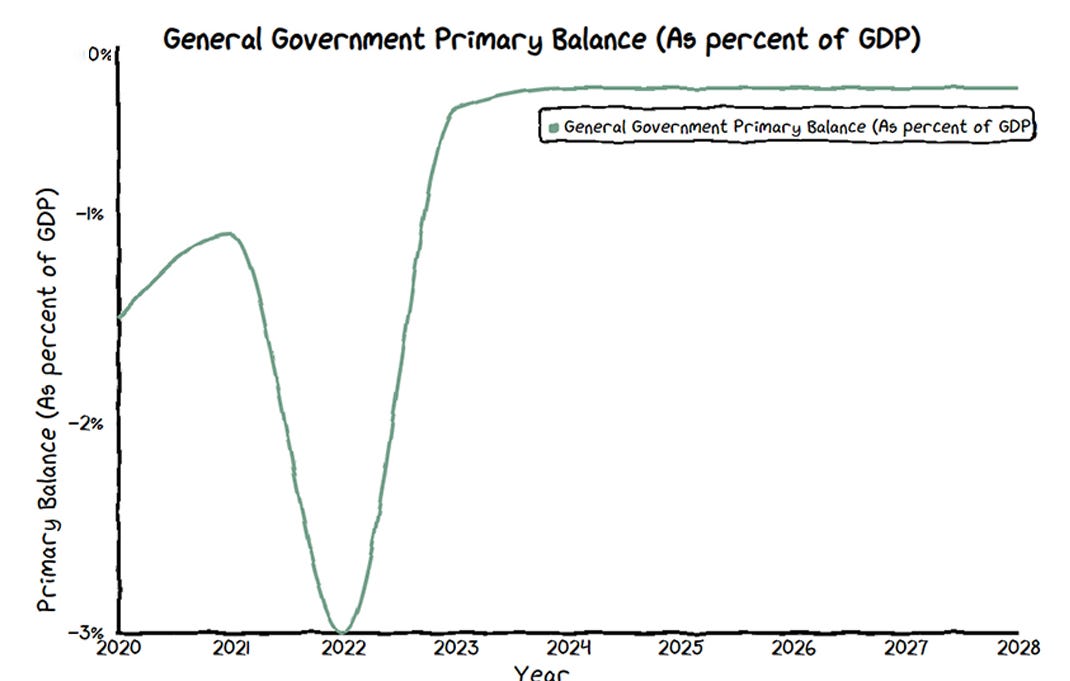

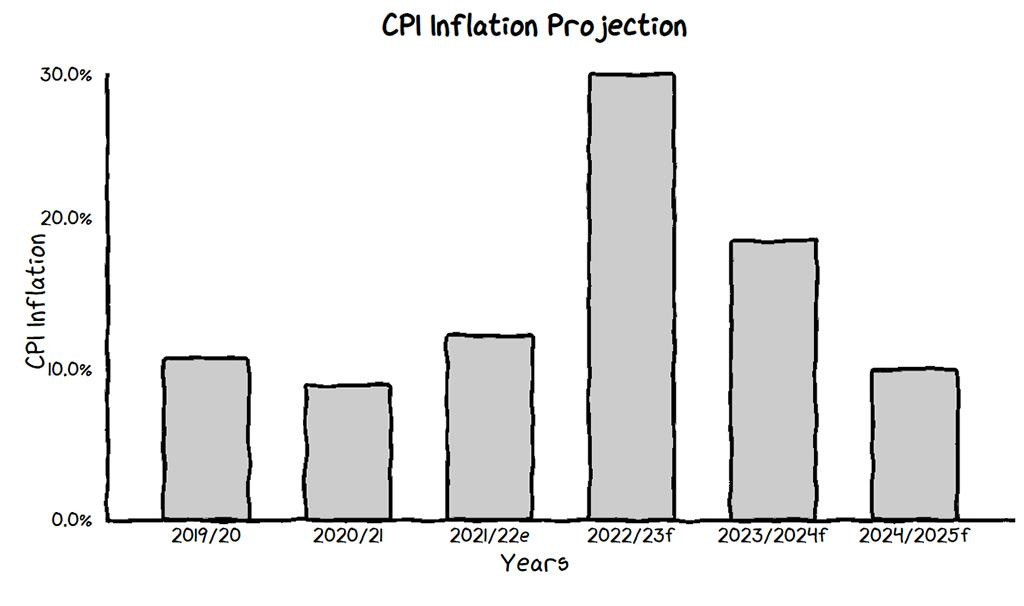

Fiscal deficits pose serious threats to emerging economies. Managing debt, productive expenditure, and arranging revenue are some of the key objectives of every IMF program availed by Pakistan. Another important aspect of IMF programs is curbing bureaucratic expenditures including wasteful spending on public enterprises. The story of which gains certain importance during the 70s, after Bhutto’s nationalization policy. The efficiency and productivity of these enterprises have been long contested by various economists, and politicians alike.

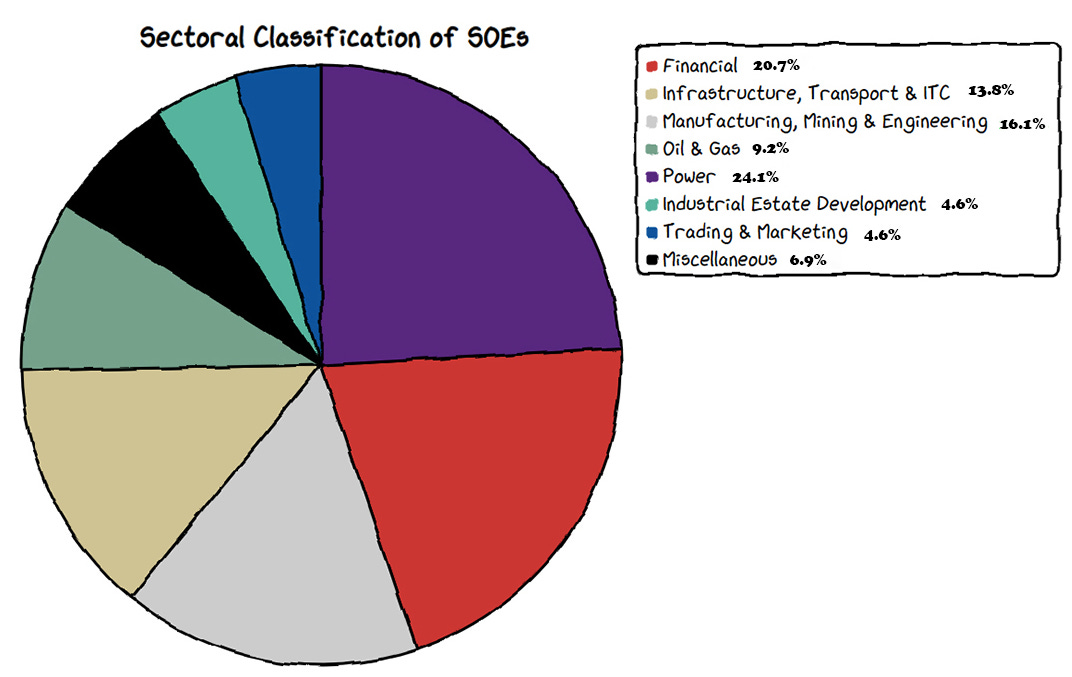

The state-owned enterprises operate in various sectors including power, manufacturing, and financial services. Deficits in these sectors are caused by their low revenues, which are dependent on markup on government loans and profits. According to SBP, the government earned around 0.4% of GDP on average between FY13 and FY16 through such state-owned enterprises. The case of profit and loss-making is pertinent since most of the losses are concentrated in specific entities. These include power companies, PIA, and Pakistan Steel Mills.

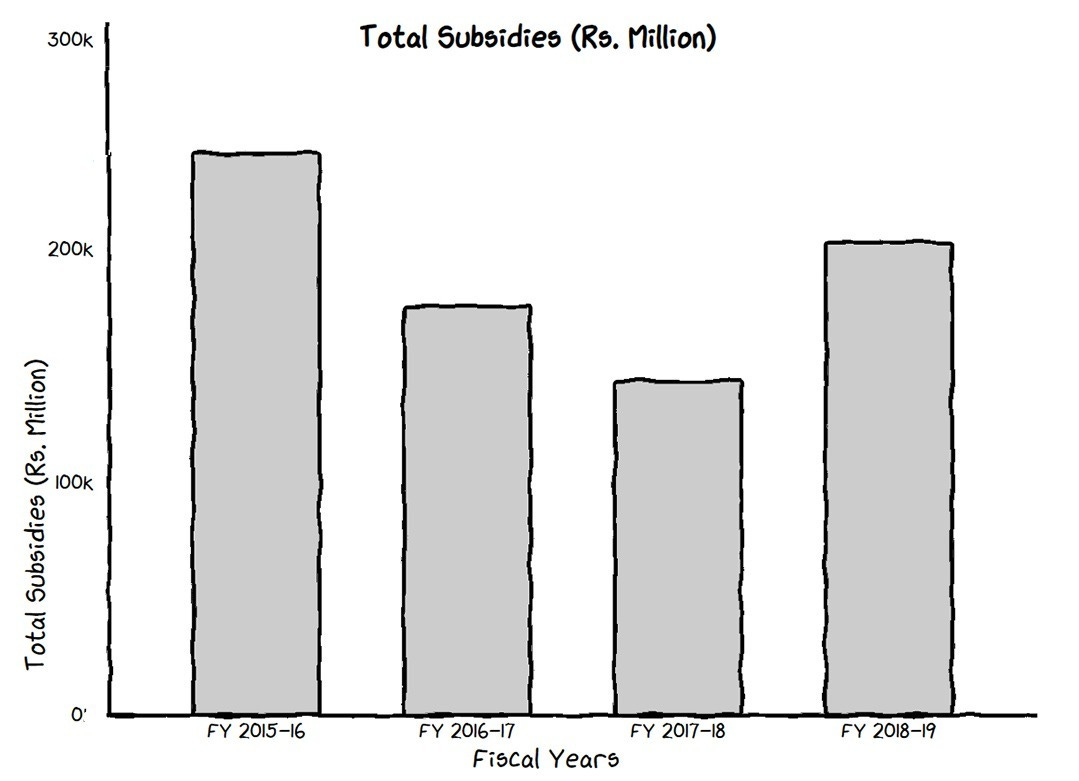

On the other hand government spending on these enterprises is around 1.5% of GDP on average between FY 13 and FY 16. The expenditure consists of loans, subsidies, and guarantees provided to state-owned enterprises. All in all, it is evident, that state-owned enterprises are a huge fiscal burden. But is that the singular reason for the 2022 Senate report on state-owned enterprises?

The research in the early 80s suggests that the efficiency of public enterprises was better than that of private enterprises. Similarly, profits were more reasonable too. Operational inefficiencies in the public enterprises post-2000s and lobbying have led to the downfall of state-owned enterprises, and not essentially their consequent fiscal burden. The overhaul of sectors covered by SOEs is the need of the hour in addition to refining business procedures.

The Overseas Investors Chamber of Commerce and Industry (OICCI) is the oldest and largest chamber in the country in terms of economic contributions. The Chamber represents over 200 foreign investors in Pakistan, including 40 Fortune 500 companies.

OICCI members have invested more than USD 21 billion since 2012, paid one-third of the total taxes collected in 2021, and contributed over PKR 11 billion in CSR activities last year. The OICCI is also the first port of call for foreign investors interested in Pakistan as an investment destination!

GRAPHICS

📝 Note: From now on , if you click/tap on the images of the graphics, they will lead to the data source.

CORRECTION: In last week’s Macro Bite (newsletter,) there was an error in the y-axis of this chart, we apologize for the mistake, and the correct graphic is shared below:

Data Visualization & Marketing Partner: Brand Nib

Visit: https://macropakistani.com/advertise/

Improve brand awareness for your startup/business or amplify the reach of your ongoing marketing campaigns by promoting them on Macro Pakistani. We are doing/have done successful paid collaborations with:

Send an email to hello@macropakistani.com

About Us: Macro Pakistani is a data-driven research platform that aims to provide a basic understanding of Pakistan’s economy. If you have an interest in contemporary news but are currently overburdened with sensationalism and specialized vocabulary, we are the platform for you.

How are we doing? Please send us any questions, comments or suggestions by replying to this email.